Score

EMPEROR Xpro

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://www.emxpro.com/en/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

Singapore

SingaporeContact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

EMXPRO Limited

EMPEROR Xpro

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 14 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The China Hong Kong CGSE regulation (license number: 102) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The China Hong Kong SFC regulation (license number: ACJ776) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | USD 50,000 |

| Minimum Spread | EUR/USD from 0.9 XAU/USD from 2.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 5,000 |

| Minimum Spread | EUR/USD from 1.4 XAU/USD from 3.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 100 |

| Minimum Spread | EUR/USD from 1.8 XAU/USD from 3.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed EMPEROR Xpro also viewed..

XM

CPT Markets

Decode Global

FP Markets

Sources

Language

Mkt. Analysis

Creatives

EMPEROR Xpro · Company Summary

| Aspect | Information |

| Company Name | EMPEROR Xpro |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2019 |

| Regulation | Suspicious Clone status by CGSE and SFC (Hong Kong) |

| Market Instruments | Forex, Precious Metals, Energies, Indices |

| Account Types | Standard, Premium, Prestige |

| Minimum Deposit | Standard: USD 100, Premium: USD 5,000, Prestige: USD 50,000 |

| Maximum Leverage | Standard & Premium: 1:400, Prestige: 1:100 |

| Spreads | Standard: From 1.8 pips, Premium: From 1.4 pips, Prestige: From 0.9 pips (EUR/USD) |

| Trading Platforms | Eunify - EMPEROR Xpro |

| Customer Support | Hotline: +86 4008422808, Email: cs@emxpro.com, itsupport@emxpro.com, marketing@emxpro.com, Online Support: 24/5 (Monday to Friday) |

| Deposit & Withdrawal | Multiple methods including Alipay, WeChat Pay, UnionPay, USDT, wire transfer. No cash deposits. |

| Educational Resources | EMPEROR Xpro Academy covering Industry Glossary, Trading Knowledge, Trading Skills, Market Insights, and more. |

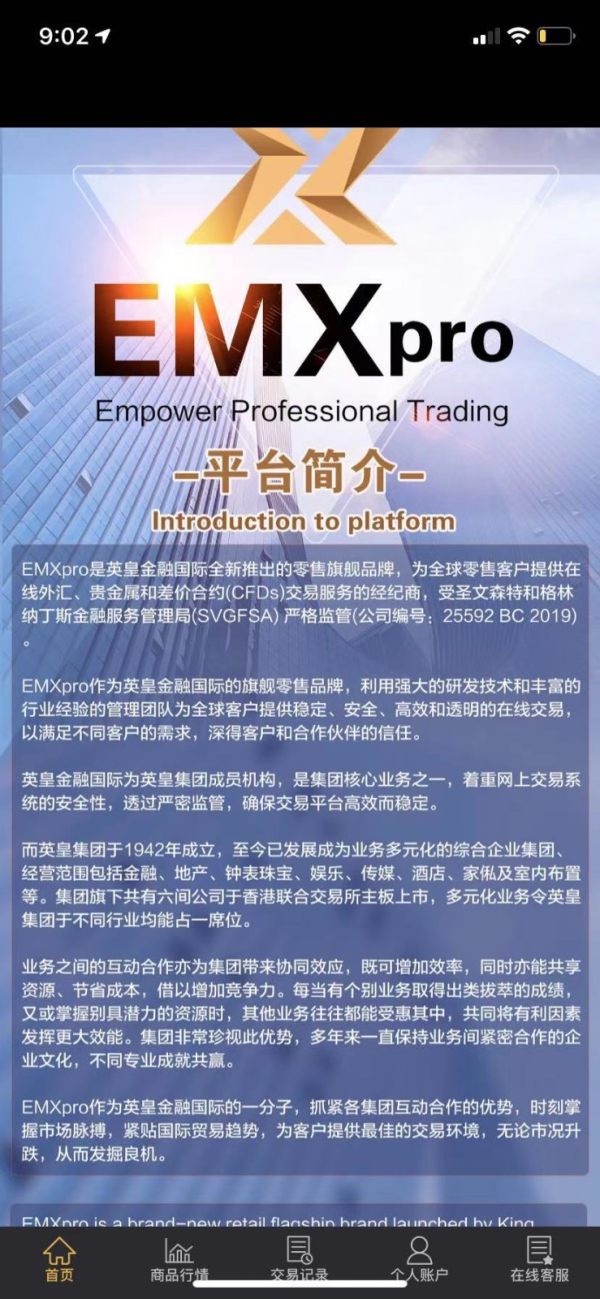

Overview of EMPEROR Xpro

EMPEROR Xpro, established in Saint Vincent and the Grenadines in 2019, offers a trading platform with a range of assets, including Forex, Precious Metals, Energies, and Indices. Despite providing diverse trading options, the platform faces regulatory concerns, as it is labeled a “Suspicious Clone” by both the Chinese Gold & Silver Exchange Society (CGSE) and the Securities and Futures Commission (SFC) of Hong Kong.

Traders must weigh the potential advantages of a variety of trading assets against the disadvantages of regulatory ambiguity, emphasizing the need for cautious consideration when engaging with EMPEROR Xpro.

Is EMPEROR Xpro legit or a scam?

EMPEROR Xpro, operating in the realm of leveraged foreign exchange trading, falls under the regulatory purview of the Chinese Gold & Silver Exchange Society (CGSE) in Hong Kong. As of the latest update, EMPEROR Xpro is identified as a “Suspicious Clone” by CGSE. The company holds License No. ACJ776. This designation reflects concerns or irregularities identified by CGSE, prompting a closer examination of the platform's compliance with regulatory standards in the foreign exchange trading sector.

Similarly, EMPEROR Xpro is subject to the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong. The platform operates within the leveraged foreign exchange trading domain and, like CGSE, the SFC classifies EMPEROR Xpro as a “Suspicious Clone” with License No. ACJ776. This dual designation by both CGSE and SFC highlights the shared regulatory concern regarding EMPEROR Xpro's activities in the financial markets.

The suspicious clone status assigned by both CGSE and SFC raises significant red flags for traders on the EMPEROR Xpro platform.

Investors may experience hesitation and concern about the security of their funds, the legitimacy of trading operations, and the overall reliability of the platform. The regulatory status can act as a deterrent for potential traders, impacting the platform's credibility and potentially leading to a decline in user confidence.

Pros and Cons

| Pros | Cons |

| Various trading assets across Forex, Precious Metals, Energies, and Indices. | Regulatory status as a “Suspicious Clone” |

| Diverse account types | User exposure reports |

| User-Friendly Trading Platform Eunify - EMPEROR Xpro | Withdrawal fees vary based on margin usage |

| Multiple payment methods | Concerns raised about the legitimacy and reliability of EMPEROR Xpro |

| Robust educational resources |

Pros:

Diverse Trading Assets:

EMPEROR Xpro offers a wide array of trading assets, including Forex, Precious Metals, Energies, and Indices, providing traders with diverse options for investment.

2. Varied Account Types:

The platform caters to different experience levels and financial commitments by offering a range of account types – Standard, Premium, and Prestige, allowing users to choose based on their preferences and trading goals.

3. User-Friendly Trading Platform:

Eunify - EMPEROR Xpro provides a user-friendly interface with specialized data and features, facilitating easy navigation and enhancing the overall trading experience for its users.

4. Multiple Payment Methods:

EMPEROR Xpro supports various payment methods for deposits, including Alipay, WeChat Pay, UnionPay, USDT, and wire transfer, offering flexibility to users in funding their accounts.

5. Educational Resources:

EMPEROR Xpro's Academy provides robust educational resources, covering Industry Glossary, Trading Knowledge, and Trading Skills, catering to traders at all levels and empowering them with insights into the financial markets.

Cons:

Regulatory Concerns:

The regulatory status of EMPEROR Xpro as a “Suspicious Clone” by both CGSE and SFC raises significant concerns about the platform's compliance with regulatory standards, potentially impacting the security of funds and the overall legitimacy of the trading operations.

2. User Exposure Reports:

Reports from users highlight serious issues such as withdrawal difficulties, fraud accusations, and pyramid scheme complaints, indicating a pattern of user dissatisfaction and potential ethical concerns related to EMPEROR Xpro's business practices.

3. Withdrawal Fees Based on Margin Usage:

Withdrawal fees on EMPEROR Xpro vary based on margin usage, potentially affecting traders with smaller margins. This fee structure may pose challenges for some users, impacting the overall cost of withdrawing funds from the platform.

4. Legitimacy and Reliability Concerns:

Concerns have been raised about the legitimacy and reliability of EMPEROR Xpro, potentially affecting user confidence. Issues such as exposure reports and the suspicious clone designation by regulatory bodies contribute to doubts regarding the platform's credibility.

Market Instruments

EMPEROR Xpro offers a selection of trading assets across various categories, including Forex, Precious Metals, Energies, and Indices.

In the Forex market, traders can expect access to major currency pairs such as EUR/USD, USD/JPY, and GBP/USD. However, the platform has limitations on providing access to less common pairs or exotic currencies, potentially restricting the diversity of Forex trading options.

In the Precious Metals category, EMPEROR Xpro provides standard options like gold (XAU/USD) and silver (XAG/USD).

For Energies, the platform includes popular commodities such as crude oil, both WTI and Brent. However, traders should be aware that access to other energy commodities like natural gas or heating oil may be absent from EMPEROR Xpro's offering, limiting diversification within this asset class.

In the Indices category, major indices such as S&P 500 and FTSE 100 are expected to be available for trading.

Traders considering EMPEROR Xpro should carefully assess the available trading assets and ensure that the platform aligns with their specific investment goals and preferences.

Account Types

EMPEROR Xpro provides a range of customized trading accounts to meet diverse investor needs, each crafted to accommodate various levels of experience and financial commitment.

Standard Account:

The Standard Account offered by EMPEROR Xpro requires a minimum initial deposit of USD 100. Traders who choose this account type will encounter spreads starting from 1.8 for EUR/USD and 3.5 for XAU/USD. With a maximum leverage of 1:400, the Standard Account allows for flexible trading with a minimum lot size of 0.01 and a maximum lot size of 10. This account type is well-suited for entry-level or casual traders who prefer a lower initial investment and are comfortable with standard trading conditions.

Premium Account:

For more seasoned traders, EMPEROR Xpro presents the Premium Account, demanding a higher minimum initial deposit of USD 5,000. The spreads are more competitive, starting from 1.4 for EUR/USD and 3.0 for XAU/USD. Like the Standard Account, the Premium Account offers a maximum leverage of 1:400, with flexible lot sizes ranging from 0.01 to 10. This account type caters to traders seeking improved trading conditions, lower spreads, and are willing to commit a larger initial investment.

Prestige Account:

Designed for experienced and high-volume traders, the Prestige Account demands a substantial minimum initial deposit of USD 50,000. This account type provides highly competitive spreads, starting from 0.9 for EUR/USD and 2.5 for XAU/USD. However, the maximum leverage is reduced to 1:100, offering a more conservative risk profile. The Prestige Account maintains flexibility in lot sizes, ranging from 0.01 to 10.

This account type is suitable for sophisticated traders who prioritize optimal trading conditions, minimal spreads, and are comfortable with a higher initial financial commitment.

| Feature | Standard Account | Premium Account | Prestige Account |

| Minimum Initial Deposit | USD 100 | USD 5,000 | USD 50,000 |

| Spread (EUR/USD) | From 1.8 | From 1.4 | From 0.9 |

| Spread (XAU/USD) | From 3.5 | From 3.0 | From 2.5 |

| Maximum Leverage | 1:400 | 1:400 | 1:100 |

| Minimum Lot Size | 0.01 lot | 0.01 lot | 0.01 lot |

| Maximum Lot Size | 10 lots | 10 lots | 10 lots |

How to Open an Account?

To open an account with EMPEROR Xpro, follow these four concrete steps:

Registration Process:

Visit the official EMPEROR Xpro website.

Locate the “Sign Up” button and click on it.

Fill out the required registration form with accurate personal information, including your full name, contact details, and address.

Create a secure password and select your preferred account type (Standard, Premium, or Prestige).

2. Account Verification:

After completing the registration, you may be required to verify your identity. This typically involves submitting scanned copies of a government-issued ID (passport, driver's license) and proof of address (utility bill, bank statement).

Follow the specific instructions provided by EMPEROR Xpro for document submission.

Once the verification process is complete and your documents are approved, you will receive confirmation.

3. Deposit Funds:

Log in to your newly created account on the EMPEROR Xpro platform.

Navigate to the “Deposit” or “Fund Your Account” section.

Choose your preferred deposit method (bank transfer, credit card, e-wallet) and follow the instructions to transfer funds.

Ensure that you meet the minimum initial deposit requirement based on your chosen account type.

4. Start Trading:

Once your account is funded, you can access the trading platform provided by EMPEROR Xpro.

Familiarize yourself with the platform's features, tools, and available assets.

Develop a trading strategy based on your goals and risk tolerance.

Execute trades, monitor market conditions, and manage your portfolio directly from the platform.

It's essential to carefully read and understand the terms and conditions provided by EMPEROR Xpro throughout the account opening process. Additionally, be aware of the risks associated with trading and ensure that you are compliant with all regulatory requirements.

Leverage

EMPEROR Xpro offers varying maximum leverage ratios across its different account types. The maximum leverage represents the proportion of borrowed funds relative to the trader's own capital, amplifying both potential profits and risks.

For the Standard and Premium accounts, EMPEROR Xpro provides a maximum leverage of 1:400. This implies that traders can control positions with a nominal value up to 400 times the amount of their deposited capital.

However, the Prestige account, designed for more experienced and higher-volume traders, features a slightly more conservative approach with a maximum leverage of 1:100. This lower leverage ratio indicates a reduced level of borrowed funds relative to the trader's capital, offering a more risk-averse trading environment.

Spreads & Commissions

EMPEROR Xpro employs a fee structure primarily based on spreads, with variations across its three distinct account types: Standard, Premium, and Prestige.

In the Standard Account, traders encounter spreads starting from 1.8 pips for the popular EUR/USD currency pair and 3.5 pips for the XAU/USD (gold) commodity pair.

For the Premium Account, the spreads are more competitive, commencing from 1.4 pips for EUR/USD and 3.0 pips for XAU/USD.

The Prestige Account offers the tightest spreads, beginning at 0.9 pips for EUR/USD and 2.5 pips for XAU/USD.

Considering the fee differentials, the Standard Account is suitable for entry-level or casual traders who prioritize lower initial investment and are comfortable with standard spreads.

The Premium Account, with its more competitive spreads, caters to experienced traders seeking enhanced trading conditions.

The Prestige Account, featuring the tightest spreads, is designed for sophisticated traders and high-volume investors who are willing to commit a substantial initial deposit for optimal trading conditions.

Trading Platform

EMPEROR Xpro's trading platform, Eunify - EMPEROR Xpro, positions itself as a professional trading system, emphasizing convenience and functionality. The app offers a user-friendly interface that consolidates trading accounts and transaction capabilities, allowing traders to easily navigate through the platform. Eunify - EMPEROR Xpro incorporates specialized data on trader sentiment and over 100 technical indicators, facilitating quick trend identification in the investment market.

The platform boasts a variety of features, including quick biometric authentication for seamless access, powerful charts with diverse timeframes and analytical tools, and a flexible approach to deposit and withdrawal options.

Traders can engage in online trading of global stock indices, forex, energies, and precious metals with 24/5 availability.

Notably, the platform supports flexible trading sizes, enabling investors to trade with minimum risk and manage account balances according to their strategies. Transparent quotes sourced directly from reputable liquidity providers, coupled with super-fast execution facilitated by powerful servers, aim to minimize trading delays and enhance the efficiency of global trading opportunities on Eunify - EMPEROR Xpro.

Deposit & Withdrawal

EMPEROR Xpro provides a diverse array of payment methods to facilitate deposits, ensuring convenience for its users. Traders can choose from options such as Alipay, WeChat Pay, UnionPay, USDT (Tether), and wire transfer. Notably, the platform does not accept cash deposits, emphasizing digital and secure transaction methods. Clients can select the payment channel that aligns with their preferences and geographic location.

The minimum deposit requirements vary based on the type of account chosen. For the Standard Account, the minimum deposit is USD 100, while the Premium Account requires a minimum deposit of USD 5,000, and the Professional Account necessitates a more substantial minimum deposit of USD 50,000.

Importantly, EMPEROR Xpro does not impose any deposit fees on its users. However, it's crucial to note that intermediary banks involved in the transaction may apply transactional fees. Traders are advised to consult their intermediary banks for specific details on any potential charges associated with the deposit process.

Withdrawal fees with EMPEROR Xpro are contingent on the margin amount used during the transaction. If the margin used is equal to or exceeds 50% of the deposited amount, no additional fees will be charged for the withdrawal. However, if the margin used is less than 50%, a withdrawal fee of 6% of the withdrawal amount will be levied.

Customer Support

EMPEROR Xpro offers comprehensive customer support through various channels.

Traders in China can reach the hotline at +86 4008422808 for immediate assistance.

For written inquiries, the platform provides dedicated email addresses, including cs@emxpro.com for client support, itsupport@emxpro.com for IT-related queries, and marketing@emxpro.com for marketing-related issues.

Online client support is available 24/5 from Monday to Friday, ensuring continuous assistance during active trading hours.

Whether via phone, email, or online chat, EMPEROR Xpro strives to address user inquiries promptly and effectively, enhancing the overall customer experience for its trading community.

Educational Resources

EMPEROR Xpro's Academy is a robust educational hub catering to traders of all levels, providing a diverse array of resources. Tailored for beginners, professionals, and amateur traders, the Academy encompasses Industry Glossary, Trading Knowledge, Trading Skills, and more. The comprehensive educational content spans a range of topics, empowering users with insights into the financial markets.

Traders can enhance their proficiency through resources on market insights, trading analysis, and relevant educational materials. With a focus on cultivating a well-informed trading community, EMPEROR Xpro's Academy serves as a valuable platform for individuals seeking to deepen their understanding of the industry and refine their trading skills.

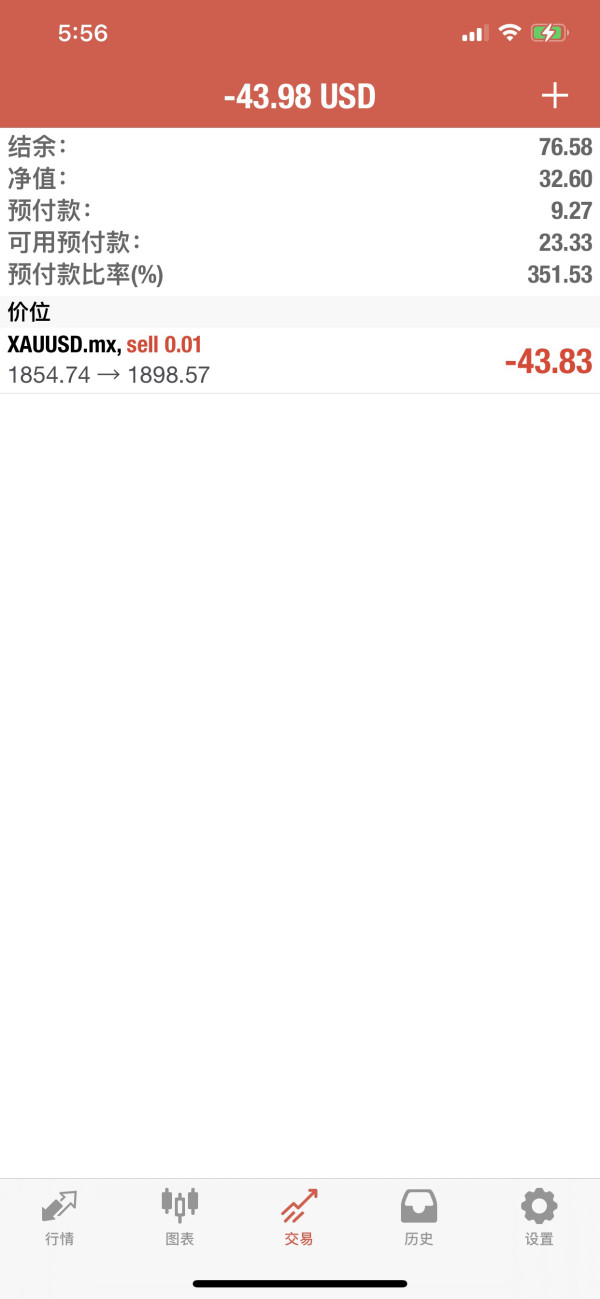

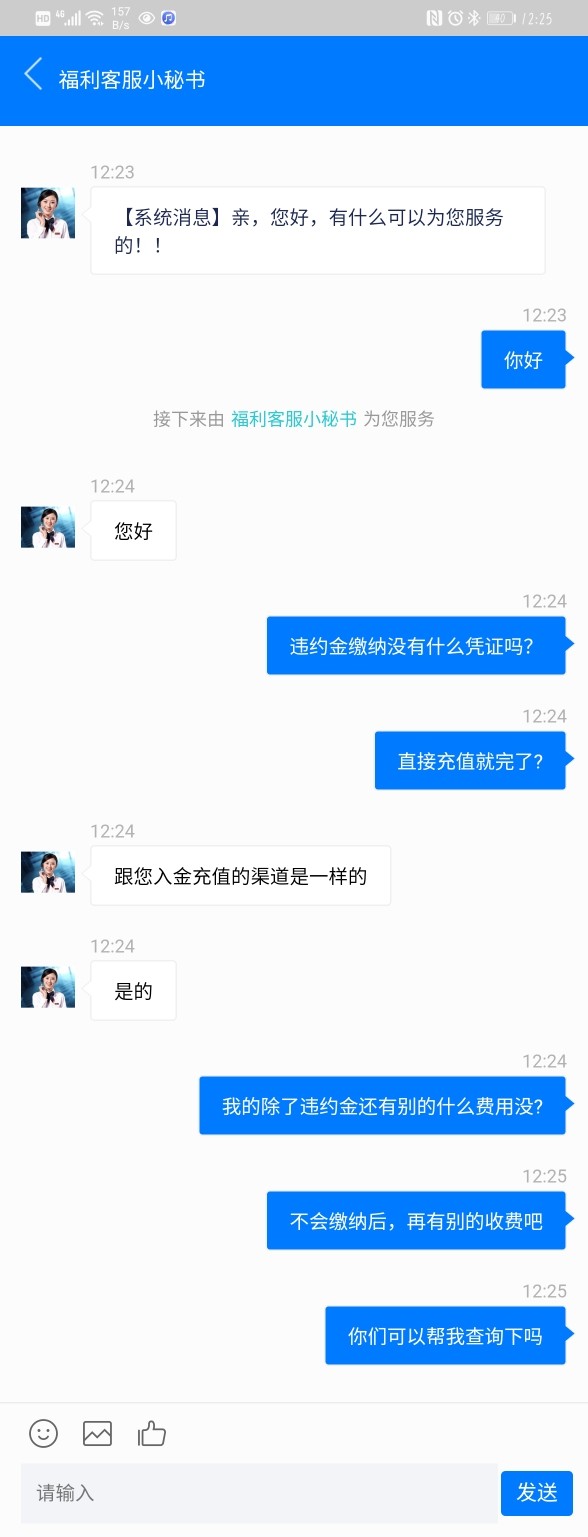

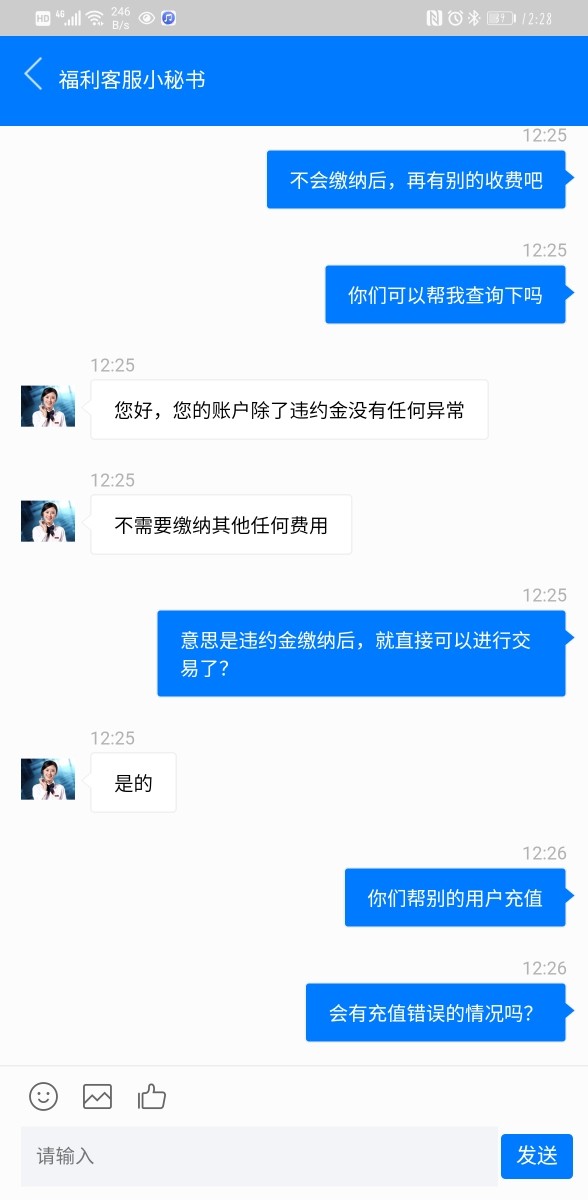

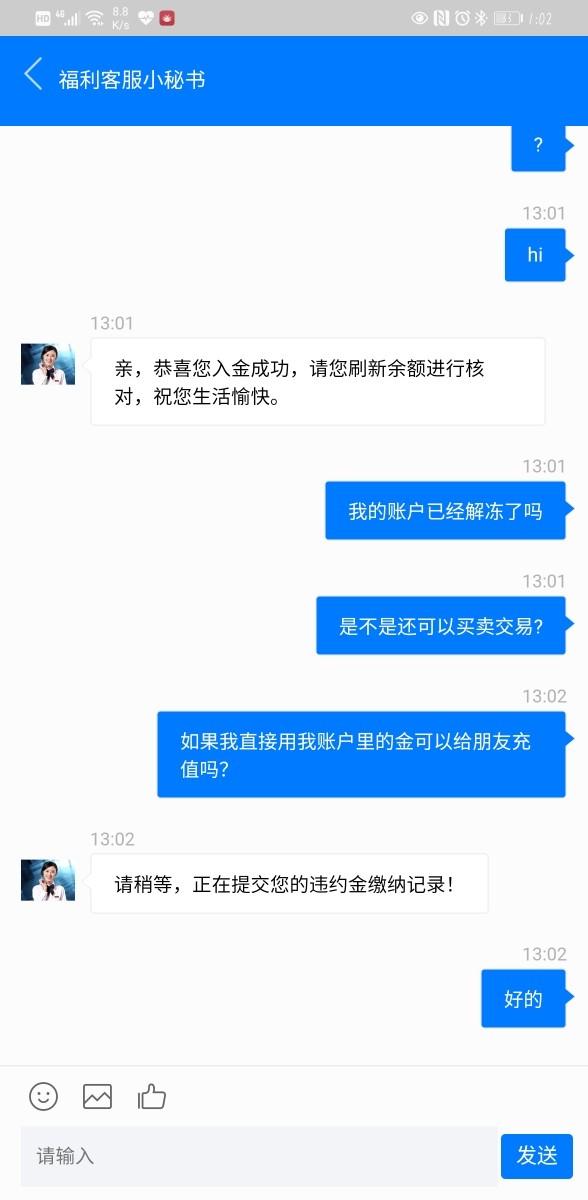

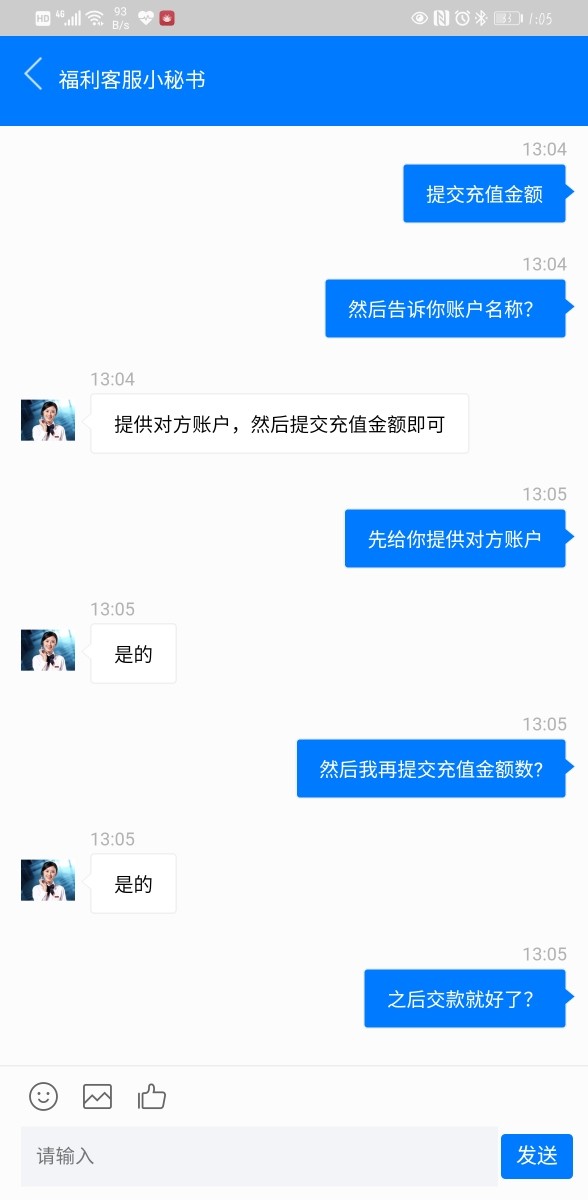

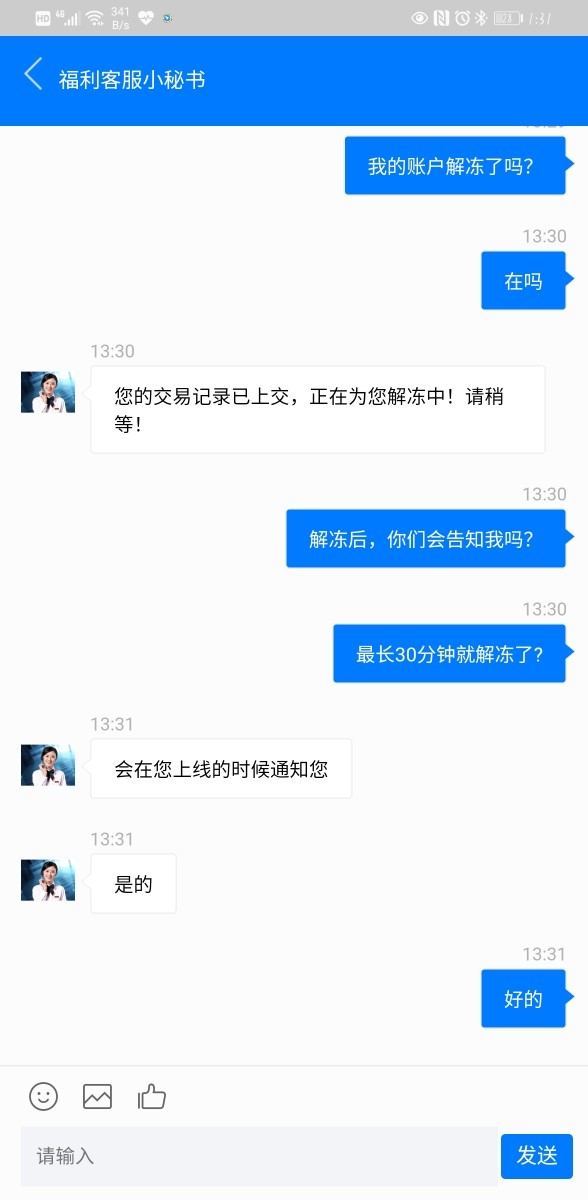

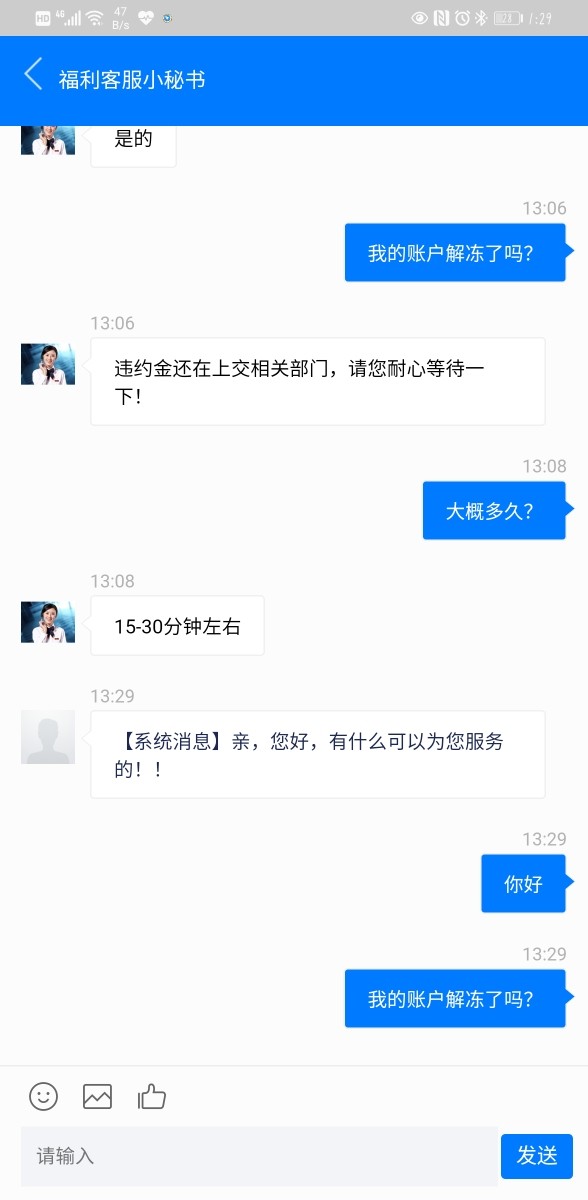

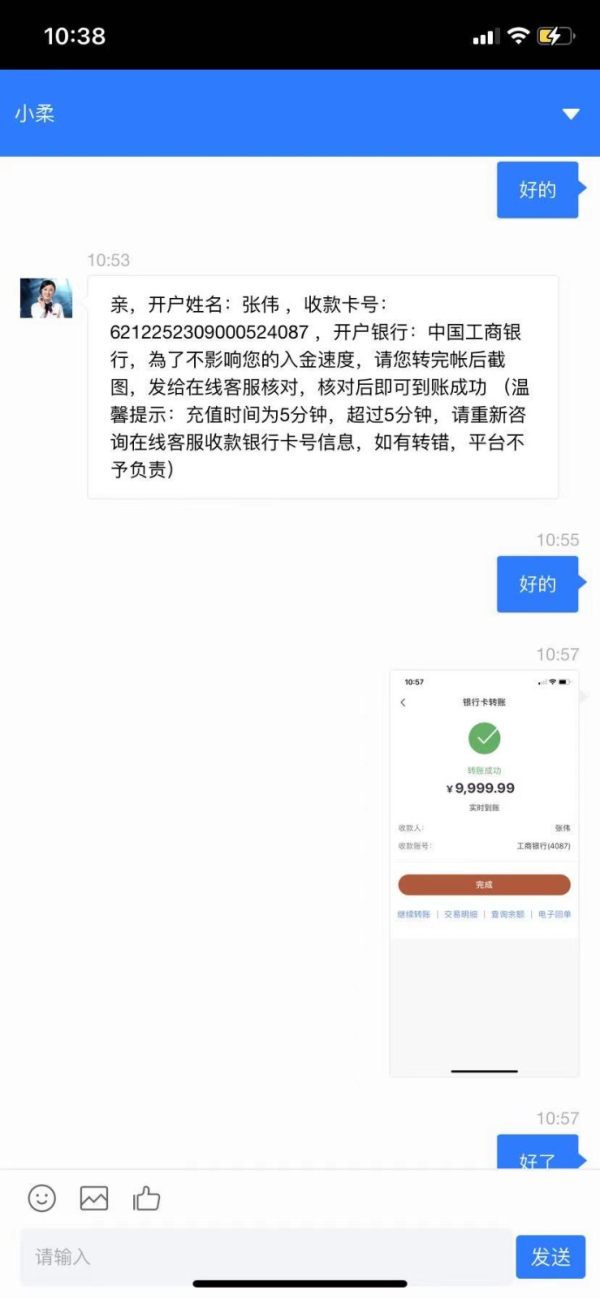

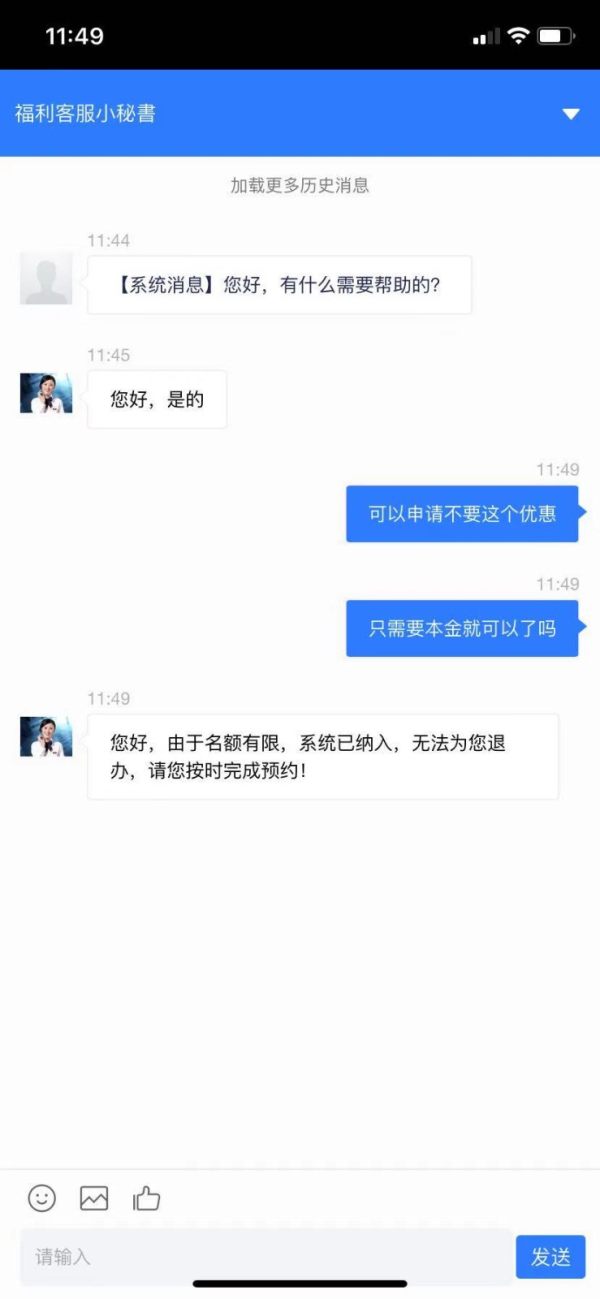

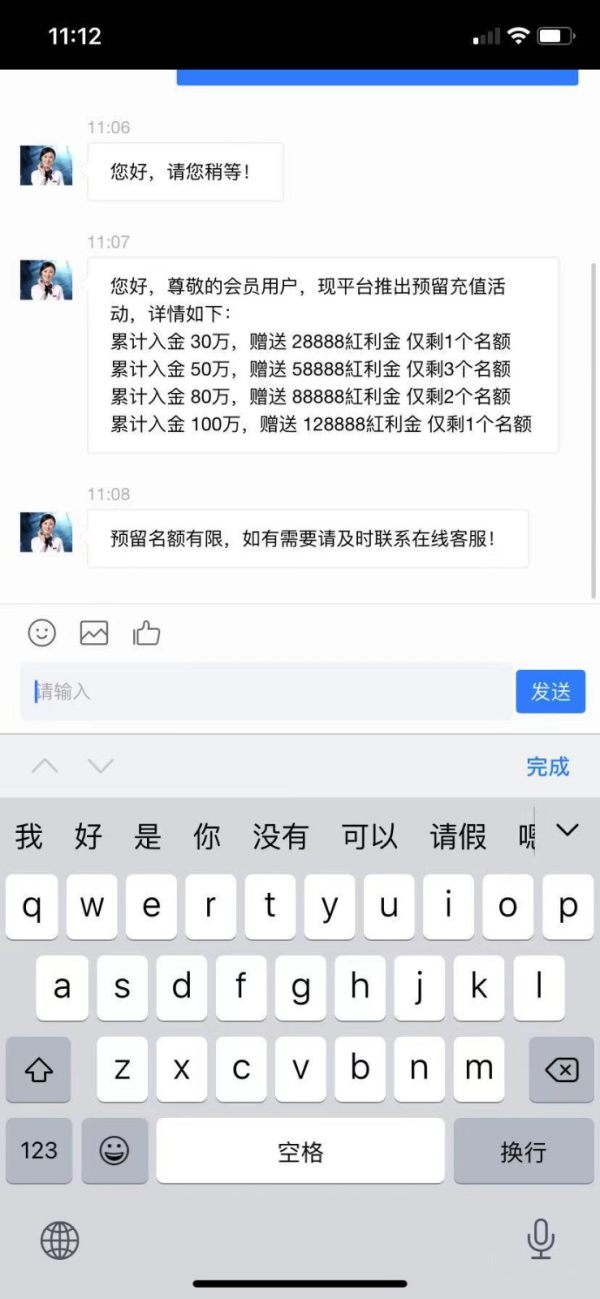

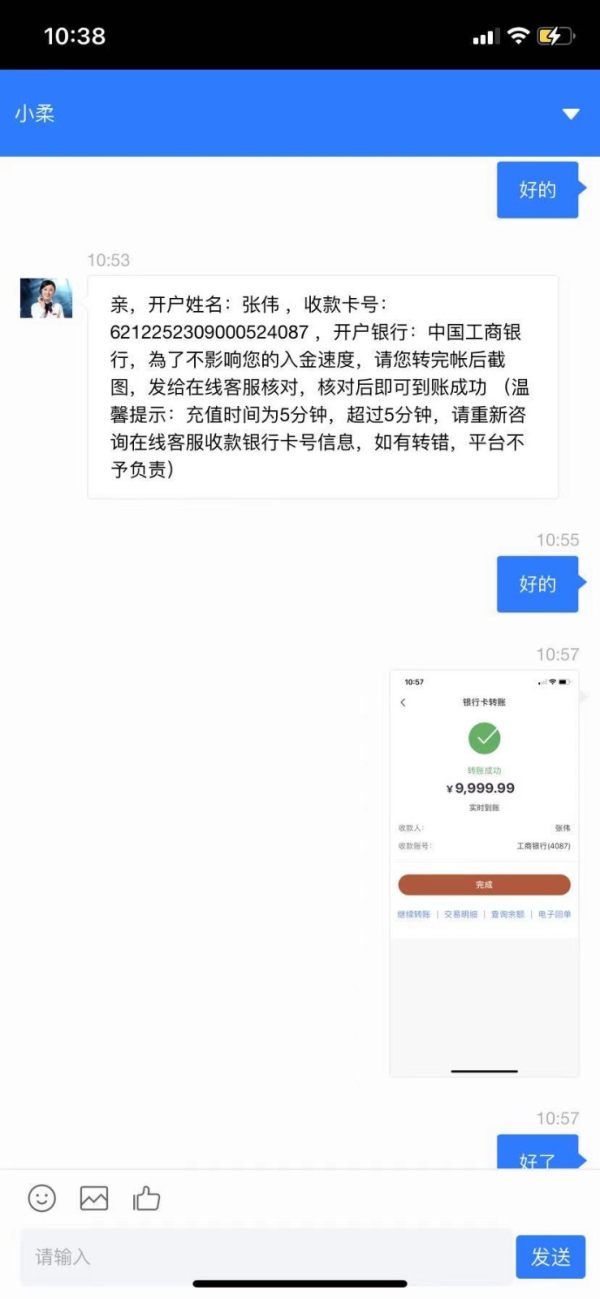

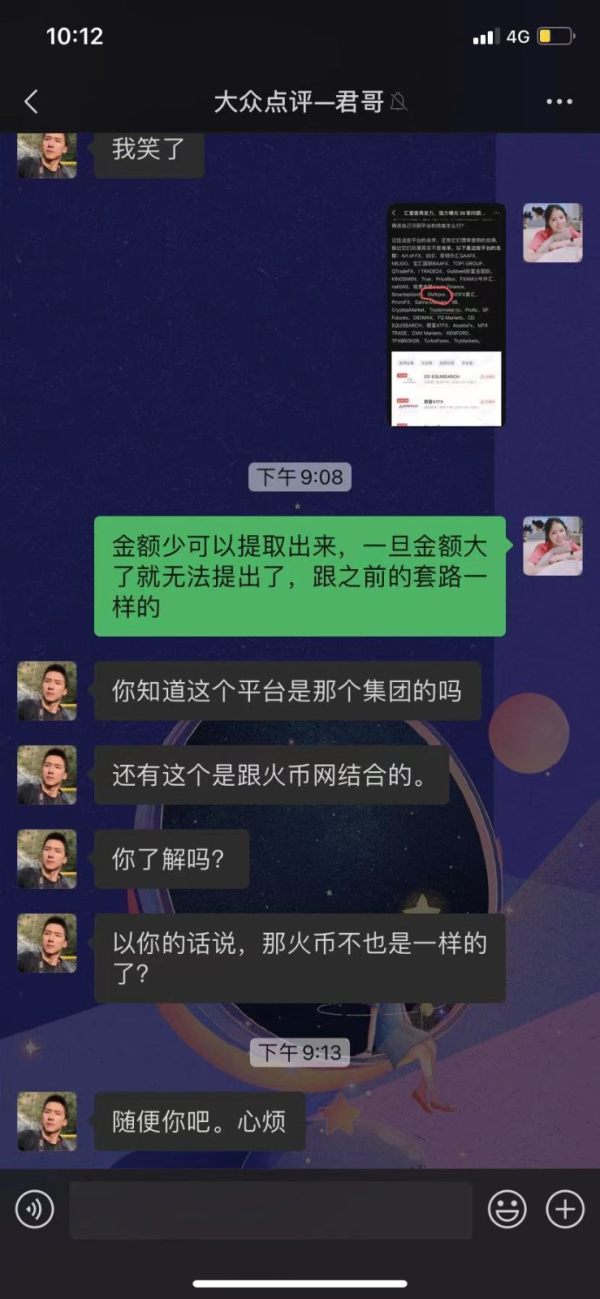

Exposure

EMPEROR Xpro faces a concerning array of user exposure, with 14 reported cases raising serious issues and impacting the platform's reputation.

Complaints range from pyramid scheme allegations to fraudulent activities, with users expressing frustration over difficulties in withdrawing funds and accusing the platform of being a scam. Multiple instances highlight instances where users claim to be unable to access their accounts or face unexpected financial penalties. The exposure reports also include allegations of deceptive practices, such as modifying bank card numbers and freezing accounts without user consent.

These exposures collectively suggest a range of serious concerns and user dissatisfaction, raising questions about the platform's legitimacy and adherence to ethical business practices.

Conclusion

In conclusion, EMPEROR Xpro presents traders with a platform founded in 2019 in Saint Vincent and the Grenadines, offering a diverse range of market instruments, including Forex, Precious Metals, Energies, and Indices. While the platform provides multiple account types and a user-friendly trading platform, it is essential to note the regulatory ambiguity surrounding EMPEROR Xpro, as it has been flagged as a “Suspicious Clone” by both the Chinese Gold & Silver Exchange Society (CGSE) and the Securities and Futures Commission (SFC) of Hong Kong.

Despite the platform's advantages such as varied trading assets, account types, and a user-friendly interface, traders should exercise caution due to the reported user exposure issues, withdrawal difficulties, and fraud accusations. The need for transparent regulatory compliance and the resolution of user concerns is paramount for EMPEROR Xpro to establish trust and credibility within the competitive landscape of online trading platforms.

FAQs

Q: Is EMPEROR Xpro regulated?

A: No, EMPEROR Xpro has been labeled a “Suspicious Clone” by both CGSE and SFC in Hong Kong.

Q: What market instruments are available on EMPEROR Xpro?

A: EMPEROR Xpro offers Forex, Precious Metals, Energies, and Indices for trading.

Q: What are the minimum deposit requirements for different account types?

A: Standard Account: USD 100, Premium Account: USD 5,000, Prestige Account: USD 50,000.

Q: How can I contact customer support?

A: You can reach EMPEROR Xpro's customer support through hotline +86 4008422808 or via email at cs@emxpro.com.

Q: Are there withdrawal fees on EMPEROR Xpro?

A: Withdrawal fees vary based on margin usage. If margin usage is less than 50%, a fee of 6% of the withdrawal amount is charged.

Q: Is there educational material available?

A: Yes, EMPEROR Xpro provides educational resources through its Academy, covering industry glossary, trading knowledge, and skills.

Review 16

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now