简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen and US Dollar May Rise on Powell Comments, Pound Eyes Carney

Abstract:The Yen and US Dollar may rise as Fed Chair Powell stokes rate hike bets and sours risk appetite. The British Pound is eyeing comments

TALKING POINTS – POWELL, YEN, US DOLLAR, BREXIT, POUND, CARNEY

Yen up, Aussie Dollar down as rally on US-China trade deal hopes unravel

Comments from Fed Chair Powell may boost US Dollar, sour market mood

Pound up on Brexit delay hopes but Carney testimony may cool momentum

The sentiment-linked Australian Dollar fell with Asia Pacific stocks while the anti-risk Japanese Yen traded higher as financial markets‘ mood soured, unable to find follow-through on yesterday’s exuberance. That rally was triggered as US President Donald Trump opted to delay a tariff hike on $200 billion in Chinese imports that was slated for on March 1, citing positive progress in on-going negotiations.

This might continue. Fed Chair Jerome Powell is due in the US Senate for the first day of semi-annual testimony. He may echo the noncommittal, neutral tone on display in minutes from January‘s FOMC meeting. That clashed with the markets’ more dovish view, boosting the US Dollar. More of the same may also feed risk aversion as markets worry about higher tightening prospects amid a global slowdown.

POUND UP ON BREXIT DELAY HOPES, CARNEY COMMENTS DUE

The British Pound is on the upswing in early European trade, buoyed by reports that UK Prime Minister Theresa May is mulling postponing Brexit. Meanwhile, opposition Labour Party leader Jeremy Corbyn has agreed to support holding a new referendum on the EU/UK divorce. Sobering comments from BOE Governor Carney in testimony before Parliaments Treasury committee might cool the rally however.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

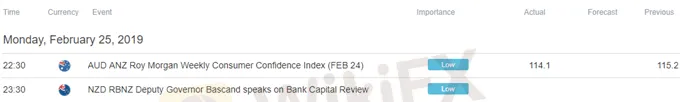

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

Currency Calculator