简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sterling: GBPUSD Technical Analysis and Brexit Update

Abstract:The British Pound continues to drift lower ahead of a pivotal Brexit week for UK PM May. Support may be tested all the way down

GBPUSD Price and Brexit Volatility:

GBPUSD struggles to break through Fibonacci retracement.

Brexit news may now provoke larger price reactions.

Q1 2019 GBP Forecast and USD Top Trading Opportunitie

Sterling volatility is set to increase over the coming weeks as Brexit negotiations and UK Parliamentary votes take hold of price action. PM May faces three votes next week – March 12-14 – and the outcome of these will steer the British Pound going into the end of the month, unless the UK and EU agree an extension of Article 50 beyond March 29. The EU has asked the UK for more clarity today about its Irish border backstop proposal, which the EU currently reject, while the UK has stated that it still requires legally binding assurances that there will be no hard border in Ireland.

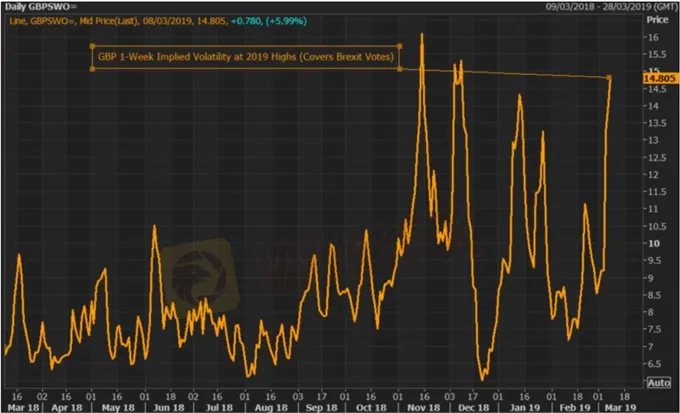

This unease is shown in the latest one-week Sterling volatility chart which has jumped to its highest level since early December 2018. Volatility is expected to stay high until the end of the month or at least until an agreement is signed off.

GBPUSD continues to respect the bullish uptrend started at the beginning of the year with higher lows holding despite the weakness seen in the pair over the last 10-days. The pair rejected resistance at the 38.22% Fibonacci retracement level (1.3177) twice this week and this level may cap upside momentum in the short-term. To the downside there is a possibility of a move back to the 200-day moving average at 1.2937, a point where it currently intersects bullish momentum.

GBPUSD Daily Price Chart (July 2018 – March 8, 2019)

Retail traders are 57.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a stronger bearish trading bias for GBPUSD.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GBP/USD (CABLE) 4Hour Anticipation

Daily wise bearish structure, but as 4H shown shift in structure to the topside

Weekly British Pound Forecast: Inflation Report Due Ahead of BOE Meeting; Brexit Talks Ongoing

As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

GBPUSD Price Rallies to a Six-Week High, Brexit Latest

GBPUSD has just hit its highest level since late-July and is eyeing further gains on a combination of a marginally stronger Sterling complex and a weak US dollar.

EURGBP Price Outlook Tracks ECB Monetary Policy and Brexit News

Two weak currencies that are currently looking ahead to potentially defining moments that will provide a clear signal for both. How will they compare against each other?

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator