Score

Chugin

Japan|5-10 years|

Japan|5-10 years| http://www.chugin-sec.jp/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Japan 7.59

Japan 7.59Contact

Licenses

Licenses

Licensed Institution:中銀証券株式会社

License No.:中国財務局長(金商)第6号

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Japan

JapanUsers who viewed Chugin also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

chugin-sec.jp

Server Location

Japan

Website Domain Name

chugin-sec.jp

Website

WHOIS.JPRS.JP

Company

JAPAN REGISTRY SERVICES

Domain Effective Date

2009-11-11

Server IP

158.199.150.210

Company Summary

Note: Chugin's official website: http://www.chugin-sec.jp/ is currently inaccessible normally.

Chugin Information

Chugin is an unregulated brokerage company registered in Japan. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Is Chugin Legit?

CySEC regulates Chugin with a suspicious clone status, making the broker less safe than the regulated one.

Downsides of Chugin

- Unavailable Website

Chugin's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Chugin does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

A suspicious clone status can not be called safe and reliable.

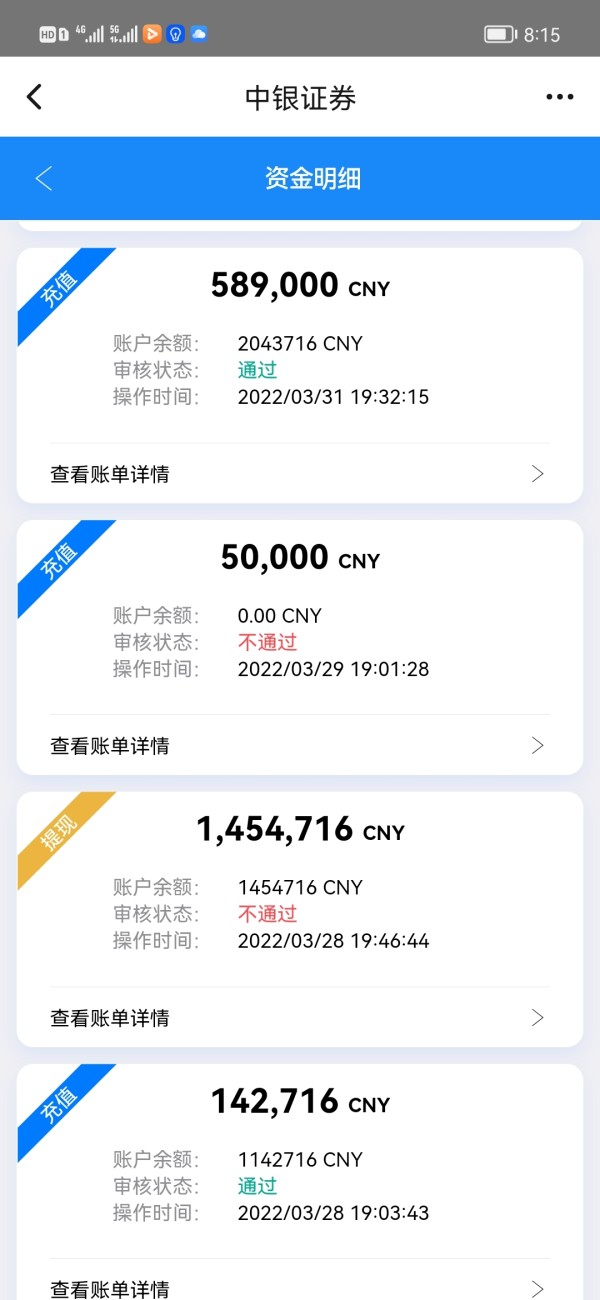

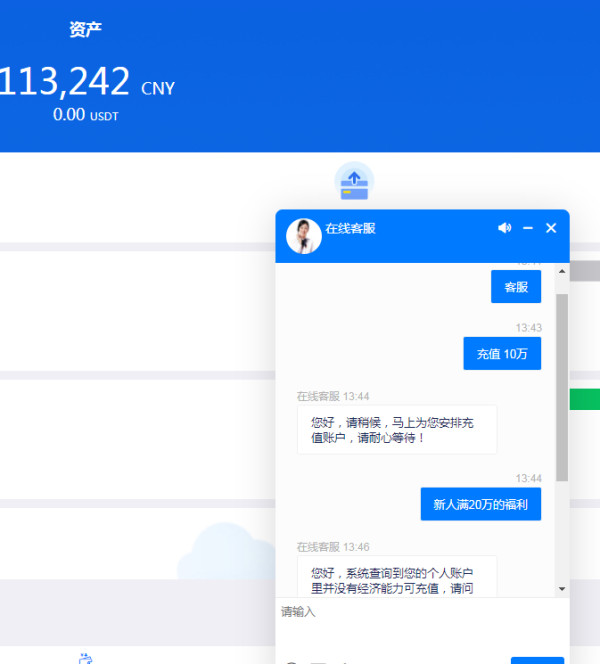

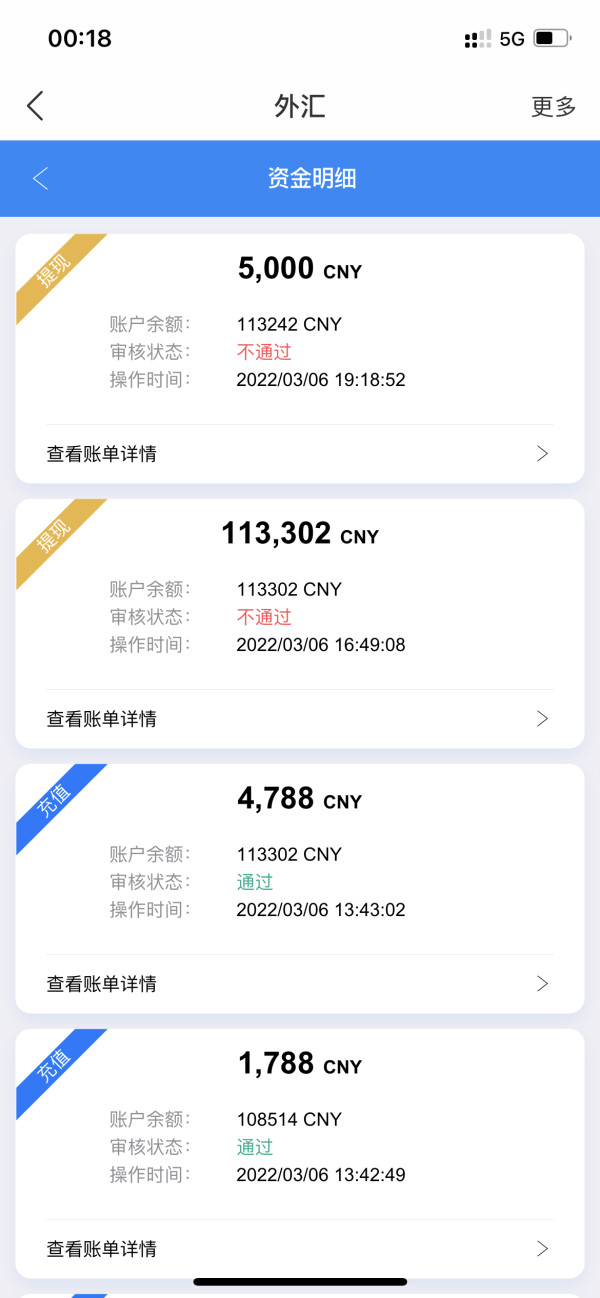

- Withdrawal Difficulty

According to a report on WikiFX, 10 users encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

Negative Chugin Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are 10 pieces of Chugin exposure in total.

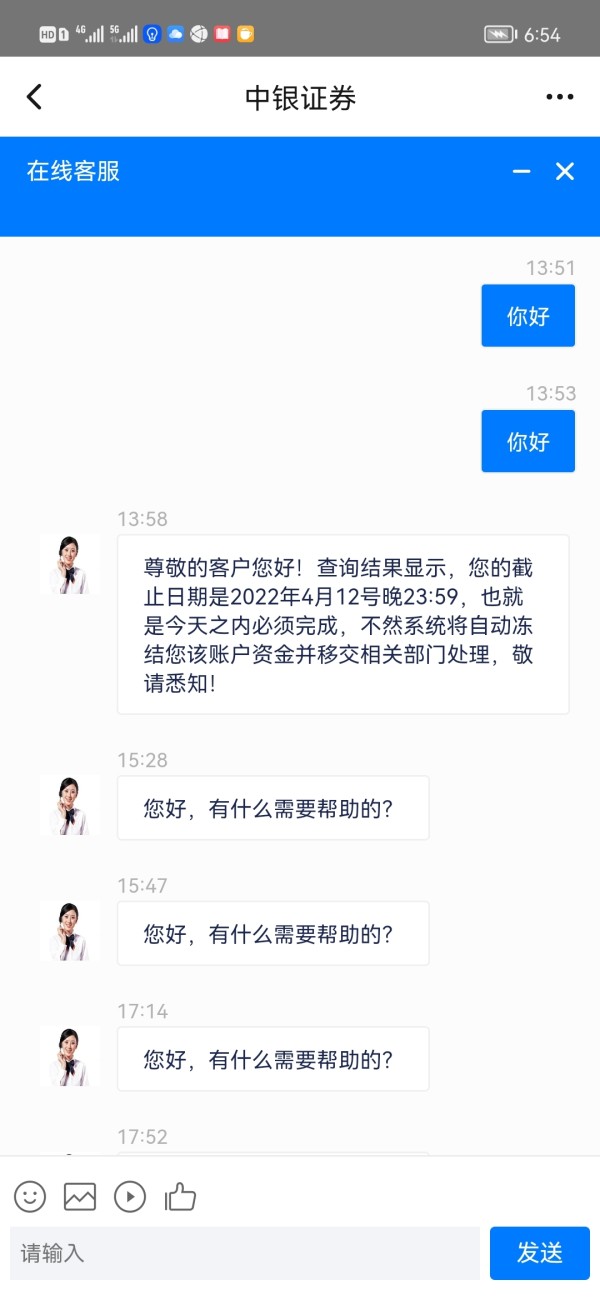

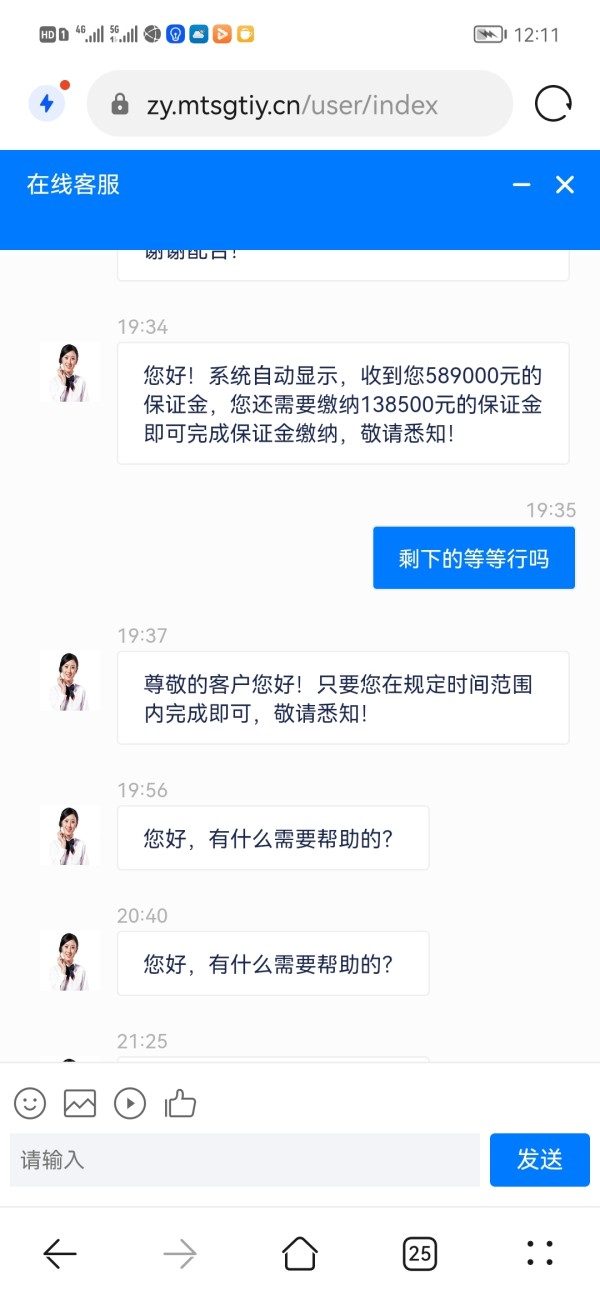

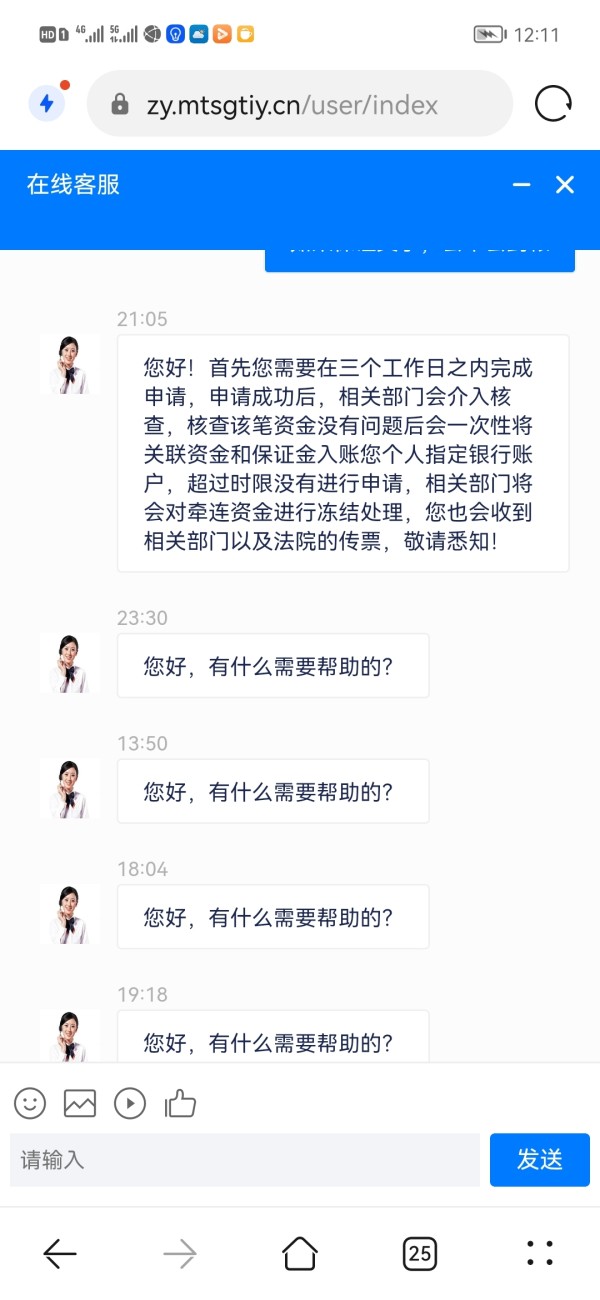

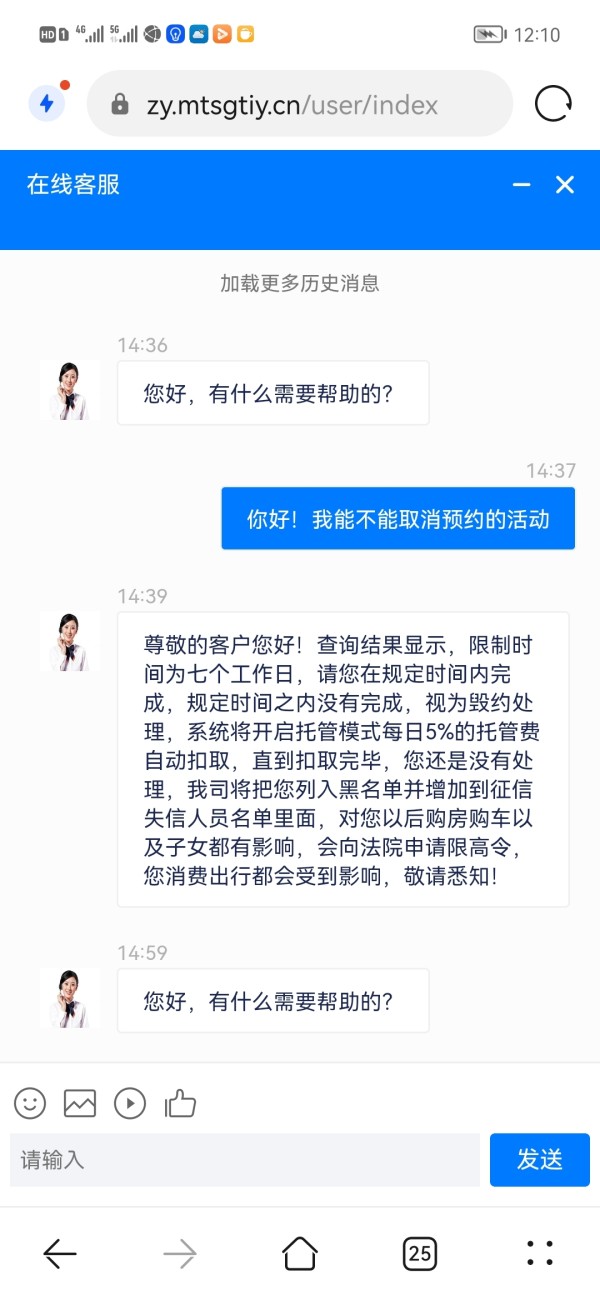

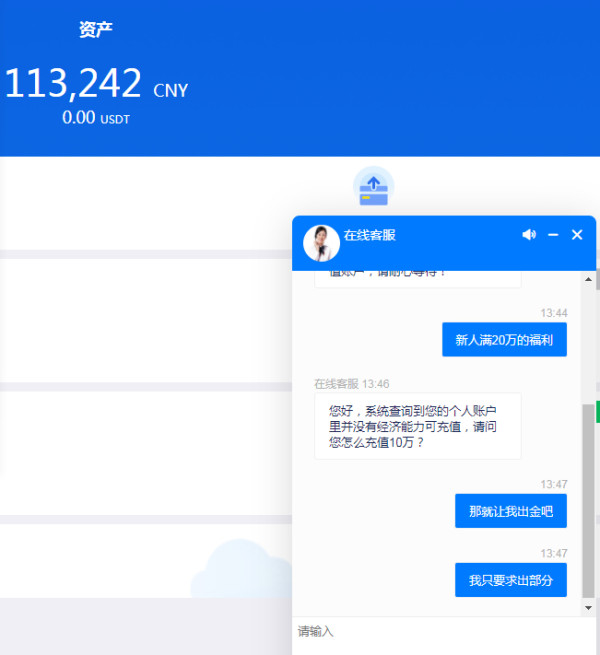

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2022 |

| Post Country | Hong Kong, China/US |

The users were unable to withdraw, and it was still pending after a long time. You may visit: https://www.wikifx.com/en/comments/detail/202204153892479663.html.

Conclusion

Chugin Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Review 10

Content you want to comment

Please enter...

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1387772722

United States

I had believed their promises initially only to be disappointed in the end. Their customer relationship zero and they are very rude. When I could not withdraw my profits, I complained to the customer support team and I was assured that it was being reviewed. Weeks after and still nothing to that effect. I wasn't comfortable so i decided to move all my investments out this time around to somewhere better but they quickly suspended my account. I was left helpless till fintrack/org assisted with the release of my stuck funds from Chugin Securities. If you ask my advice, Stay away from this platform.

Exposure

2022-04-15

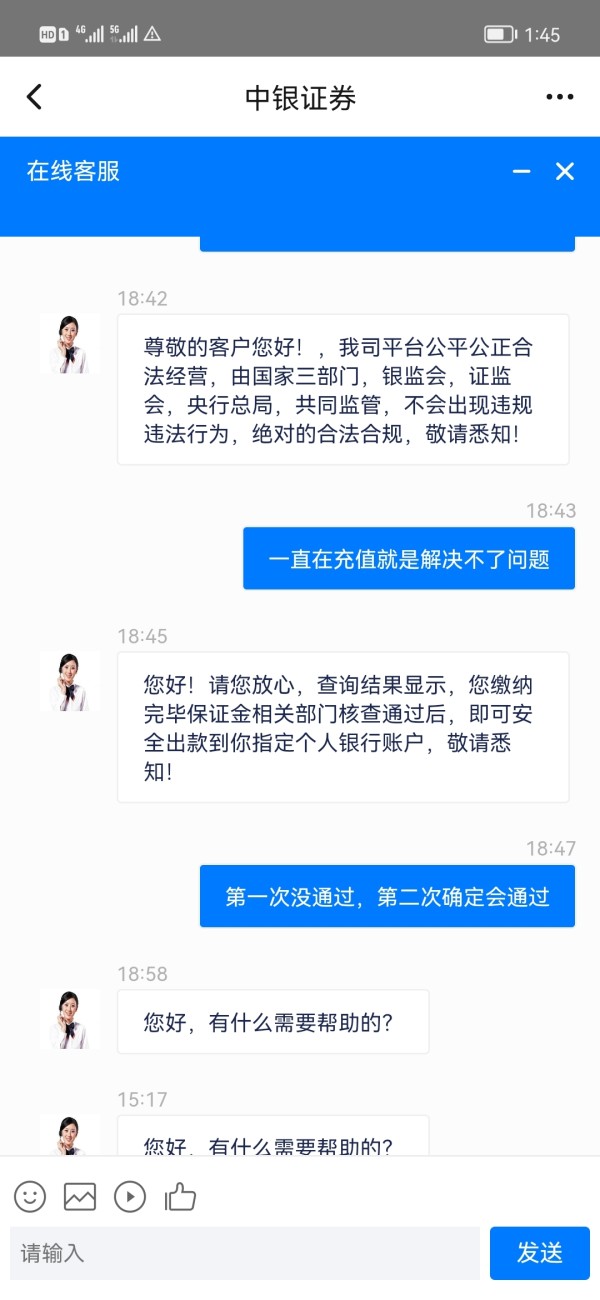

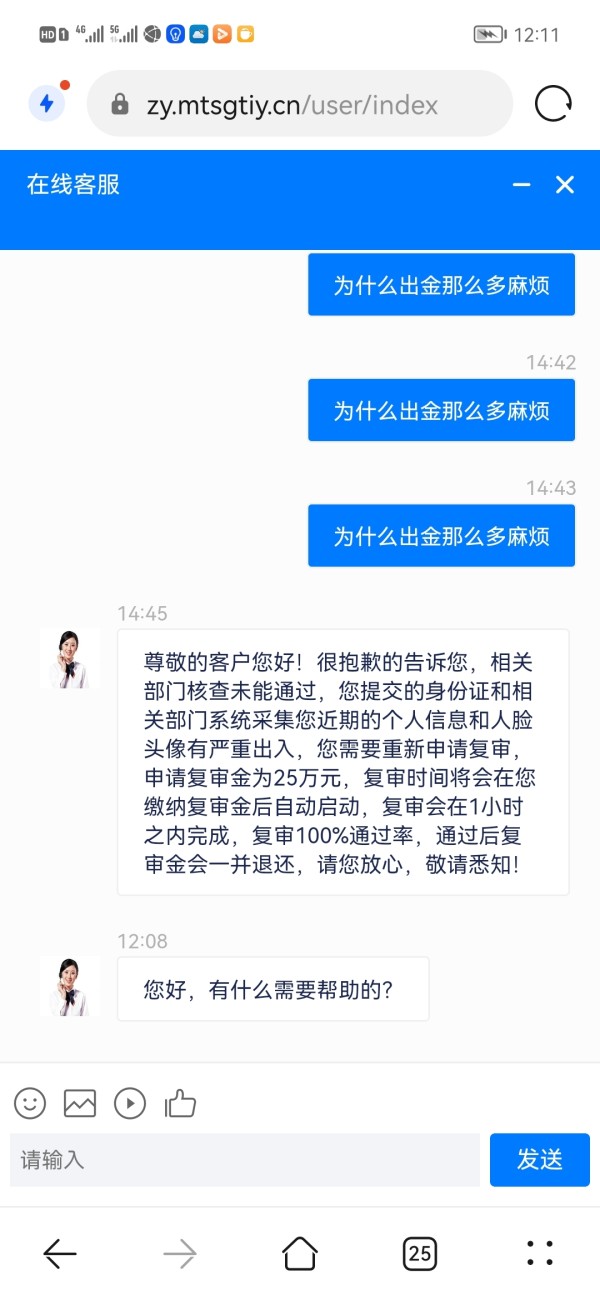

FX1658861402

Hong Kong

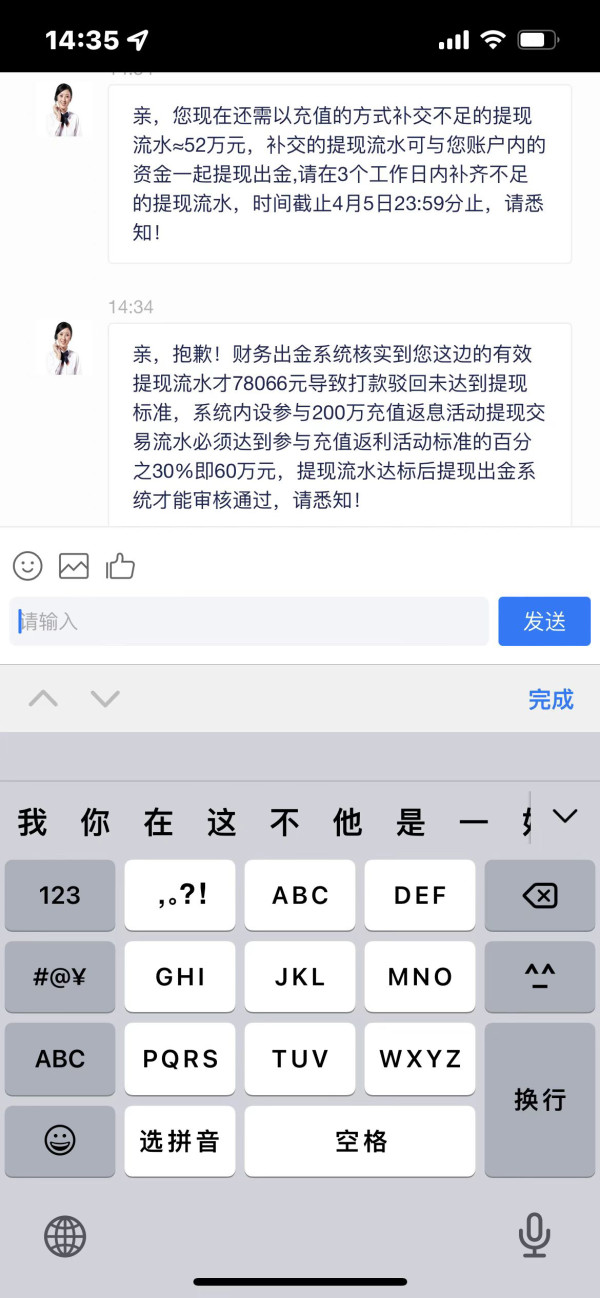

Unable to withdraw and require to pay tax. After that, it requires to pay margin and still cannot pass after that. It ask you to keep depositing and deny the withdrawal by various reason.

Exposure

2022-04-13

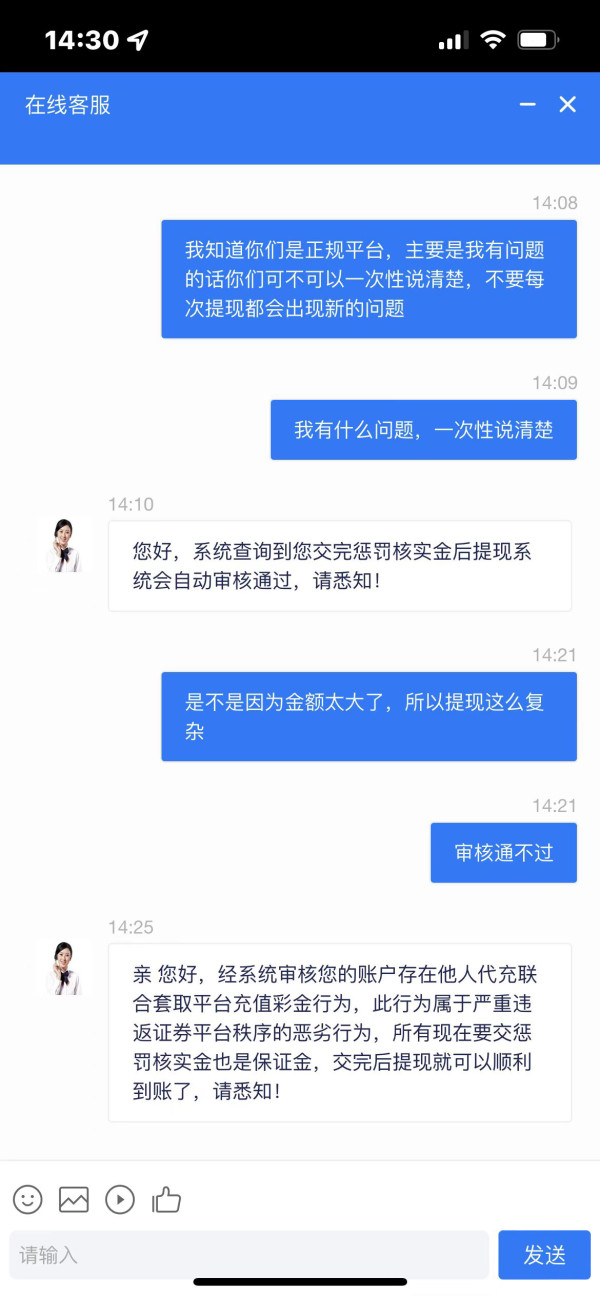

G7

Hong Kong

I hope that relevant department can handle this matter. I follow the requirement step by step so why can't I make withdrawal. I hope an mediation and a reasonble explaination.

Exposure

2022-04-11

FOOL

Hong Kong

Chugin does not allow to withdraw and the customer service is pretty cocky. I had report the case. Please solve it ASAP

Exposure

2022-03-08

FOOL

Hong Kong

Unable to withdraw. I have been deiceived for 100000RMB. I just want my principle back, but the customer service blocked me.

Exposure

2022-03-07

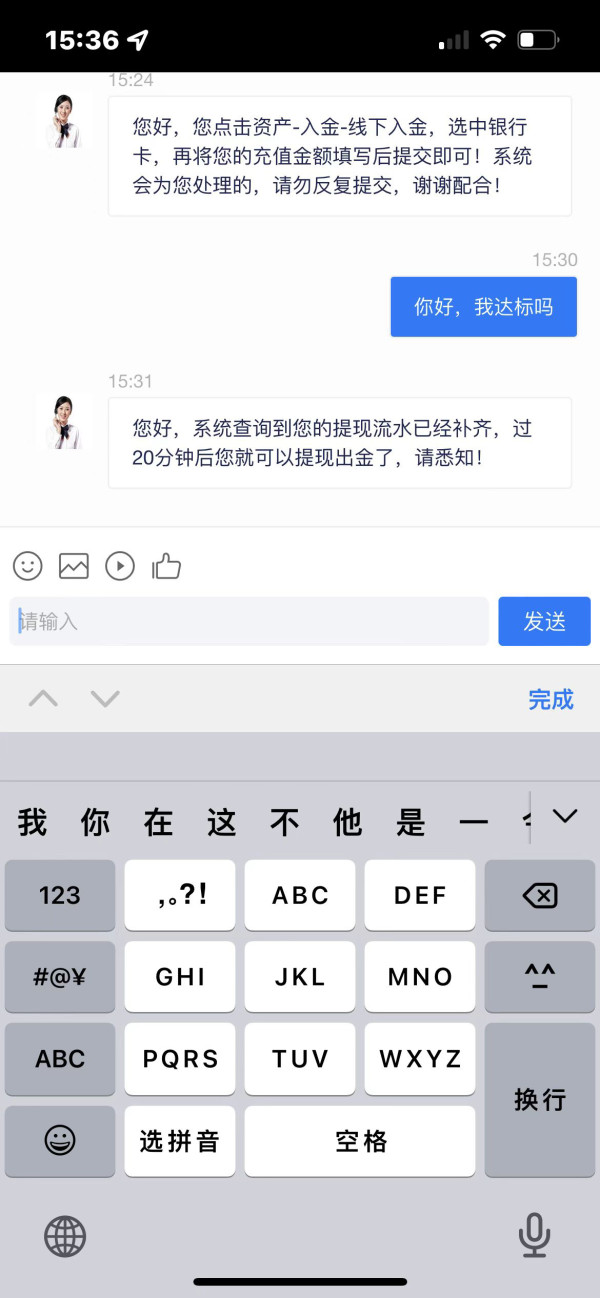

FOOL

Hong Kong

The customer service makes an appointment for a new person to deposit 200,000. If it is not fully deposited, it will not be up to the requirement and will not allow to withdraw. I ask customer service if I can withdraw when I do not meet the requirements. The customer service ignored me and blocked me.

Exposure

2022-03-07

lLl38718

Hong Kong

Keep saying that my account has many problems and ask me to pay. They promise many times to withdraw instantly, but it is never implemented. Suspect of fraud.

Exposure

2022-02-27

飞鱼63895

Hong Kong

Suspected to be fraud. Unable to withdraw. Withdrawal was rejected by customer service and the customer service does not respond.

Exposure

2022-02-13

弥17516

Hong Kong

The money in BOC Securities cannot be withdrawn, customer service is locked, suspected fraud

Exposure

2022-01-22

弥17516

Hong Kong

The money in the account cannot be withdrawn, the customer service is locked and cannot be contacted, suspected fraud,

Exposure

2022-01-21