简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The victim is unable to withdraw money both capital and profit after investing in UEZ Markets

Abstract:This article sheds light on the plight of an investor who finds themselves unable to withdraw both their capital and profits after investing in UEZ Markets.

About UEZ Markets

UEZ Markets is a forex broker that was founded in 2018. It is regulated by the Australia Securities & Investment Commission (ASIC, No. 001300519). UEZ Markets offers a variety of trading instruments, including Forex, Metals, Energies, Crypto, and Indices through the MT5 trading platform. This broker does not hold a legitimate license, we could not consider this broker a reliable broker. Thus, we hope all traders understand the risk of investing in this broker.

The Case in Details

On March 27, 2023, The trader decided to invest $1000 with UEZ Markets, a broker promising consistent monthly profits ranging from 5-6% of the invested capital. The allure of such gains, coupled with the assurance of being able to withdraw both the profits and the initial investment, enticed the victim to take the leap. To legitimize their engagement, UEZ Markets issued investment certificates, labeling them as “Term Managed Account” (TMA), seemingly to establish an air of credibility around their services.

The Red Flag

As time progressed, the victim's investment reportedly yielded profits as promised. With a sense of accomplishment, the investor initiated a withdrawal request to access their accrued profits and capital. To their shock and dismay, UEZ Markets declined the withdrawal request, citing an inability to process the transaction. This red flag sparked concerns about the legitimacy and reliability of the broker, leaving the victim in a state of financial limbo.

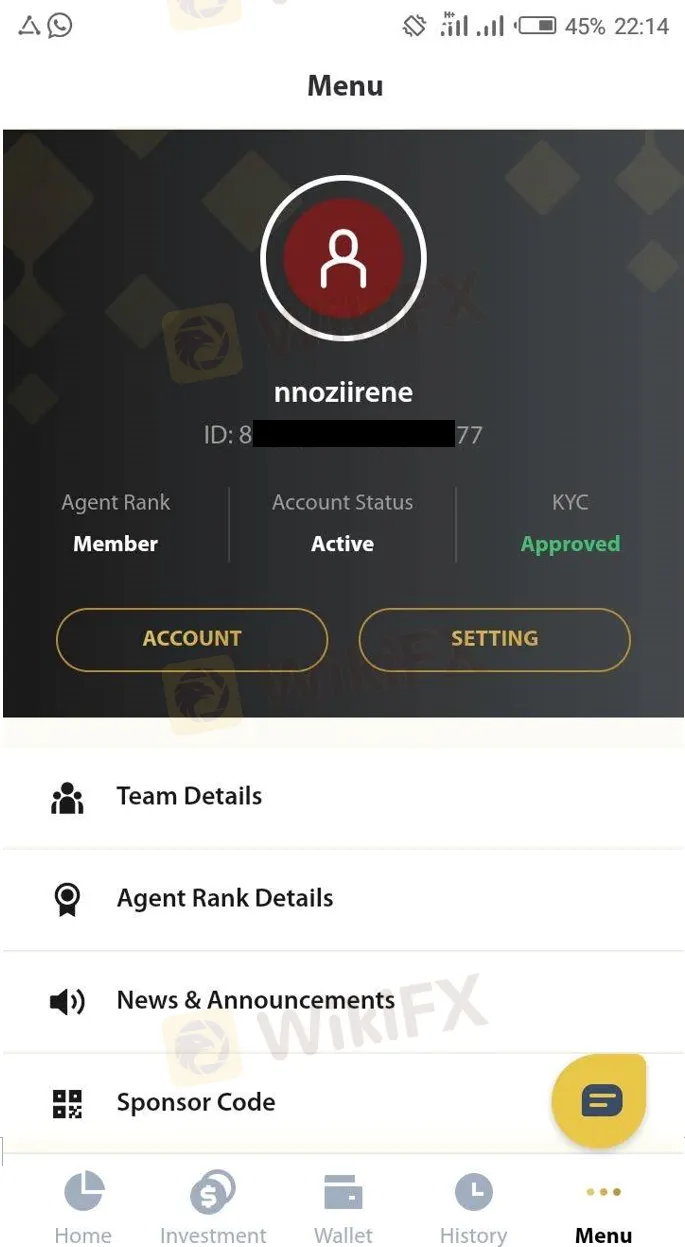

Faced with the predicament of being unable to withdraw both the profits and the invested capital, the victim turned to WikiFX for assistance. WikiFX, a platform that provides information and ratings about forex brokers, is often sought after by investors seeking clarity and redress. The victim's hope lies in WikiFX's ability to investigate the matter, potentially helping them recover their invested funds.

Conclusion

Investing is a double-edged sword; it can bring substantial returns, but it also carries risks. The tale of the victims unable to withdraw their capital and profits from UEZ Markets underscores the importance of research, due diligence, and cautious decision-making in the investment realm. It also highlights the necessity for robust regulatory frameworks to prevent instances of fraud and protect investors' rights. As the victim seeks assistance from platforms like WikiFX, the hope remains that they will find a solution to their ordeal and serve as a cautionary tale for others considering similar investment paths.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Importance of Backtesting in Forex Trading

One of the most effective ways to validate trading strategies is through backtesting. This process involves testing a trading strategy using historical data to assess its effectiveness before applying it in live markets. Understanding the importance of backtesting can significantly enhance a trader's chances of success.

EXPERT OPTION Review 2024: Read Before You Trade

EXPERT OPTION is unregulated with an inaccessible website and a 1.25/10 WikiFX rating. Verify brokers using WikiFX to avoid trading risks and unlicensed platforms.

FINRA Fines ViewTrade Securities $40,000 for Supervisory Failures

ViewTrade Securities faces a $40,000 fine for failing to supervise outside brokerage accounts. This action emphasizes the importance of maintaining market integrity.

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

FOREX.com teams up with Kalshi to offer event-based trading on the US Presidential Election, blending political outcomes with market predictions. Find out more about this collaboration.

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

Currency Calculator