Score

Global Online

United States|5-10 years|

United States|5-10 years| http://gom.lmmt5.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Global Online also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

lmmt5.com

Server Location

Hong Kong

Website Domain Name

lmmt5.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2018-08-29

Server IP

27.124.3.220

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | Global Online Market Limited |

| Regulation | Unregulated.Claimed to be regulated by ASIC and NFA (False) |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:100 |

| Spreads | 3.2 pips and higher with commission |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | Limited selection of currency pairs and CFDs |

| Account Types | Not specified |

| Demo Account | Available (based on the information) |

| Payment Methods | Visa, MasterCard, Skrill, Bank Wire (partial) |

| Educational Tools | None |

Overview

Global Online Market Limited, based in the United States, presents a concerning profile for potential traders. Despite claiming to be regulated by ASIC and NFA, investigations reveal these assertions to be false, rendering the company unregulated and lacking oversight. The broker offers a MetaTrader 4 platform but provides only a limited selection of currency pairs and CFDs. Further details regarding account types are absent, and their website is currently down. Educational tools are also nonexistent. While a demo account is available, the absence of regulatory compliance and the lack of educational resources raise significant red flags about the reliability and trustworthiness of this broker, making it a risky choice for investors.

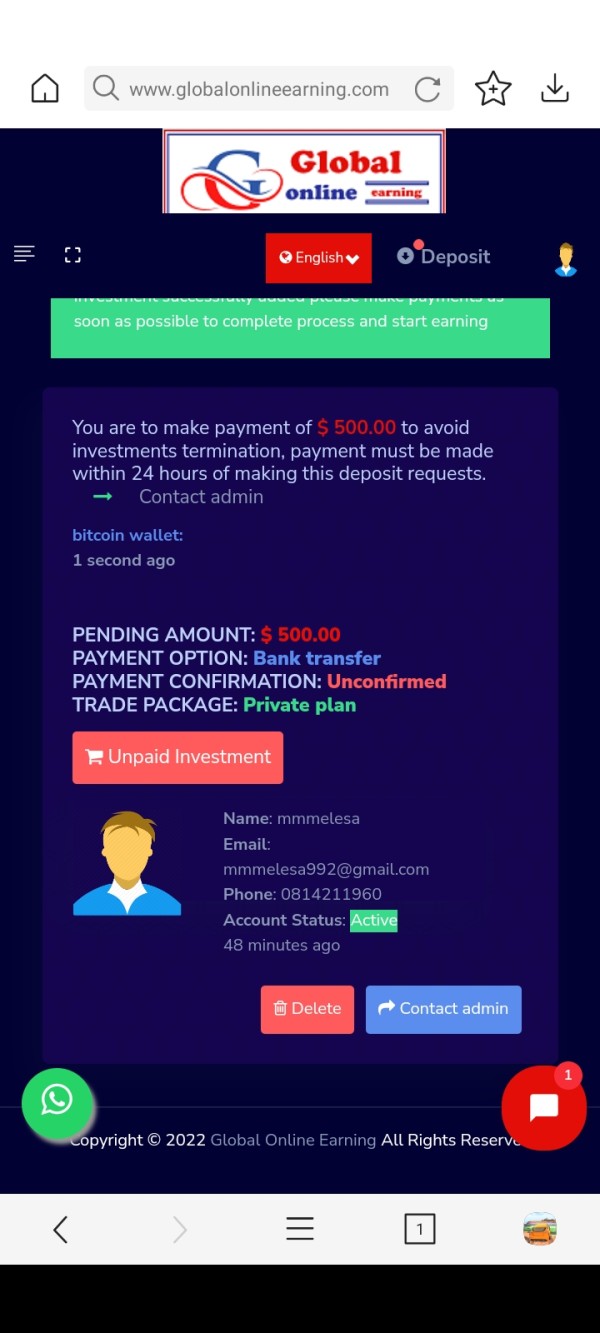

Regulation

Unregulated.

The regulatory status of Global Online Market Limited appears highly suspicious, as it claims to be regulated by the National Futures Association (NFA) in the United States but exhibits several concerning indicators. The listing of “Suspicious Clone” and the description of a “Common Financial Service License” raise doubts about the legitimacy of its regulatory assertion. Furthermore, the absence of essential regulatory details, such as an effective date, website, address, and phone number, adds to the uncertainty. It is crucial for potential investors to exercise extreme caution when dealing with a broker displaying such irregularities in its regulatory status, as it may indicate a lack of proper oversight and transparency.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global Online Market Limited presents a concerning profile, with regulatory ambiguity and a lack of transparency. While it offers a range of trading instruments and the MT4 platform, traders should exercise caution due to the limited product selection, high commission fees, and missing educational resources. Reports of slow customer support and potential withdrawal difficulties further raise concerns, making it advisable to consider regulated and reputable brokers for a safer trading experience.

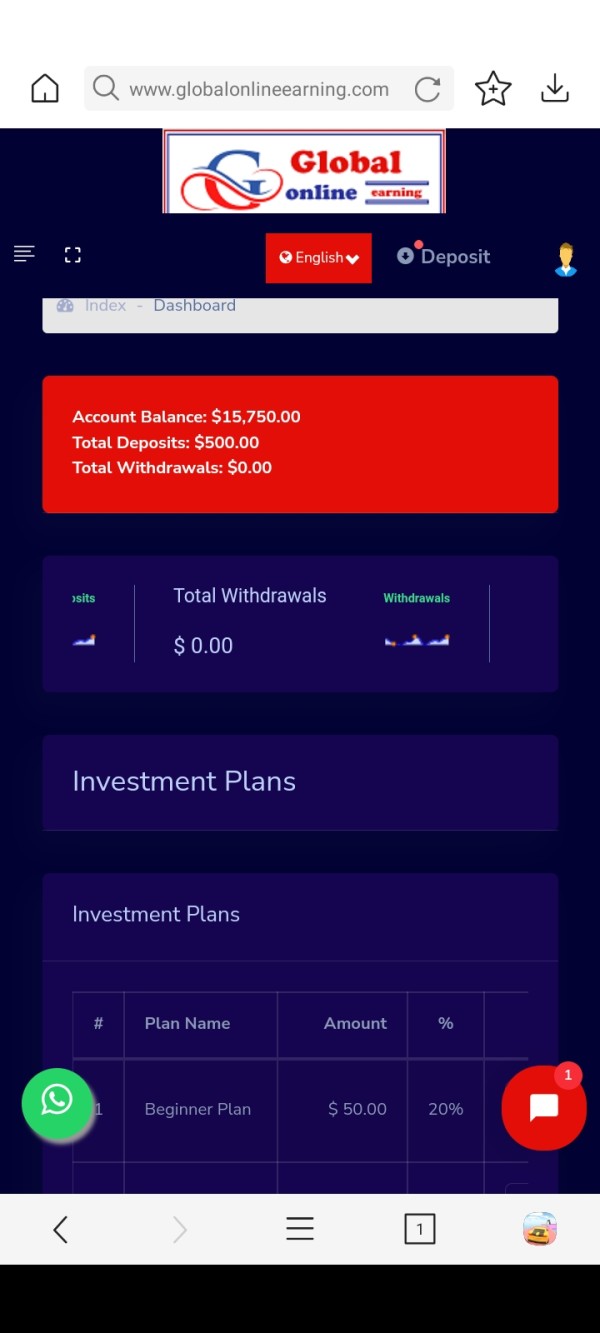

Market Instruments

Global Online Market Limited provides a range of trading instruments, primarily focusing on currency pairs and Contracts for Difference (CFDs).

Currency Pairs:

Major Pairs: Likely includes EUR/USD, GBP/USD, USD/JPY, etc.

Minor Pairs: May offer currency pairs like EUR/GBP, AUD/NZD, etc.

Contracts for Difference (CFDs):

Commodities: CFDs on commodities such as gold, silver, and oil.

Indices: CFDs on major stock indices like the S&P 500, FTSE 100, etc.

Stocks: Potentially offers CFDs on individual company stocks.

Cryptocurrencies: Possibility of trading CFDs on popular cryptocurrencies like Bitcoin and Ethereum.

Please note that without specific details, this organization is based on common offerings found among forex brokers. To provide a more detailed table, additional information about the exact instruments, trading hours, and other specifics would be needed.

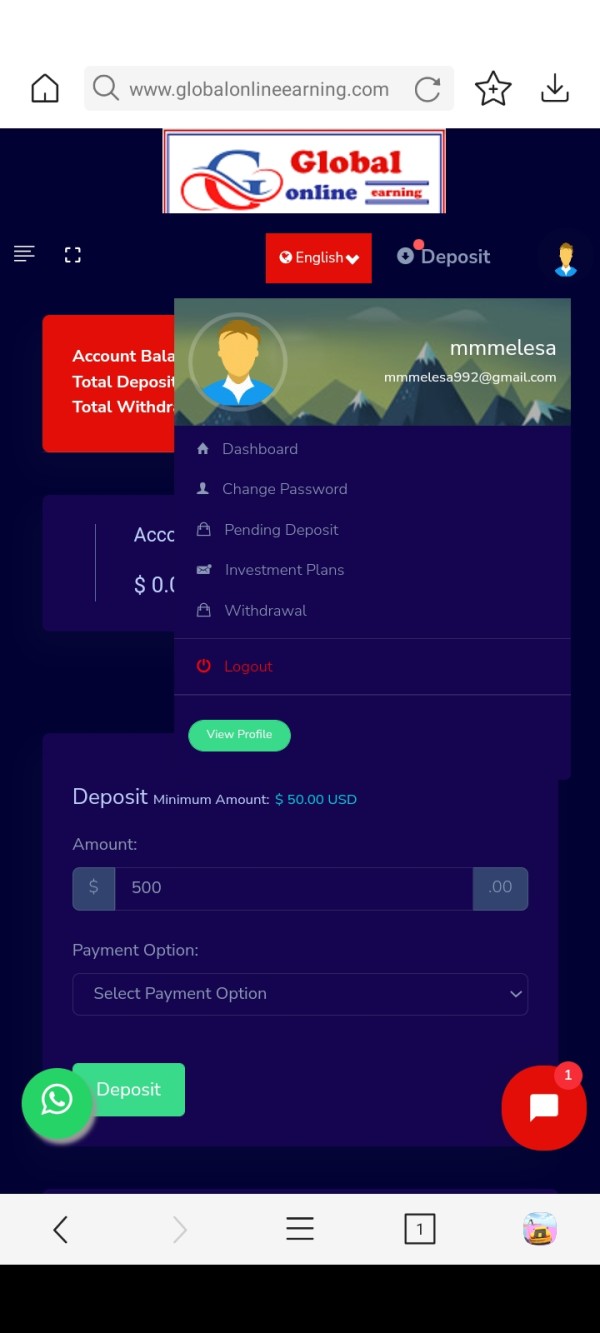

Account Types

Based on the available information, there is no specific data provided about the types of trading accounts offered by Global Online Market Limited. The information lacks details regarding the account tiers or features, leaving the status of the account types undefined. If further information becomes available, a more comprehensive description can be provided.

Leverage

Global Online Market Limited offers a maximum trading leverage of up to 1:100. This leverage ratio allows traders to control a larger position size in relation to their initial investment, potentially amplifying both profits and losses in their trading activities. It's important for traders to exercise caution when using high leverage, as it can increase the level of risk in their trading endeavors.

Spreads and Commissions

Spreads:

Global Online Market Limited offers spreads that start at 3.2 pips for various currency pairs and CFDs. While this initial spread may seem reasonable, it's essential to consider the overall cost of trading with this broker. The spreads can vary depending on the specific trading account and instrument, so traders should carefully review the spread conditions for their preferred assets. Additionally, keep in mind that the cost of trading may be influenced by the commission fee imposed by the broker.

Commissions:

Global Online Market Limited charges a commission fee of $30 per traded lot, round trip. This commission fee applies to all trades and can significantly impact the total trading expenses. Traders should factor in this cost when evaluating their trading strategies and deciding whether to choose this broker. It's important to note that the commission fee is separate from the spreads and is an additional cost that traders must consider in their overall trading budget.

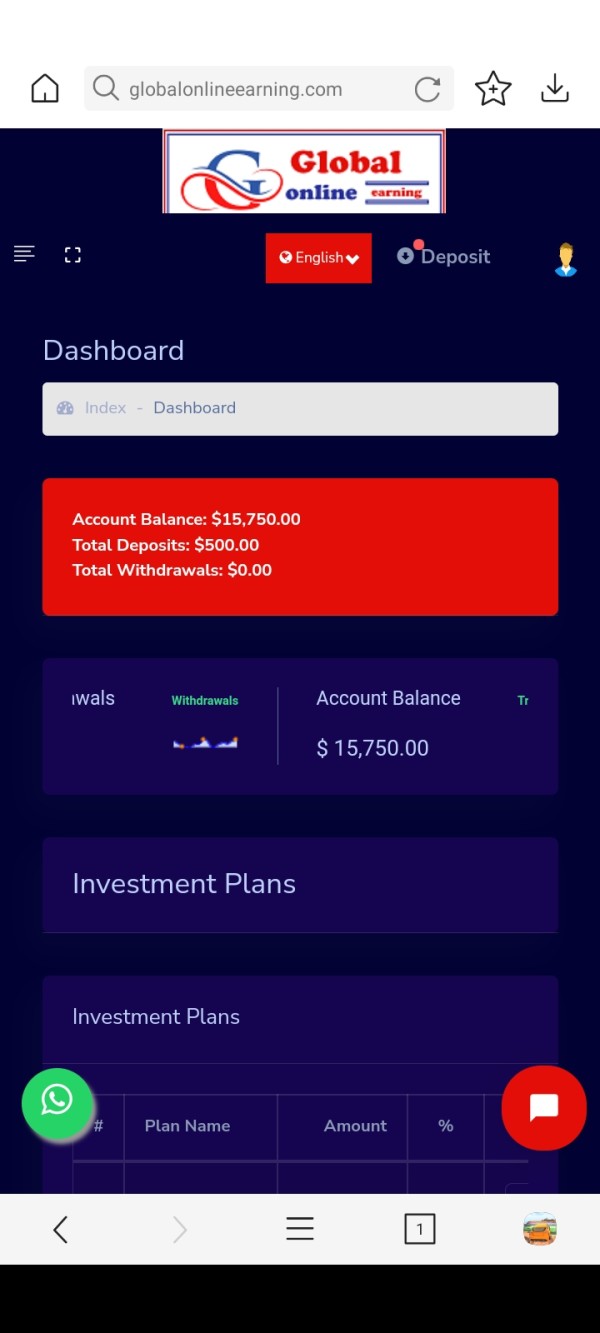

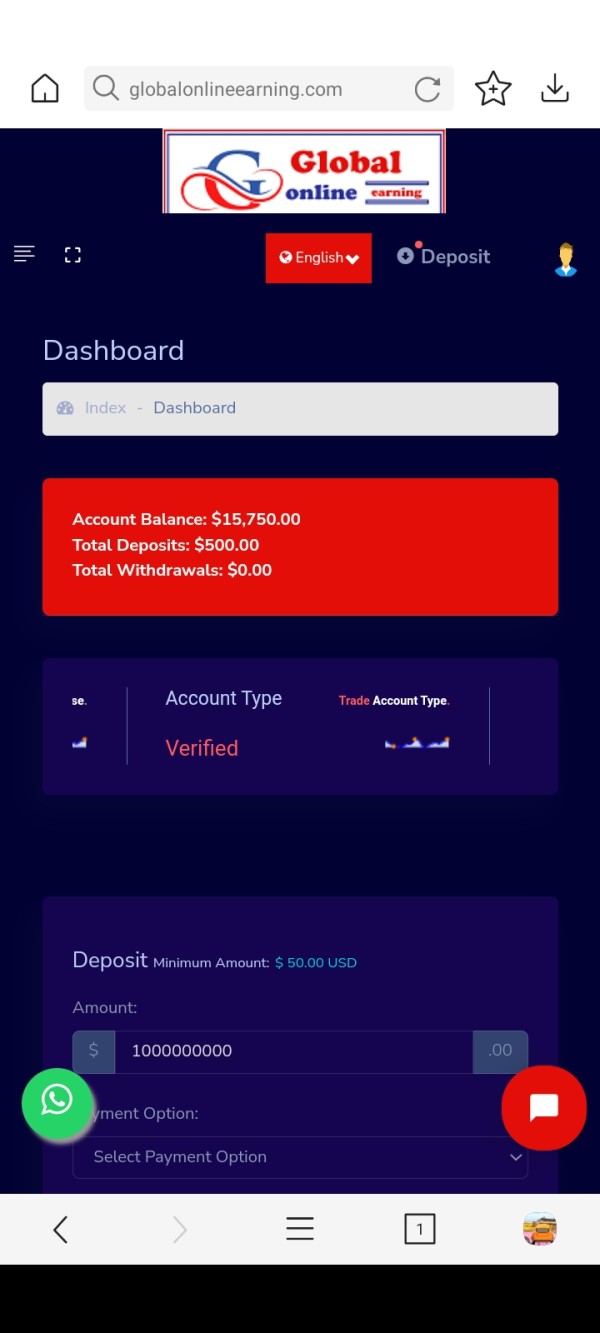

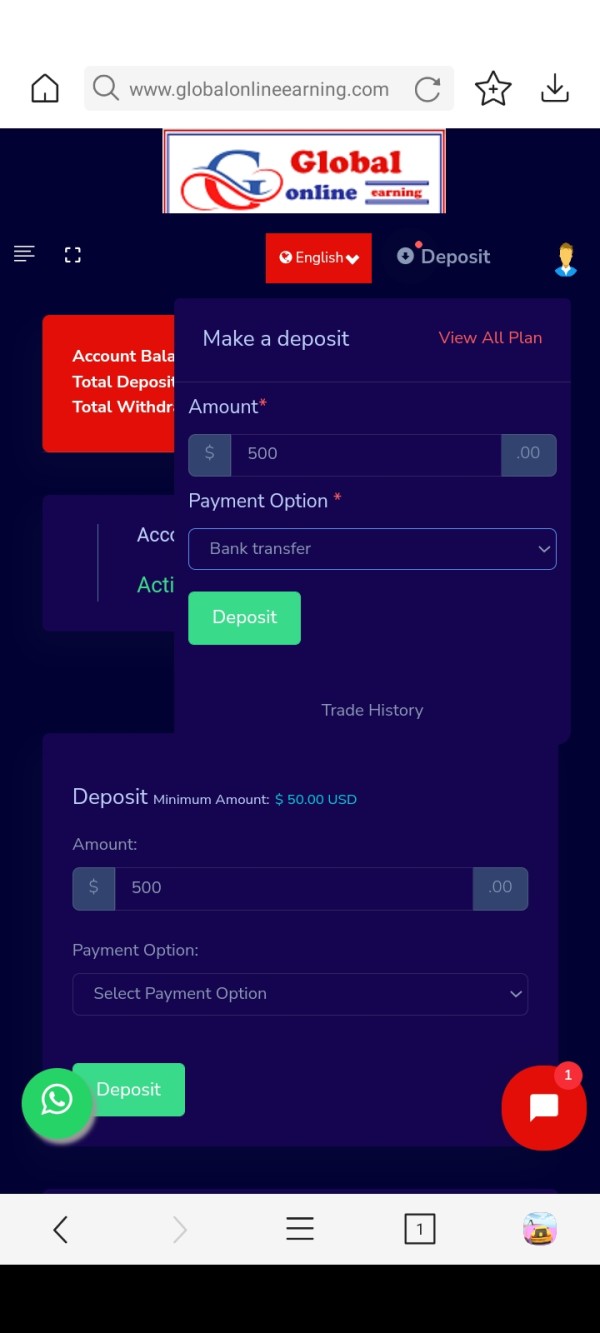

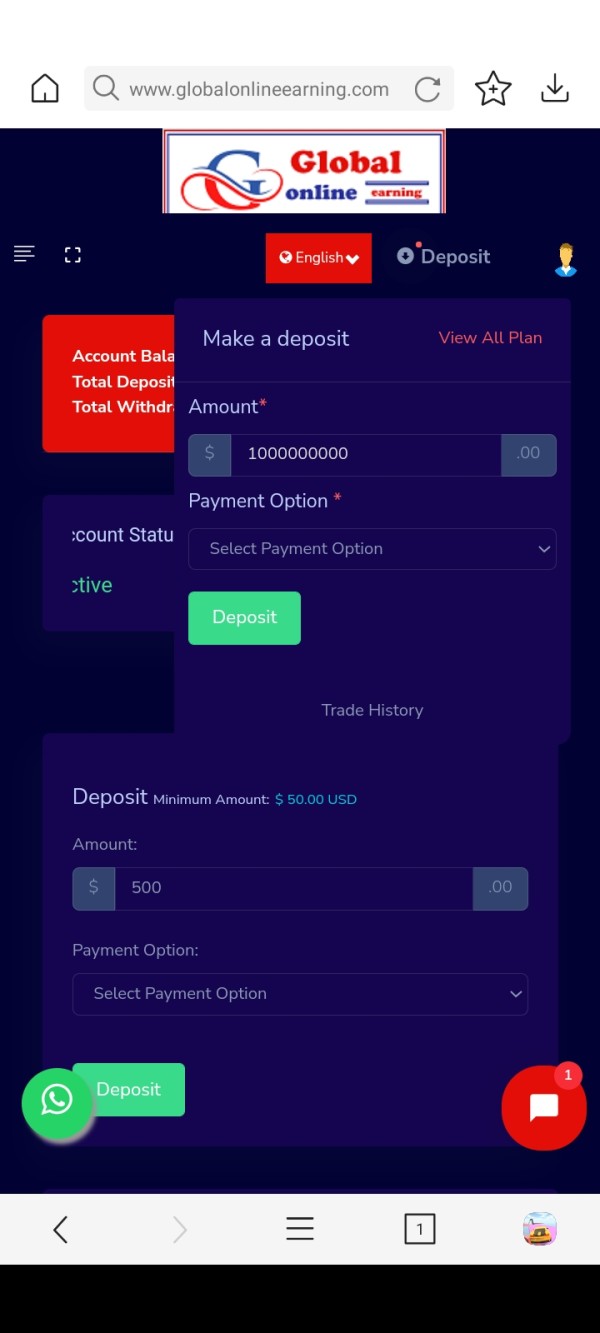

Deposit & Withdrawal

Deposit:

Minimum Deposit: Global Online requires a minimum deposit of $100.

Accepted Payment Methods: You can deposit funds using Visa, MasterCard, bank wire transfer, or Skrill.

Deposit Process: Log in to your account, navigate to the deposit section, and follow the provided instructions. Details and the deposit amount will be required.

Additional Fees: The review suggests potential unexpected fees; check the broker's terms and conditions or contact support for clarity.

Withdrawal:

Withdrawal Process: Specific withdrawal details are not provided in the review, but typically, you'd log in, go to the withdrawal section, and follow instructions.

Withdrawal Restrictions: Be cautious of withdrawal difficulties mentioned in the review, as the broker allegedly imposes trading volume requirements.

Lack of Segregation: Global Online doesn't segregate client accounts, potentially putting client funds at risk.

Compensation Scheme: The broker lacks a compensation scheme, which could leave clients unprotected in case of insolvency.

In summary, while Global Online offers various deposit methods and a low minimum deposit, it raises concerns about withdrawal difficulties, lack of fund segregation, and the absence of a compensation scheme. Consider these factors and opt for regulated, reputable brokers for fund safety.

Trading Platforms

Global Online utilizes the MetaTrader 4 (MT4) trading platform, a highly regarded and user-friendly platform. MT4 offers advanced charting tools, automated trading capabilities, mobile compatibility, and real-time market data. While MT4 is a strong platform, traders should consider other factors like regulatory compliance and customer support when evaluating the broker's suitability.

Customer Support

The customer support provided by support@gomltd.com appears to be subpar and lacking in responsiveness. Numerous users have reported experiencing frustrating delays in receiving assistance, with some complaints left unanswered for an extended period. This level of unresponsiveness and inadequate support raises concerns about the broker's commitment to addressing customer inquiries and issues promptly, potentially leaving traders feeling unsupported and frustrated.

Educational Resources

Global Online's educational resources are notably lacking. The absence of comprehensive educational materials and resources for traders, particularly for those who are new to the forex and CFD markets, is a significant drawback. In an industry where knowledge and education are crucial for making informed trading decisions, the absence of such resources may leave traders feeling ill-equipped to navigate the markets effectively. This limitation may hinder traders' ability to develop their skills and make informed investment choices, potentially leading to increased risks in their trading activities.

Summary

Global Online Market Limited, a US-based broker, raises alarming concerns for potential traders. Despite claiming regulatory oversight by ASIC and NFA, investigations reveal that these claims are unsubstantiated, leaving the company unregulated and lacking transparency. The broker offers the MetaTrader 4 platform but offers a limited selection of currency pairs and CFDs. Critical details about account types are missing, and the website is currently inaccessible. Educational resources are absent, and customer support is notably unresponsive. With regulatory ambiguities, limited offerings, and poor support, Global Online presents a risky and unreliable choice for investors.

FAQs

Q1: Is Global Online Market Limited a regulated broker?

A1: No, despite claiming regulation by ASIC and NFA, investigations reveal that Global Online Market Limited lacks proper regulatory oversight, making it unregulated and potentially risky.

Q2: What trading platform does Global Online use?

A2: Global Online utilizes the MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and advanced features.

Q3: What is the minimum deposit requirement with Global Online?

A3: Global Online requires a minimum deposit of $100 to start trading.

Q4: Does Global Online offer educational resources for traders?

A4: No, Global Online's educational resources are notably lacking, which may leave traders without essential knowledge for informed decision-making.

Q5: How can I contact Global Online's customer support?

A5: You can reach Global Online's customer support via email at support@gomltd.com, although reports suggest that response times may be slow and unsatisfactory.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

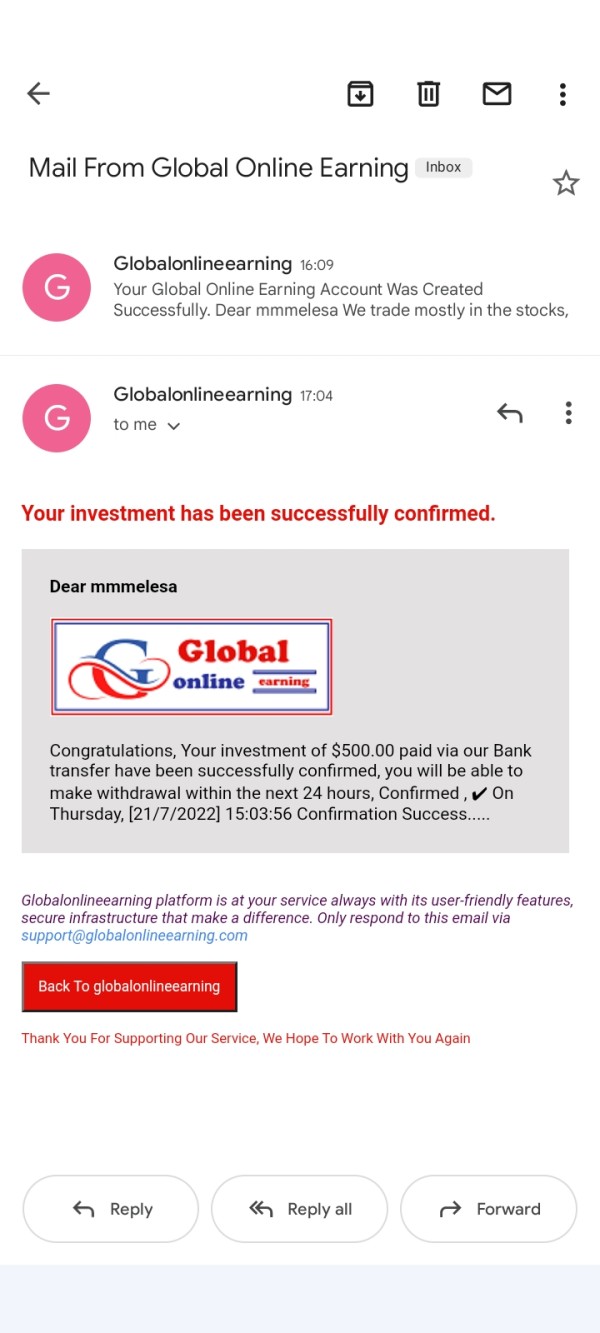

Review 1

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now