简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trust Capital TC -Overview Guide of This Broker

Abstract:Trust Capital TC is an unregulated financial services provider that offers trading opportunities in various financial markets, including forex, metals, commodities, indices, energies, shares, and cryptocurrencies. They offer different account types with varying minimum deposit requirements to accommodate traders of different experience levels. Additionally, Trust Capital TC provides access to the MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms, along with a range of educational resources and customer support services.

| Trust Capital TC Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Cyprus |

| Regulation | No Regulation |

| Market Instruments | 200+, Forex, Metals, Commodities, Indices, Energies, Shares, Cryptocurrencies |

| Demo Account | Available |

| Spread | No Swaps (Solo Account), no Swaps (Together Account), raw spreads from 0 pips (Pro Account) |

| Trading Platforms | MetaTrader4, MetaTrader5 |

| Minimum Deposit | $250 (Solo Account), $1,000 (Together Account), $3,000 (Pro Account) |

| Customer Support | Phone: +35725378899 |

| Fax: +357 25388577 | |

| Email: cs@trustcapitaltc.eu | |

| Address: Head Office: 23 Olympion Street, Libra Tower, Office: 202, 3035 Limassol, Cyprus. Representative Office: Representative Office Al Abraj Street, Binary By Omniyat Office 1410, Business Bay, PO Box 113478 Dubai, UAE | |

| Live chat, contact form | |

| 09:00 to 23:00 (Monday to Friday) GMT+3 | |

What is Trust Capital TC?

Trust Capital TC is an unregulated financial services provider that offers trading opportunities in various financial markets, including forex, metals, commodities, indices, energies, shares, and cryptocurrencies. They offer different account types with varying minimum deposit requirements to accommodate traders of different experience levels. Additionally, Trust Capital TC provides access to the MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms, along with a range of educational resources and customer support services.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Multiple Market Instruments: The platform offers over 200 trading products, including Forex, Metals, Commodities, Indices, Energies, Shares, Cryptocurrencies, catering to various trading needs and experience levels.

Diverse Account Types: The platform offers diverse account types, including the Solo Account, Together Account, and Pro Account, catering to various trading needs and experience levels.

Multiple Customer Support Channels: Trust Capital TC provides various customer support channels including phone, fax, email, address, live chat and contact form, enhancing accessibility and assistance for clients.

Cons:

No Valid Regulation: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency.

Is Trust Capital TC Legit or a Scam?

Regulatory sight: Presently, Trust Capital TC has the sole authority of a suspicious clone license under the Straight Through Processing(STP) of the Cyprus Securities and Exchange Commission (CYSEC), bearing license number 369/18. This type of license, which allows a company to mimic the services of a legitimate financial entity, raises concerns about the legitimacy and trustworthiness of the company's operations.

Trust Capital TC previously held a clone license authorized by the European Authorized Representative (EEA) of the Financial Conduct Authority (FCA) with license number 840503. However, the current status of this license is revoked.

Market Instruments

Trust Capital TC offers a wide array of trading instruments, providing clients with access to over 200 financial products across various asset classes.

These include forex pairs, allowing traders to speculate on the exchange rates of major, minor, and exotic currency pairs. Additionally, clients can trade precious metals such as gold and silver, commodities like oil and natural gas, and indices representing major stock market indices from around the world.

Furthermore, Trust Capital TC offers trading opportunities in energy markets, enabling investors to trade contracts for difference (CFDs) on energy commodities. Clients can also engage in share trading, accessing a selection of stocks from global exchanges.

Moreover, Trust Capital TC recognizes the growing popularity of cryptocurrencies and offers trading in digital assets like Bitcoin, Ethereum, and Litecoin, allowing traders to capitalize on the price movements of these dynamic markets.

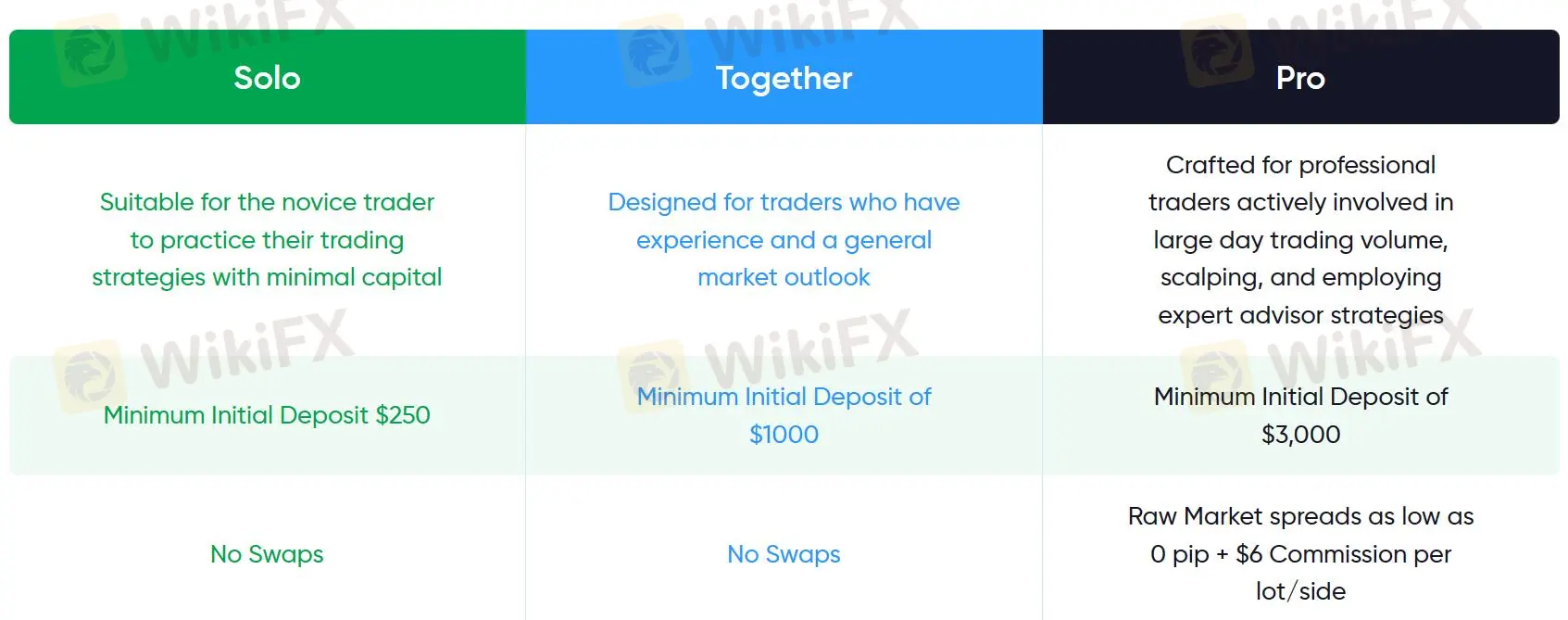

Account Types

Trust Capital TC caters to traders of varying experience levels and preferences by offering a range of account options with different minimum deposit requirements.

For those looking to start with a smaller initial investment, the Solo Account stands out with a minimum deposit requirement of $250. This account type provides access to the platform's features and trading instruments, making it suitable for beginners or those looking to test the waters of online trading.

For traders seeking enhanced features and capabilities, the Together Account requires a minimum deposit of $1,000. With this account, traders can access additional tools and resources to support their trading strategies.

Finally, for more experienced traders or those who require direct market access and tight spreads, the Pro Account offers a minimum deposit requirement of $3,000.

How to Open an Account?

Step 1: Click the button ''Open Live Account'' on the homepage.

Step 2: Follow the on-screen instructions to input your personal and contact details.

Step 3: After filling out the form, you will need to agree to the following:

You agree to allow Trust Capital TC to contact you via phone and email and process your personal data for marketing purposes.

You have carefully read and understood the companys Privacy Policy.

Step 4: Complete the reCAPTCHA verification.

Step 5: Click the green “Begin” button.

Spreads & Commissions

Trust Capital TC provides a range of account options with competitive spreads and commission structures tailored to suit the trading preferences of its clients. For Solo and Together accounts, traders benefit from no swaps, making them suitable for those who prefer to avoid overnight interest charges.

Additionally, Trust Capital TC offers Pro accounts with raw market spreads starting from 0 pips, providing direct access to interbank liquidity and ensuring transparent pricing. While Pro account holders enjoy tight spreads, they are subject to a commission of $6 per lot/side, facilitating precise cost management and ensuring a transparent fee structure.

Trading Platforms

Trust Capital TC provides its clients with access to both the MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms, offering a versatile and comprehensive trading experience. These platforms are renowned for their user-friendly interfaces, advanced charting tools, and extensive range of technical indicators, empowering traders to analyze markets effectively and make informed trading decisions.

With MT4 and MT5, clients can trade a diverse range of financial instruments, including forex, commodities, indices, and cryptocurrencies, all from a single interface. The platforms also support algorithmic trading through the integration of expert advisors (EAs) and customizable automated trading strategies.

Trading Tools

Trust Capital TC provides traders with a comprehensive set of trading tools to enhance their trading experience and make informed decisions in the financial markets. These tools include:

Calculator: Trust Capital TC offers a handy calculator tool that enables traders to quickly assess various aspects of their trades, such as pip value, margin requirements, and profits or losses. This calculator simplifies complex calculations, allowing traders to focus on their trading strategies without the hassle of manual computations.

Economic Calendar: Keeping track of economic events and data releases is crucial for successful trading. Trust Capital TC's economic calendar provides traders with up-to-date information on key economic indicators, central bank meetings, and geopolitical events that can impact financial markets. By staying informed about scheduled economic events, traders can anticipate market movements and adjust their trading strategies accordingly.

Rollover Schedule: For traders engaging in positions overnight, understanding rollover rates is essential. Trust Capital TC offers a rollover schedule tool that provides transparency on the rollover rates for various currency pairs and commodities. This allows traders to factor in rollover costs when planning their trades and managing their positions effectively.

Holiday Schedule: Market holidays can significantly affect trading conditions and liquidity in the financial markets. Trust Capital TC's holiday schedule tool helps traders stay informed about upcoming market holidays around the world. By being aware of these holidays, traders can adjust their trading schedules and risk management strategies to avoid disruptions.

Dividend Schedule: For traders interested in trading stocks and equity indices, dividends play a crucial role in investment decisions. Trust Capital TC's dividend schedule tool provides information on upcoming dividend payments for individual stocks and indices. By knowing when dividends are scheduled to be paid, traders can adjust their trading strategies to capitalize on dividend-related opportunities or mitigate risks associated with dividend payments.

Deposits & Withdrawals

Trust Capital TC offers a variety of deposit and withdrawal methods, including:

Bank Transfer (EUR and USD): 1-5 business days for deposits and withdrawals. There is a fee of up to €35.00 per transaction for deposits and up to 0.15% per transaction for withdrawals.

Visa/Mastercard/Maestro (USD, GBP, CHF, EUR, RUB): Same day deposit processing and 2-3 business day withdrawal processing. There is a €0.50 fee per transaction for withdrawals.

SEPA (EUR and USD): 1-5 business days for deposits and withdrawals. There is a minimum 20 euro fee plus 0.1% per transaction.

Crypto to Fiat: Same day processing for both deposits and withdrawals. There is a 1.00% fee for both deposits and withdrawals.

Trust Capital TC aims to make deposits as straightforward and accessible as possible by accepting a wide range of payment methods. These include internationally recognized credit cards such as VISA and MASTERCARD. They also accommodate e-Wallet solutions like SKRILL and NETELLER. Direct transfers through BANK WIRE are also an option. In addition to these, they accept Pay Pal and also cater to Online Banking for LocalPayments.

Customer Service

Trust Capital TC provides a comprehensive and accessible customer support network. Their support team can be reached 09:00 to 23:00(Monday to Friday) GMT+3through different channels for ultimate convenience.

Live chat

Phone: +35725378899

Fax: +357 25388577

Email:cs@trustcapitaltc.eu

Address:

Head Office: 23 Olympion Street, Libra Tower, Office: 202, 3035 Limassol, Cyprus

Representative Office: Representative Office Al Abraj Street, Binary By Omniyat Office 1410, Business Bay, PO Box 113478 Dubai, UAE

Education

Trust Capital TC is committed to supporting the growth and success of its traders through a robust offering of educational resources.

Firstly, the platform hosts Forex Seminars, providing traders with an interactive learning environment to delve into various aspects of forex trading, including market analysis, trading strategies, and risk management. These seminars offer valuable insights and practical knowledge to help traders navigate the complexities of the forex market with confidence.

In addition to group seminars, Trust Capital TC offers personalized One-on-One Forex Sessions, allowing traders to receive tailored guidance and mentorship from seasoned professionals. These sessions provide an invaluable opportunity for traders to address specific challenges, refine their trading skills, and develop personalized trading strategies under the guidance of experienced mentors.

Furthermore, Trust Capital TC keeps traders informed with up-to-date Market News, delivering insights into market trends, economic events, and geopolitical developments that may impact trading decisions. By staying informed about the latest market developments, traders can make well-informed decisions and adapt their strategies accordingly to capitalize on emerging opportunities and mitigate risks.

Lastly, Trust Capital TC provides a comprehensive Financial Glossary, offering definitions and explanations of key financial terms and concepts relevant to trading. This glossary serves as a valuable reference tool for traders, helping them to deepen their understanding of financial markets and terminology, and empowering them to navigate the trading landscape with confidence and proficiency.

Conclusion

In conclusion, Trust Capital TC offers an extensive range of trading instruments, various account types, multiple trading platforms, and a wide range of accepted payment methods, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation raises significant concerns about the safety and trustworthiness of the platform.

Frequently Asked Questions (FAQs)

| Question 1: | Is Trust Capital TC regulated? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | Does Trust Capital TC offer demo accounts? |

| Answer 2: | Yes. |

| Question 3: | What is the minimum deposit for Trust Capital TC? |

| Answer 3: | The minimum initial deposit to open an account is $250. |

| Question 4: | Does Trust Capital TC offer industry-leading MT4 & MT5? |

| Answer 4: | Yes. It offers MT4 and MT5. |

| Question 5: | Is Trust Capital TC a good broker for beginners? |

| Answer 5: | No. It is not a good choice for beginners because of its unregulated condition. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Peso Depreciation to 59:$1 Likely Amid Strong Dollar Surge

Currency Calculator