简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Where Can I Get a COT Report?

Abstract:Where Can I Get a COT Report? The Commitment of Traders report can be found online in the following ways.

The Commitment of Traders report can be found online in the following ways.

1st step:

In the web browser you are using, go to the following address.

https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.html

Step 2:

After the page has come up, scroll down to the “Current Legacy Report” and click on “Short Format” under “Futures Only” on the “Chicago Mercantile Exchange” row to get the most recent COT report.

Step 3:

It may seem scary at first because it seems to be a large, gobbled-up block of text, but with a little effort, you can get correctly what you need.

Just hit CTRL+F (or whatever your browser's find function is) and type in the currency you're looking for.

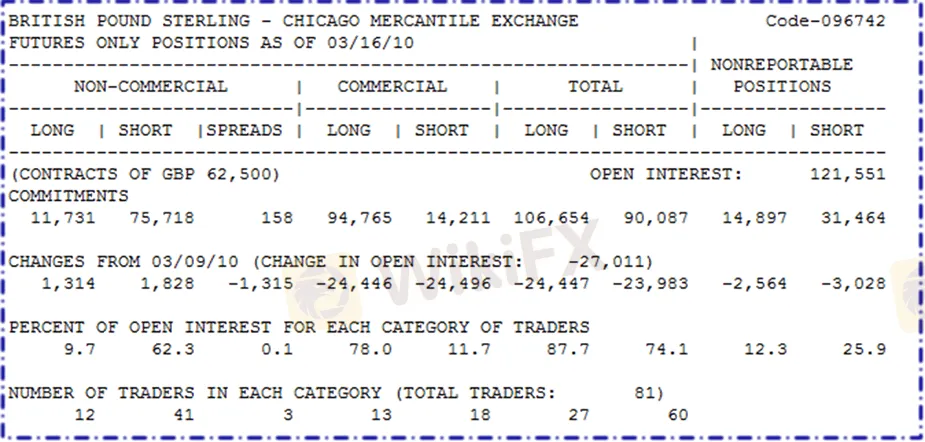

For example, to find the British Pound Sterling, or GBP, just search for “Pound Sterling” and you'll be led to a section that looks like this:

What the hell is going on here?! Don't be concerned. We'll go over each category in detail below.

Commercial: These are large corporations who make use of currency futures to hedge and protect themselves from excessive exchange rate volatility.

Individual traders, hedge funds, and financial institutions make up the non-commercial sector. Traders who are looking for speculative gains make up the majority of this group. In other words, these are traders like you who are only interested in making money!

The number of long contracts submitted to the CFTC is this.

Short: This is the number of short contracts disclosed to the Commodity Futures Trading Commission (CFTC).

Open interest:This column shows the number of contracts that have yet to be executed or delivered.

Number of trades: The total number of traders that are needed to report positions to the CFTC is given here.

Reportable positions:The amount of options and futures holdings that must be reported to the Commodity Futures Trading Commission (CFTC).

Non-reportable positions: The number of open interest positions that do not fulfill the CFTC's reportable rules, such as those held by retail traders.

If you want to see all of the available historical data, go here.

The COT report contains a lot of information, but you don't have to memorize it all.

As a novice trader, all you'll be concerned with is answering the query,

“What da dilly on da market yo?”

Translates as “How is the market this week?”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator