Score

BKS Fintech

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://bksfintech.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomAccount Information

Users who viewed BKS Fintech also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

bksfintech.com

Server Location

United States

Website Domain Name

bksfintech.com

Server IP

104.21.61.150

Company Summary

| Aspect | Information |

| Company Name | BKS Fintech |

| Registered Country | China |

| Founded Year | Within 1 year |

| Regulation | No valid regulation |

| Spreads | Competitive spreads, starting from 0.1 pips |

| Trading Platforms | MetaTrader 5, MT iPhone/iPad, MT Android, MT Mac |

| Tradable Assets | Forex, CFDs on Commodities, Stocks, Indices, Bonds, Digital Currencies |

| Account Types | Standard Account, VIP Account, Islamic Account, Demo Account |

| Demo Account | Available |

| Customer Support | 24/7 Livechat, Email: cs@bksfintech.com, support@bksfintech.com |

Overview of BKS Fintech

BKS Fintech, a recently established online trading platform based in China, offers competitive spreads starting at 0.1 pips. While lacking formal regulation, it provides versatile trading options through platforms like MetaTrader 5, MT iPhone/iPad, MT Android, and MT Mac.

Traders can access Forex, CFDs on Commodities, Stocks, Indices, Bonds, and Digital Currencies. Account types include Standard, VIP, Islamic, and Demo accounts, with 24/7 Live chat and email support (cs@bksfintech.com, support@bksfintech.com) available for customer assistance.

Is BKS Fintech legit or a scam?

BKS Fintech's regulatory status raises concern, as it has been confirmed that the broker currently lacks valid regulation. Additionally, the claim of NFA regulation in the United States, with license number 0466949, is under suspicion of being a clone. It's important to exercise caution and be mindful of potential risks when considering involvement with this broker.

Pros and Cons

BKS Fintech presents a range of advantages and potential drawbacks for traders to consider. On the positive side, the platform offers competitive spreads starting at 0.1 pips, ensuring cost-effective trading. A diverse array of trading platforms is available, catering to various preferences and needs. Furthermore, traders have access to a wide selection of tradable assets, enhancing their opportunities for diversified trading strategies. BKS Fintech also provides the convenience of multiple account types, including a Demo Account, allowing users to practice and explore without real financial risk. The availability of 24/7 Livechat support ensures that assistance is readily accessible whenever required.

However, it's important to note the potential drawbacks. BKS Fintech lacks formal regulatory oversight, which may raise concerns for some traders who prioritize regulated environments. Additionally, the company's limited history, having been established within the past year, may prompt caution among those who value longer-standing brokerage firms with established track records. As traders weigh these pros and cons, it's essential to make an informed decision that aligns with their individual trading preferences and risk tolerance.

| Pros | Cons |

| Competitive spreads from 0.1 pips | Lack of formal regulatory oversight |

| Diverse range of trading platforms | Limited company history (within 1 year) |

| Wide array of tradable assets | |

| Multiple account types available | |

| Availability of Demo Account | |

| 24/7 Livechat |

Market Instruments

Access a world of global markets with BKS Fintech, right at your fingertips. Our range of trading products includes:

Forex Market: Offering 61 products.

CFDs on Commodities: Providing access to 24 products.

Stocks: With over 2000 products available.

Indices: Covering 25 products.

Bonds: Featuring 11 products.

Digital Currencies: Including 21 products.

Explore these diverse offerings and seize trading opportunities across a wide spectrum of financial instruments.

Account Types

BKS Fintech offers a range of account types tailored to meet various trading preferences and needs:

Standard Account: Designed for traders seeking a traditional trading experience with competitive spreads and access to a wide range of financial instruments.

VIP Account: For seasoned traders, this account provides enhanced features, including lower spreads, personalized support, and advanced trading tools.

Islamic Account: Catering to traders who adhere to Islamic principles, this account offers swap-free trading, ensuring compatibility with religious beliefs.

Demo Account: Ideal for beginners and those looking to practice, the demo account offers a risk-free environment to hone trading skills using virtual funds.

How to Open an Account?

Opening an account with BKS Fintech is a straightforward process:

Visit the Website: Navigate to the official BKS Fintech website.

Register: Click on “Open Account” to begin registration.

Personal Details: Fill in your name, email, phone, and other info.

Account Type: Choose the trading account that suits you.

Verification: Submit identity documents for verification.

Agree and Deposit: Accept terms, fund your account, and start trading.

Spreads & Commissions

BKS Fintech offers competitive spreads starting from as low as 0.1 pips. With an average spread of 0.1, it stands among the best globally. Importantly, there are no hidden fees, ensuring transparency and no additional charges. This is attributed to our varied and exclusive liquidity blend, contributing to consistently tight spreads around the clock, five days a week.

Trading Platforms

BKS Fintech provides a variety of trading platforms, including:

MetaTrader 5: Users can engage with a state-of-the-art platform featuring powerful tools and features for efficient trading.

MT iPhone/iPad: Traders on the go can utilize the MT platform optimized for iPhone and iPad, ensuring convenient trading.

MT Android: Users of Android devices can stay connected and make well-informed decisions through the MT platform tailored for their needs.

MT Mac: Mac users enjoy a seamless trading experience via the dedicated MT platform designed to enhance their trading journey.

These platforms cater to diverse trading preferences and are designed for accessibility and functionality across different devices. Moreover, BKS Fintech's robust trading terminal is available on multiple platforms, including Windows, MAC, Android, Web Browser, and iOS. This terminal ensures uninterrupted access and functionality, enriching the trading experience for users.

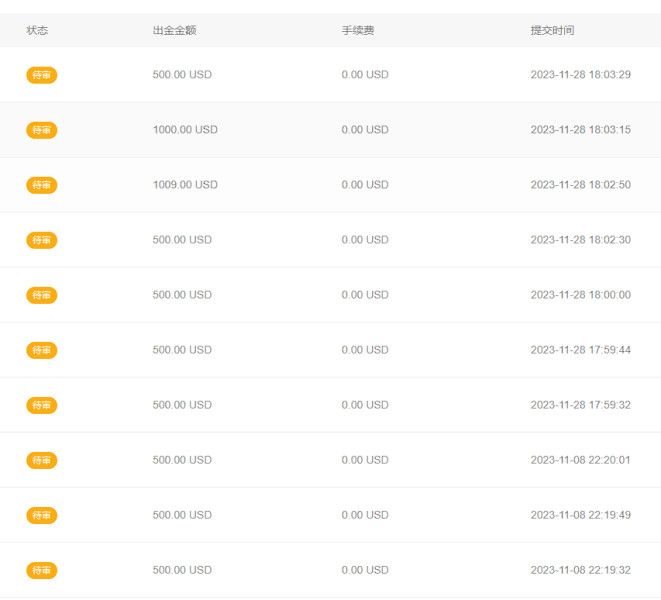

Deposit & Withdrawal

With BKS Fintech, you have the freedom to manage your funds your way:

Instant Deposit: Enjoy quick and hassle-free deposits, ensuring your funds are ready for trading promptly.

Fast Withdrawal: Experience swift and efficient withdrawals, ensuring you have access to your funds when you need them.

Secure Transfers: Your transactions are conducted securely, providing peace of mind. Plus, benefit from a 0% commission on your transfers, enhancing your financial flexibility.

Customer Support

BKS Fintech ensures accessibility around the clock, offering a timely connection through its online customer service Livechat. In case of queries or the need for expert guidance, the committed customer service team remains available 24/7 to provide assistance.

Communication with BKS Fintech can also be facilitated through email channels:

- Customer Services: cs@bksfintech.com

- Client Support: support@bksfintech.com

BKS Fintech's global presence is evident with offices spanning different jurisdictions, aligned to cater to diverse needs.

Conclusion

BKS Fintech offers competitive spreads from 0.1 pips, a diverse range of trading platforms, and a wide array of tradable assets, along with multiple account types and a Demo Account for practice. The availability of 24/7 Livechat support enhances customer assistance. However, the lack of formal regulatory oversight and the company's limited history within the past year should be considered when evaluating its offerings.

FAQs

Q: What are the advantages of trading with BKS Fintech?

A: BKS Fintech provides competitive spreads starting at 0.1 pips, a variety of trading platforms, and a diverse selection of tradable assets.

Q: How can I reach customer support at BKS Fintech?

A: You can access 24/7 Livechat support or contact the customer service team via email at cs@bksfintech.com and support@bksfintech.com.

Q: Are there different account types available at BKS Fintech?

A: Yes, BKS Fintech offers a range of account types, including Standard, VIP, Islamic, and Demo accounts, providing options.

Q: Does BKS Fintech have regulatory oversight?

A: BKS Fintech currently lacks formal regulatory oversights.

Q: What is the company history of BKS Fintech?

A: BKS Fintech has been established within the past year.

Q: Can I practice trading without real financial risk with BKS Fintech?

A: Yes, BKS Fintech offers a Demo Account that allows you to practice trading strategies and explore the platform without risking real funds.

Q: What is the range of tradable assets available at BKS Fintech?

A: BKS Fintech provides access to a diverse array of tradable assets, including Forex, CFDs on Commodities, Stocks, Indices, Bonds, and Digital Currencies.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now