简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Sunton Capital- Why do some investors feel irritated by this broker?

Abstract:Sunton Capital is a trending topic in the recent forex market. We wonder if this broker is worthy to be invested in as some investors feel upset about this broker. WikiFX made a comprehensive review of this broker. We will analyze this broker from different perspectives, such as basic information, regulation, exposures, and so on.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of Sunton Capital based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 36,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether Sunton Capital is a scammer or not, we evaluated this broker from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of Sunton Capital based on its general information and regulatory status.

To understand Sunton Capital better, we explore Sunton Capital by analyzing three main perspectives:

A. General Info of Sunton Capital

B. Regulatory Status

A. General Info of Admiral Markets

(source: Sunton Capital)

About Sunton Capital

Sunton Capital is a forex broker and claims that it is registered in China, with its founding time, actual office address, and the company behind it unknown to all.

Leverage

The maximum leverage level of Sunton Capital is 1:100, not that generous compared with many other brokers. Since leverage can amplify gains as well as losses, inexperienced traders are not advised to use high leverage.

Spreads & Commissions

Sunton Capital only mentions it offers low spreads, but does not specify detailed spreads on a particular instrument.

Trading Platform

When it comes to trading platforms available, the only platform available at Sunton Capital is a web version of MetaTrader5.

Deposit & Withdrawal

Payment methods used by Sunton Capital are credit cards, debit cards, wire transfers, crypto methods, and at times, some alternative payment gateways. Withdrawals use the same methods, although with withdrawals users have to look out for fees! The typical withdrawal processing time is between 2 and 5 days.

(source:WikiFX)

B. Regulatory Status

What is a Legitimate License?

The legitimate license is the business license issued by the financial regulatory institution of each country/region.

Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under the protection to some extent.

Whether a forex brokerage firm holds a legitimate license or not is one of the important factors to evaluate the reliability of forex brokers.

The content of the regulation and the difficulty of obtaining a license vary with the country and agency issuing the license.

The legitimate license of Sunton Capital

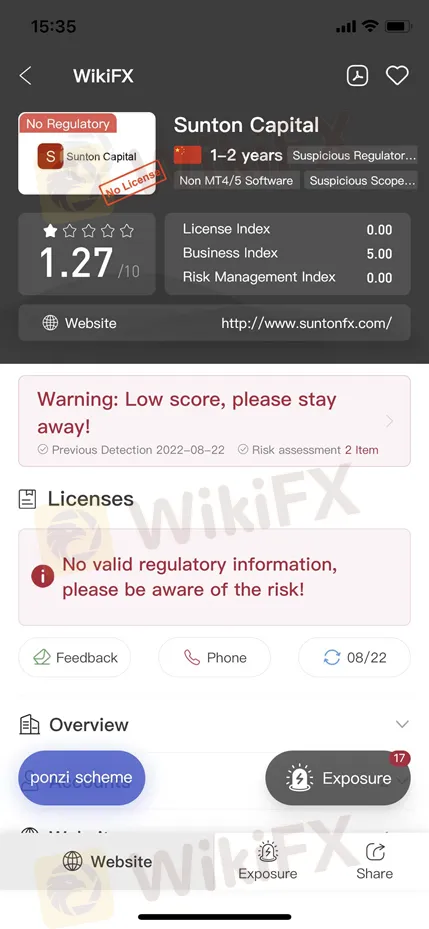

According to WikiFX, Sunton Capital is not regulated by any regulatory authority. Therefore, we consider this broker an unlicensed broker.

2. Exposure related to Sunton Capital on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of August 22, 2022, WikiFX has received 17 complaints against this broker within three months. Below are some of them.

This trader from Indonesia claimed that Sunton Capital is a scam. He suffers a heavy financial loss after investing in this broker.

This trader believed that Sunton Capital is a Ponzi Scheme.

This investor from Thailand complained that he cannot withdraw.

Another trader from Nigeria claimed that this platform kept saying insufficient funds when he tried to withdraw.

3. Special survey about Sunton Capital from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

Sunton Capital has been given by WikiFX a low rating of 1.27/10.

(source:WikiFX)

B. WikiFX Alerts

4. Conclusion

Due to too many complaints, we do not consider Sunton Capital is a reliable broker. The biggest problem that the investors complained about the most is the withdrawal rejection. We advise you to be aware of the potential risks. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself. If you have any problems with this broker, please do not hesitate to contact WikiFX. The global customer service of WikiFX is +234-706 777 7762 on WhatsApp. Or you can call +65-31290538. We are willing and ready to help you out.

Click on Sunton Capital' WikiFX page for details

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trading is an Endless Journey

Every trader dreams of quick success, but rushing the process often leads to mistakes. It’s easy to get swept up in the excitement of winning trades or discouraged by unexpected losses. The truth is, mastering the emotional side of trading can be even more important than understanding market analysis or strategies.

How to Know if the Market is Correcting or Reversing?

In trading, distinguishing between a market correction and a market reversal is crucial for making sound decisions. Misjudging one for the other can lead to missed opportunities or significant losses. While both involve price movements, their causes, duration, and implications differ substantially. Understanding these differences can help traders improve their strategies and adapt to market conditions effectively.

Empowering the Next Generation in Finance with WikiFX: Gen Z’s Investment Journey

With a steadfast commitment to fostering sustainable financial literacy and providing clear, strategic guidance to the next generation, WikiFX has collaborated with Van Lang University and Hoa Sen University to host an exclusive series of financial education workshops. This marks a pioneering initiative by WikiFX in Vietnam, designed not only to deliver foundational knowledge but also to instill a sense of responsibility and cultivate prudent financial decision-making among aspiring young traders.

Robinhood Launches Options Trading in the UK by 2025

Robinhood to introduce options trading in the UK by 2025 following FCA approval. Discover how this expansion aligns with Robinhood's strategy for global growth and new features.

WikiFX Broker

Latest News

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

SEC Warns on Advance Fee Loan Scams in the Philippines

Russia Turns to Bitcoin for International Trade Amid Sanctions

Rs. 20 Crore Cash, Hawala Network, Income Tax Raid in India

Hong Kong Stablecoins Bill Boosts Crypto Investments

BEWARE! Scammers are not afraid to impersonate the authorities- France’s AMF said

Currency Calculator