简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How Oil Moves with USD/CAD

Abstract:The charge of forex trade between Canada and the U.S. is often that is between strongly correlated to the price of oil. Over the long run, when the price of oil rises, the value of the Canadian dollar (CAD) (also called the loonie) usually rises relative to that of the U.S. dollar.

The charge of forex trade between Canada and the U.S. is often that is between strongly correlated to the price of oil. Over the long run, when the price of oil rises, the value of the Canadian dollar (CAD) (also called the loonie) usually rises relative to that of the U.S. dollar. That correlation can be directly attributed to the way Canada earns most of its U.S. dollars—from the sale of crude oil—and the percentage of Canada's revenue that this constitutes.

Well ..Lets talk about the other kind of gold, the black one.

As you can notice, the crude oil is most of the time cited to as the “black gold” or we here at WikiFX like to call it, “black crack.”

And One can live without gold, but when youre a crack addict, it will be hard for you to live without crack. Oil is like the antidote that runs through the veins of the global economy, the same it is a major source of energy and other economy.

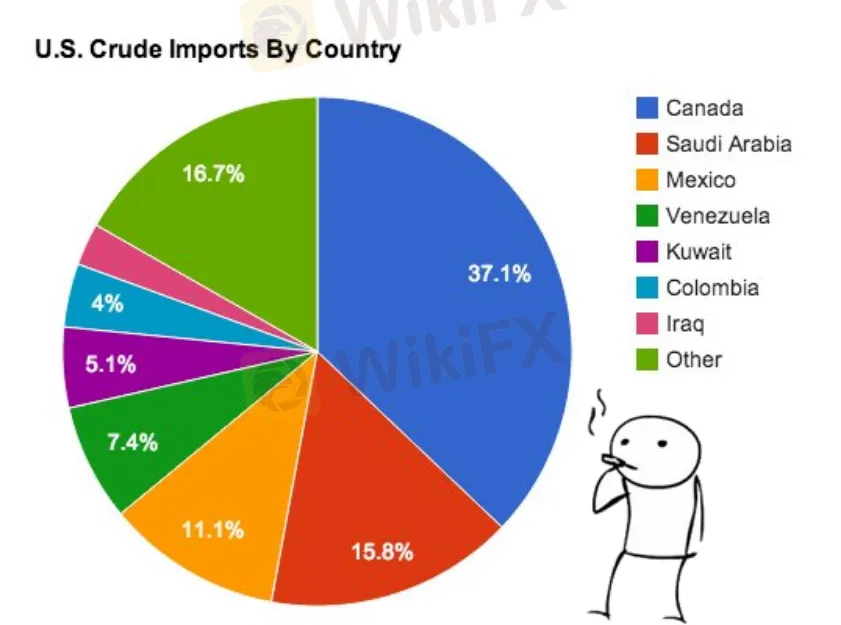

Canada, being one of the top oil producers in the world, exports over 3 million barrels of oil and petroleum products per day to the United States. This surely makes it the largest distributor of oil to the U.S. And This highlighted that Canada is United States main black crack dealer!

Due to high volume involved, it produces a massive amount of demand for Canadian dollars. Also, notice that Canadas economy is depending just on exports, with about 85% of its exports going to its big brother down south, the U.S. And for this reason, USD/CAD can be greatly influenced by how U.S. consumers respond to changes in oil prices.

When the U.S. demand increases, manufacturers will need to order more oil to maintain the demand. This can lead to a rise in oil prices, which can guide to a fall in USD/CAD. While when the U.S. demand falls, manufacturers may choose to hang out, and this could affect demand for the CAD since the manufacturers doesn't need to purchase more goods.

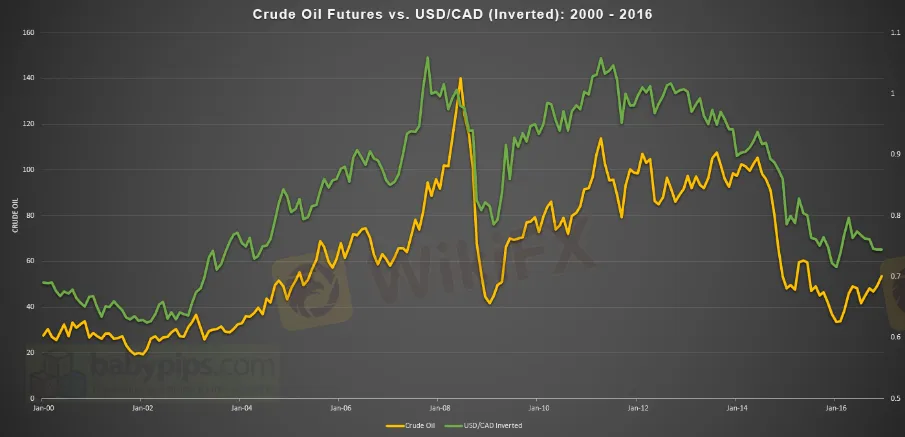

Oil has a negative connection with USD/CAD of about 93% between 2000 through 2016. When oil rises up, USD/CAD goes down. When oil goes down, USD/CAD goes up. Vice-versa. And to make the relationship clearer, we can invert USD/CAD to highlight how both markets move pretty much at the same time (i.e., crude oil will gain value with the Canadian dollar while the U.S. dollar falls…and inversely related. Check it out in the chart below:

Check it out in the chart below:

Crude Oil vs. USD/CAD Inverted

Now, the next time you gas up your car and notice that oil prices are rising, then this information could be of importance for your use! It can act as a clue for you to go short on USD/CAD!

Out of the multiple Forex Brokers, Some allow you to trade gold, oil, and other commodities. You can readily pull up their charts using their platforms there. Also You can track the prices of gold on Yahoo! Finance. You can check the prices of oil on Bloomberg too.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator