Score

GPM broker

Spain|2-5 years|

Spain|2-5 years| https://www.gpmbroker.com/profesional.aspx

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Spain

SpainUsers who viewed GPM broker also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

gpmbroker.com

Server Location

Spain

Website Domain Name

gpmbroker.com

Website

WHOIS.NICLINE.COM

Company

ARSYS INTERNET, S.L. D/B/A NICLINE.COM

Domain Effective Date

2014-04-30

Server IP

89.248.107.80

Company Summary

| Aspect | Information |

| Registered Country | Spain |

| Founded Year | 2019 |

| Company Name | GPM broker |

| Regulation | Not Regulated |

| Minimum Deposit | 5000 EUR |

| Maximum Leverage | Up to 1:200 |

| Spreads | Variable, depends on the financial instrument traded |

| Trading Platforms | Customized version of Trader Workstation (TWS) |

| Tradable Assets | Stocks, currencies, commodities, indices, futures, bonds, ETFs, ETCs, CFDs |

| Account Types | GPM Professional Broker, GPM SV, GPM Swissquote, GPM Trader |

| Demo Account | Available |

| Customer Support | Telephone: +34 913 191 684Email: info@gpmbroker.com Physical Address: Calle de Montesa 38, Pasaje Martí, Local 1, 28006 Madrid |

| Payment Methods | Bank transfer |

Overview

GPM broker, founded in 2019 and headquartered in Spain, operates in a regulatory gray area, raising concerns about investor fund safety. With a minimum deposit requirement of 5000 EUR and leverage of up to 1:200, GPM offers a diverse range of tradable assets including stocks, currencies, commodities, and more. The broker provides a customized version of the Trader Workstation (TWS) as its trading platform and offers various account types such as GPM Professional Broker, GPM SV, GPM Swissquote, and GPM Trader. A demo account is also available for practice. Customer support is accessible via telephone, email, and physical address. The broker accepts bank transfers as the primary payment method.

Regulation

GPM broker operates in a regulatory gray area, as it lacks official oversight from financial regulatory bodies. This absence of regulation can raise concerns regarding the safety and security of investors' funds and the overall integrity of the trading platform. Without regulatory supervision, there may be a higher risk of fraudulent activities or malpractices within the brokerage firm. Additionally, the lack of regulatory compliance could mean that investors have limited recourse in case of disputes or losses. It is crucial for investors to carefully assess the risks associated with using an unregulated broker like GPM and consider alternative options that offer regulatory protection and accountability.

Pros and Cons

GPM broker offers a range of advantages and disadvantages for traders to consider. On the positive side, it provides access to a diverse range of investment options, including stocks, currencies, commodities, and more. Additionally, the broker offers a variety of account types tailored to different trading needs, as well as leverage options for amplified trading opportunities. However, there are drawbacks to consider, such as operating in a regulatory gray area, which may raise concerns about the safety of investors' funds. Additionally, some users have raised allegations of potential scam activities associated with the broker, underscoring the importance of caution and thorough research. Despite these drawbacks, GPM broker provides essential contact information for customer support and offers a versatile trading platform accessible across multiple devices.

| Pros | Cons |

|

|

|

|

|

|

|

|

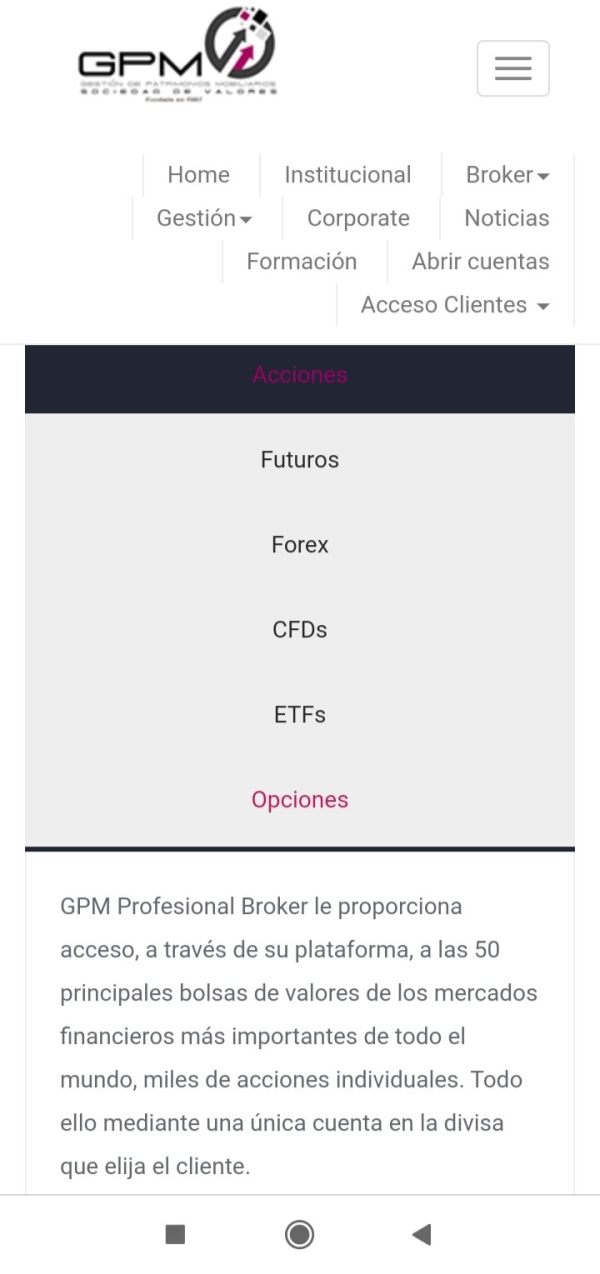

Market Instruments

The GPM broker platform offers a variety of ways for investors to trade and manage their money:

Investment Options: Investors can trade in futures contracts, stocks (ownership in companies), forex currencies (foreign exchange), funds (diversified portfolios), and bonds (debt securities).

Services Provided: GPM also offers safekeeping services for assets, traditional portfolio management, and access to alternative investment funds and SICAVs.

In summary, GPM broker provides a range of investment options and services to meet different investment needs.

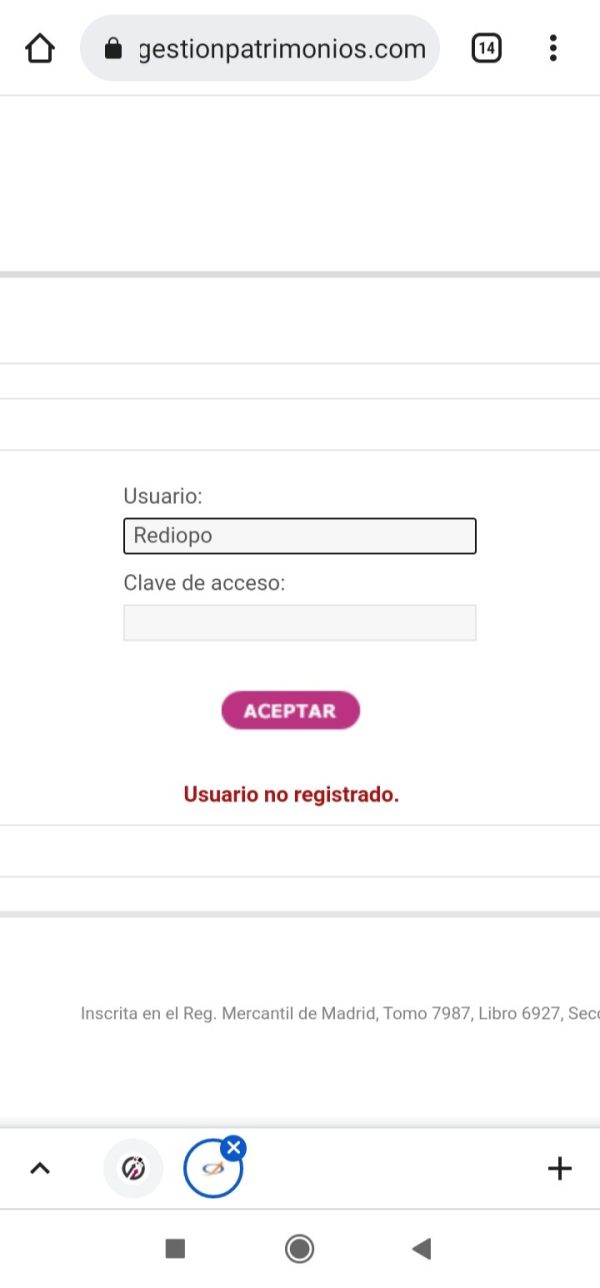

Account Types

GPM offers a range of account types tailored to different trading needs and preferences:

GPM Professional Broker: This account type provides access to a comprehensive and advanced trading platform offering trading in stocks, currencies, commodities, and indices. It boasts competitive commissions and top-notch graphics for traders who require professional-grade tools and features.

GPM SV: The SV account is designed for traders interested in trading national and international stocks and over-the-counter (OTC) markets. It offers direct access to fixed income and variable income desks, as well as an open architecture of investment funds, SICAVs, and pension plans for diversified investment opportunities.

GPM Swissquote: This account type is focused on Direct Market Access (DMA) Contract for Differences (CFDs), allowing traders to execute trades at the best available prices. It provides access to market depth and enables direct negotiation, empowering traders to implement entry and exit strategies efficiently.

GPM Trader: The GPM Trader account offers a user-friendly trading experience with real-time prices, interactive charts, and intuitive tools. It includes an extensive graphics package, options chain, and fundamental analysis tools to support traders of all levels. Additionally, traders can open a demo account to practice trading strategies risk-free.

This broker offers a flexible trading leverage from 1:30 to 1:200. This means that for every unit of capital a trader has in their account, they can control a position in the market that is 200 times larger. For example, with $1,000 in their account, traders can control positions worth up to $200,000. Leverage amplifies both potential profits and potential losses in trading, requiring careful risk management and understanding of associated risks.

Spreads and Commissions

At GPM broker, traders encounter variable spreads and commissions. Commission rates vary depending on the financial instrument being traded. For example, stock options start at €2 per contract, ETFs and ETCs have a commission of 0.08% with a minimum of €8, futures start at €4 per contract, bonds have a commission of 0.08%, and CFDs have a commission of 0.08% with a minimum of €8. This structure ensures transparency and allows traders to understand the costs associated with their trades. Variable spreads also adapt to market conditions, offering opportunities for traders to capitalize on market movements.

Deposit & Withdrawal

At GPM broker, the primary payment method mentioned on their website is bank transfer, with a minimum deposit requirement of 5000 EUR. Notably, popular payment methods such as credit and debit cards, as well as online payment processors like Skrill and Neteller, are not available for deposits or withdrawals. This suggests that clients are required to fund their accounts via bank transfers exclusively. Withdrawals are likely facilitated through the same method, with clients needing to provide their bank account details for the transfer of funds. While bank transfers are generally secure, they may take longer to process compared to other payment methods, potentially impacting the speed of deposits and withdrawals for traders using the GPM broker platform.

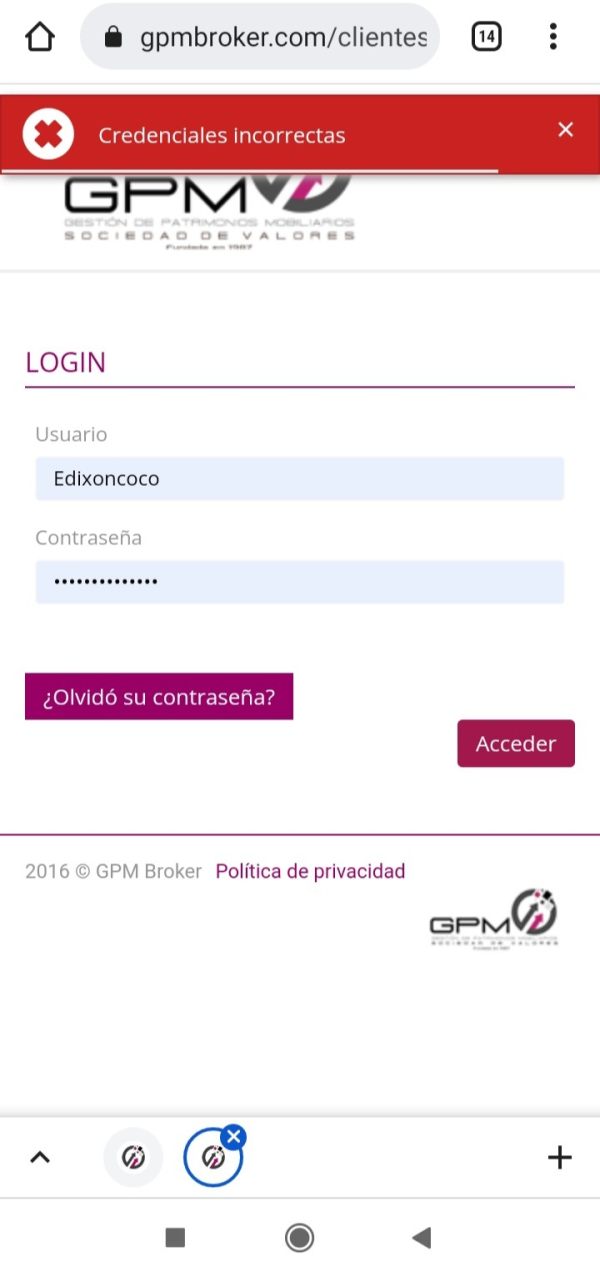

Trading Platforms

GPM broker offers a user-friendly trading platform called Trader Workstation (TWS). It's accessible from PCs, web browsers, and mobile devices, providing real-time market data and advanced tools for trading stocks, options, futures, and forex. With its intuitive interface and comprehensive features, traders can analyze markets, execute trades, and manage their portfolios efficiently from anywhere with an internet connection.

Customer Support

Despite the earlier indication of lacking contact channels, GPM broker indeed provides essential contact information for customer support. They offer a telephone number (+34 913 191 684), an email address (info@gpmbroker.com), and a physical address (Calle de Montesa 38, Pasaje Martí, Local 1, 28006 Madrid).

Notice

Some users have labeled GPM broker as a potential scam, raising concerns about the legitimacy and trustworthiness of the platform. Such accusations typically stem from experiences or perceptions of inadequate service, questionable practices, or difficulties encountered during trading or interactions with the company. While individual experiences may vary, the presence of such allegations can cast doubt on the broker's credibility and integrity within the trading community. Without concrete evidence or regulatory investigations to substantiate these claims, it's crucial to approach such accusations with caution and conduct thorough research before forming conclusions. However, the existence of such allegations underscores the importance of due diligence and vigilance when engaging with any brokerage platform, highlighting the need for transparency, regulatory compliance, and responsive customer support to address client concerns and maintain trust within the trading community.

FAQs

Q1: What financial instruments can I trade with GPM broker?

A1: GPM broker offers a variety of trading options, including stocks, currencies, commodities, indices, futures contracts, bonds, ETFs, and CFDs.

Q2: How can I contact GPM broker for support?

A2: You can reach GPM broker for support via telephone at +34 913 191 684, email at info@gpmbroker.com, or visit their physical address at Calle de Montesa 38, Pasaje Martí, Local 1, 28006 Madrid.

Q3: What is the minimum deposit required to open an account with GPM broker?

A3: The minimum deposit requirement for opening an account with GPM broker is 5000 EUR, payable through bank transfer.

Q4: Does GPM broker offer leverage for trading?

A4: Yes, GPM broker offers leverage of up to 1:200, allowing traders to control larger positions with a smaller amount of capital.

Q5: Are there any fees associated with trading on the GPM platform?

A5: Yes, GPM broker charges commissions and variable spreads for trading various financial instruments. Commission rates vary depending on the instrument, starting from €2 per contract for stock options and 0.08% with a minimum of €8 for ETFs, ETCs, futures, bonds, and CFDs.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now