简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stocks and Forex: What's the Connection?

Abstract:Using global equities markets to make forex trading decisions has one downside: determining which leads to which. It's like the age-old question, "Which came first, the chicken or the egg?"

Using global equities markets to make forex trading decisions has one downside: determining which leads to which.

It's like the age-old question, “Which came first, the chicken or the egg?” or “Who's your daddy?!?”

Are the stock markets making the decisions? Is the forex market the one that wears the trousers in the relationship, or is it the other way around?

The core assumption is that when trust in a domestic equities market rises, so does confidence in that country, resulting in an inflow of money from foreign investors.

This creates demand for the indigenous currency, causing it to appreciate against other currencies.

When a domestic equities market performs poorly, still, investor confidence plummets, prompting them to change their invested money back into their home currencies.

In principle, that sounds terrific, but in practice, it's...complicated.

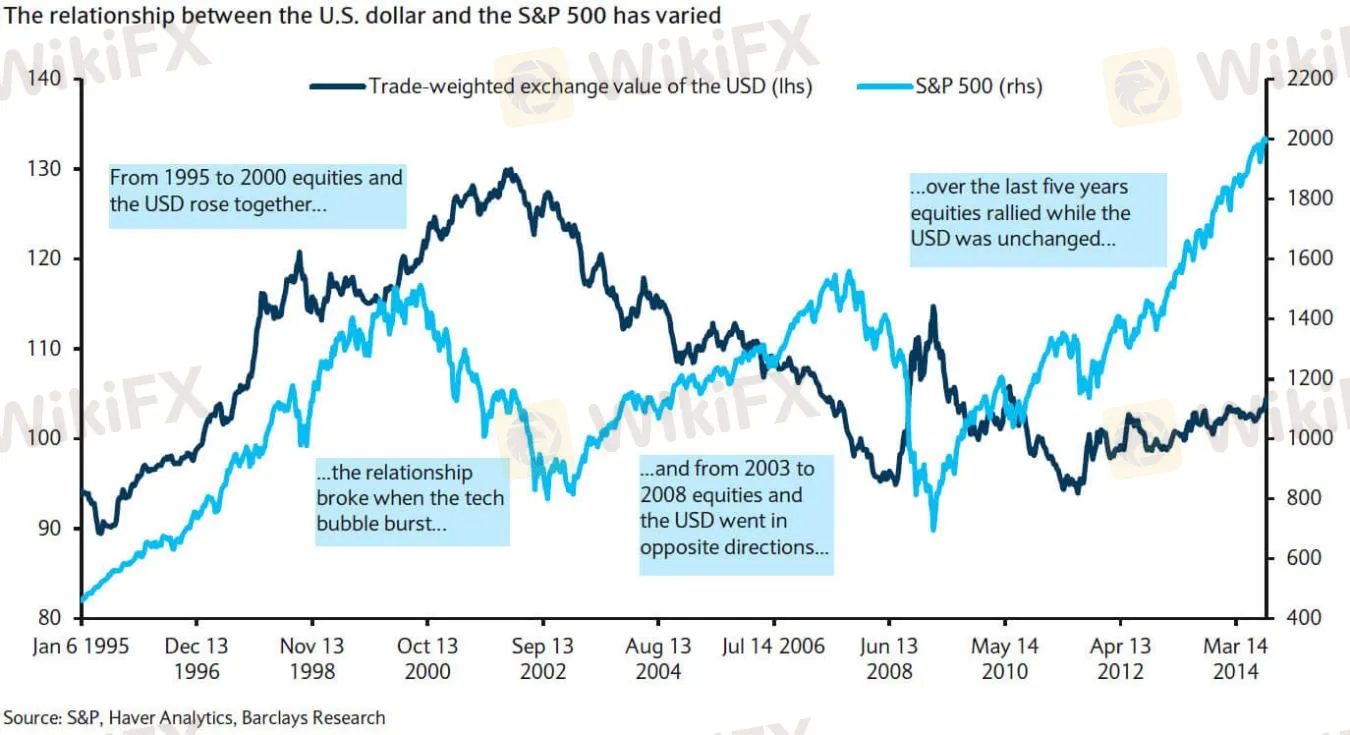

The historical link between the US dollar and the S&P 500, for example, hasn't been consistent.

They've moved together, moved in opposing directions, and been unrelated throughout the last 20 years, as seen here.

However, this does not imply that the partnership is pointless.

All you need to know is when the connection is functioning (positive or negative) and when it isn't.

Here's an illustration of how stocks in the United States and Japan went in opposing directions from their respective currencies.

Any positive economic data from the United States and Japan tends to put downward pressure on their respective currencies, the dollar and the yen.

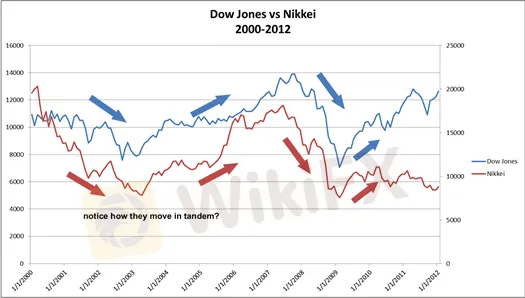

To begin, consider the connection between the Dow Jones Industrial Average and the Nikkei to show how stock markets around the world behave in relation to one another.

Since the turn of the century, the Dow Jones Industrial Average and the Nikkei 225, a Japanese market index, have moved in lockstep, dropping and rising at the same time, like lovers on Valentine's Day.

It's also worth noting that one index may take the lead at times, surging or falling first before being followed by the other.

Although it does not occur on a regular basis, stock markets around the world do tend to shift.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator