简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use the USDX for Forex Trading

Abstract:Hold your trigger finger and you’ll soon figure out! We all know that most of the widely traded currency pairs include the U.S. dollar. If you don’t know, some that include the U.S. dollar are EUR/USD, GBP/USD, USD/CHF, USD/JPY, and USD/CAD.

I guess you're probably wondering “How do I use this USDX in my trading tools?” Well, hold your trigger finger and you‘ll soon figure out! We all know that most of the widely traded currency pairs include the U.S. dollar. If you don’t know, some that include the U.S. dollar are EUR/USD, GBP/USD, USD/CHF, USD/JPY, and USD/CAD.

What does this mean? If you trade any of these pairs, the USDX can be the next best thing to sliced bread (or hamburger on a bun… or chocolate ice cream). If you dont, the USDX will still give you an idea of the relative strength of the U.S. dollar around the world. To be precise, when the market outlook for the U.S. dollar is not clear, more frequently the USDX gives a better picture.

In the diverse world of forex, the USDX can act as an indicator of the U.S. dollars strength.

The reason been that the USDX is comprised of more than 50% by the Eurozone, EUR/USD is quite inversely related. Check it here:

Next, take a look at a chart of EUR/USD.

It can be consider as a mirror image! If one goes up, the other most likely goes down. Will you look at that? It looks like the trend lines almost inversely match up accurately. This could be a big help to those big on trading EUR/USD. Some of our forex trading friends in the forums monitor the USDX as an indicator for EUR/USD. Spend time with them if you wanna learn more about using this index.

When the USDX makes significant movements, you can nearly for sure look for currency traders to react to the movement accordingly. Both the USDX and forex traders react to each other. Breakouts in spot USD pairs will almost certainly move the USDX in a similar breakout fashion.

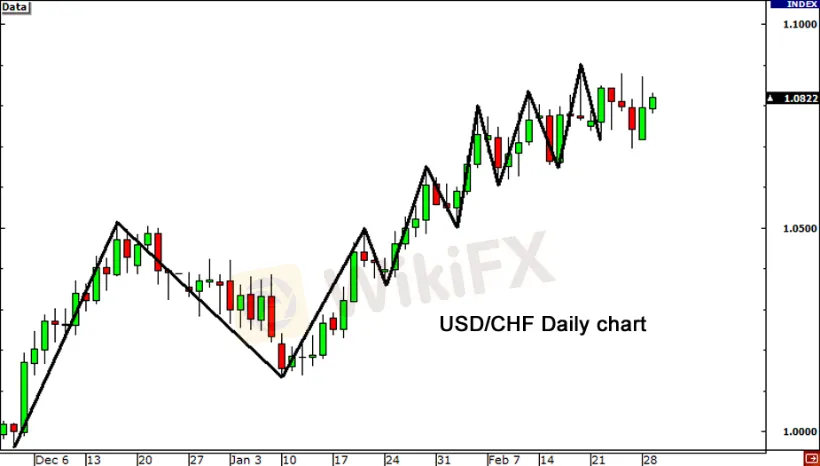

To add it all up, forex traders use the USDX as a key indicator for the direction of the USD. Keep in mind all the time the position of the USD in the pair you are trading. Take example, when the USDX is strengthening and rising, and you are trading EUR/USD, a strong USD will show a downtrend on the EUR/USD chart. When you are trading a pair which is dominated by USD, in which the USD is the based currency, such as the USD/CHF, a rise in the USDX will most likely show a rise in USD/CHF charts like the one shown below.

Here are two little tips you should always remember:

If USD is the base currency (USD/XXX), then the USDX and the currency pair should move in the same direction.

If USD is the quote currency (XXX/USD), then the USDX and the currency pair should move in opposite directions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator