简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Outlook: Unemployment Data, Utilities To Lead Index Price

Abstract:The S&P 500 will look to Fridays release of non-farm payrolls data as it struggles to fend off bearish price action.

S&P 500 Outlook Talking Points:

Another round of TLTROs from the ECB seemingly pressured the S&P 500 on Thursday, contributing to a fourth consecutive day of losse

Non-farm payrolls and US unemployment will be released at 13:30 GMT, 8:30 AM EST Friday

The data may leverage significant influence over US equities given their turbulence this week

See how IG clients are positioned on the Dow Jones, S&P 500 and the US Dollar with our free IG Client Sentiment Data.

S&P 500 Outlook: Unemployment Data to Lead Index Price

Yesterday I highlighted the potential impact of the ECB‘s monetary policy meeting on the Dow Jones. With the resulting price action more bearish than anticipated, a risk-off mood remains dominant into Friday’s session. As the headline data, change in US non-farm payrolls and the unemployment rate will look to influence early equity performance as markets digest the data.

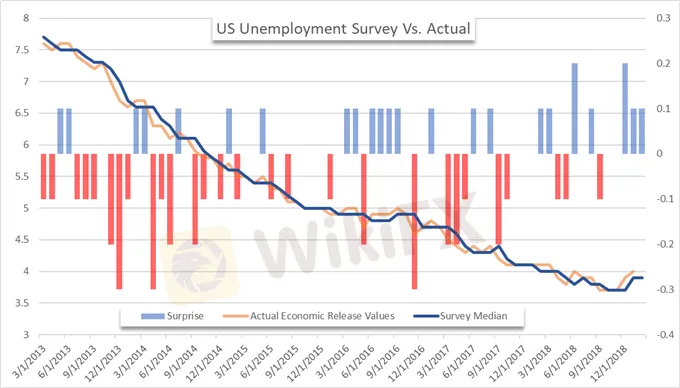

US Unemployment Rate (Chart 1)

With previous unemployment releases, sector sensitivity to data surprises seems to be somewhat random and often overshadowed by other themes. For example, the unemployment rate in December 2018 surprised markets with a 0.2% beat of survey expectations. Evidently, strong employment was unable to stem the tide from other market themes and sector performance was negative throughout. The recent string of positive data surprises also did little to encourage bullish price action.

S&P 500 Sector Reaction to Unemployment Data (Chart 2)

With that said, the utilities sector appears to be one of the more volatile industries on days of the data‘s release. Regardless of direction, the sector has been one of the top-3 biggest movers in 6 of the last 8 release sessions. Further, it notched the biggest move in 4 of the last 8. As Friday’s session approaches, it would be within reason to assume utilities will once again appear an outlier for market volatility.

Dow Jones Price Chart: Daily Time Frame (January 2018 – March 2019) (Chart 3)

Dow Jones Price chart overlaid with ratio of SPX to XLU (Utilities ETF)

The sector has outperformed the broader S&P 500 since mid-February. Largely because the typically-defensive sector has enjoyed gains from the broader-market rebound while standing firm on red days like today.

Looking to take your trading to the next level? Check out our free Advanced Trading Guides.

According to a Twitter poll, traders are fairly split on tomorrow‘s unemployment outcome, with a slight bearish leaning. Follow @PeterHanksFX to participate in the poll and for equity-leaning content. Given the turbulence in equities this week after failing to break through technical resistance, tomorrow’s data may spark considerable price action as traders grasp to find the next trend.

For other non-farm payroll trading opportunities, check out Pre-NFP Price Action Setups Across the US Dollar.Non-farm payrolls is one of the most market moving economic indicator for the US Dollar, learn to trade real-time news events like it with our Trade the News Trading Guide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

【MACRO Alert】The possibility of Trump winning the election is closely linked to market conditions! Could Japan become a big winner from this?

Although the market has responded positively to the prospect of Trump's possible re-election, and the Japanese stock market has shown an upward trend as a result, investors should also remain cautious and pay attention to the long-term impact of the election results on global economic policies and market sentiment. As strategist Tomo Kinoshita pointed out, while short-term market dynamics may be closely related to the election results, ultimately, the fundamentals of companies, economic data, an

Commodity prices Surge as Geopolitical Tension Rise

he market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday's session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day.

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

Daily Market Newsletter - February 8, 2024

Recap of Global Market Trends and Trading Opportunities

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

Currency Calculator