简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A South African Trader Claimed That SWIFT EARNERS Blocks His Withdrawal Request

Abstract:SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

Case Description

The South African victim, whose identity we are protecting for privacy reasons, recounts their ordeal with SWIFT EARNERS:

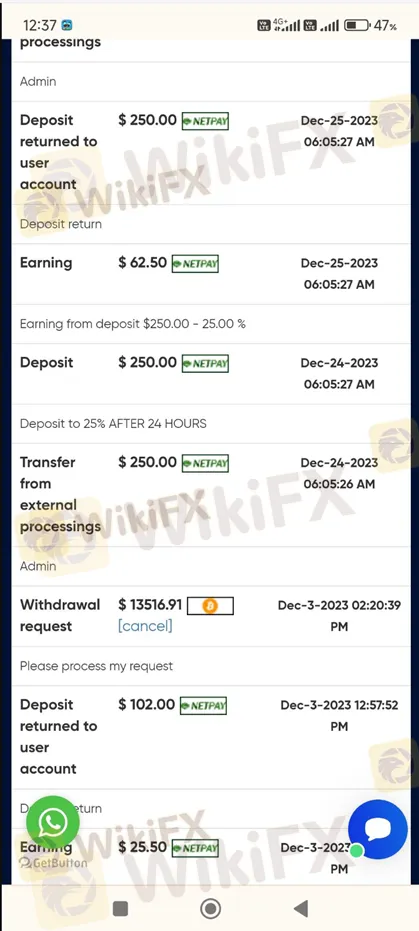

“These people (SWIFT EARNERS) take deposits from people and then dont payout when you want to withdraw. I have spent more than 20 thousand ZAR in withdrawal fees only to be told they have to charge again.”

This statement highlights a common tactic used by fraudulent brokers: imposing exorbitant and repeated withdrawal fees, effectively preventing clients from accessing their own money. Such practices not only erode trust but also highlight the malicious intent behind the operations of SWIFT EARNERS.

About SWIFT EARNERS

SWIFT EARNERS markets itself as a registered broker with trading experience spanning 1-2 years. However, this relatively short operational history combined with several red flags raises serious concerns:

Is it Legit?

SWIFT EARNERS operates without regulation, meaning any financial authority does not oversee it. This absence of regulatory oversight significantly increases the risk to investors, as there is no recourse for those who fall victim to its unscrupulous practices.

Physical Addresses

The broker lists two physical addresses: one in San Dimas, California, USA, and another in Bangkok, Thailand. These addresses do little to reassure potential clients, especially considering the international nature of financial fraud and the difficulties in pursuing legal action across borders.

Poor Reputation

Independent review platforms like WikiFX have given SWIFT EARNERS a dismal score of 1.22/10. Such a low rating is indicative of widespread dissatisfaction and multiple reports of unethical behavior.

Suspicious Business Practices

The story of our South African victim is not an isolated incident. SWIFT EARNERS has been reported to engage in several dubious practices:

Unresponsive Customer Service

The victim has reported that once he deposits their money, customer service becomes unresponsive or outright hostile, further complicating any attempts to recover funds.

Conclusion

The case against SWIFT EARNERS is compelling and deeply concerning.

Investors are strongly advised to conduct thorough research and opt for brokers with verifiable regulatory oversight. The allure of high returns should never overshadow the fundamental importance of security and trustworthiness in financial dealings.

In light of these findings, raising awareness and protecting potential investors from falling prey to such schemes is imperative. When choosing a trading partner, always prioritize transparency, regulation, and a solid reputation. If you want more information about certain brokers' reliability, you can open our website. Or you can download the WikiFX App to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator