简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Clientele Feedback: What are Investors' Opinions of Forex4you?

Abstract:While investment markets have always been on the hit list of scammers, the foreign exchange market is more susceptible because of the sheer number of its transactions.

With an average of $6.6 trillion daily turnover, the forex market is the most tempting place for money stealers to make off their loot. Since multiple complaints have been filed against Forex4you, we suspect this broker to be a suspicious entity and warn investors from signing up with it.

Forex4you - A Quick Overview

Founded in 2007, Forex4you (https://www.forex4you.com/) is an online brokerage firm based in the British Virgin Islands. The company provides retail trading services across various financial markets, including forex, commodities, stocks, and indices. Flexible account types and multiple trading platforms appear to be the company's strong points in enticing traders. The company also supports social trading services, enabling clients to copy the trades of expert professionals and generate a passive income. An educational library is also available for clients to learn the basics of forex and CFD trading.

Is Forex4you Regulated?

Forex4you, a brand name of E-Global Trade & Finance Group, Inc., is authorized and regulated by the British Virgin Islands Financial Services Commission (BVI FSC) under the Securities and Investment Business Act, 2010, license number SIBA/L/12/1027. And the brokerage is neither registered nor regulated anywhere else.

Clientele Feedback

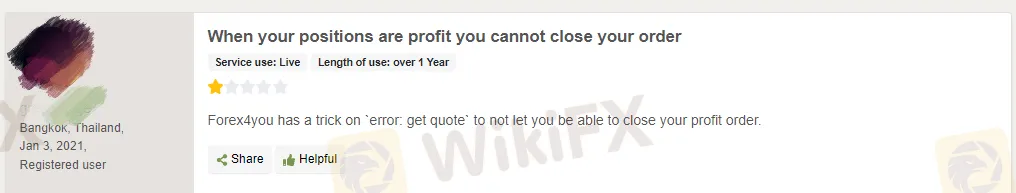

Forex4you holds a poor reputation among clients. The organization is accused of stealing from its customers by artificially inflating prices, closing accounts without warning, and ignoring customers' requests to withdraw their funds. Here are some screenshots.

What Makes Forex4you A Suspicious Broker?

First, it is an offshore entity that only regulated by BVI FSC. Although the regulator has been around for almost 20 years, it is still less stringent than the FCA, ASIC, or CySEC due to its relatively easy registration and low minimum paid-in capital requirements.

Second, the broker is a poorly rated companies. More than 80% of the reviews have reported its malpractices on social and digital marketing platforms.

Why Forex4you Dissatisfied Customers?

A dissatisfied client told us the whole experience when trading with Forex4you.

When he signed up with a broker, a member of the sales team contacted him, claiming to be his account manager. The manager asked the client to deposit money into the account, making fake promises to help him generate lucrative returns.

After the client made an initial deposit, the case got transferred to retention agents who try to con him out of even more funds.

Once the company believed the customer has invested up to the maximum extent, it became less incentivized for the company to keep in touch with him. Therefore, it stopped answering his calls and emails. The most disappointing aspect was that the withdrawals were never

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CySEC Suspends FXOpen Shareholder Voting Rights for Prudent Management

The Cyprus Securities and Exchange Commission (CySEC) has decided to suspend the voting rights of FXOpen EU Ltd’s sole indirect shareholder, Aliaksandr Klimenka, to ensure sound management.

The impact of the U.S. presidential elections on gold and Forex prices

Analysis of the impact of the 2024 U.S. presidential election on gold prices and the forex market, with a focus on U.S. dollar movements and its relationship to safe-haven assets during periods of economic uncertainty.

Broker Review: Is Sure FX Reliable?

Sure FX, a Colombian-based forex and commodities broker, was founded in 2019 to provide traders with access to global markets, specifically in Forex and commodities.

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

Currency Calculator