简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro at Risk on CPI, Dollar and Yen May Rise on US Data

Abstract:The Euro may fall further as soft inflation data cools ECB policy bets. The Dollar and Japanese Yen may rise as US economic data cools

TALKING POINTS – EURO, CPI, US DOLLAR, YEN, PAYROLLS, ISM

Euro may fall as soft CPI data cools 2019 ECB rate hike bet

Dollar and Yen may rise as upbeat US data cools risk appetite

Aussie Dollar falls on Chinese PMI, CAD down with crude oil

Eurozone CPI data headlines the economic calendar in European trading hours. The headline year-on-year inflation gauge is expected to fall to 1.4 percent in January, the lowest since April 2018. A soft result might cool 2019 ECB rate hike prospects, weighing on the Euro.

Later in the day, the spotlight turns to US employment data and manufacturing ISM survey. The former is expected to show payrolls growth slowedwhile factory-sector activity perked up in January. US news-flow has notably improved relative to baseline forecasts recently, opening the door for upside surprises.

Rosy results might offer a lifeline to the beleaguered US Dollar. The currency touched the lowest level in almost three months this week following a dovish FOMC policycall. Officials stepped back from a promise of gradual rate hikes and even hinted that the pace of balance sheet unwinding may be slowed.

The data may also have potent implications for broader risk appetite trends. Markets cheered the Feds timid stance despite its origins in genuinely worrying developments, from slowing global growth to political instability across much of the G10 space and beyond.

With that in mind, evidence of a healthier US economy than investors have envisioned may be met with a somewhat counter-intuitive response. If it is judged as likely to ease the Feds concerns, it may well translate into a risk-off response that lifts the Japanese Yen alongside the Greenback.

AUSSIE DOLLAR FALLS ON CHINA PMI, CAD DOWN WITH CRUDE OIL

The Australian Dollar underperformed in Asia Pacific trade. The currency fell alongside local bond yields following disappointing Chinese PMI data that stoked worries about the negative knock-on effects on growth, inflation and RBA monetary policy from a slowdown in Australias largest export market.

The Canadian Dollar declined alongside a pullback in crude oil prices. The currency sometimes defaults to taking cues from one of its home countrys top export commodities on the belief that significant price swings can have broader implications for economic performance and thereby BOC monetary policy.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

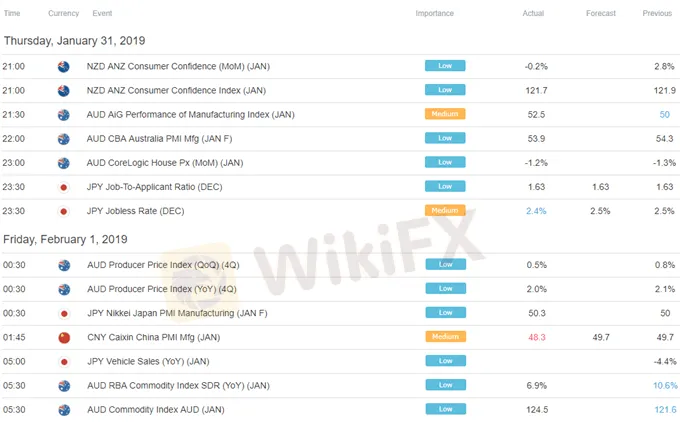

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

XM - Featured Broker in WikiFX SkyLine Guide

Angel One is an Ideal choice for you ?

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

6 Trading Platforms That May Put Your Money at Risk

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Be a part of SquaredFinancial Live Talk show on US Election

Currency Calculator