Score

YUN CHEN

China|5-10 years|

China|5-10 years| http://www.ycfutures.cn/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Japan 2.51

Japan 2.51Contact

Licenses

Licenses

Licensed Institution:云晨期货有限责任公司

License No.:0127

Basic information

China

ChinaUsers who viewed YUN CHEN also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ycfutures.cn

Server Location

China

Website Domain Name

ycfutures.cn

ICP registration

滇ICP备05004789号-2

Website

WHOIS.CNNIC.CN

Company

阿里云计算有限公司(万网)

Domain Effective Date

2007-09-12

Server IP

112.74.48.127

Company Summary

| Company Name | Yun Chen Futures Co., Ltd. |

| Founded | March 2002 |

| Ownership | Subsidiary of Aluminum Corporation of China Limited (Chinalco) |

| Headquarters | 111 Renmin East Road, Kunming, Yunnan Province, China, 650051 |

| Email Address | ycfutures@sina.com |

| Customer Service Phone | 0871-63142017 |

| Complaints Phone | 0871-63412005 |

| Complaints Email | ycqhxf@chalco.com.cn |

| Complaints Address | 4th Floor, Block B, Times Square, 363 Jinbi Road, Kunming, Yunnan Province, China |

| Services | Commodity Futures Brokerage, Financial Futures Brokerage |

Overview

Yun Chen Futures Co., Ltd. was founded in March 2002 and operates under the financial division of Aluminum Corporation of China Limited (Chinalco). The company specializes in commodity futures brokerage and financial futures brokerage services, with a registered capital of 300 million yuan. Yun Chen Futures is a member of several prominent Chinese commodity exchanges, including the Dalian Commodity Exchange, Shanghai Futures Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and the Shanghai International Energy Exchange. Additionally, they are a trading and settlement member of the China Financial Futures Exchange. The company has branch offices and business departments in Beijing, Shanghai, Kunming, Mengzi, and Qujing, and it also owns a risk management subsidiary called Shanghai Diansheng Trading Co., Ltd. Yun Chen Futures plays a significant role in the Chinese futures market, offering comprehensive futures brokerage services to support clients in their investment and risk management endeavors.

Regulation

Yun Chen is subject to regulatory oversight by the China Financial Futures Exchange (CFFEX). As an individual or entity involved in financial activities within China's futures market, compliance with CFFEX regulations is essential to ensure fair and transparent trading practices. CFFEX plays a pivotal role in maintaining market integrity, monitoring trading activities, and enforcing rules and regulations that promote stability and investor confidence in the Chinese financial futures market. Yun Chen, like all participants in this market, must adhere to CFFEX's guidelines and requirements to contribute to the overall health and reliability of the financial futures sector in China.

Pros and Cons

Yun Chen Futures, operating under Chinalco, enjoys a strong reputation and diverse exchange membership. They offer comprehensive services and transparent fee structures, complemented by accessible customer support. However, challenges include language support, withdrawal restrictions, limited deposit/withdrawal hours, browser compatibility, and specific age and ID requirements. Overall, Yun Chen Futures provides a reliable platform for trading in Chinese commodity and financial futures markets.

| Pros | Cons |

| 1. Established Reputation: Affiliated with Chinalco. | 1. Limited Language Support: Primarily Chinese language. |

| 2. Diverse Exchange Membership: Member of major Chinese exchanges. | 2. Withdrawal Restrictions: Limits on withdrawal amounts. |

| 3. Comprehensive Services: Offers commodity and financial futures. | 3. Limited Deposit/Withdrawal Hours: No overnight withdrawals. |

| 4. Transparent Trading Fees: Clear fee structures. | 4. Browser Compatibility: Requires Internet Explorer 11. |

| 5. Customer Support: Multiple support channels. | 5. Limited Age and ID Requirements. |

How to open an account?

To open an account, you will need to follow these steps and prepare the required documents and equipment:

Step 1: Prepare the following items:

Mobile phone

Identity card (Chinese citizens) or residence permit (foreign residents)

Bank card

Webcam or camera

Speaker

Microphone

Pen and paper

Step 2: Start the account opening process:

Visit the online account opening portal during the service hours, which are Monday to Friday from 09:00 to 17:00.

Make sure you are at least 18 years old and have a valid Chinese citizen ID or the new version of a foreign resident's permanent residence ID card.

Ensure that your web browser has the necessary security controls installed. If not, you can download them from the portal.

Use Internet Explorer 11 as your web browser.

Your operating system should be Windows 7 or a newer version.

Step 3: Follow the account opening procedure:

Provide your basic information as required by the online platform.

Complete the suitability assessment.

Download and review the necessary agreements.

If needed, apply for additional trading codes.

Choose a supported bank for your account transactions.

Step 4: Submit your application:

Once you have filled in all the required information and documents, submit your account opening application through the online platform.

Please note that the exact process may vary depending on the specific financial institution or platform you are using. It's essential to carefully read and follow the instructions provided on the respective website or portal to ensure a smooth account opening process.

Deposit & Withdrawal

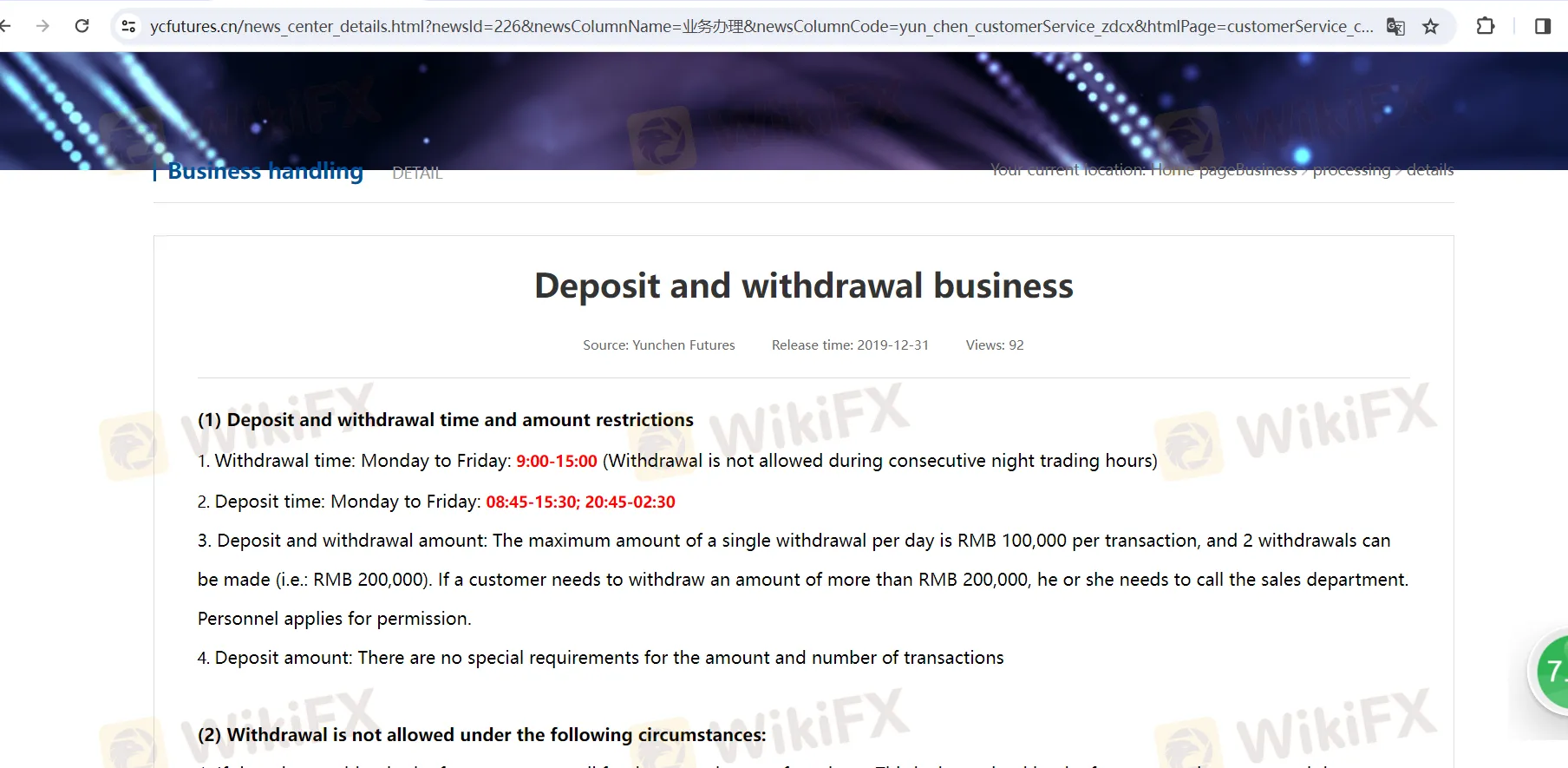

Deposit and Withdrawal Times and Amount Limits:

Withdrawal Time: You can initiate withdrawals from Monday to Friday between 9:00 AM and 3:00 PM. However, withdrawals are not allowed during continuous overnight trading sessions.

Deposit Time: Deposits are accepted on weekdays from 8:45 AM to 3:30 PM and from 8:45 PM to 2:30 AM (next day).

Withdrawal Amount: The maximum withdrawal amount per transaction is 100,000 Chinese Yuan (CNY) or 100,000 RMB. You are allowed to make up to two withdrawals per day, totaling 200,000RMB. If you need to withdraw more than 200,000RMB. you must contact the business personnel at the branch via telephone to request permission.

Deposit Amount: There are no specific restrictions on the deposit amount or the number of deposits you can make.

Restrictions on Withdrawals:

In the Presence of Open Positions: If you have open positions in your futures account, you cannot withdraw all of your funds. This limitation is due to the futures margin system and the daily zero-liability settlement system. With open positions, the withdrawable funds are calculated as: Withdrawable Funds = (Available Funds - Mark-to-Market Profit/Loss) * (1 - Margin Requirement/Client Equity).

Same-Day Closing Profits: Profits from closing positions on the same day cannot be withdrawn until the settlement process is completed. This rule is in place to protect investors' interests and prevent the risk of transferring funds through wash trades or other means.

Minimum Residual Funds: A minimum residual fund of 1001 CNY is required to be maintained in your futures account. Real-time calculations of available funds during trading hours may differ slightly from the results calculated during the settlement process due to precision issues. Without setting a “minimum residual fund,” withdrawing funds based on real-time calculations during trading hours may lead to a slight underfunding in your account after settlement.

Exceeding Withdrawal Limits: If the withdrawal amount exceeds the single withdrawal limit set by the futures company (as mentioned in the second point), you may not be able to complete the withdrawal.

Minimum Account Balance: To prevent futures accounts from becoming dormant due to prolonged inactivity, a minimum account balance of 1001 CNY is required. Withdrawals of this minimum balance require prior telephone appointment and authorization.

It's important to adhere to these guidelines and contact the company's business personnel for any special withdrawal requests or inquiries to ensure a smooth deposit and withdrawal process while trading futures through Yun Chen Futures.

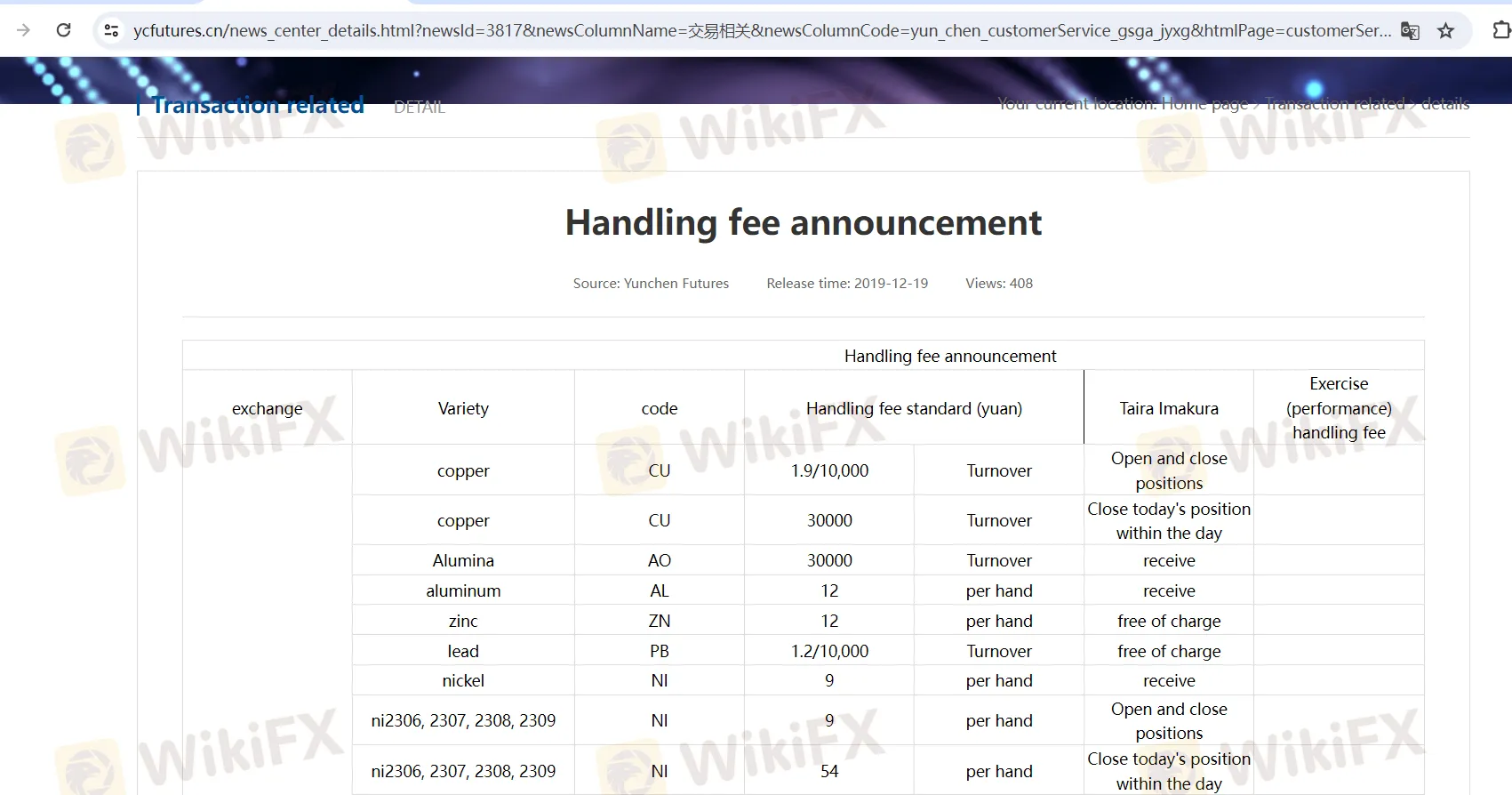

Trading Fees

Shanghai Futures Exchange:

Commodities like copper (CU), aluminum oxide (AO), aluminum (AL), zinc (ZN), lead (PB), and nickel (NI) have different fee structures per 10,000 units or per hand, depending on the type of transaction (e.g., opening/closing positions, intra-day trading).

Options for copper, aluminum, zinc, rubber, synthetic rubber, gold, and silver are also listed, with specific fees per hand and conditions for fee waivers.

Dalian Commodity Exchange:

Lists fees for commodities like corn (C), cornstarch (CS), soybeans (A, B), soybean meal (M), soybean oil (Y), palm oil (P), and others.

Trading fees vary, charged per hand or per 10,000 units. Some specific contracts (e.g., FU2309, JD, RR) have different rates.

Options for commodities like soybean meal, corn, iron ore, liquefied petroleum gas, polypropylene, PVC, and others are included with their respective fees.

Zhengzhou Commodity Exchange:

Features commodities such as white sugar (SR), cotton (CF), wheat (PM, WH), rice (RI, LR, JR), rapeseed meal (RM), and more.

Fees are listed per hand, with some commodities having different rates for specific contracts (e.g., CF2309, CF2311/2401).

Options for commodities like toluene diisocyanate (PX), soda ash (SH), white sugar, cotton, rapeseed oil, thermal coal, methanol, PTA, and peanuts are presented with their fees.

China Financial Futures Exchange:

Lists fees for indices like the CSI 500 (IC), CSI 300 (IF), SSE 50 (IH), and CSI 1000 (IM), as well as for government bonds (T, TF, TS, TL).

Fees are specified per 10,000 units or per hand, with additional fees for certain transactions.

Shanghai International Energy Exchange:

Includes commodities such as crude oil (SC), 20# rubber (NR), cathode copper (BC), low-sulfur fuel oil (LU), and container freight index (EC).

The fees are mostly per hand or per 10,000 units, with some contracts having specific fees for opening/closing positions and intra-day trading.

Guangzhou Futures Exchange:

Lists fees for industrial silicon (SI) and lithium carbonate (LC), along with their options. Fees are per 10,000 units or per hand, with some conditions for fee waivers.

This comprehensive list provides detailed information on the trading fee structures for a variety of commodities and their options across multiple Chinese commodity exchanges.

Customer Support

Yun Chen Futures provides comprehensive customer support services to address inquiries and concerns from its clients. Here's an overview of their customer support:

Customer Service Address:

Address: 111 Renmin East Road, Kunming, Yunnan Province, China, 650051.

Customer Service Contact Information:

Email: ycfutures@sina.com

Customer Service Phone: 0871-63142017

Complaints and Feedback Contact:

Phone: 0871-63412005

Email: ycqhxf@chalco.com.cn

Address: 4th Floor, Block B, Times Square, 363 Jinbi Road, Kunming, Yunnan Province, China.

Yun Chen Futures offers multiple channels for clients to reach out for assistance and support, including email and telephone communication. They have a dedicated complaints and feedback department to address any issues or concerns that clients may encounter during their trading experience.

The provided contact information allows clients to seek guidance, resolve issues, or provide feedback on their experiences with the company. This commitment to customer support helps ensure a positive and efficient trading experience for their clients.

Summary

Yun Chen Futures Co., Ltd., established in March 2002, is a subsidiary of Aluminum Corporation of China Limited (Chinalco). The company specializes in commodity and financial futures brokerage services, with a registered capital of 300 million yuan. It holds memberships in major Chinese commodity exchanges, including Dalian Commodity Exchange, Shanghai Futures Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and Shanghai International Energy Exchange. Additionally, it is a trading and settlement member of the China Financial Futures Exchange. With branch offices in various Chinese cities, Yun Chen Futures offers comprehensive support for investment and risk management.

Yun Chen is subject to regulatory oversight by the China Financial Futures Exchange (CFFEX), ensuring compliance with market regulations and fostering transparency and integrity in the Chinese financial futures market.

To open an account with Yun Chen, clients must prepare necessary documents and equipment, complete suitability assessments, and follow the online account opening procedure during service hours. The company has specific guidelines for deposit and withdrawal operations, including limits and restrictions based on various factors.

Trading fees vary depending on the commodity and exchange, with detailed fee structures provided for different types of transactions. Yun Chen Futures places a strong emphasis on customer support, offering multiple channels for clients to seek assistance and address concerns, including dedicated contact information for complaints and feedback. This commitment to support aims to enhance clients' trading experiences and contribute to the overall health of the Chinese futures market.

FAQs

Q1: How can I contact Yun Chen Futures for customer support?

A1: You can reach Yun Chen Futures' customer support via phone at 0871-63142017 or email at ycfutures@sina.com. For complaints and feedback, contact them at 0871-63412005 or ycqhxf@chalco.com.cn.

Q2: What are the trading hours for deposit and withdrawal with Yun Chen Futures?

A2: Yun Chen Futures allows withdrawals from 9:00 AM to 3:00 PM on weekdays, excluding continuous overnight trading sessions. Deposits are accepted between 8:45 AM to 3:30 PM and 8:45 PM to 2:30 AM on weekdays.

Q3: What documents do I need to open an account with Yun Chen Futures?

A3: To open an account, you'll need a mobile phone, valid ID or residence permit, bank card, webcam, speaker, microphone, and pen and paper.

Q4: Are there any restrictions on withdrawal amounts from Yun Chen Futures?

A4: Yes, the maximum withdrawal limit is 100,000 CNY per transaction, with up to two withdrawals allowed per day. Special requests for higher amounts require contacting the branch.

Q5: Which Chinese commodity exchanges does Yun Chen Futures operate on?

A5: Yun Chen Futures is a member of several prominent Chinese commodity exchanges, including Dalian Commodity Exchange, Shanghai Futures Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and Shanghai International Energy Exchange, along with being a member of the China Financial Futures Exchange.

Keywords

- 5-10 years

- Regulated in China

- Futures License

- Suspicious Scope of Business

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now