Score

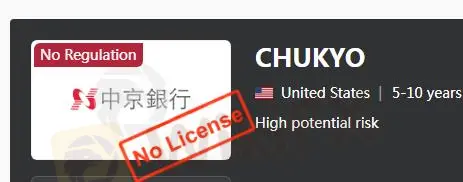

CHUKYO

United States|5-10 years|

United States|5-10 years| https://www.chukyo-bank.co.jp/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Japan 8.05

Japan 8.05Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed CHUKYO also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Company Summary

| CHUKYO Review Summary | |

| Founded | 1943 |

| Registered Country/Region | Japan |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Shares, Commodities, ETFs, Crypto, Mutual Funds, Loans, Insurance, Defined Contribution Pension |

| Demo Account | ❌ |

| Leverage | Not mentioned |

| Spread | Not mentioned |

| Trading Platform | Chukyo Direct Net Version, Chukyo Investment Trust Direct, Chukyo Business Direct, Chukyo Forex WEB |

| Min Deposit | 500 USD (for Foreign Currency Time Deposits) |

| Customer Support | Phone: 52-211-0345 |

CHUKYO Information

THE CHUKYO BANK, Ltd. is a Japanese financial institution that was established in 1943. It's headquartered in Nagoya and operates primarily in Japan.

The bank provides a variety of financial services to both individual and corporate clients, such as banking, credit card services, and loan guarantees. However, it lacks regulation by any well-known financial institution.

Pros & Cons

| Pros | Cons |

| Deep understanding of the Japanese market | Lack of regulation |

| Convenient online banking | Website and services only in Japanese |

| Can provide customized financial advice | There are no MT4 or MT5 platforms available |

| Complex fee structure |

Is CHUKYO Legit?

CHUKYO is not regulated by other well-known regulatory authorities.

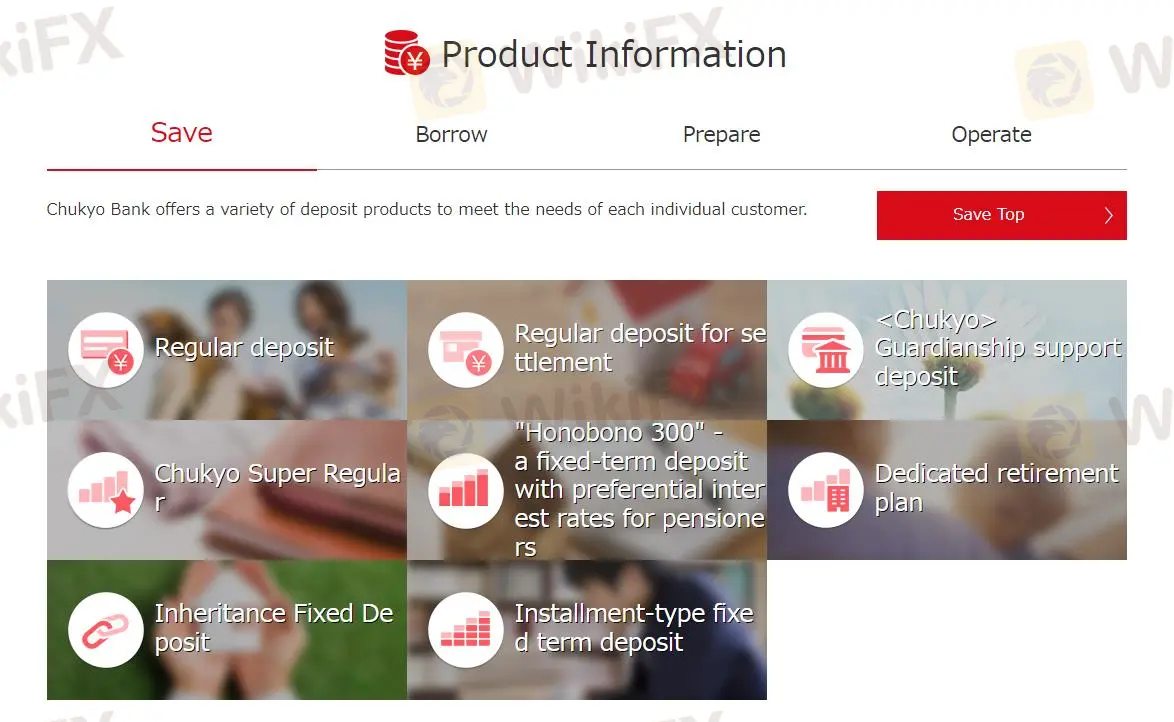

What Can I Trade on CHUKYO?

CHUKYO provides a full suite of financial services, encompassing investment products, lending options, insurance coverage, and retirement planning.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Metals | ❌ |

| Commodities | ✔ |

| ETFs | ✔ |

| Crypto | ✔ |

| Energies | ❌ |

| Futures | ❌ |

| Mutual Funds | ✔ |

| Loans | ✔ |

| Insurance | ✔ |

| Defined Contribution Pension | ✔ |

Account Type

CHUKYO offers personal accounts for savings, borrowing, and investment, including online platforms like Chukyo Direct Net Version and Chukyo Investment Trust Direct.

For corporate customers, CHUKYO provides full business solutions ranging from management and fundraising to accountancy and international business support. Online platforms such as Chukyo Business Direct and Chukyo Forex WEB frequently offer these services.

CHUKYO Fees

Compare with other trading institution, the fees structure of CHUKYO is relatively complex.

Domestic Transfers

Within the same branch fees start from 330 yen for transfers under 30,000 yen. To other banks fees can go up to 880 yen depending on the destination.

ATM Fees

220 yen for transfers under 30,000 yen using the Chukyo Direct Net Version. And 440 yen for transfers over 30,000 yen via the same method.

Other Fees

A 440-yen fee is charged for remittances within the banks branches when remittance, reissuance of documents needs 1,100 yen. As for loan-related fees, partial early repayments or interest rate changes may range from free to 55,000 yen, depending on the specific situation.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for which type of traders |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

| <Chukyo> Direct Net Version | ✔ |

| Individual customers |

| Bank Pay | ✔ |

| Individual customers using smartphones |

| <Chukyo> Business Direct | ✔ |

| Businesses |

| <Chukyo> Foreign Exchange WEB | ✔ |

| Businesses involved in international trade |

Deposit and Withdrawal

The minimum deposit for Chukyo Bank's Foreign Currency Time Deposits is 500 USD, with a flexible range of 1 to 12 month periods.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Foreign Currency Time | 500 USD (or equivalent) | 1 per USD/EUR/Australian dollar | same day |

| Ordinary Deposits | None | \ | same day |

| Ordinary Deposits for Payments | None | \ | same day |

| Savings-Type Fixed Deposits | Varies based on product type | \ | same day |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Foreign Currency Time | Varies based on deposit amount | 1 per USD/EUR/Australian dollar | same day |

| Ordinary Deposits | None | \ | same day |

| Ordinary Deposits for Payments | None | \ | same day |

| Savings-Type Fixed Deposits | Varies based on deposit amount and term | \ | same day |

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now