简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use the Straddle Trade Strategy to Trade the News

Abstract:What if there was a way to generate rapid money regardless of whether the market was going up or down? It's doable as long as price volatility is high enough. And when will you be able to get this turbulence? When economic data or central bank announcements are made public! The first step is to find out which news reports to exchange.

What if there was a way to generate rapid money regardless of whether the market was going up or down?

It's doable as long as price volatility is high enough.

And when will you be able to get this turbulence? When economic data or central bank announcements are made public!

The first step is to find out which news reports to exchange.

We have analyzed the most significant breaking news stories.

In a normal world, you'd only trade those reports because there's a good possibility the market will move dramatically after they're released.

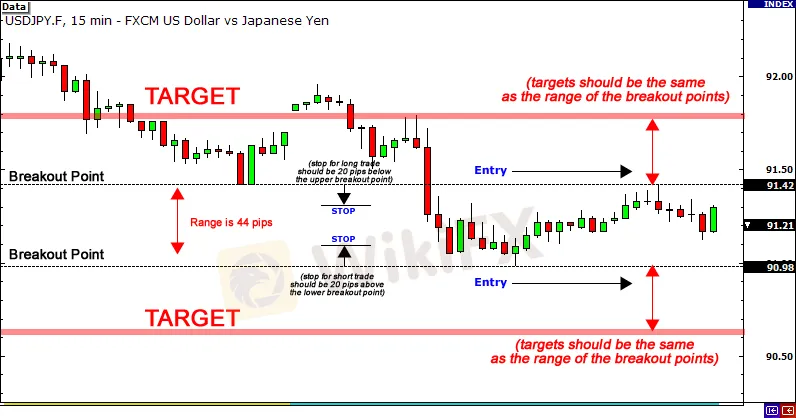

The next step is to check out the range at least 20 minutes before the game.

Your upper breakout point will be the top of that range, and your lower breakout point will be the bottom of that range.

It's worth noting that the smaller the range, the more probable you'll see a large change as a result of the news story.

Your entry levels will be the breakout points.

This is the place where you should place your orders. Your stops should be 20 pips below and above the breakout points, and your initial targets should be roughly the same as the breakout levels' range.

Trade in the Middle

A straddle trade is what this is called.

You want to be able to play BOTH sides of the table.

It makes no difference which way the price moves.

The straddle approach will put you in a position to profit from it.

All you have to do now is wait for the news to come out, and you'll be ready to join the market in either direction.

You can get triggered in one direction only to be stopped out because the price suddenly reverses in the opposite direction.

Your other entry, on the other hand, will be activated, and if that trade succeeds, you should be able to recoup your losses and make a modest profit.

In the best-case scenario, only one of your transactions is activated, and the price continues to climb in your favor, preventing you from losing money.

In either case, if done correctly, you should end up with a positive attitude for the day.

One of the things that appeals to me about a non-directional bias approach is that it removes all emotions.

You simply want to profit from the move when it occurs.

Because you'll be activated either way, you'll be able to take advantage of additional trading chances.

Setting reasonable profit targets should help to enhance the number of winning trades, given most news events have a limited impact on longer-term price action.

There are a plethora of other news trading techniques, but the concepts covered in this class should always be part of your routine if you're devising a strategy for profiting from news report moves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator