简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Theory of the Dollar Smile

Abstract:When a country's domestic outlook worsens, currencies tend to fall, but the U.S. dollar's unique global role makes it unusual, so even if the economy isn't going smoothly, the currency may climb.

Have you ever wondered why the US dollar strengthens in both bad times and good times, like a Beyoncé single?

When a country's domestic outlook worsens, currencies tend to fall, but the U.S. dollar's unique global role makes it unusual, so even if the economy isn't going smoothly, the currency may climb.

Pretend there are two “types” of US dollars to better understand why this is the problem.

A “domestic” US dollar exists that functions in the same way as other currencies. It's tied to the economy's long-term prospects and investment returns.

Also there is an “international” US dollar that is used in global transactions a major currency (for payments) and is necessary for purchasing of highly wanted US government bonds.

When markets are volatile and global economy slows, the “international” US dollar increases for a variety of reasons.

When a “shock” occurs, whether in the United States or elsewhere, that is large enough to drive investors and traders to panic and push financial markets lower, the broad US dollar will certainly increase.

In fact, a brilliant former Morgan Stanley employee came up with a theory to explain the phenomena.

Stephen Jen, a former economist at the International Monetary Fund and Morgan Stanley who now manages the London-based hedge fund and consultancy firm Eurizon SLJ Capital, devised a theory dubbed the “Dollar Smile Theory.”

Explanation of the Dollar Smile Theory

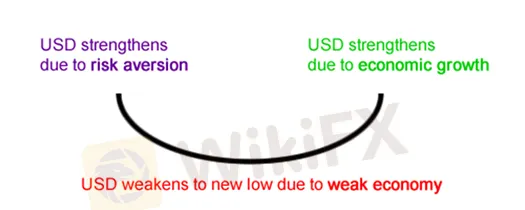

His idea outlines three primary scenarios for how the US currency will behave. Here's an example of what I'm talking about:

Scenario #1: The dollar shoot up due to risk aversion.

The first part of the smile depicts the US dollar profiting from risk aversion, which drives investors to “safe haven” currencies such as the US dollar and the Japanese yen.

Investors are hesitant to pursue risky properties such as U.S. government debt (“US Treasuries”) because they believe the global economic situation is shaky. They would rather buy “safer” properties such as US government debt (“US Treasuries”) regardless of the state of the US economy.

But, because you need USD to buy US Treasuries, the US dollar gets stronger due to the increasing demand for USD (to buy US Treasuries).

Scenario #2: Due to a weak economy, the dollar falls to a new low.

The dollar has reached a new low.

The lower half of the smile represents the Greenback's poor action as the US economy struggles with weak fundamentals.

The prospect of interest rate decreases is also weighing on the US currency.

(But, if other countries are predicted to decrease interest rates as well, this may be less of a concern because interest rate differentials are all about assumptions of future direction.)

As a result, the dollar is being shunned by the market. “Sell! Sell! Sell!” became the USD rallying cry.

Another aspect is the economic performance of the United States in comparison to other countries. Although the US economy is not always bad, if it is growing at a slower rate than other countries, investors will prefer to sell their dollars and buy the currency of the stronger country.

It's like if you were the owner of an NBA team with Reggie Miller as the standout player.

Michael Jordan is suddenly healthy and accessible. Undoubtedly, you'd trade Miller for Jordan because Jordan is the better player on a relative basis.

Reggie Miller isn't bad, it's just that there's a better option at the moment. Now, if you make the trade and Michael Jordan suffers a season-ending injury and Reggie Miller happens to be available, you'll know what to do.

“Miller Time” should take the place of “Air Jordan.” It's all relative, as you can see.

Scenario #3: The US Dollar Gains Strength Due to Economic Growth

Economic growth causes the dollar to appreciate.

Finally, as the US economy sees the light at the end of the tunnel, a smile appears.

As the economy improves and signs of recovery emerge, attitude toward the dollar improves.

In other words, as the US economy grows stronger and prospects of interest rate hikes rise, the greenback begins to gain (relative to other countries).

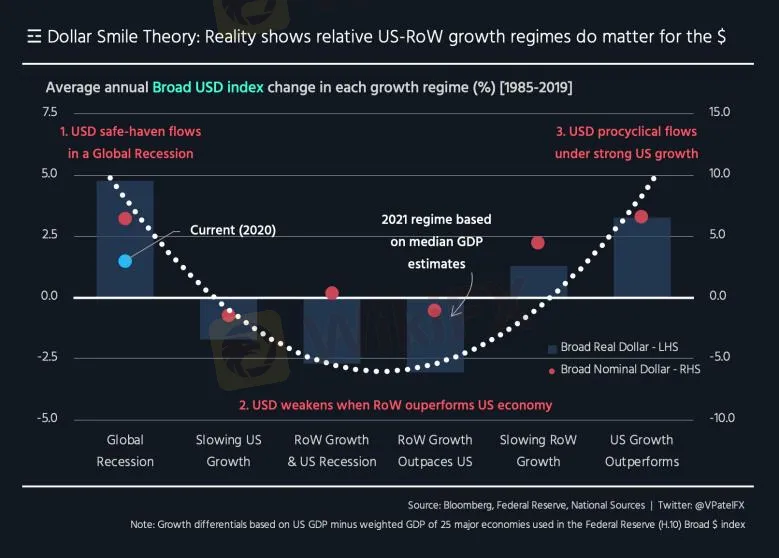

Let's have a look at how the Dollar Smile Theory actually works.

As you can see, the US dollar is serving as a safe haven currency as a result of the global epidemic, which has harmed many economies throughout the world. All countries, including the United States, are struggling.

However, if the economies of the “rest of the world” (RoW) improve and begin to develop faster than the US economy, the US dollar is likely to weaken.

Relative economic development is the key. If other countries' economies are rising, but the US economy is growing even faster, the US dollar will swing to the right.

Will the Dollar Smile Theory prove to be correct?

Only time will tell if this is true.

In any incident, this is a crucial theory to remember. Keep in mind that all economies are cyclical. They improve, then deteriorate, then improve, then deteriorate, and so on.

The most important thing is to review whatsoever stage of the cycle the US economy is in and then comparing it to the rest of the world (RoW).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator