Score

HTFX

United Kingdom|5-10 years| Benchmark B|

United Kingdom|5-10 years| Benchmark B|https://www.htfx.co/

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

HTFXVULTD-Demo

United Kingdom

United KingdomBenchmark

Speed:AA

Slippage:C

Cost:A

Disconnected:D

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

HTFX Limited

HTFX

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The Vanuatu VFSC regulation with license number: 700650 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed HTFX also viewed..

XM

Exness

IronFX

Neex

HTFX · Company Summary

| Company Name | HTFX |

| Founded | 2018 |

| Registered Country/Region | Vanuatu |

| Regulation | FCA, CySEC, VFSC (Offshore) |

| Tradable Assets | 120+, forex pairs, commodities, indices, cryptos, shares, metals |

| Account Types | Standard, Cent, ECN |

| Demo Account | Available |

| Max. Leverage | 500:1 (forex/gold), 200:1 (oil) |

| Spreads | From 1.4 pips (Standard account) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Deposit & Withdrawal | RediPay, THAI QR PAYMENT, RPNpay, helpay2, CC, ChipPay, teleport, PAYOK, Tether, Alipay |

| Customer Support | Contact form |

| Phone: +678 29816 | |

| Email: support@htfx.com | |

| Address: 2 Floor, ZEO Building, Freshwater 1, Port Vila, Vanuatu | |

| Social media: Facebook, Twitter, YouTube and Instagram | |

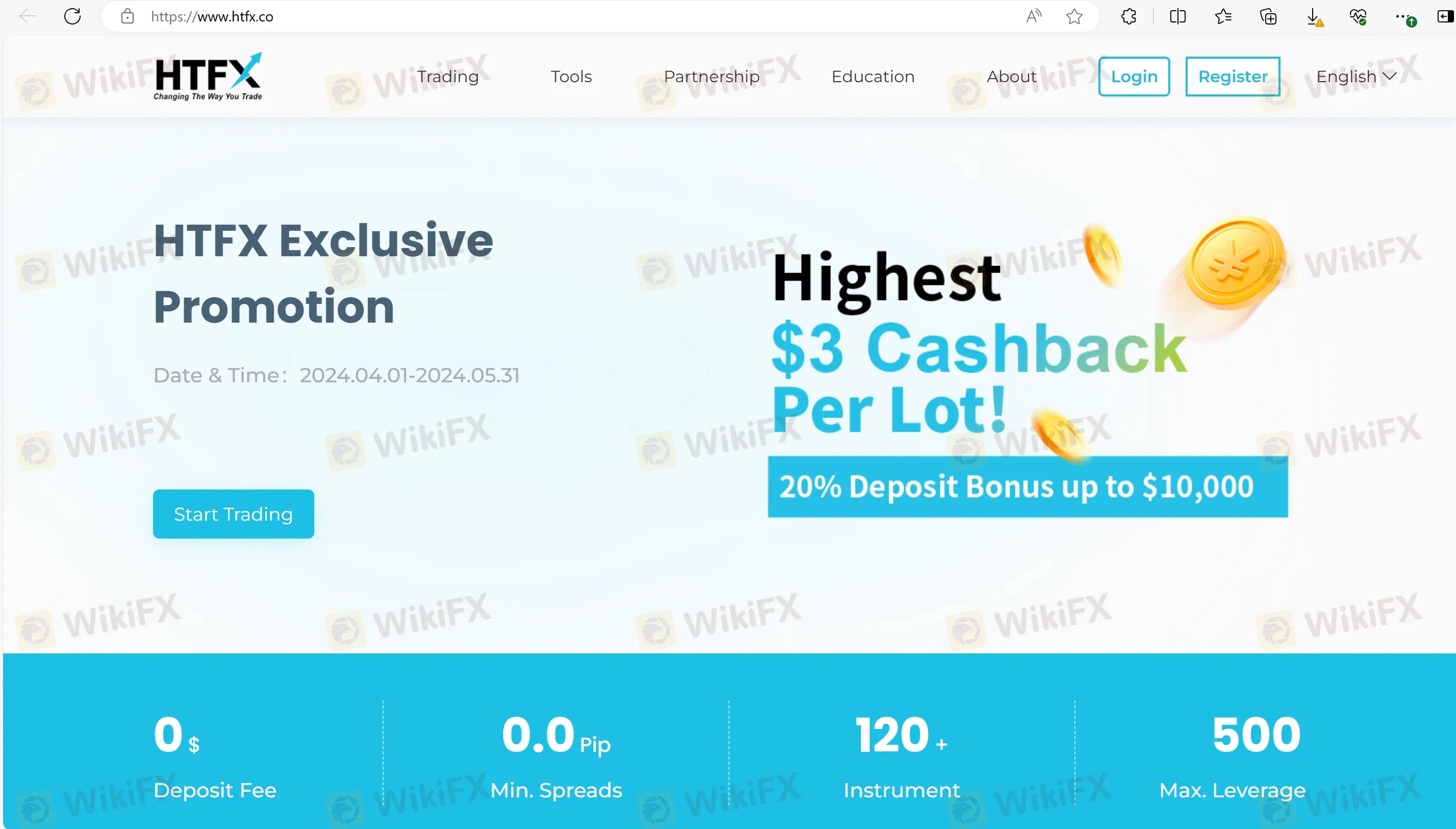

| Bonus | 20% deposit bonus up to $10,000 (from April 1, 2024, to May 31, 2024) |

| Regional Restrictions | Citizens/Residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, Ukraine are not allowed |

Overview of HTFX

HTFX is a well-established forex broker with offices spanning across the UK, Cyprus, Indonesia, Thailand, Malaysia, Vietnam, Taiwan, Hong Kong, and Vanuatu, regulated by both FCA and CySEC. With a minimum deposit of $50 and maximum leverage of 500:1, it offers competitive spreads starting from 1.4 pips on the Standard account.

Traders can access MetaTrader4 (MT4) and MetaTrader5 (MT5) platforms, trading various assets like forex pairs, commodities, indices, cryptos, shares, and metals. HTFX provides Standard, Cent, and ECN account types, along with a demo account option.

Pros & Cons

| Pros | Cons |

| Regulated by FCA and CySEC | Offshore regulated by VFSC |

| Low minimum deposit ($50) | Citizens/Residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, Ukraine are not allowed |

| Competitive maximum leverage (500:1) | |

| Access to MetaTrader4 and MetaTrader5 platforms | |

| Diverse range of tradable assets | |

| Various account types | |

| Availability of demo accounts | |

| Multiple deposit and withdrawal options |

However, their VFSC is offshore regulated is a limitation and citizens/residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, Ukraine are not allowed.

Is HTFX Legit?

HTFX is a regulated forex broker, supervised by two regulatory agencies: the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. The broker operates under Straight Through Processing (STP) license types. HTFX's FCA license number is 822279, while its CySEC license number is 332/17.

Additionally, HTFX holds an offshore license from the Vanuatu Financial Services Commission (VFSC), which, while less stringent than FCA or CySEC, still provides a regulatory framework.

Being regulated by these reputable authorities signifies compliance with stringent financial and operational standards, providing traders with a level of confidence and security in their trading activities with HTFX.

Market Instruments

HTFX provides a diverse and extensive range of over 120 trading instruments. This selection includes major and minor forex pairs, offering ample opportunities for currency trading enthusiasts to capitalize on fluctuations in global markets. Additionally, HTFX includes commodities such as oil and gold, which are popular among traders looking to hedge or diversify their portfolios against market volatility.

The platform also offers trading in indices, cryptos, shares, and metals, thus accommodating a variety of trading interests from traditional equity investments to more contemporary digital assets. This comprehensive assortment ensures that HTFX clients can engage with multiple asset classes through a single platform, enhancing their ability to execute diverse trading strategies effectively.

Account Types

HTFX offers three tailored account types to meet the diverse needs of traders at different stages of their trading careers.

| Account Type | Min. Deposit | Available Instruments |

| Cent | $50 | forex, metals, energy |

| Standard | $50 | forex, commodities (gold, oil), indices CFD, cryptos CFD, shares CFD |

| ECN | $100 | forex, commodities (gold, oil), indices CFD, cryptos CFD, shares CFD |

The Cent account, requiring a minimum deposit of $50, is designed specifically for starters, allowing them to trade in smaller cent lots with a focus on forex, metals, and energy. This account type is ideal for those new to trading or those looking to test strategies with lower risk.

The Standard account, also with a $50 minimum deposit, is a classic account type that suits a broad range of traders. It expands the tradable assets to include forex, commodities like gold and oil, indices CFDs, cryptos CFDs, and shares CFDs, offering greater flexibility and opportunity for portfolio diversification.

For more seasoned or professional traders, the ECN account is available with a minimum deposit of $100 and features low spreads. This account supports trading across all the same instruments as the Standard account but is optimized for high-volume trading that professional traders often engage in.

Each account type is structured to provide specific benefits and trading conditions to cater to the unique trading styles and goals of HTFXs clientele.

How to Open an Account?

Opening an account with HTFX is a straightforward and efficient process designed to quickly integrate new users into the trading platform. To open an account with HTFX, follow these general steps:

- Visit HTFX's official website: Go to the HTFX website using a web browser.

- Account Registration: Click the “Register” button on the homepage and start the account registration process.

- Fill out the Registration Form: Complete the required registration form with your personal information, including your country, email address, password, name, and phone number.

Make sure that you have read the Conflict of Interest Policy, Order Execution Policy, Private Policy, Risk Disclosure, Terms & Condition, and then click the “Register” button.

Leverage

HTFX provides a dynamic range of leverage options tailored to various trading preferences and risk appetites, catering specifically to the asset being traded.

| Account Type | Leverage (forex/gold) | Leverage (oil) |

| Cent | 500:1 | 100:1 |

| Standard | 200:1 | |

| ECN |

For forex and gold trading, HTFX offers an aggressive leverage of up to 500:1 across all account types, enabling traders to maximize their trading potential with a relatively low capital outlay. This high leverage ratio is particularly advantageous for those looking to exploit small price movements in these highly liquid markets.

When it comes to oil trading, the leverage options are differentiated based on the account type to accommodate varying levels of risk management. The Standard and ECN accounts offer leverage up to 200:1, providing substantial market exposure for more experienced traders. In contrast, the Cent account, typically suited for newer traders or those with a cautious approach, offers a lower leverage of up to 100:1 on oil trading.

This tiered leverage system allows HTFX clients to select their preferred level of market engagement and risk according to their individual trading strategies and experience levels.

Spreads & Commissions

HTFX offers a structured approach to spreads and commissions that caters to the needs of different types of traders through its varied account options.

| Account Type | Spread | Commission |

| Cent | From 1.4 pips | 0 |

| Standard | ||

| ECN | From 0.0 pips | $7/lot |

For those using the Cent and Standard accounts, HTFX provides a spread starting from 1.4 pips, with no commission charges, making these accounts ideal for newcomers or those who prefer straightforward trading costs.

In contrast, the ECN account is tailored for more experienced traders who can handle tighter spreads and are looking for more direct market access. This account offers spreads from as low as 0.0 pips, which can significantly enhance trading efficiency by reducing the cost of trading on price movements. However, this benefit comes with a commission cost of $7 per lot, which compensates for the ultra-low spread environment and is typical for ECN accounts that provide closer to market prices.

This pricing structure ensures that HTFX can accommodate various trading strategies and preferences, allowing traders to choose an account type that best fits their trading style and cost considerations.

Trading Platforms

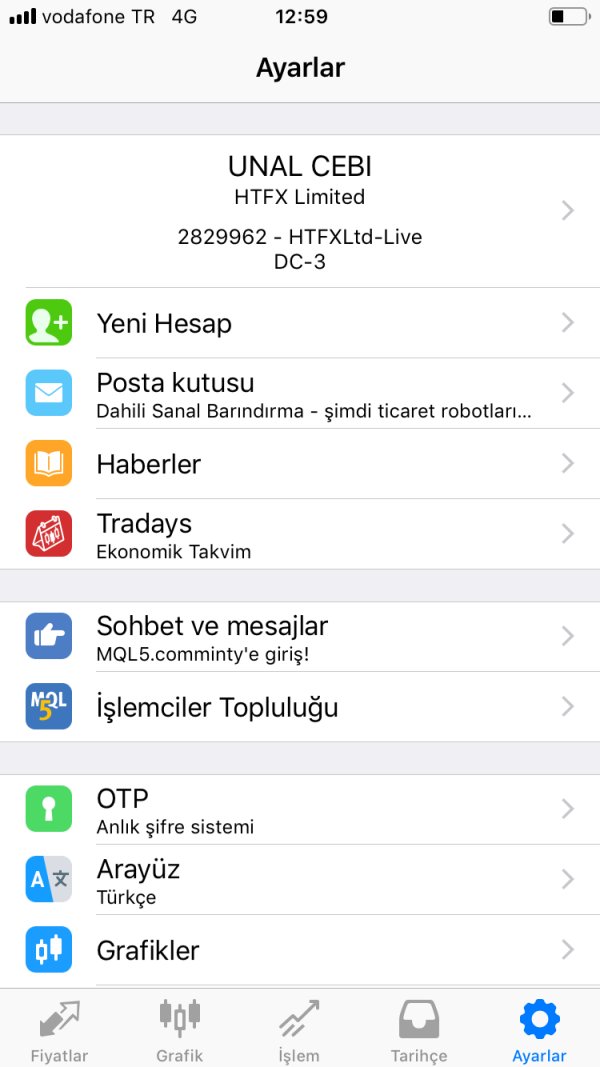

HTFX offers its clients access to two popular and widely-used trading platforms, MetaTrader4 (MT4) and MetaTrader5 (MT5). Traders can access these platforms on Windows, MacOS, Android, iOS, and Web devices.

MetaTrader4 (MT4) is a powerful and user-friendly platform that allows traders to execute trades, analyze the markets, and implement various trading strategies. With a range of technical indicators and charting tools, traders can conduct in-depth market analysis and make informed trading decisions.

MetaTrader5 (MT5) is an advanced platform that builds upon the features of MT4, providing additional capabilities, such as access to more financial instruments and improved order execution. This platform caters to the needs of experienced traders who seek more complex trading functionalities.

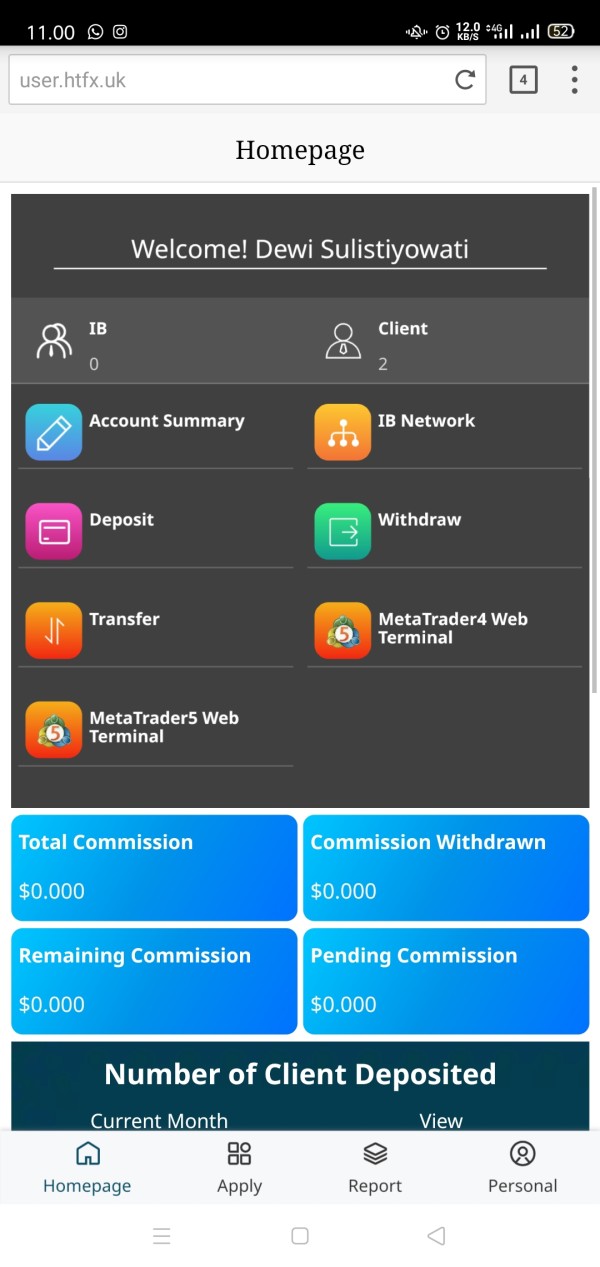

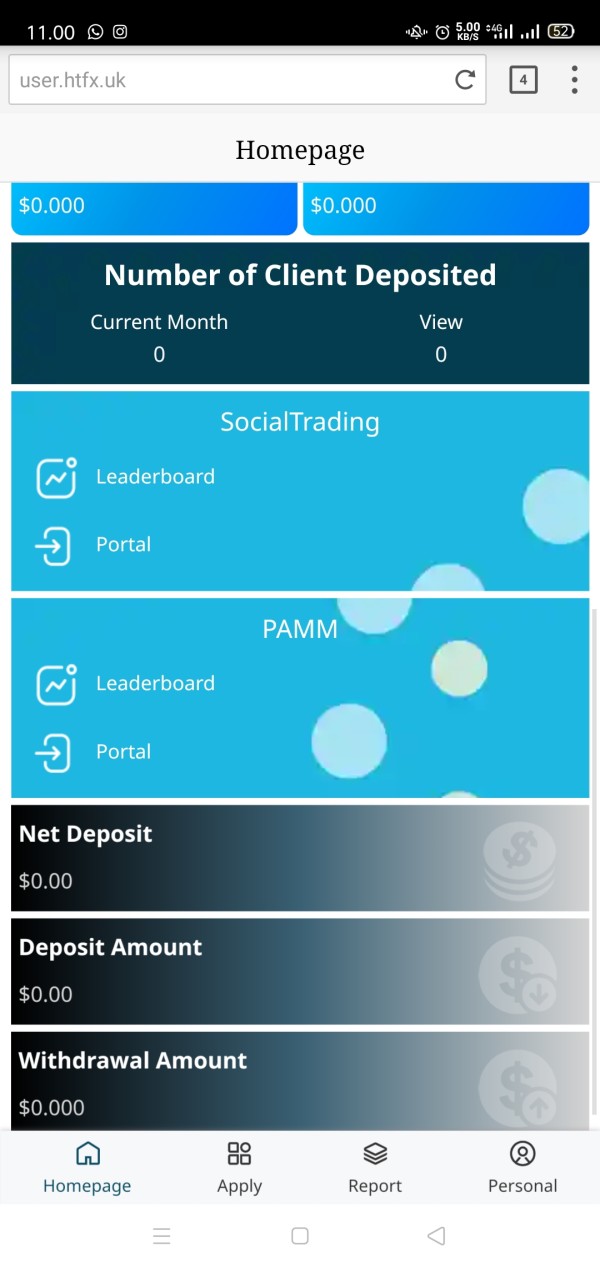

Copy Trade & PAMM

HTFX provides innovative trading solutions such as Copy Trade and PAMM (Percentage Allocation Management Module), catering to a diverse range of traders with varying levels of expertise and commitment.

The Copy Trade service allows less experienced traders or those with limited time to automatically replicate the trades of more seasoned traders. This feature not only simplifies the trading process but also provides an opportunity to learn from successful strategies.

On the other hand, the PAMM service is designed for investors interested in having their funds managed by professional traders. This system pools money from multiple investors into a single managed account, traded by a skilled manager who allocates gains, losses, and fees according to each investors share in the pool.

Both services offer robust platforms for those looking to either tap into the expertise of others or invest in a managed portfolio, thus broadening the scope of investment opportunities available through HTFX.

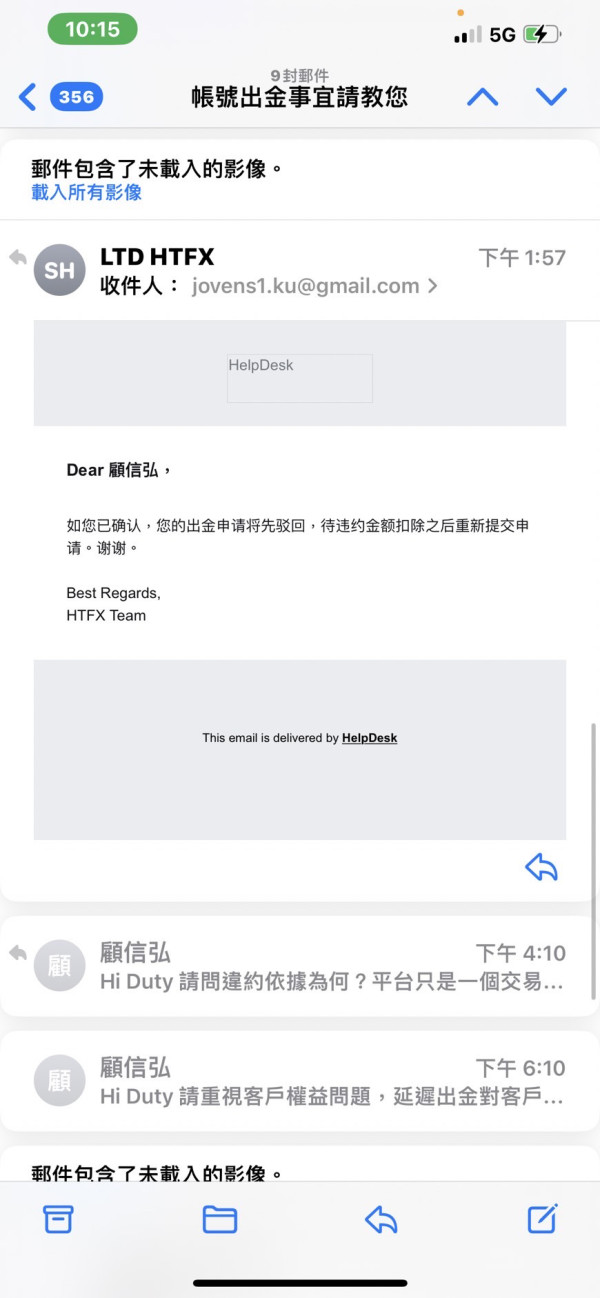

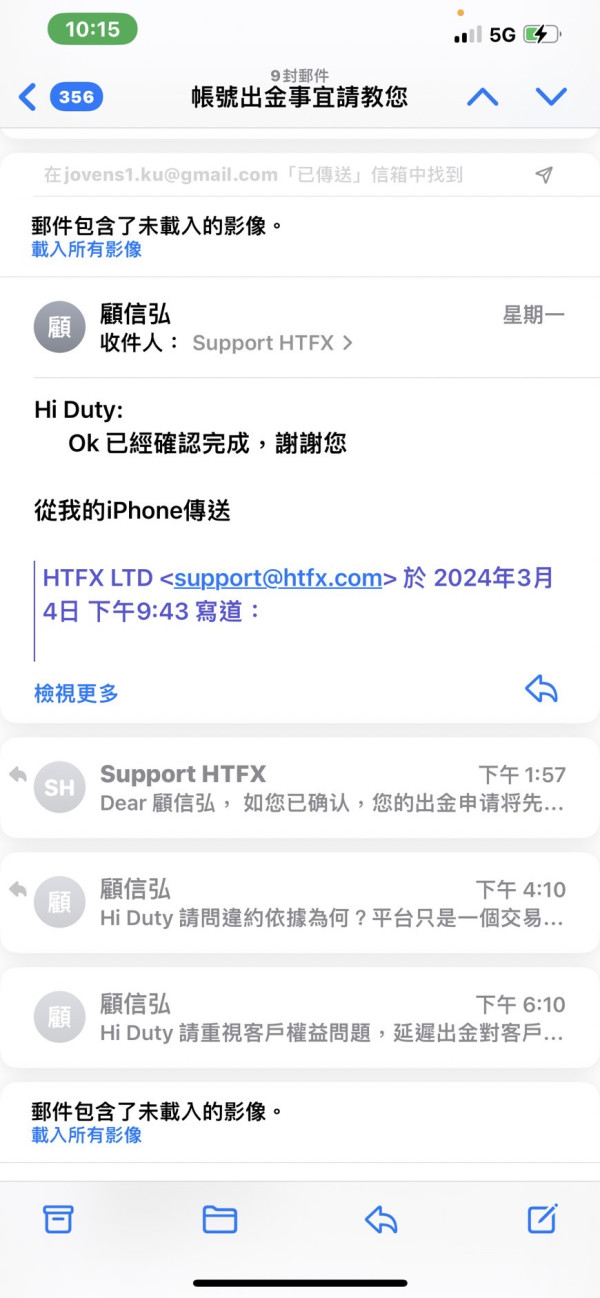

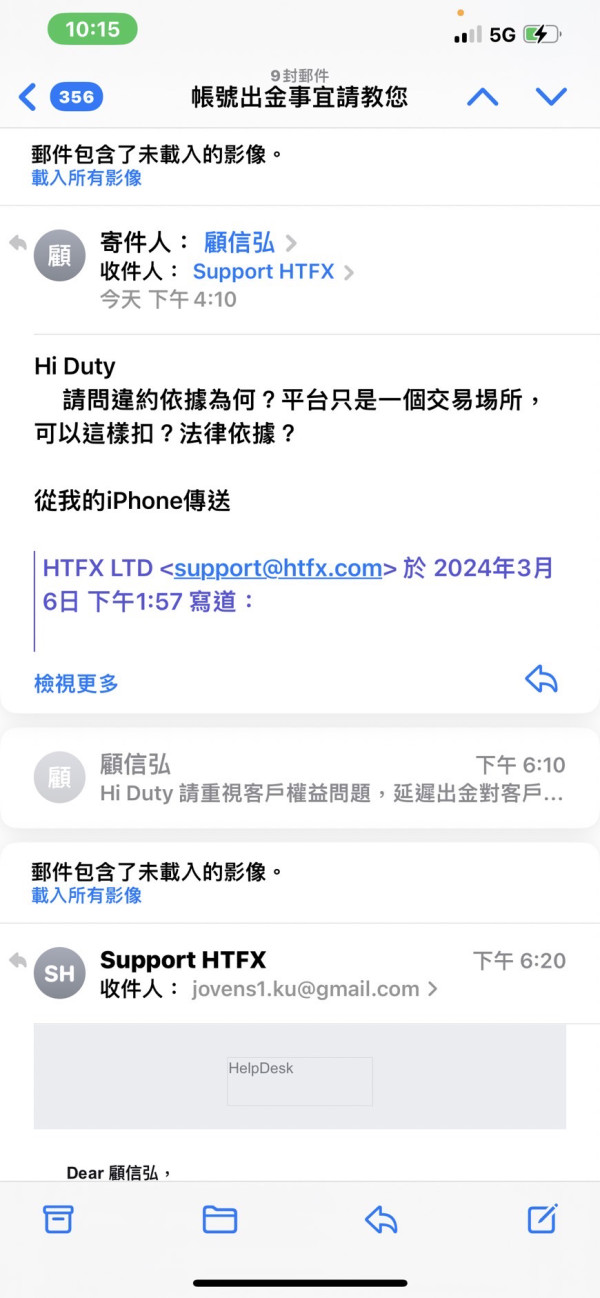

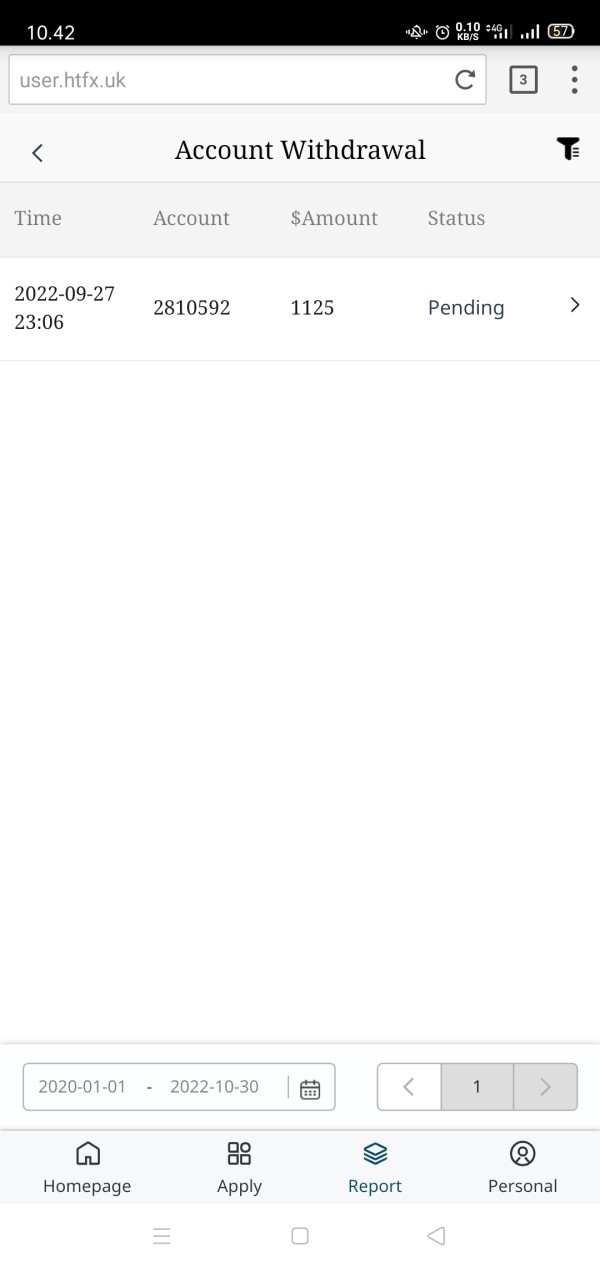

Deposit & Withdrawal

HTFX offers a diverse array of payment methods to accommodate its global clientele, ensuring that both deposits and withdrawals can be made with ease and convenience. Accepted payment options include RediPay, THAI QR PAYMENT, RPNpay, helpay2, CC, ChipPay, teleport, PAYOK, Tether, and Alipay. This wide range of choices caters to various preferences and provides flexibility for traders around the world.

Importantly, HTFX does not charge any deposit fees, which enhances the attractiveness of trading with them by reducing the overall transaction costs for traders. However, specific details on withdrawal processes and timelines are not extensively provided.

Bonus

HTFX is currently offering an enticing promotion for its traders: a 20% deposit bonus that can go as high as $10,000. This generous offer is available from April 1, 2024, to May 31, 2024, providing an excellent opportunity for both new and existing clients to significantly enhance their trading capital.

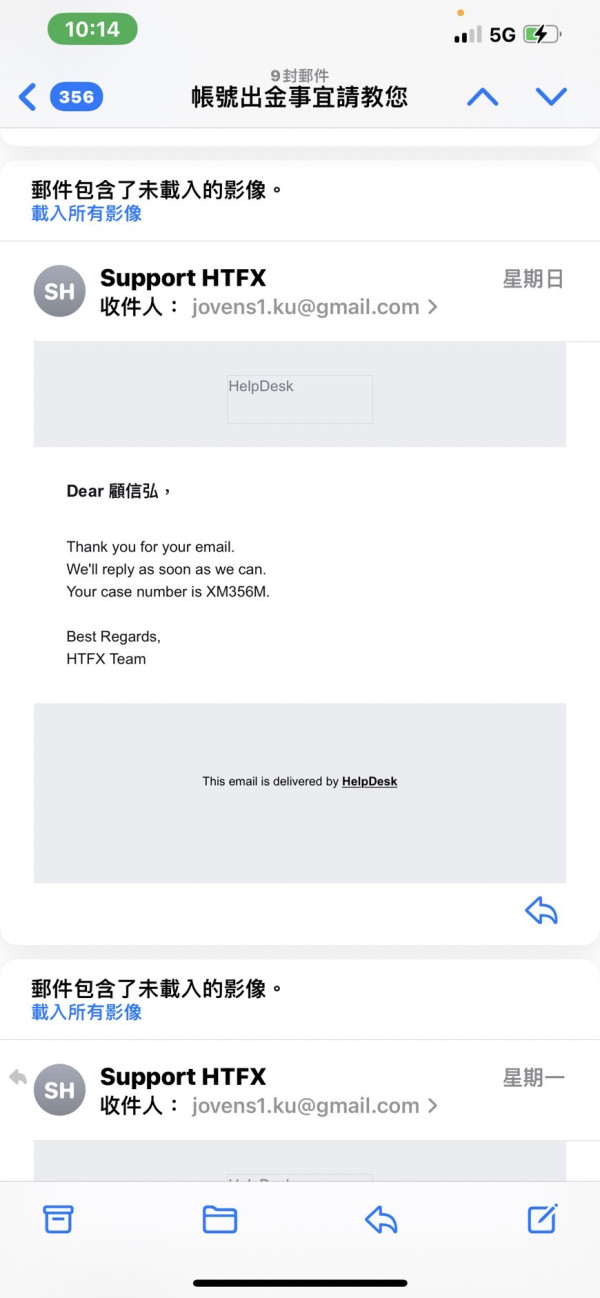

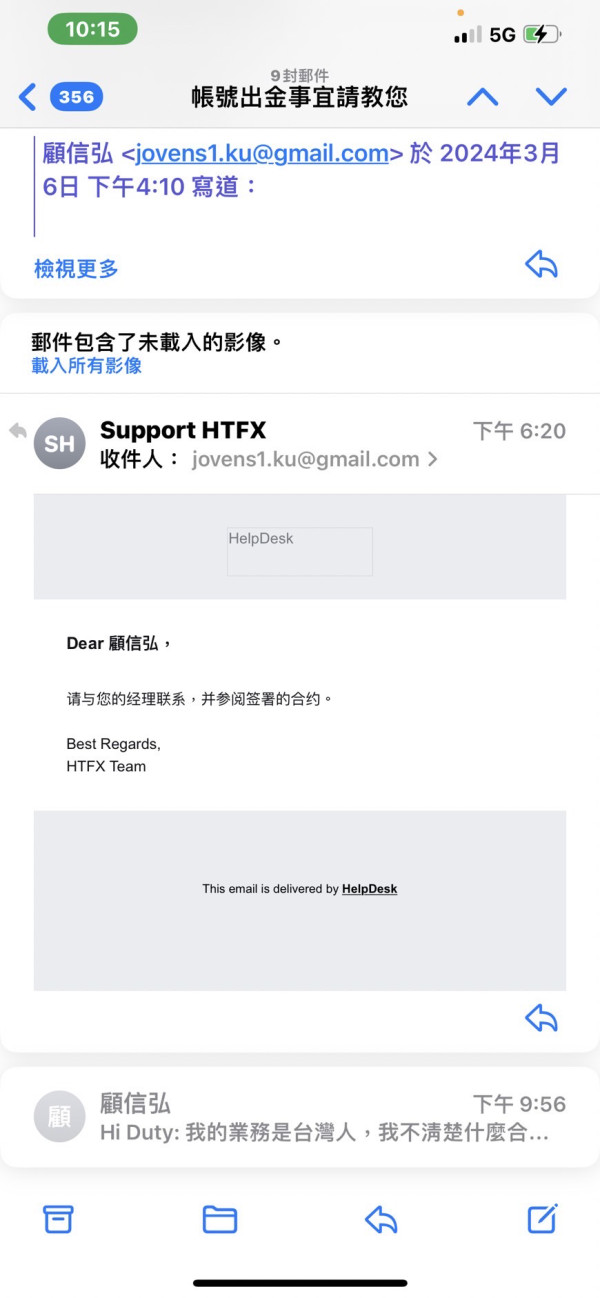

Customer Support

HTFX is committed to providing exceptional customer support, ensuring that traders can access assistance and resolve any issues swiftly and efficiently. Traders can reach out to HTFX through multiple channels: a dedicated contact form on their website, by phone at +678 29816, or via email at support@htfx.com for more detailed inquiries. The broker's physical presence is established with an office located at 2 Floor, ZEO Building, Freshwater 1, Port Vila, Vanuatu, offering a tangible location for official matters.

Additionally, HTFX maintains a strong online presence on several social media platforms including Facebook, Twitter, YouTube, and Instagram. This multi-channel approach not only facilitates easy communication but also allows HTFX to engage with their clients regularly and provide timely updates and helpful information across various platforms.

FAQs

What regulatory agencies oversee HTFX?

HTFX is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and offshore regulated by Vanuatu Financial Services Commission (VFSC).

Can I trade demo with HTFX?

Yes. Demo accounts are available on the HTFX.

What is the minimum deposit required to open an account with HTFX?

$50.

Does HTFX offer the leading MT4 and MT5?

Yes. Both MT4 and MT5 are available.

At HTFX, are there any regional restrictions for traders?

Yes. HTFX does not provide services to citizens/residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, and Ukraine.

News

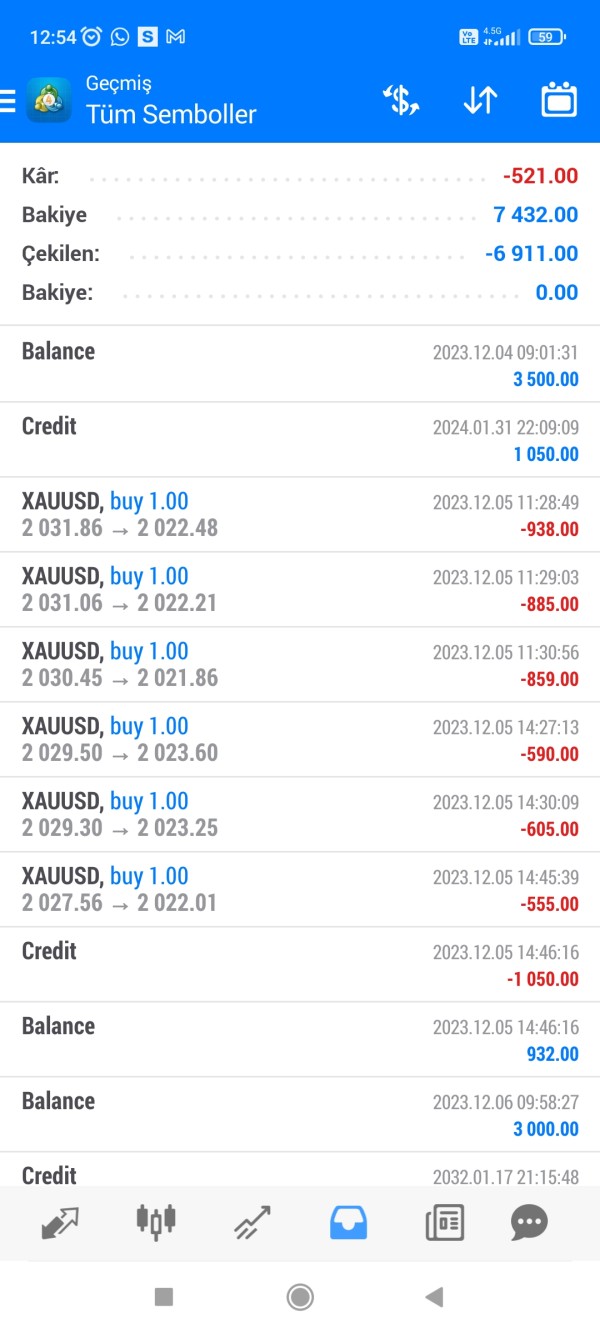

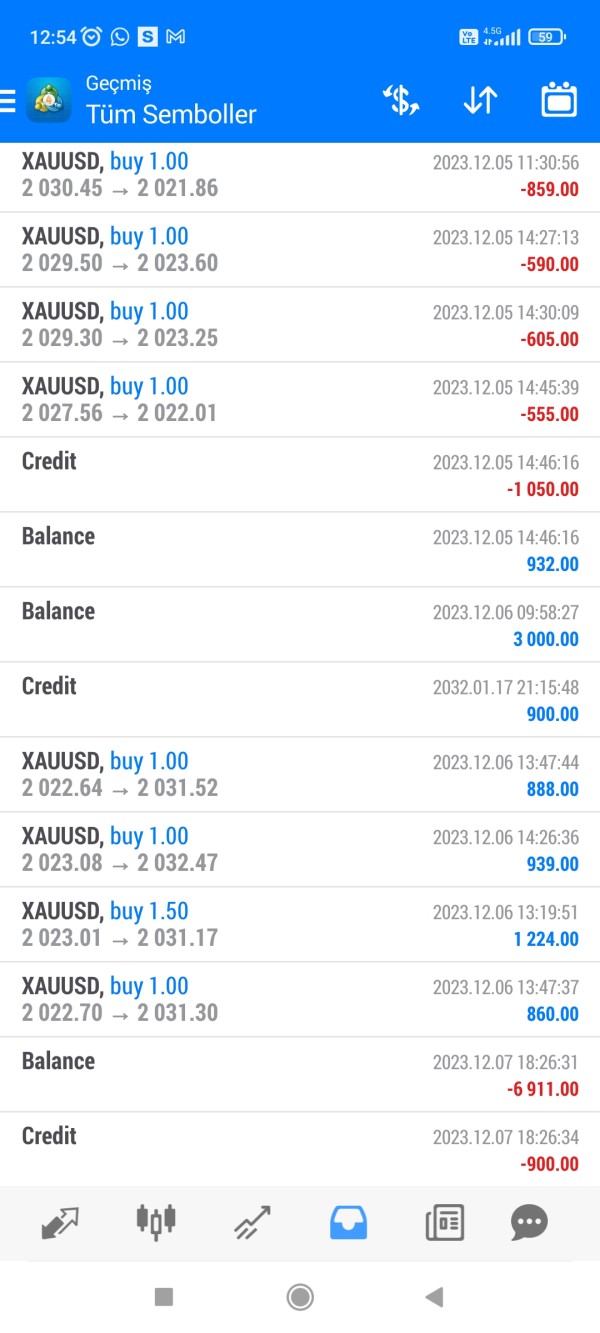

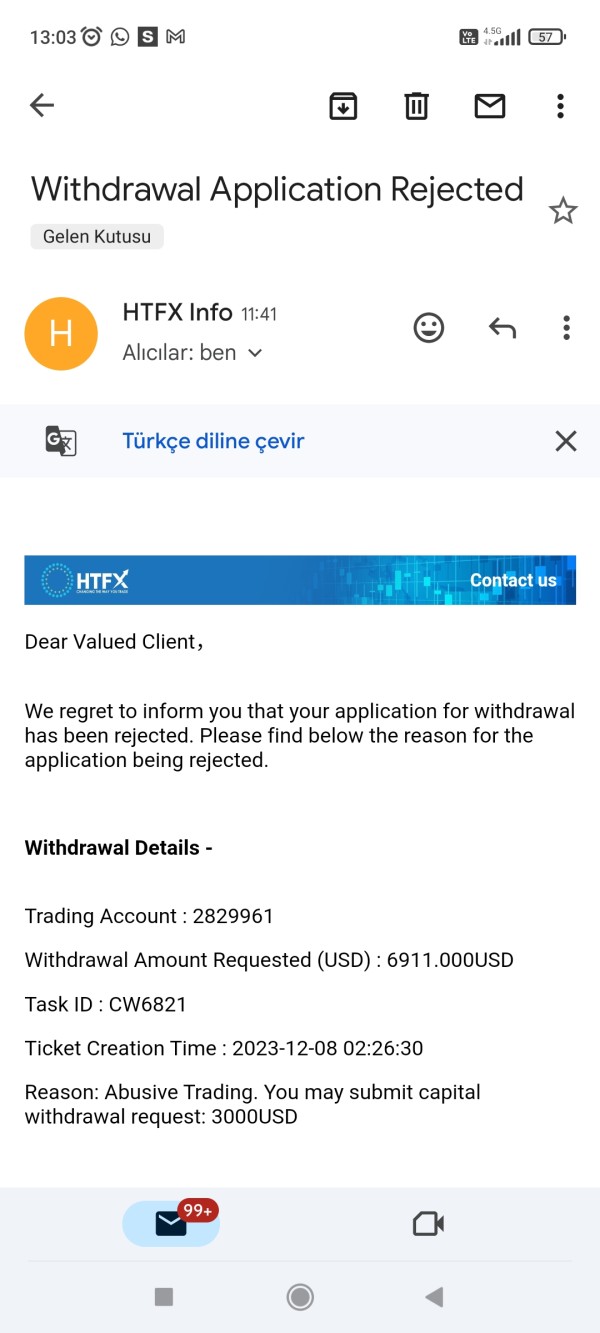

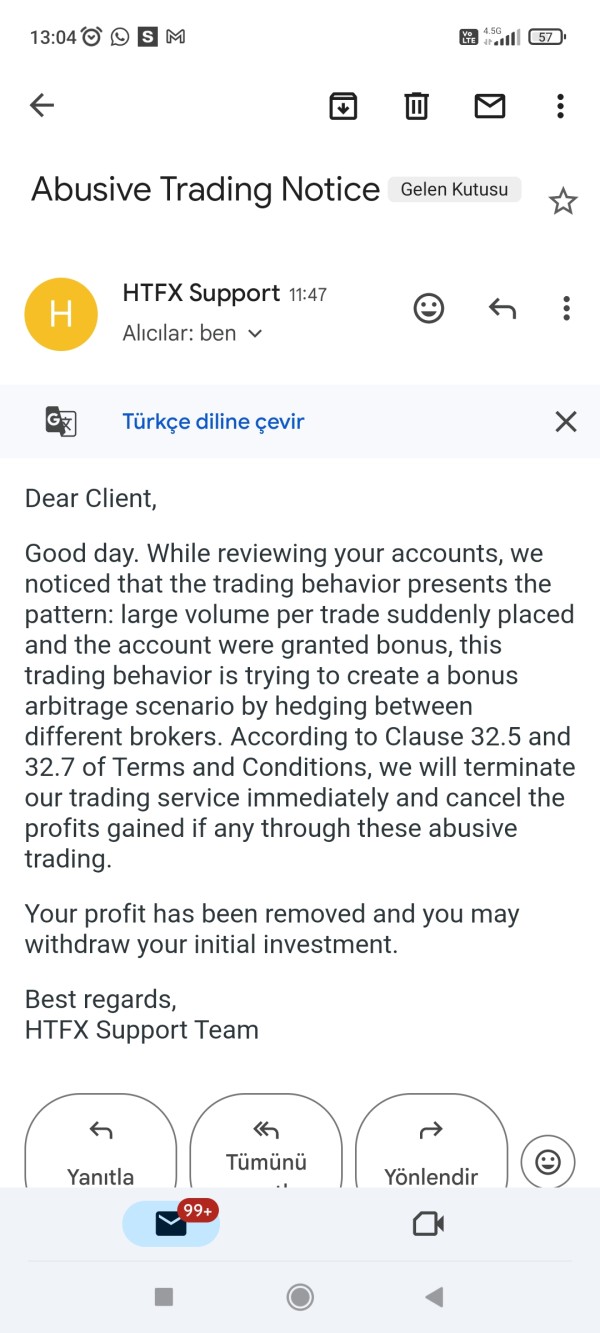

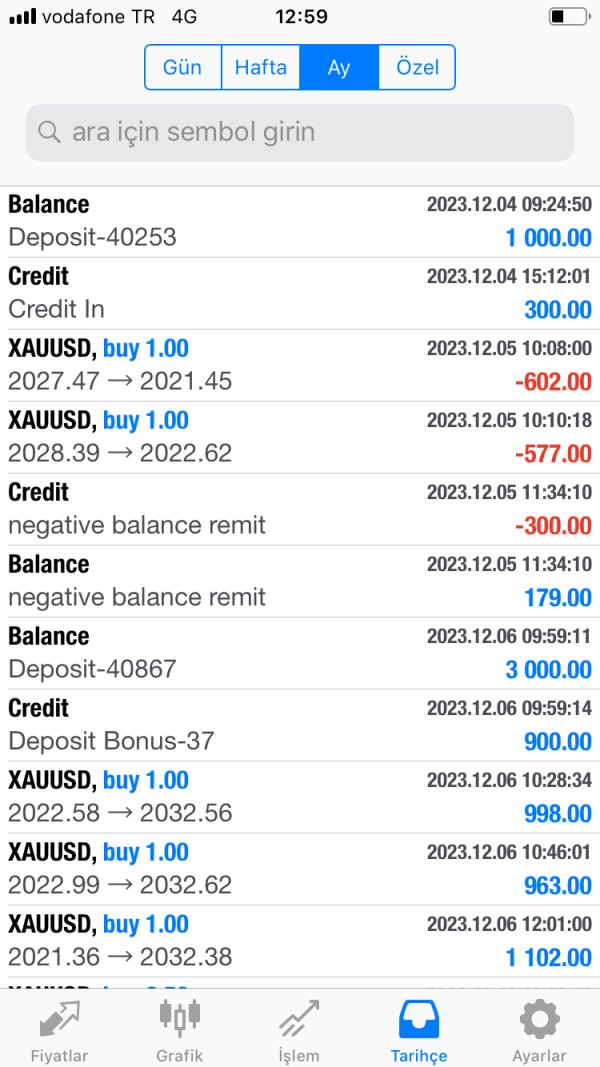

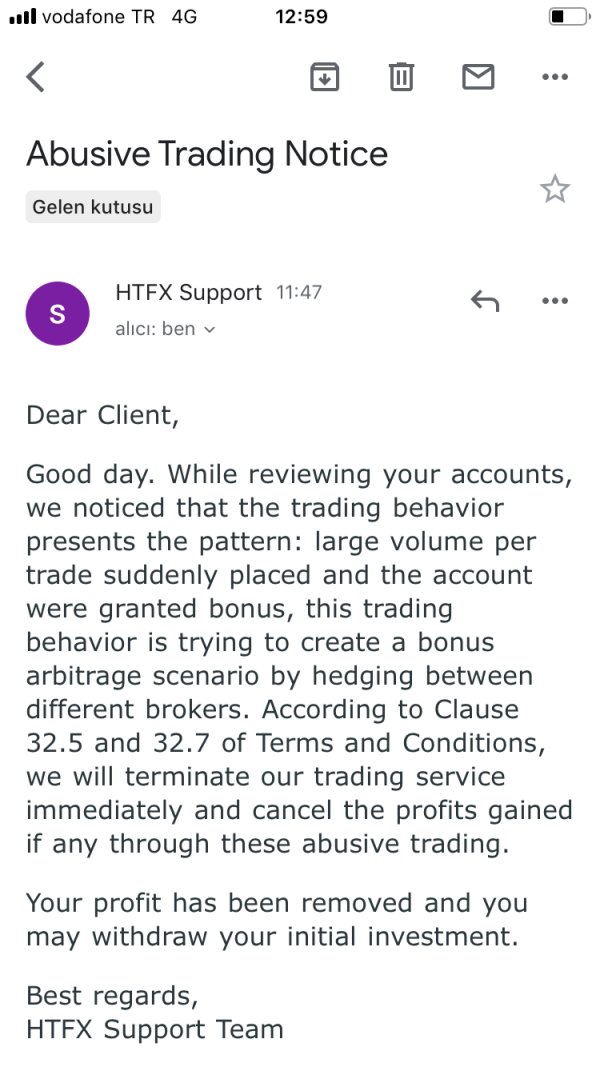

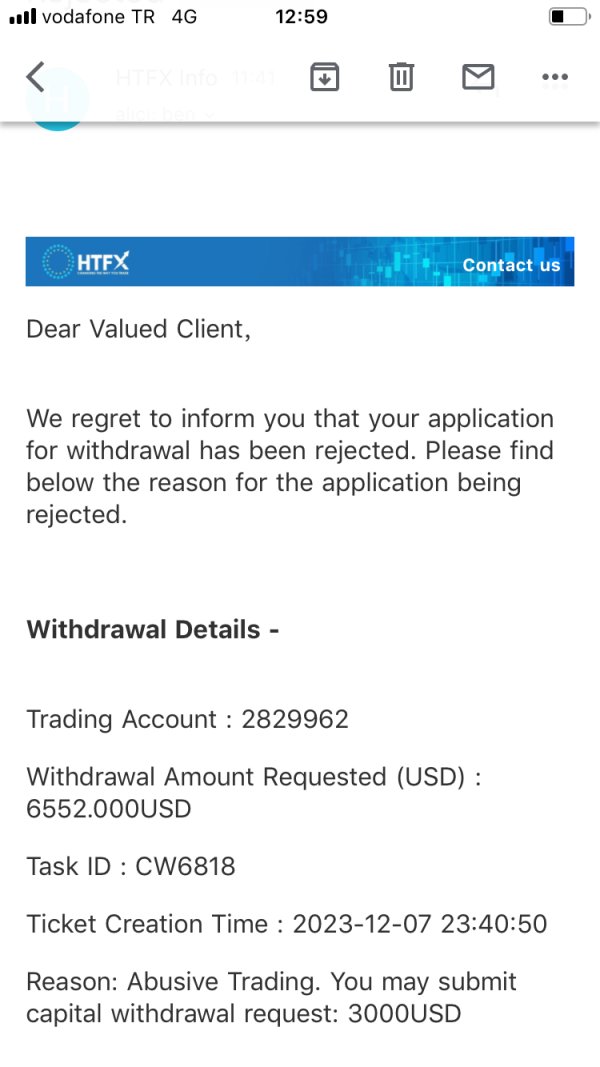

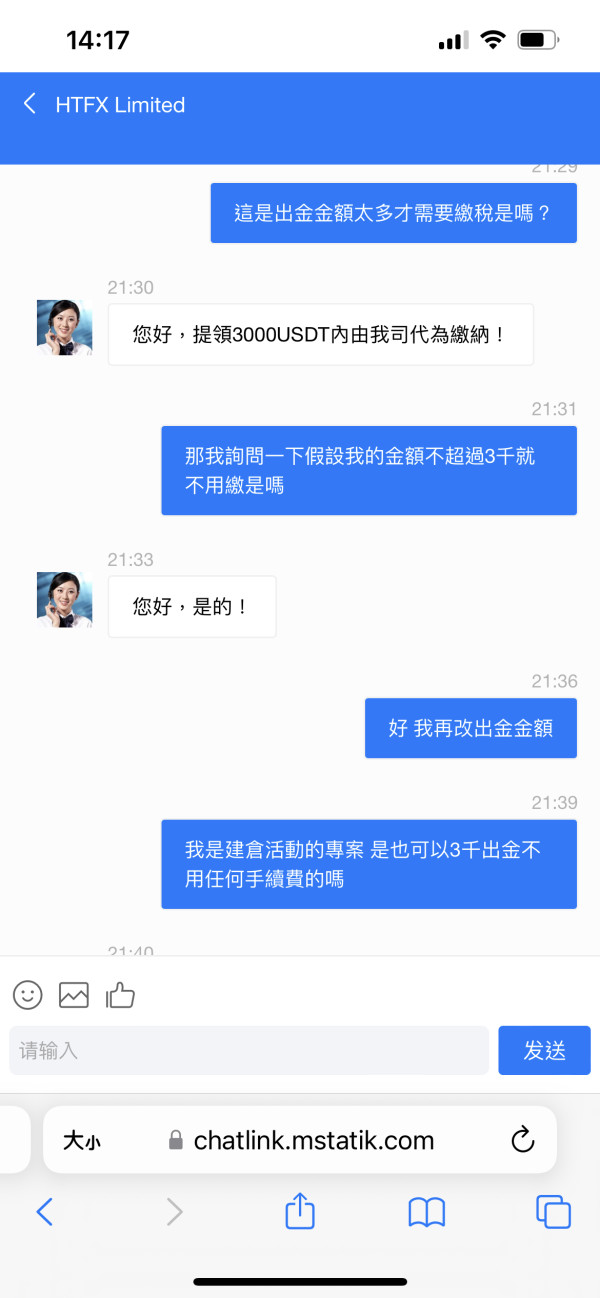

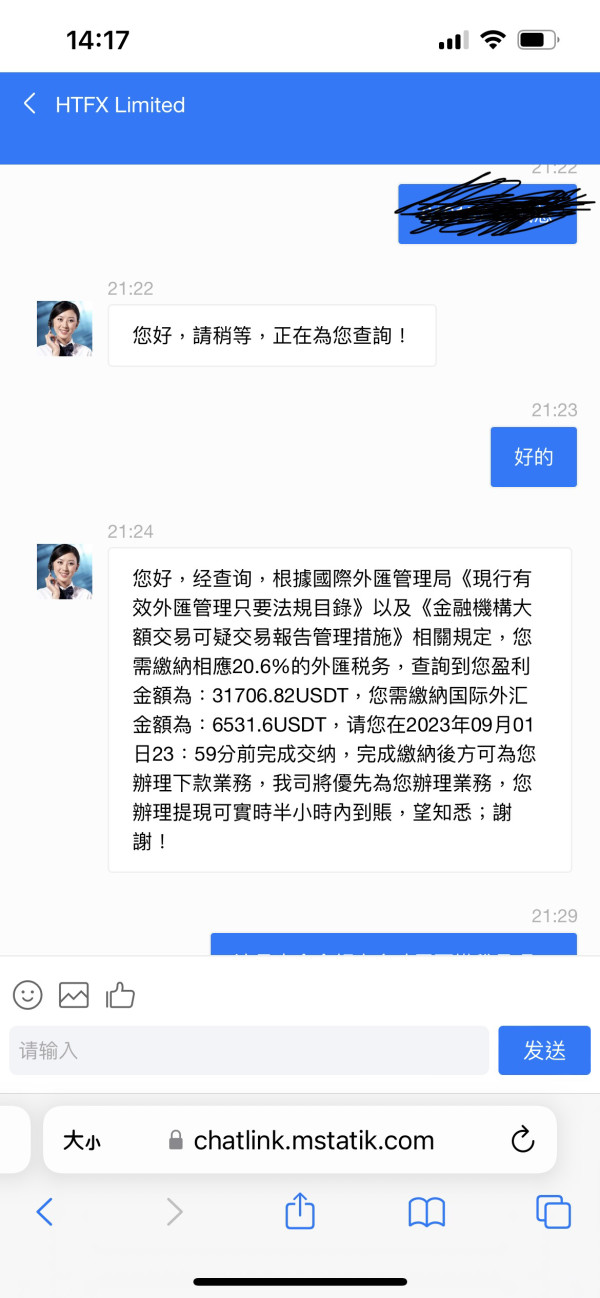

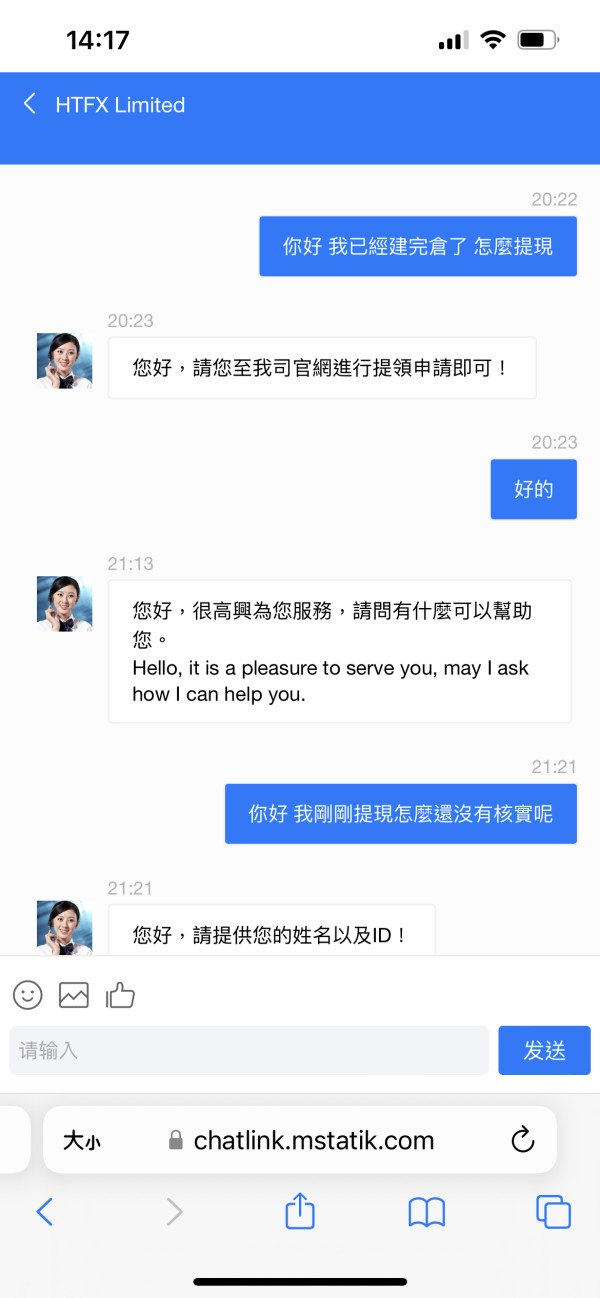

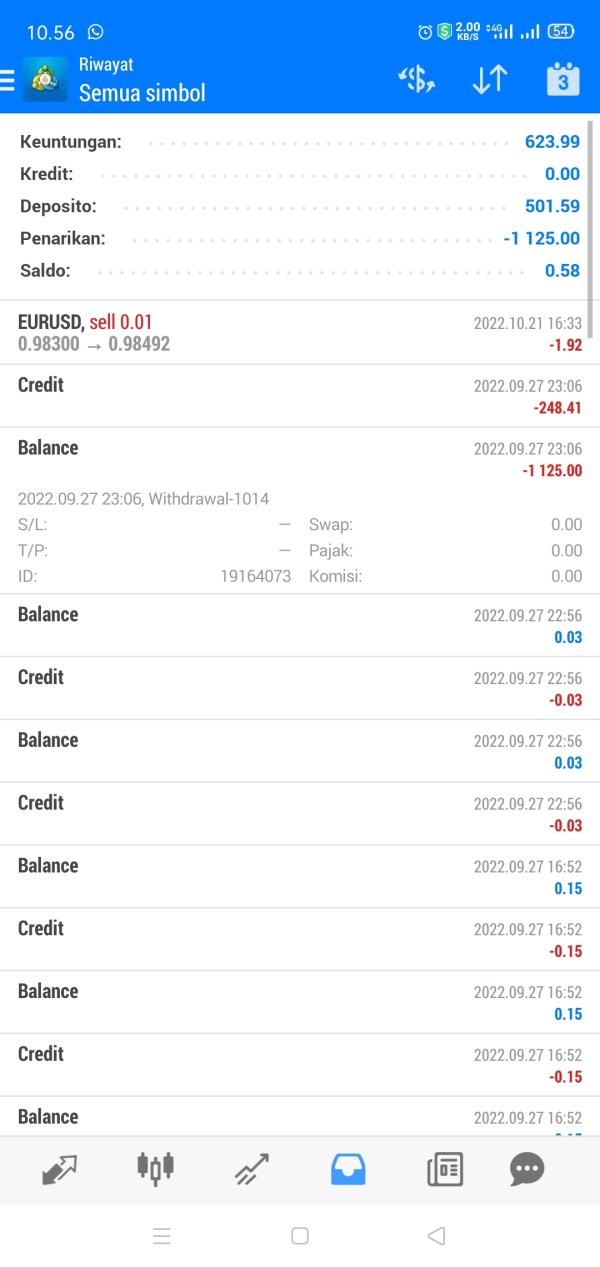

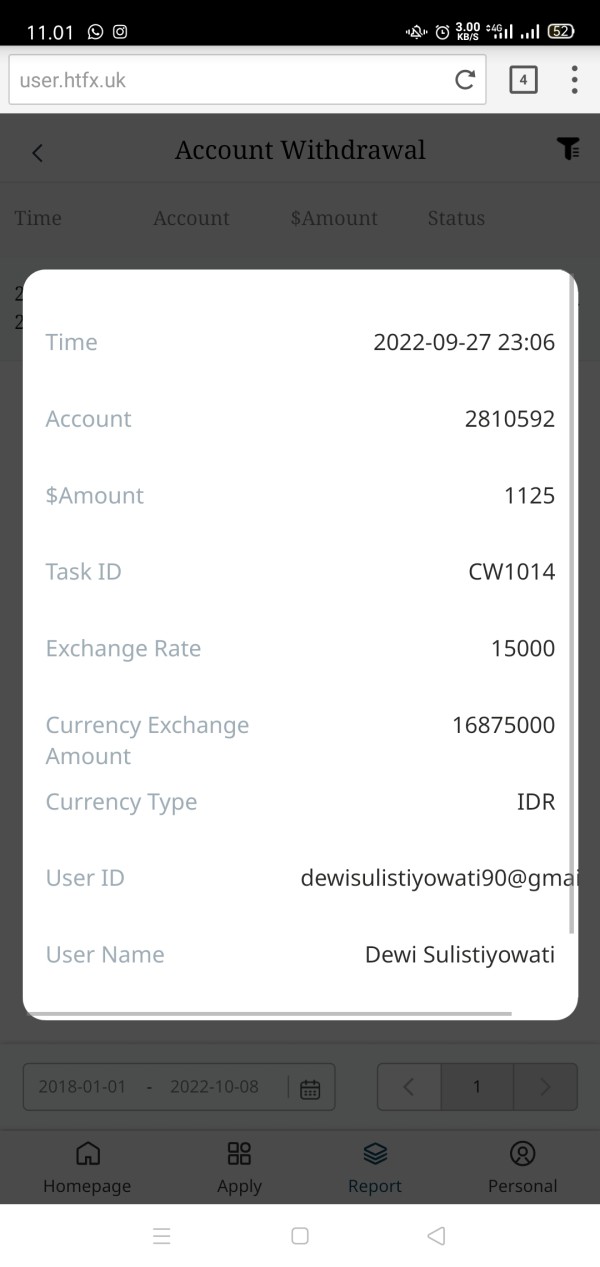

ExposureHTFX: Erasing Clients’ Profits

In the realm of online trading, a distressing account surfaces, shedding light on the ordeal faced by an investor, Abdulkadir, in dealings with HTFX. This narrative unfolds a sequence of events that turned tumultuous for a 20-year-old Turkish investor seeking financial growth and opportunity through the online broker.

WikiFX

WikiFX

NewsWikiFX Reviews HTFX in Depth

In this article, we'll look in-depth at HTFX, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

WikiFX

WikiFX

Review 27

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now