简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

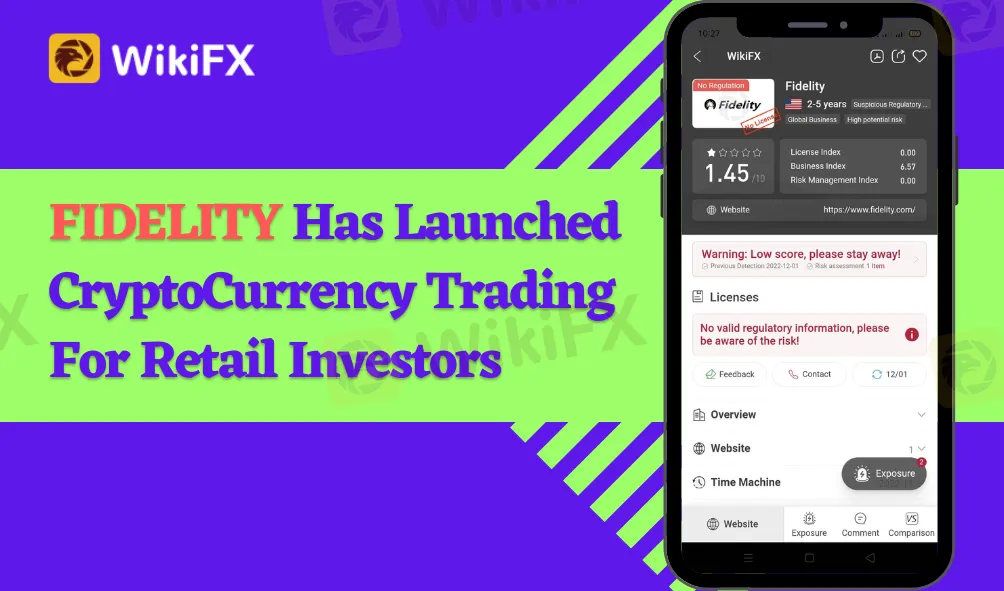

Fidelity Has Launched CryptoCurrency Trading For Retail Investors

Abstract:Fidelity, one of the world's major financial services companies, has begun to provide consumers with bitcoin trading accounts.

This follows their earlier disclosure of a wait list earlier this month. According to The Block, select users, presumably those on the queue, got an email outlining the release with the message “The wait is gone.”

Fidelity has been involved in the bitcoin sector for some time, beginning mining bitcoin in 2014, according to the company website. In addition, in December 2021, it will offer a spot bitcoin ETF in Canada.

The financial services behemoth's involvement in bitcoin has not gone unnoticed, with US lawmakers questioning its provision of a 401k plan that enables customers to allocate to bitcoin.

The same group of senators recently revived the same concern, stating in their newest letter, “Fidelity Investments has decided to go beyond conventional finance and plunge into the very unstable and more dangerous digital asset sector.”

Despite these cautions, Fidelity looks to be jumping into bitcoin wholeheartedly, as interest in bitcoin within the conventional banking industry grows. It should be emphasized that the move comes at a very intriguing moment, considering recent events surrounding the collapse of FTX and the increased focus on volatility in the sector.

With the industry image so shaky, the acts of behemoths like Fidelity will almost surely have repercussions for bitcoin legislation in the future.

Aside from FTX, senators claim that cryptocurrency investments have only developed as a dangerous and speculative bet, and they are afraid that Fidelity would assume similar risks with millions of Americans' retirement assets.

Fidelity is the biggest retirement plan provider in the United States, with more than $10 trillion in assets under management, and its move was considered a crucial driver for making cryptocurrency even more popular. The cryptocurrency option is now accessible to the 23,000 employers that use Fidelity to manage their 401(k) retirement funds.

You may check out more of Fidelity news here: https://www.wikifx.com/en/dealer/5871434190.html

Always remember to check the true identity of a broker before investing. Being regulated online trading broker must be known to public to be considered as trustworthy broker.

Stay tuned for more Online Trading news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alameda Sues KuCoin to Reclaim $50M in FTX Asset Recovery Drive

Alameda Research, a subsidiary of the defunct cryptocurrency exchange FTX, has recently filed a lawsuit against KuCoin in the U.S. Bankruptcy Court for the District of Delaware. This legal move aims to recover more than $50 million in assets that Alameda claims are part of the FTX estate.

AI Triples U.S. Treasury’s Fraud Recovery to $1B in 2024

The U.S. Treasury's use of AI for fraud detection leads to a significant increase in recovery, reaching $1 billion in fiscal 2024, thanks to machine learning.

FB Investment Scam Cost Malaysian Housewife RM80K

A 50-year-old Malaysian housewife recently lost RM82,175 to a fraudulent investment scheme promoted on Facebook in July. The victim, a former secretary in a private company, was initially attracted to the enticing investment opportunity and followed a link from the advertisement that directed her to WhatsApp to connect with the scheme's operator.

The Role of Moving Averages in Trend Trading

Moving averages are essential tools in technical analysis, widely used by traders to identify trends and make informed decisions. By smoothing out price data, moving averages help traders filter out noise and determine the overall direction of a market, making them invaluable in trend trading strategies.

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

Currency Calculator