简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

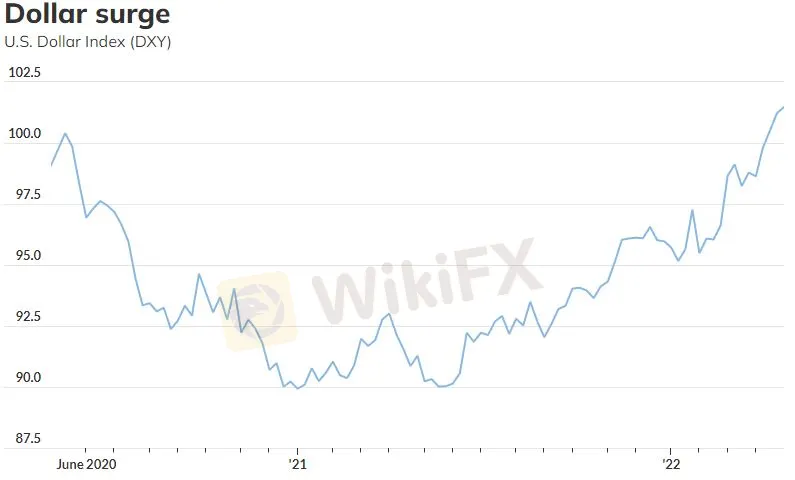

U.S. dollar hits 2-year high as investors flee stock market, commodities slump

Abstract:Yuan trims loss after China cuts foreign currency reserve requirements for banks

The U.S. dollar was a prime beneficiary of a flight to quality Monday, with a closely followed index trading at its highest since March 2020 as expanding COVID-19 lockdowns in China and growing expectations for outsize rate increases from the Federal Reserve saw global equities continue to skid and commodity prices plunge.

The ICE U.S. Dollar Index DXY, 0.40%, a measure of the currency against a basket of six major rivals, was up 0.3% at 101.55 after trading as high as 101.74 — its loftiest since March 2020 when the onset of the COVID-19 pandemic set off a global scramble for greenbacks.

‘Potent cocktail’The dollar often serves as a haven during periods of geopolitical uncertainty and unsettled markets.

“Theres no shortage of blood on the financial market dancefloor this morning. A poor equity market close on Friday set the stage but the war in Ukraine, the threat to the Chinese economy from Covid restrictions, and the monetary policy rhetoric, led by the Fed but followed all over the world, make a potent cocktail,” said Kit Juckes, global macro strategist at Societe Generale, in a note.

U.S. stocks fell sharply on Friday, with the Dow Jones Industrial Average DJIA, -0.76% dropping nearly 1,000 points for its worst day since October 2020. Global equities slumped Monday, with U.S. stock-index futures pointing to a weaker start, while oil and other commodities were under heavy pressure.

Emmanuel who?Those events rendered the unexpectedly strong showing of French President Emmanuel Macron, who cruised to victory Sunday over far-right candidate Marine Le Pen, a “non-event” for the euro, Juckes said.

The shared currency EURUSD, -0.66% saw initial support around the election soon give way, trading at a level last seen in March 2020. The DXY is weighted heavily toward the euro. The euro was off its low but down 0.5% versus the dollar at $1.075.

Yuan jittersThe dollar came off highs versus other currencies after the Peoples Bank of China cut the amount of foreign reserves banks must hold — lowering the foreign exchange reserve requirement ratio by 1 percentage point, to 8%.

The dollar remained up 0.7% versus the Chinese currency USDCNY, 0.91% at 6.5488 yuan. In offshore dealings, the currency USDCNH, 1.06% traded at 6.577 per dollar, with the U.S. unit up 0.8%. The yuan has fallen sharply versus the dollar as China deals with signs of a sharp economic slowdown.

The yuan took a sharp leg lower on Monday as Beijing started to test millions of residents and began shutting down business districts and some residential areas amid a spike in COVID cases. That led to long lines at supermarkets amid fears a repeat of restrictions seen in Shanghai, with millions now locked down for weeks.

The yuans weakness was seen contributing to market jitters on its own A devaluation of the yuan in 2015 sent shockwaves through global financial markets and contributed to a stock-market pullback.

Yen bounceThe dollar lost ground versus the yen, however, with the Japanese currency somewhat reasserting its role as a top haven during bouts of cross-asset volatility. The yen has slumped sharply versus the dollar this year, falling to around a 20-year low versus the dollar as the Bank of Japan maintains ultra-easy monetary policy as Federal Reserve officials have signaled a half-point rate increase is likely when policy makers meet in May, with the potential for further larger-than-usual moves in subsequent months.

The dollar USDJPY, -0.61% was down 0.4% at 128.08 yen in recent trade.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Twin Scam Alert: Broker Capitals is a New Domain of Finex Stock

This week, the Italy financial regulator CONSOB issued a warning against an unlicensed broker named Broker Capitals. When we clicked on Broker Capitals' website, its logo, trade name, and design seemed familiar to us.

Berkshire CEO-designate Abel sells stake in energy company he led for $870 million

Berkshire Hathaway Inc said on Saturday that Vice Chairman Greg Abel, who is next in line to succeed billionaire Warren Buffett as chief executive, sold his 1% stake in the company’s Berkshire Hathaway Energy unit for $870 million.

Paying particular heed to payrolls

A look at the day ahead in markets from Alun John

Dollar extends gains against yen as big Fed hike bets ramp up

The dollar extended it best rally against the yen since mid-June on Monday, buoyed by higher Treasury yields after blockbuster U.S. jobs data lifted expectations for more aggressive Federal Reserve policy tightening.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Standard Chartered Secures EU Crypto License in Luxembourg

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator