简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exposing X Charter: A Victim's Tale of Deception and Fraud

Abstract:Unsuspecting individuals can easily fall prey to the deceitful tactics of unscrupulous brokers. Among the myriad of fraudulent entities lurking in the shadows, X Charter stands as a glaring example of betrayal and deception, leaving a trail of shattered dreams and financial ruin in its wake.

Unsuspecting individuals can easily fall prey to the deceitful tactics of unscrupulous brokers. Among the myriad of fraudulent entities lurking in the shadows, X Charter stands as a glaring example of betrayal and deception, leaving a trail of shattered dreams and financial ruin in its wake.

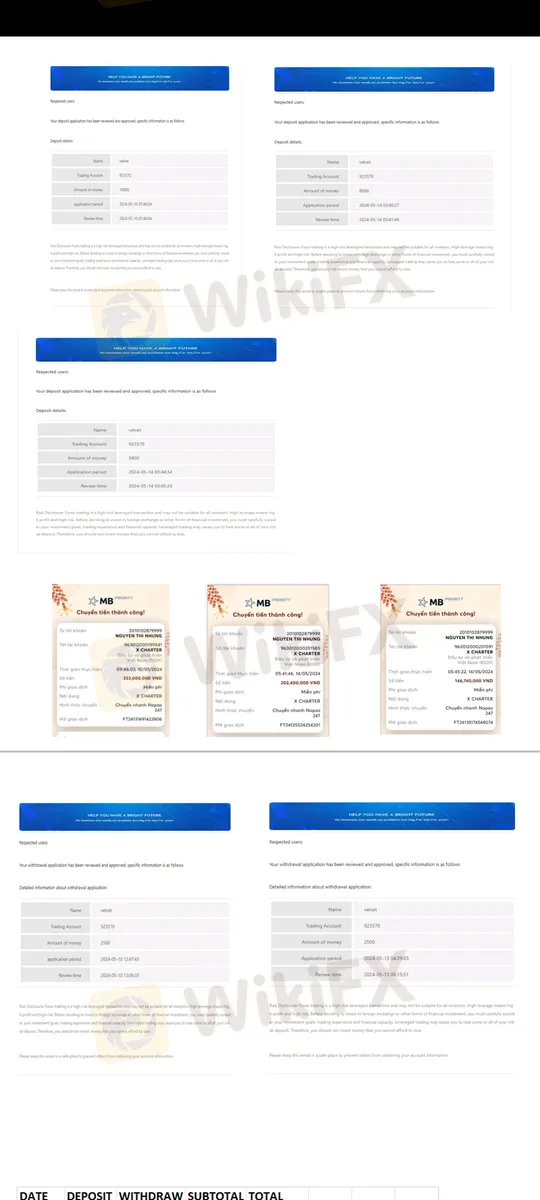

Nguyen Thi Nhung, a 38-year-old investor from Vietnam, found herself ensnared in X Charter's web of deceit when she was contacted by one of their agents on May 7, 2024. Promised lucrative returns through their Premium Plan, which purported to double deposited funds and offer higher interest rates, Nguyen saw an opportunity to grow her wealth and secure her financial future.

With trust and hope, Nguyen signed up with X Charter on May 10, 2024, depositing $10,000 into her account. True to their deceitful promises, X Charter matched her deposit, boosting her account balance to $20,000. Initially, everything seemed promising as Nguyen successfully made withdrawals and witnessed her account balance grow. However, the facade of prosperity quickly crumbled, revealing the sinister intentions of X Charter.

In a cruel twist of fate, Nguyen's account suddenly became inaccessible on May 16, 2024. Shocked and dismayed, she realized that she had fallen victim to a sophisticated scam orchestrated by X Charter. Despite her efforts to engage in legitimate trading activities, her trust was callously betrayed, leaving her with nothing but a sense of betrayal and a depleted bank account.

What makes X Charter's actions even more reprehensible is their blatant disregard for accountability and transparency. Nguyen received no prior warning or explanation for the termination of her account, leaving her stranded and helpless in the face of financial adversity. Her brief stint with X Charter lasted a mere two days, yet the repercussions of their deception will haunt her for much longer.

Nguyen's harrowing experience serves as a cautionary tale for investors worldwide, highlighting the importance of thorough due diligence and skepticism when dealing with online brokers. X Charter's deceitful practices not only robbed Nguyen of her hard-earned money but also shattered her trust in the financial system.

As advocates for transparency and accountability, it is imperative that we expose entities like X Charter for their fraudulent activities, safeguarding investors from falling victim to their schemes. Let Nguyen's story serve as a rallying cry for justice and reform in the realm of online trading, ensuring that deceitful brokers like X Charter are held accountable for their actions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator