Score

Fulton FX

Japan|2-5 years|

Japan|2-5 years| http://fultonfx.com/en/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Japan

JapanUsers who viewed Fulton FX also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

fultonfx.com

Server Location

South Africa

Website Domain Name

fultonfx.com

Server IP

206.238.221.7

Company Summary

| Company Name | Fulton FX |

| Headquarters | Tokyo, Japan |

| Regulations | No license |

| Market Instruments | Forex, Crude oil, Precious metals, Stock indices |

| Leverage | Up to 1:500 |

| Spread | Starting from 0.0 pips |

| Minimum Deposit | N/A |

| Deposit/Withdraw Methods | Maestro, PayPal, UnionPay, VISA, Cirrus, JCB |

| Trading Platforms | Proprietary trading software |

| Customer Support | Phone, email, WhatsApp |

| Educational Resources | N/A |

Overview of Fulton FX

Fulton FX is a brokerage firm based in Tokyo, Japan, with its registered address located at 33rd Floor, Shinjuku Mines Tower, 2-1-1 Yoyogi, Shibuya-ku, Tokyo. The broker provides access to a wide range of market instruments, including forex, crude oil, precious metals, and stock indices. Traders can utilize flexible leverage options of up to 1:500, enabling them to control larger positions with a smaller amount of capital. Fulton FX offers a competitive trading environment with a minimum spread starting from 0.0 pips and allows various trading strategies such as scalping, hedging, and automated trading. Their trading platform offers traders the tools and resources to execute trades efficiently and access real-time market data for informed decision-making.

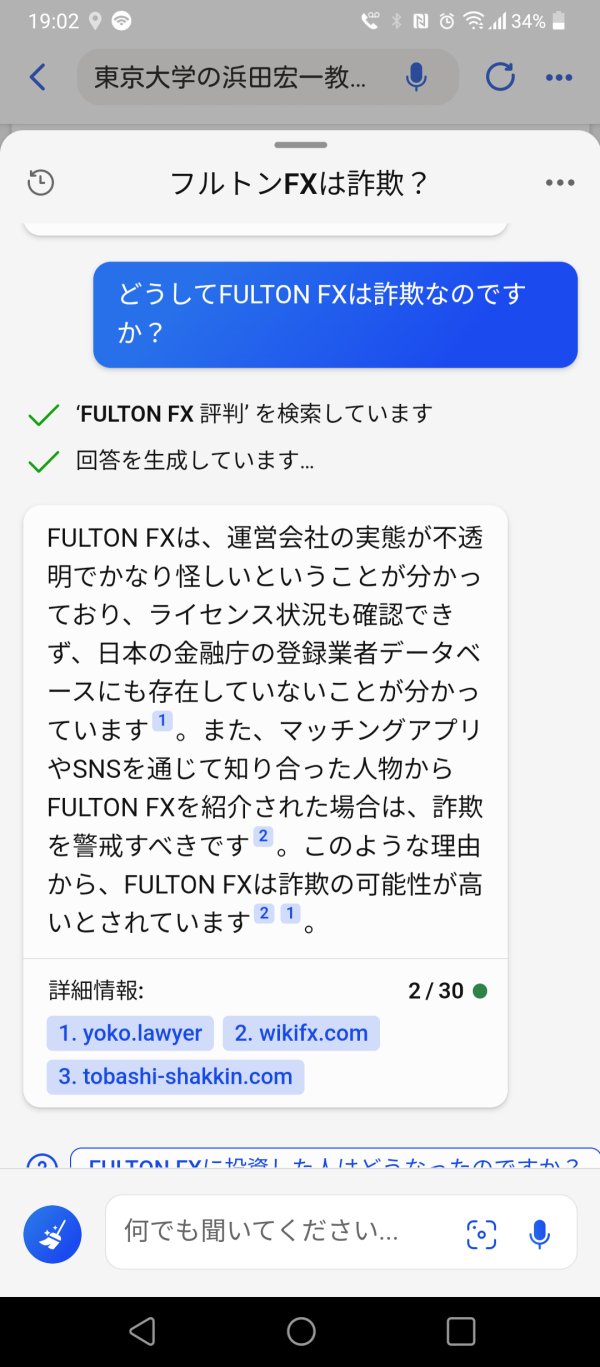

Is Fulton FX regulated?

The regulatory status of Fulton FX is a matter of concern and poses potential risks for traders. According to the information provided, Fulton FX's regulatory status with the United States NFA (National Futures Association) is abnormal and categorized as “Unauthorized.” The broker's business scope appears to exceed the limits regulated by the NFA, specifically pertaining to its UNFX Non-Forex License (license number: 0556754).

Additionally, it has been verified that Fulton FX currently lacks any valid regulation. As a result, traders should exercise extreme caution and be aware of the risks associated with trading on an unregulated platform. Engaging with an unauthorized broker could potentially expose traders to various financial and operational risks, making it crucial for individuals to conduct thorough due diligence and consider the potential implications before proceeding with trading activities on Fulton FX.

Pros and Cons

Fulton FX offers a diverse range of market instruments, providing traders with access to forex, crude oil, precious metals, and stock indices. The flexible leverage options of up to 1:500 are advantageous for controlling larger positions with a smaller capital outlay. The broker's competitive trading conditions, with spreads starting from 0.0 pips, are appealing to traders seeking cost-effective trading. Additionally, Fulton FX allows various trading strategies, including scalping, hedging, and automated trading, catering to different trader preferences. Their platform provides efficient tools and real-time market data for well-informed decision-making.

One notable concern is Fulton FX's regulatory status. This lack of valid regulation raises potential risks for traders, who need to exercise caution and thoroughly assess the implications of trading with an unregulated broker. Traders should be mindful of the potential risks associated with unauthorized status and carefully consider their options before engaging with the broker. Another drawback of Fulton FX is the lack of transparency regarding fees information. Traders may not have clear visibility on certain charges, such as commissions or other trading costs. Furthermore, the absence of details on the minimum deposit requirement may make it challenging for traders to assess the initial investment needed to open an account. Additionally, Fulton FX's limited provision of educational resources may hinder the development of traders' skills and knowledge.

| Pros | Cons |

| Diverse range of market instruments | Regulatory status is abnormal and unauthorized |

| Flexible leverage options | Lack of transparency regarding fees information |

| Competitive trading conditions | No info on minimum deposit requirement |

| Allows various trading strategies | Limited educational resources |

| Efficient platform with real-time data | Lack of variation in account types |

Market Instruments

Fulton FX offers a broad range of market instruments to accommodate diverse trading preferences. Clients can access a variety of asset classes through the platform, including forex, crude oil, precious metals, and stock indices. The forex market presents opportunities to trade major, minor, and exotic currency pairs, while crude oil contracts enable traders to capitalize on oil price fluctuations. Additionally, investors can trade precious metals like gold, silver, platinum, and palladium, which serve as safe-haven assets during times of economic uncertainty.

Moreover, the platform provides access to various stock indices, allowing traders to take positions on the overall performance of specific markets. By offering these diverse market instruments, Fulton FX empowers traders to explore different opportunities and manage their portfolios more effectively. However, traders should exercise caution and understand the risks associated with each instrument before engaging in trading activities on the platform.

How to open an account in Fulton FX?

Opening an account with FULTON FX is a straightforward process that allows traders to access their trading platform and start trading various financial instruments.

Begin by visiting the FULTON FX website and selecting the “Register” option to initiate the account opening process.

Fill in the required information, including personal details and contact information, in the registration form.

After completing the registration, undergo the necessary audit process to verify your identity and ensure compliance with regulatory requirements.

Once your account is verified, proceed to deposit funds into your trading account using one of the accepted payment methods.

With funds in your account, you are now ready to start trading on the Fulton FX platform, utilizing their various trading instruments and tools.

Spread and Commission Fees

Fulton FX offers a flexible trading volume, allowing customers to trade with transaction sizes ranging from 0.1 Lot (1,000 currency units) to 1000 Lot (1 million currency units). The platform's advanced technology ensures that prices are classified and sorted in real-time across multiple providers and quote layers. This ensures that traders can execute trades at the best available price, regardless of their trade size. With spreads starting from as low as 0.0 pips, Fulton FX provides a competitive and cost-effective trading environment for its clients.

The platform's tight spreads are beneficial for traders as they reduce the cost of executing trades. Lower spreads mean that traders pay less in the difference between the bid and ask price of an asset, which can significantly impact overall trading costs. This is particularly advantageous for traders who engage in high-frequency trading or those who frequently open and close positions.

Leverage

Fulton FX provides traders with flexible leverage options, allowing them to enhance their trading positions and potential returns. With leverage ratios of up to 1:500, clients can control larger trading positions with a relatively smaller amount of capital. This feature is particularly attractive to traders seeking to amplify their potential profits.

Leverage enables traders to magnify their exposure to the financial markets, which can be advantageous when used wisely. It allows traders to take larger positions than they would with their available balance alone. However, it is essential to note that while leverage can amplify potential gains, it also increases the risk of significant losses. Traders should exercise caution and use leverage responsibly, ensuring they have a comprehensive risk management strategy in place to protect against adverse market movements.

Trading Platform

Fulton FX offers a proprietary trading platform for iOS, Android, and PC devices, presenting advanced features such as fast trade execution and customizable layouts. While the platform boasts various tools, such as over 30 indicators for market analysis and access to transaction history, it is essential to note that some aspects may raise concerns. Notably, the unparalleled trade execution speed and the potential for multiple screens and customizable layouts might not align with the industry standard, raising questions about the platform's reliability and fairness.

Furthermore, users should exercise caution as there are potential risks associated with the platform. The provision of sophisticated charting tools and trading capabilities might raise suspicions about the fairness of the trading environment. There is a possibility that such a feature-rich platform could be manipulated or rigged in favor of the platform provider, potentially disadvantaging traders. As a result, traders should carefully assess the platform's credibility and ensure that they conduct due diligence before engaging in trading activities on Fulton FX.

Deposit & Withdrawal

Fulton FX provides a range of convenient and secure payment methods for clients to easily fund their trading accounts. Accepted options include Maestro, PayPal, UnionPay, VISA, Cirrus, and JCB. Traders can use their debit or credit cards like Maestro and VISA, opt for popular online payment systems like PayPal, or utilize region-specific options such as UnionPay. The platform's diverse payment offerings ensure accessibility and ease of funding, allowing traders from different regions to deposit funds efficie

Customer Support

Fulton FX provides various channels for customer support, ensuring traders can easily reach out for assistance and inquiries. Customers can contact the company through their phone line at +81 03-6824-4811, allowing direct communication with the support team. Additionally, traders can use the customer service email address, info@fultonfx.com, to send queries and receive timely responses. Furthermore, Fulton FX offers support through WhatsApp, providing an accessible and convenient way for traders to communicate with the support team using the popular messaging platform.

Conclusion

Fulton FX is a trading broker that offers a diverse range of market instruments, including forex, crude oil, precious metals, and stock indices. Traders can access flexible leverage options of up to 1:500, allowing them to control larger positions with relatively smaller capital. The platform boasts competitive trading conditions, such as a minimum spread starting from 0.0 pips, and supports trading strategies like scalping, hedging, and automated trading.

However, it's important to note that Fulton FX's regulatory status has raised concerns. The broker's abnormal status with the United States NFA (National Futures Association) and classification as “Unauthorized” indicates a lack of valid regulation. This aspect raises potential risks for traders, who should exercise caution and conduct thorough research before engaging with the broker. While Fulton FX offers attractive features, traders need to weigh the benefits against the potential risks associated with trading on an unregulated platform.

FAQs

Q: What is the regulatory status of Fulton FX?

A: Fulton FX currently has an abnormal regulatory status with the United States NFA (National Futures Association) and does not have any other valid license.

Q: What is the maximum leverage offered by Fulton FX?

A: Fulton FX provides flexible leverage options up to 1:500.

Q: How can I reach customer support at Fulton FX?

A: You can contact Fulton FX's customer support through their phone line, via email at info@fultonfx.com, or WhatsApp.

Q: What is the minimum spread on Fulton FX's platform?

A: Fulton FX offers a minimum spread starting from 0.0 pips.

Q: What are the market instruments available for trading on Fulton FX?

A: Fulton FX offers a diverse range of market instruments, including forex, crude oil, precious metals, and stock indices.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

チーフ

Japan

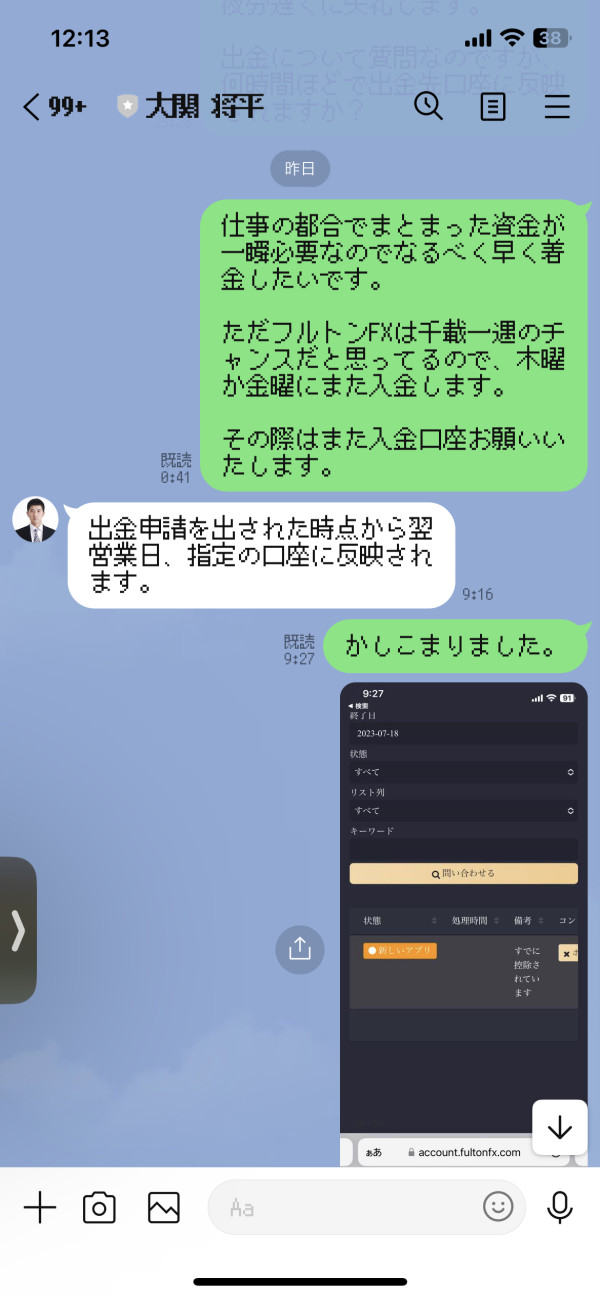

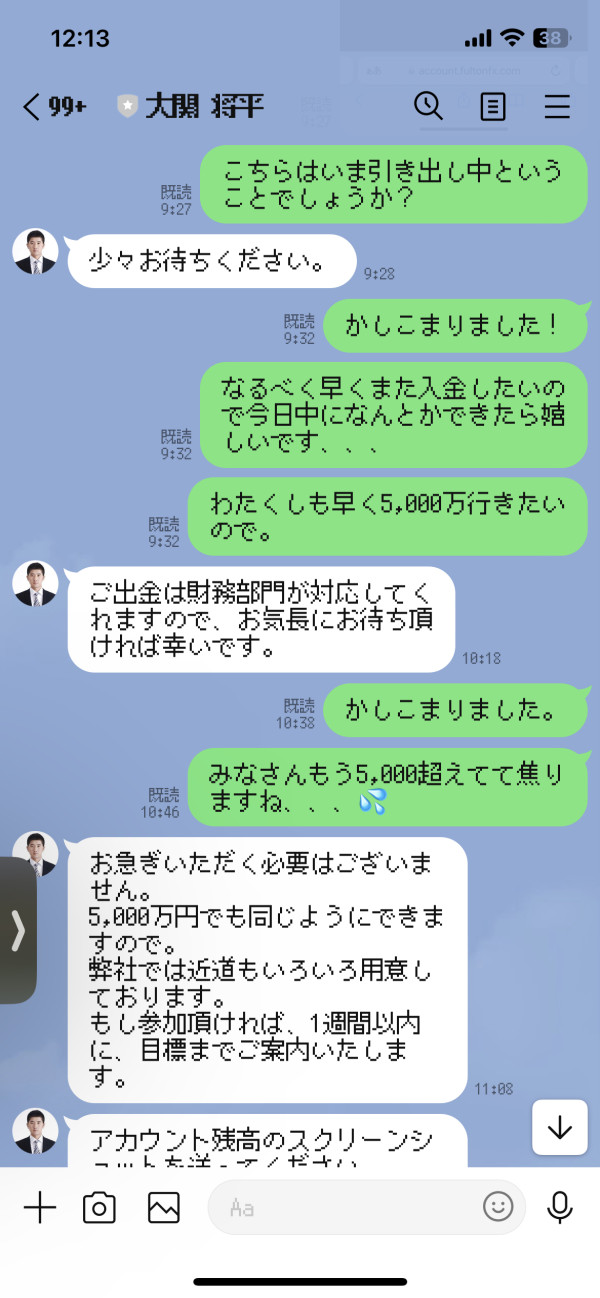

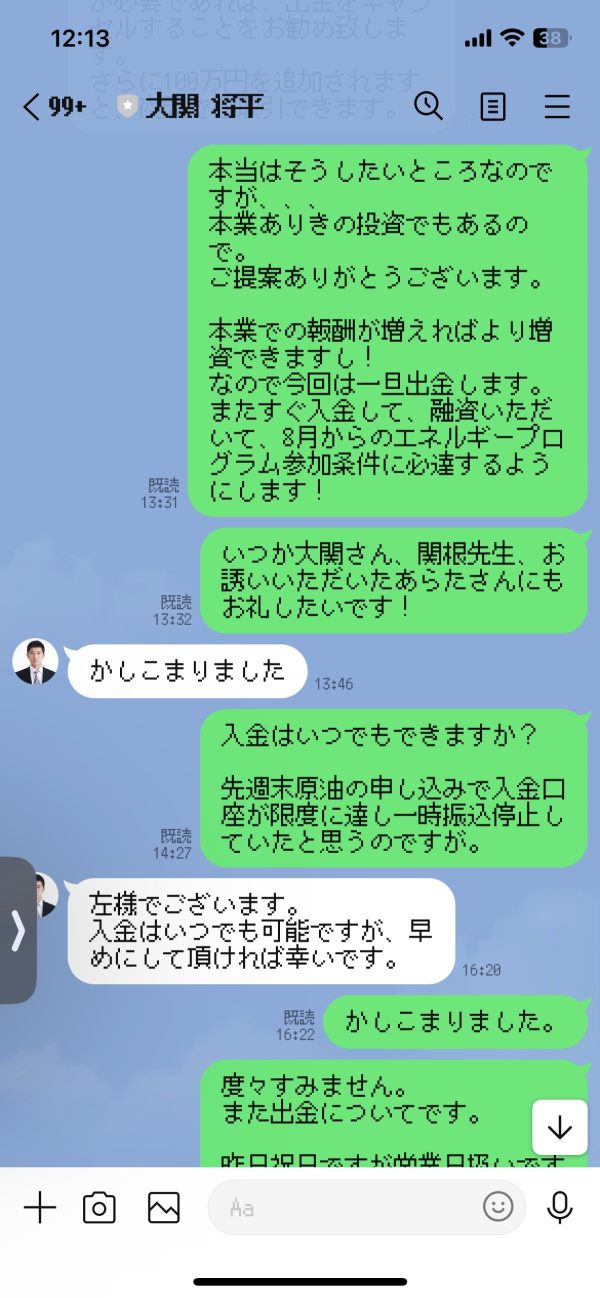

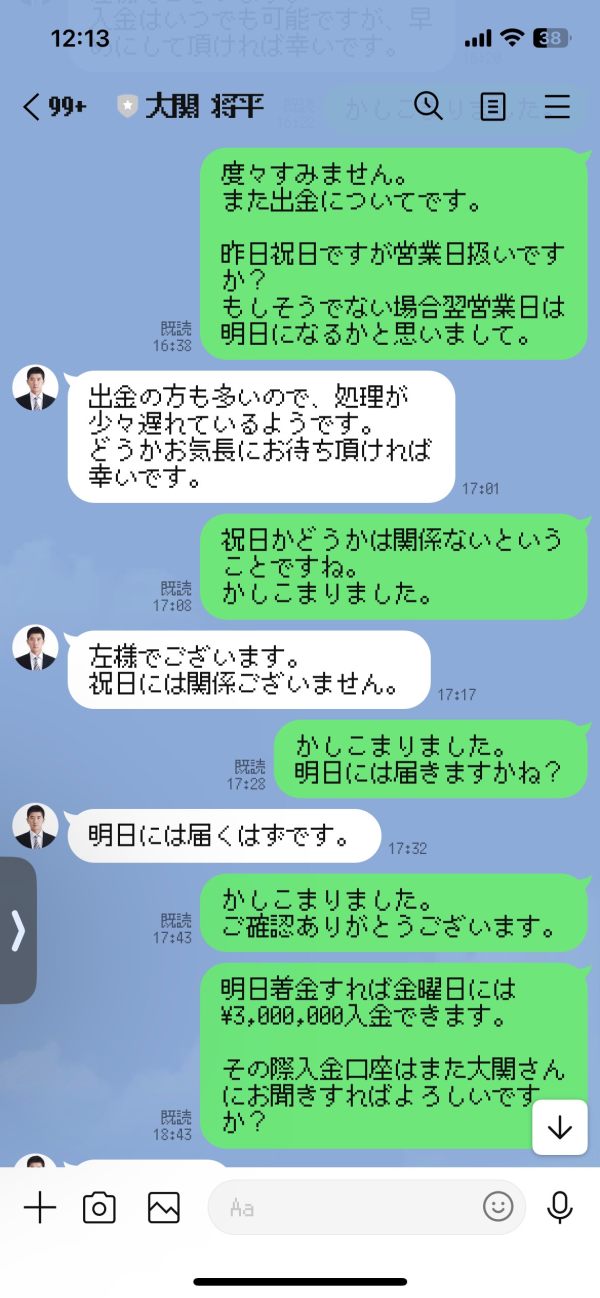

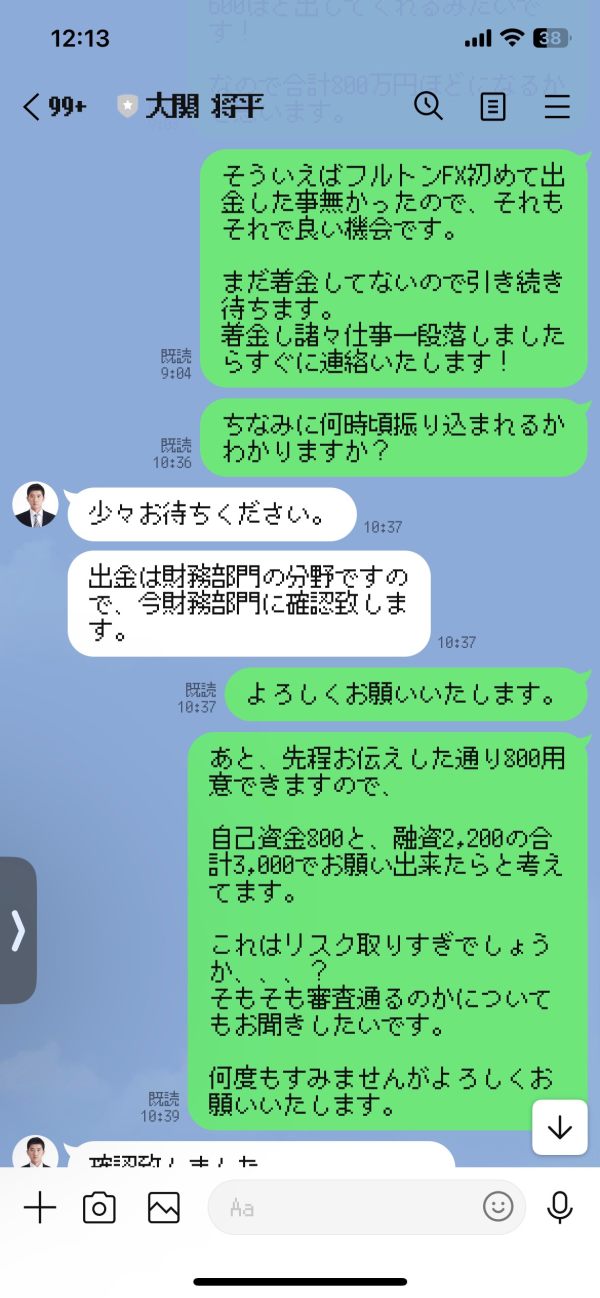

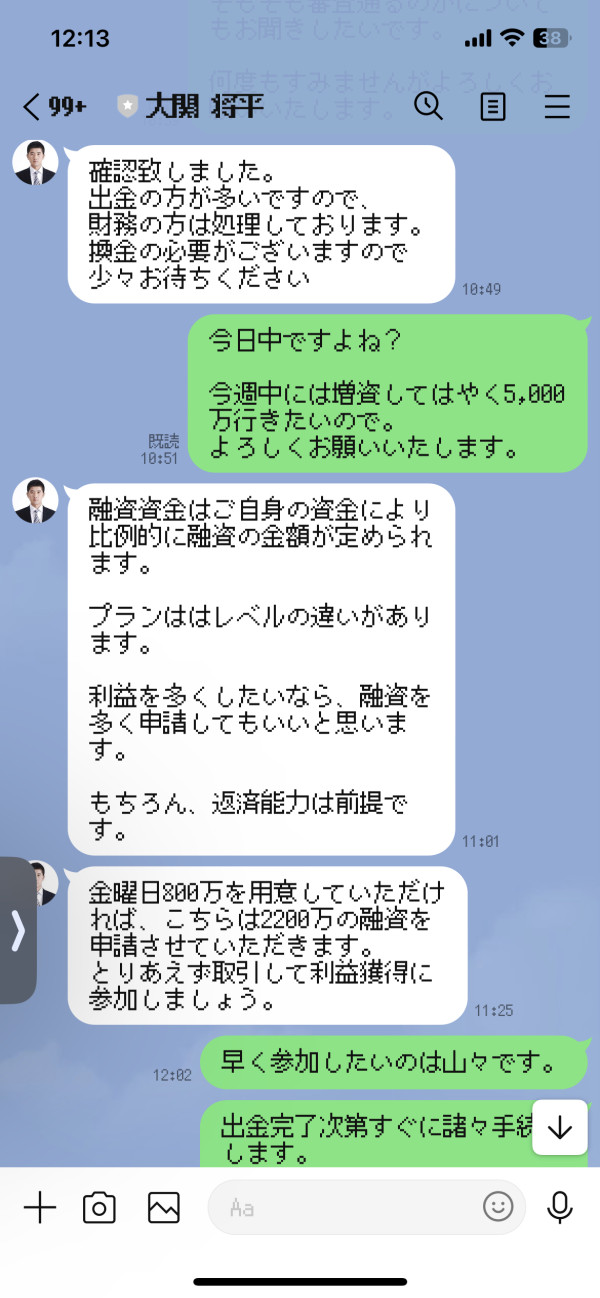

Fulton FX deceived by FX scam? can't withdraw

Exposure

2023-08-07

moon751

Japan

I'm going to transfer it so I pay tax on the profit. I declare that it is okay because I am affiliated with Mitsubishi Bank. A security deposit is required to withdraw funds. completely fraudulent. I installed the FX app here and it became a strange game and I couldn't use it.

Exposure

2023-08-06

もち

Japan

I made a withdrawal on 7/17, but it has not been transferred as of today, 7/19 12:07. We have been informed that the finance department has not been able to meet due to too many withdrawal requests, but the truth is unknown.

Exposure

2023-07-19

FX1121821420

Japan

Although I want to withdraw, due to there are still unsettled transactions. Even if try to close an account, it will be displayed out of business hours and do not have permission to make transaction. I want to withdraw funds from my account.

Exposure

2023-07-17