简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SEK Eyeing Consumer Confidence, GDP, Manufacturing PMI, EU Data

Abstract:The Swedish Krona will be on the lookout for key domestic economic indicators during a week of high event risk in Europe and the US.

SEK TALKING POINTS – USD/SEK, SWEDEN GDP, EU DATA, OMX

Data-heavy week in Sweden to impact Krona

EU economic reports in sight as region slow

Outlook for Swedens economy and the Krona

See our free guide to learn how to use economic news in your trading strategy!

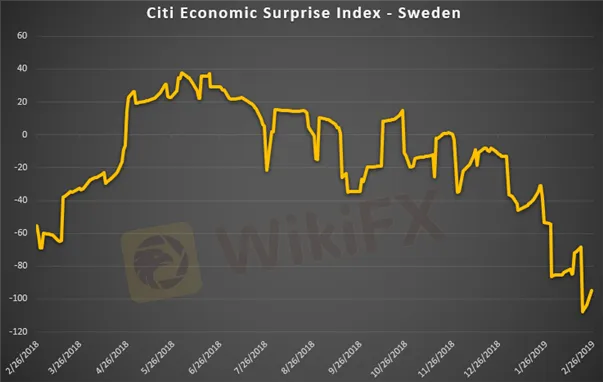

The Swedish Krona will be eyeing several key economic reports coming out of the Scandinavian country this week. Most notably is GDP, manufacturing PMI, retail sales and consumer confidence. Forecasts for quarter-on-quarter growth stand at 0.6 percent with the previous showing a contraction at 0.2 percent. For over a year, Sweden‘s economy has been underperforming relative to economists’ expectations according to the Citi Economic Surprise Index.

However, looking at Sweden‘s benchmark OMX equity index since January would give the impression that all is well in the Nordic country. Since the start of the year, it has climbed over 15 percent but may start sputtering soon as negative RSI divergence suggests underlying momentum is fading. The Riksbank’s dovish disposition has helped push equities higher with investors taking advantage of cheap credit.

OMX Equity Index – Daily Chart

However, this has also created a problem of high household indebtedness which Riksbank officials have repeatedly stated is a central concern. If interest rates rise, it could cripple households that are heavily laden with debt and could spark a stark slowdown. Policymakers are also concerned with political and economic developments abroad that could weigh on the export-driven Krona should investor sentiment sour.

A cascade of economic data out of the US and EU will be hitting markets this week which could affect SEK. There is also Fed Chairman Jerome Powells congressional testimony and a slew of US data that is scheduled to be released over roughly the same span of time. Depending on the magnitude of the reports, it could potentially alter Fed monetary policy which would ripple out into the global economy.

Since January, USD/SEK has risen over five percent, with reports showing the Swedish Krona as the worst performer out of all the G-10 currencies. The fundamental outlook for Nordic assets suggests this trend will continue throughout 2019.

Leading up to the event risks this week, USD/SEK may trade within spitting distance in the lower bound of the 9.3110-9.4066 trading range. If GDP and other major indicators fall short of expectations, the pair could extend beyond 9.4066 as an initial reaction. This dynamic may be extended further if US economic data outperforms expectations, giving the Fed impetus to raise rates which could push the pair higher.

USD/SEK – Three-Hour Chart

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

NOK Eyes Crude Oil Prices, Norges Bank and FOMC Rate Decisions

The Norwegian Krone will likely experience higher-than-usual volatility alongside crude oil prices ahead of rate decisions by the Norges Bank and Fed.

USDNOK Breaks Critical Support - USDSEK Retreats at Alarming Rate

USDNOK and USDSEK are both experiencing retreats at an alarming rate, potentially opening the door to a short-term break in critical support areas.

NOK, SEK Forecast: Volatility Eyed on ECB, EU News, US Jobs Data

The Swedish Krona and Norwegian Krone will likely experience higher-than-usual volatility ahead of the ECB rate decision and critical European and US data.

Euro Nervously Eyes ECB and EU Data, SEK May Fall on Swedish GDP

The Swedish Krona may fall on GDP data and the Euro may struggle to rise if the ECB shows an increasing risk of a Eurozone financial crisis as key economic data is released.

WikiFX Broker

Latest News

Canadian Watchdog Warns Against Capixtrade

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

ATTENTION! WARNING AGAINST FRAUD BROKERS

The Importance of Backtesting in Forex Trading

Alameda Sues KuCoin to Reclaim $50M in FTX Asset Recovery Drive

The impact of the U.S. presidential elections on gold and Forex prices

The Role of Moving Averages in Trend Trading

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

Currency Calculator