简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: RBA Could Jolt AUDUSD Price Action

Abstract:AUDUSD overnight implied volatility jumps to 1-month highs ahead of the Reserve Bank of Australia's interest rate decision expected early in Tuesday's session.

AUDUSD IMPLIED VOLATILITY – TALKING POINTS

-

AUDUSD overnight implied volatility skyrockets to 10.7 percent in anticipation of the Reserve Bank of Australias rate review expected Tuesday at 3:00 GMT

Although markets are largely expecting the RBA to keep interest rates on hold at 1.50 percent, Governor Philip Lowe could provide supplemental information on the central banks latest view on monetary policy and economic outlook

New to Forex? Check out this free Forex for Beginners educational trading guide

Forex option traders have bid up implied volatility on overnight AUDUSD contracts ahead of the Reserve Bank of Australia‘s latest monetary policy decision slated for Tuesday at 3:00 GMT. While the central bank is widely expected to stay on the sidelines and leave its policy interest rate unchanged at 1.50 percent, follow-up commentary from Governor Lowe looks to provide AUD traders with additional insight on the RBA’s next move.

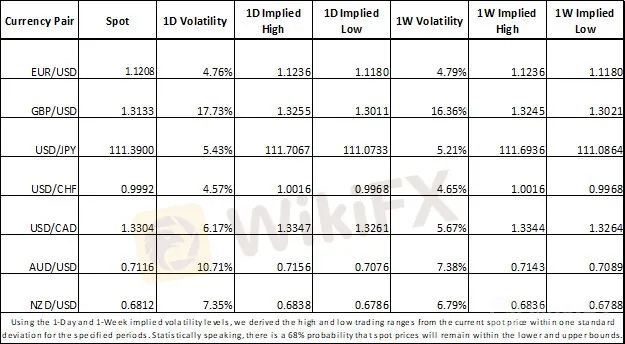

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

The accompanying monetary policy decision statement will likely highlight the latest developments in Australia‘s labor and housing markets which largely contribute to the central bank’s relative dovish or hawkish tilt. Despite the Australian unemployment rate recently dropping to 4.9 percent, its lowest reading since June 2011, the RBA could still refrain from taking a less-dovish stance in consideration of neighboring New Zealand whose central bank hinted at cutting the country's policy interest rate last week.

AUDUSD CURRENCY PRICE CHART: 4-HOUR TIME FRAME (MARCH 05, 2019 TO APRIL 01, 2019)

AUDUSD spot prices have recently traded between the 23.6 percent and 38.2 percent Fibonacci retracement lines drawn from Marchs low and high. Although, the currency pair appears to have coiled between short-term trendlines which could position AUDUSD for a material break above downtrend resistance or below uptrend support. According to overnight implied volatility measures, however, currency market participants could expect AUDUSD to trade between 0.7076 and 0.7156.

FOREX ECONOMIC CALENDAR – AUDUSD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

In addition to the RBA‘s rate review, a handful of economic data out of Australia and the US could exacerbate AUDUSD price volatility. The latest reading on US Durable Goods Orders could move the market’s needle if actual data crosses the wires materially above or below consensus. Also, AiG‘s Performance of Services Index has potential to send AUDUSD gyrating later in Tuesday’s session depending on the reading.

AUDUSD CLIENT SENTIMENT

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to IGs client positioning data, 61.3 percent of AUDUSD traders are net-long with the ratio of traders long to short at 1.59 to 1. Moreover, traders have grown increasing bullish AUDUSD as the number of traders net-long is 11.4 percent higher than Friday and 26.9 percent higher compared to last week. However, we typically take a contrarian view to crowd sentiment which suggests AUDUSD prices may continue to fall.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

Stocks Mixed As RBA Leaves Rates Alone, Australian Data Mixed Too

Equities were mostly lower, if not by very much. Australian interest rates remained at record lows. That was as expected, but retail sales disappointed as the current account surged ahead

Australian Dollar Ticks Up, China Caixin PMI Flags Surprise Expansion

The Australian Dollar got a small burst of life on news that Chinas private manufacturing sector did better than its large, state-run partner last month.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Hong Kong Court Rules in Favor of Investors in JPEX Case

Visa and Coinbase Partner for Instant Crypto Transfers in US, EU

Currency Calculator