简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Traders Must Know The Roles of Support and Resistance Levels

Abstract:Support and resistance levels assist traders to understand the market better. As we all know, anyone who has a better understanding of the market has a sharper edge compared to those who don’t

Indeed, knowledge is power in trading.

Basically, support levels indicate prices that a currency will not likely fall below. Conversely, resistance levels indicate prices that a currency will probably not exceed.

Support and resistance levels can be seen as the ‘oracle’ of market trends because these can predict whether a current trend will keep going or not more accurately. Accuracy is everything in trading. A fool-proof information enables traders to confidently enter or close a position, or place a stop or a limit.

Technical Analysis

Technical analysts use charts and other tools to study and analyze the market history and come up with a pattern that may aid them to make a prediction of future activities. But even with the capability to archive past activities and generate patterns from it, past performance is not a guarantee of future results.

This method looks into the supply and demand surrounding specific security and currency. It is more focused on what actually happens, instead of coming up with an explanation about why something happens.

One of the basic assumptions of technical analysis is that history has a tendency of repeating itself.

Currencies move in various directions. If it moves up, it will not stay there forever; we can possibly see it in downtrends or range. Trends can be long or short term, and certainly, it will not march on one direction indefinitely. There will be a frequent encounter of either support or resistance.

Support and Resistance: A Closer Look

A currency has reached a support level if it undergoes a difficulty of falling below a specific price.

This happens most of the time because a currencys drop in value results in there being more buyers than sellers. With this, the floor is created because traders dive in and snap up purchases.

On the other hand, a currency has reached a resistance level if it undergoes a difficulty rising above a specific value. It usually happens when the number of sellers exceeds the number of buyers after a currency has experienced a significant increase in price.

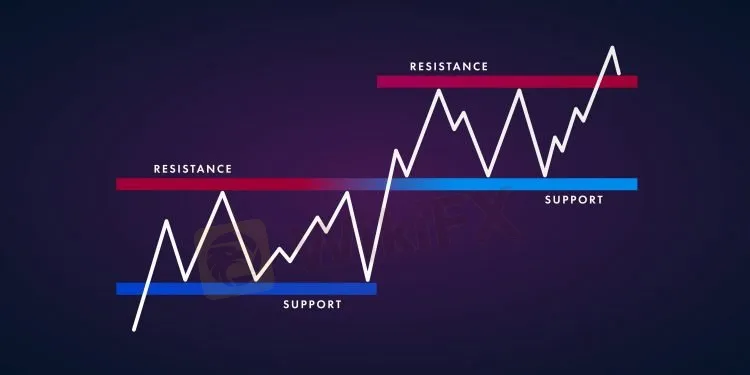

The Reversal of Their Roles

Even with a better prediction that support and resistance levels provide, the information generated from them is not always confirmed.

To give you an example, if a currency exceeds past resistance, it can pull the interests of a lot of investors, and as a result, increases its prices.

On the reversal, other investors might possibly wait for the currency to decrease some value, mainly if it increased in price upon surpassing resistance. With this taking place, investors who hold back could be a fresh new source of support.

If a currency sinks below support, this situation could be a contributing factor to initiate a bigger sell-off. This situation can happen when a currency reacts to major news on political or economic development. So the old support could become the new resistance as the currency finds it hard to achieve its last price range.

Highly-Significant Levels

It is still the classic psychology that plays a major role in an investor‘s decisions. These are not entirely because of the outside influences that we can see and hear. It’s more of the investors psychology. With this, the global market will frequently create levels of support and resistance largely driven by psychology.

There is no doubt that support and resistance levels are crucial. By carefully analyzing and identifying these levels, investors can pinpoint the ranges that currencies are trading in and make more accurate transactions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Review: Is FxPro Reliable?

Founded in 2006, FxPro is a reputable UK-based broker, trading on various market instruments. In this article, we will help you find the answer to one question: Is FxPro reliable?

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator