简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Price Latest: Negative Sentiment Pushing Prices Lower

Abstract:EURUSD took a dip lower after the latest ZEW release showed German current conditions data falling sharply, the latest in a line of weak data

IMF Warns of Risks to Global Growth, Advanced Economies to Fall Sharply

EURUSD Touches a Two-Week Low

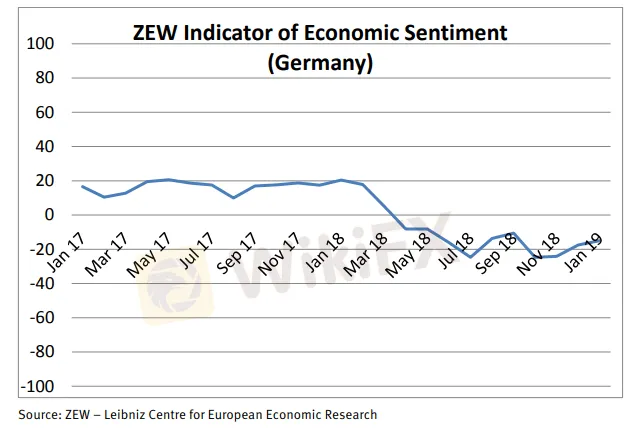

The latest ZEW readings confirmed that German, and the single-block, sentiment remains negative, confirming recent data. The German economic sentiment reading ticked 2.5 points higher to -15.0 and despite this increase the reading remains well below the long-term average of 22.4 points. The current situation assessment fell sharply, down 17.7 points to 27.6, the lowest reading since January 2015.

The Euro-Zone economic assessment rose a mere 0.1 points to -20.9, while the current economic situation in the Euro-Zone fell by 6.8 points to 5.3.

German BDI Warns of Serious Growth Problem

The Euro fell further against the US dollar and hit a two week+ low and is likely to fall further with 1.1300 the next target. A break below here opens the 1.1265 area ahead of the November 12 low at 1.1215. The pair remain all three moving averages and continue the bear move off the January 10, 1.1570 high.

EURUSD Daily Price Chart (August 2018 – January 22, 2019)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

GemForex - weekly analysis

Analysis for the week ahead: Markets remain worried by global recession fears

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator