简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: March US Nonfarm Payrolls & EURUSD Price Outlook

Abstract:Markets are expecting the weak February print of 20K to be a one-off; consensus calls for 170K.

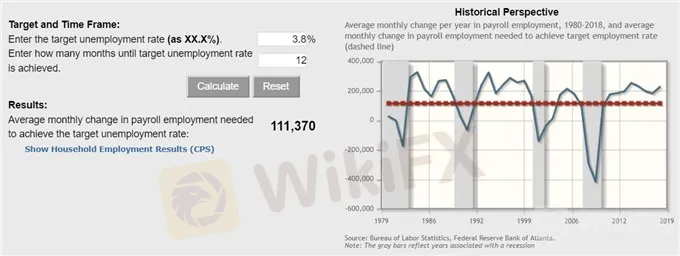

The main issue for the US Dollar when it comes to the March US Nonfarm Payrolls report is whether or not the US labor market rebounded after the US government shutdown. After all, the February reading was a meager 20K. But with the unemployment rate still near cycle lows at 3.8%, there is still evidence that the labor market remains tight by the FOMCs standards. Market participants are expecting that March reading will show a strong rebound, given that jobless claims remain low. Accordingly, current expectations for the data are calling for the unemployment rate to hold at 3.8%, and for the headline jobs figure to come in at +170K.

According to the Atlanta Fed Jobs Growth Calculator, the economy only needs +111K jobs growth per month over the next 12-months to sustain said unemployment rate at its current 3.8% level.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

EURUSD Price Chart: Daily Timeframe (June 2018 to April 2019)

EURUSD has been on a losing streak since the Feds March meeting, falling all but one day since March 20. Momentum is firmly to the downside right now, with price squarely below the daily 8-, 13-, and 21-EMA envelope in sequential order. Likewise, daily MACD and Slow Stochastics are trending lower, with the former having crossed below its signal line last week; the latter is nearing a sell signal. A test of the yearly low at 1.1176 is not out of the question this week (nor would be a break to fresh yearly lows).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

WikiFX Broker

Latest News

ATTENTION! WARNING AGAINST FRAUD BROKERS

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

Alameda Sues KuCoin to Reclaim $50M in FTX Asset Recovery Drive

Canadian Watchdog Warns Against Capixtrade

The impact of the U.S. presidential elections on gold and Forex prices

The Importance of Backtesting in Forex Trading

The Role of Moving Averages in Trend Trading

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

Currency Calculator