简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

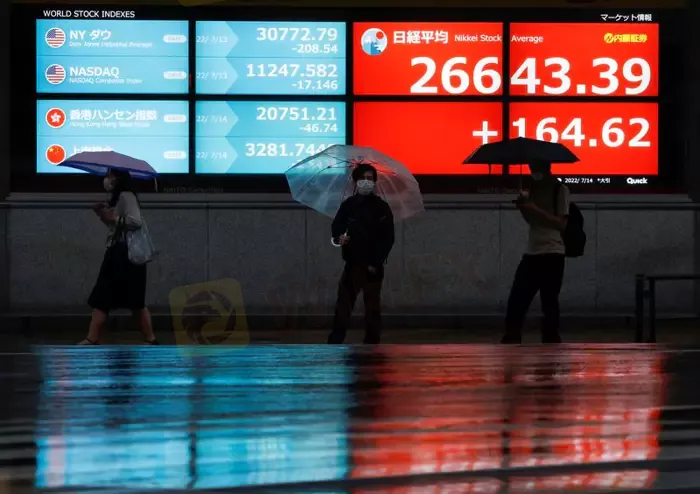

Asian stocks gain as investors weigh risk from Pelosi Taiwan visit

Abstract:Asia-Pacific bond yields followed U.S. Treasury yields higher on Wednesday and the dollar continued its climb after Federal Reserve officials signalled they are nowhere near done raising interest rates.

Stocks rose in volatile trading across Asia on Wednesday and the dollar pared early gains as investors weighed the potential fallout from U.S. House Speaker Nancy Pelosis visit to Taiwan, which has angered China.

Bond yields were also helped as demand for the safest assets eased despite heightened tensions between the United States and China, which views Taiwan as a breakaway province.

“In the longer term, there will be more frictions between the U.S. and China,” said Redmond Wong, Greater China market strategist at Saxo Markets in Hong Kong. “We have already been seeing selling from overseas investors in Chinese equities.”

Japan‘s Nikkei closed up 0.53%, rebounding from Tuesday’s two-week closing low, while Hong Kong‘s Hang Seng gained 0.83% and Taiwan’s TAIEX index rebounded from earlier losses to gain 0.2% at the close.

MSCI‘s broadest index of Asia-Pacific shares rose 0.19%, helped by the rally in Japan as bargain hunters came in following Tuesday’s decline to a two-week closing low.

Australias AXJO fell 0.41% and Chinese blue chips lost 0.13%.

“Obviously, as investors in China, we would not like to see tensions escalate,” said Thomas Masi, vice president and co-portfolio manager of the GW&K Emerging Wealth Strategy.

“And we don‘t see the benefit necessarily of this trip, but there could be something that we don’t understand. On a risk-reward basis, should tensions ease, theres a lot more upside in these stocks.”

FTSE futures were down 0.20% and Euro STOXX 50 futures dropped 0.08% ahead of markets opening in Europe.

U.S. stock futures jumped 0.32%, following the S&P 500s 0.67% drop overnight.

A trio of Fed policymakers signalled on Tuesday that there would be no let up in the tightening campaign aimed at taming the highest inflation since the 1980s, even though it will take rates to a level that will more significantly curb economic activity.

Two of them, San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans, are widely regarded as doves.

Traders now see a chance of around 39.5% that the Fed will hike by another 75 basis points at its next meeting in September.

The benchmark U.S. 10-year Treasury yields were around 2.71% in Tokyo, not far from the overnight high of 2.774% following a 14 basis point surge.

The U.S. dollar index, which gauges the currency against the yen and five other major peers, was 0.188% lower at 106.25, having rebounded as much as 1.43% overnight following its slide to a nearly one-month low at 105.03.

Gold gained 0.57% higher to $1,769.73 per ounce, but following a 0.68% retreat the previous session.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

New Zealand's FMA Warns Against "YouTube Crypto Investment Scam"

The Financial Markets Authority (FMA), New Zealand's financial regulator, warns individuals against investment scams that use YouTube channels to promote fraudulent cryptocurrency investment firms/websites. The authority explained on its official website how the YouTube cryptocurrency scam works, providing a step-by-step guide to help people recognize and avoid it. Read HOW THE SCAM WORKS and BE SAFE.

Trading is an Endless Journey

Every trader dreams of quick success, but rushing the process often leads to mistakes. It’s easy to get swept up in the excitement of winning trades or discouraged by unexpected losses. The truth is, mastering the emotional side of trading can be even more important than understanding market analysis or strategies.

How to Know if the Market is Correcting or Reversing?

In trading, distinguishing between a market correction and a market reversal is crucial for making sound decisions. Misjudging one for the other can lead to missed opportunities or significant losses. While both involve price movements, their causes, duration, and implications differ substantially. Understanding these differences can help traders improve their strategies and adapt to market conditions effectively.

Empowering the Next Generation in Finance with WikiFX: Gen Z’s Investment Journey

With a steadfast commitment to fostering sustainable financial literacy and providing clear, strategic guidance to the next generation, WikiFX has collaborated with Van Lang University and Hoa Sen University to host an exclusive series of financial education workshops. This marks a pioneering initiative by WikiFX in Vietnam, designed not only to deliver foundational knowledge but also to instill a sense of responsibility and cultivate prudent financial decision-making among aspiring young traders.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator