Score

Sun Capital

Hong Kong|2-5 years|

Hong Kong|2-5 years| https://www.suncsl.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:Sun Capital Securities Limited

License No.:ALT721

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed Sun Capital also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

suncsl.com

Server Location

United States

Website Domain Name

suncsl.com

Server IP

172.67.165.242

Company Summary

| Aspect | Information |

| Registered Country | Hong Kong |

| Company Name | Sun Capital |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Bronze Account), $1,000 (Silver Account), $5,000 (Gold Account) |

| Maximum Leverage | 1:1000 |

| Spreads | Bronze Account: 2.0 pips on major currency pairs, Silver Account: 1.5 pips on major currency pairs, Gold Account: 1.0 pips on major currency pairs |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Currency pairs and cryptocurrencies |

| Account Types | Bronze, Silver, Gold |

| Customer Support | Limited online presence, no active social media profiles, no instant messaging platforms |

| Payment Methods | Cryptocurrency-only for deposits and withdrawals |

| Educational Tools | None |

| Website Status | As of October 13, 2022, the website was categorized as a suspicious website |

| Scam Situation | The website was labeled as a potential 'scam' |

Overview

Sun Capital, an unregulated company based in Hong Kong, raises numerous concerns for potential investors. The absence of regulatory oversight and a suspicious website categorization as of October 13, 2022, cast doubt on its legitimacy. The company's reliance on cryptocurrency-only transactions for deposits and withdrawals is unconventional and may pose risks, considering the inherent volatility of cryptocurrencies.

While Sun Capital provides trading options in currency pairs and cryptocurrencies, its limited online presence and absence of active social media profiles or instant messaging platforms for customer support are concerning. The lack of educational tools further limits its potential to support traders in making informed decisions.

Combined with the potential 'scam' label associated with its website, Sun Capital's overall appeal for investors is considerably diminished, and individuals should exercise caution and explore alternative, more reputable options in the market.

Regulation

Unregulated.

Its official website “www.suncsl.com” is categorized as a suspicious website as of October 13, 2022. It is not affiliated with Sun Capital Securities Limited, a licensed company regulated by the Securities and Futures Commission (SFC) in Hong Kong. The website's use of a similar name to a legitimate, regulated entity is a common tactic used by suspicious websites to deceive investors. Investors should exercise caution and avoid engaging with such websites to prevent potential financial scams or harm.

Pros and Cons

Sun Capital has several pros, including offering diverse market instruments, multiple account types, high leverage (1:1000), competitive spreads, and the use of the MetaTrader 4 platform. However, it also has notable cons, such as being an unregulated broker, having a suspicious website, exclusively using cryptocurrencies for transactions, limited online presence and customer support channels, and a lack of educational resources. Potential users should carefully weigh these factors before considering Sun Capital for their trading needs.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Market Instruments

Sun Capital provides a diverse range of market instruments to its clients. Among the offerings available, Sun Capital offers access to currency pairs and cryptocurrencies. These financial instruments play a crucial role in the portfolio of services the institution provides to its customers.

Currency Pairs: Sun Capital facilitates trading in the foreign exchange market, allowing its clients to engage in currency pair trading. This involves the buying and selling of one currency in exchange for another. Currency pairs are typically divided into major, minor, and exotic pairs, and clients can take advantage of the dynamic forex market to speculate on currency value fluctuations.

Cryptocurrencies: In addition to traditional currency pairs, Sun Capital also offers exposure to the cryptocurrency market. Cryptocurrencies have gained significant popularity and importance in recent years, and Sun Capital ensures its clients have the opportunity to trade, invest, or diversify their portfolios with digital assets such as Bitcoin, Ethereum, and various altcoins. These digital currencies are known for their potential for rapid price movements and can be an appealing asset class for many investors.

Account Types

Sun Capital offers three account types to cater to the diverse needs of its clients:

Bronze Account:

Minimum Deposit: $100

Ideal for beginners or those with limited capital, the Bronze account provides basic access to trading opportunities.

Silver Account:

Minimum Deposit: $1,000

Designed for traders with more experience and capital, the Silver account offers enhanced features and tools.

Gold Account:

Minimum Deposit: $5,000

The premium Gold account is for experienced traders with substantial capital, offering advanced features and dedicated support.

Clients can choose the account type that best suits their experience and financial goals.

Leverage

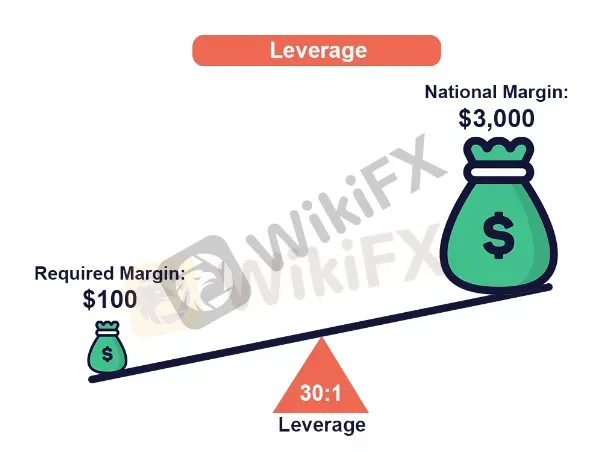

The broker offers a maximum trading leverage of 1:1000. This means that clients can potentially control a position size up to 1,000 times their initial investment. Leverage can amplify both potential profits and potential losses in trading, so it's essential for traders to use it cautiously and be aware of the associated risks.

Spreads and Commissions

Spreads:

Bronze Account: Offers a 2.0 pip spread on major currency pairs with no additional commission, making it suitable for beginners.

Silver Account: Features a 1.5 pip spread on major currency pairs with a fixed $5 per lot traded commission, providing predictability for traders.

Gold Account: Provides a competitive 1.0 pip spread on major currency pairs with a reduced $3 per lot traded commission, catering to experienced traders looking to optimize costs.

Commissions:

Bronze Account: No separate commission is charged; trading costs are covered by the spread, making it straightforward for newcomers.

Silver Account: Includes a fixed $5 per lot traded commission, balancing the narrower spread for those who prefer predictable cost management.

Gold Account: Applies a reduced $3 per lot traded commission, offering a cost-efficient solution alongside its tight spreads for experienced traders.

Deposit & Withdrawal

Sun Capital exclusively offers cryptocurrency-based deposit and withdrawal methods, which may raise concerns for some potential clients:

Cryptocurrency Only: Clients of Sun Capital can deposit funds into their trading accounts and withdraw profits solely in cryptocurrency. This exclusive use of cryptocurrencies for financial transactions may be considered unconventional and, to some, potentially suspicious. It is crucial for individuals considering Sun Capital to carefully evaluate their comfort level with this approach and be aware of the associated risks, as cryptocurrency transactions can be subject to price volatility and regulatory considerations.

The decision to rely solely on cryptocurrencies for deposit and withdrawal methods is unique to Sun Capital and may impact the convenience and accessibility of its services for different types of clients. Individuals interested in trading with this broker should thoroughly assess the suitability of this approach based on their preferences and needs.

Trading Platforms

Sun Capital offers its clients the widely recognized and trusted MetaTrader 4 (MT4) platform, providing a robust and user-friendly tool for trading and analysis. MT4 is celebrated for its extensive charting capabilities, technical indicators, and automated trading features, making it a versatile platform suitable for both novice and experienced traders. By providing MT4, Sun Capital ensures that its clients have access to a proven and popular trading platform that can enhance their trading experience and effectiveness in the financial markets.

Customer Support

Sun Capital's customer support appears to be notably lacking in terms of online presence and communication options. The absence of active social media profiles on Twitter, Facebook, Instagram, and YouTube can limit clients' access to important updates, educational content, and community engagement, which is a standard practice in the financial industry. Additionally, the lack of a LinkedIn profile restricts networking opportunities and industry insights. Furthermore, the absence of instant messaging platforms like WhatsApp, QQ, and WeChat may inconvenience clients seeking real-time assistance. While an email address is provided for inquiries, the limited range of communication channels and online engagement might raise concerns about the accessibility and responsiveness of Sun Capital's customer support, potentially leaving clients feeling isolated or underserved.

Educational Resources

Sun Capital's lack of educational resources can be seen as a significant drawback for clients. Without access to educational materials such as webinars, tutorials, or market analysis, traders may find it challenging to enhance their knowledge and trading skills. A comprehensive educational suite is a standard offering in the financial industry, and its absence from Sun Capital's services could limit clients' ability to make informed decisions and maximize their trading potential.

Summary

Sun Capital, an unregulated broker, offers trading in currency pairs and cryptocurrencies with varying spreads and commissions depending on the chosen account type. They provide a maximum leverage of 1:1000. Notably, they exclusively use cryptocurrency for deposits and withdrawals, which might raise concerns for some clients. Sun Capital offers the MetaTrader 4 platform but lacks a substantial online presence, with no active social media profiles and limited customer support channels. Moreover, their website is down, and some users have raised concerns about its legitimacy, labeling it as a potential 'scam.'

FAQs

Q1: What account types does Sun Capital offer?

A1: Sun Capital offers three account types: Bronze, Silver, and Gold, with varying minimum deposit requirements and features to cater to different trading needs.

Q2: What is the maximum leverage available with Sun Capital?

A2: Sun Capital offers a maximum trading leverage of 1:1000, allowing clients to control positions up to 1,000 times their initial investment.

Q3: Can clients deposit and withdraw using traditional currencies with Sun Capital?

A3: No, Sun Capital exclusively uses cryptocurrencies for deposits and withdrawals, offering an unconventional approach for financial transactions.

Q4: Is Sun Capital a regulated broker?

A4: No, Sun Capital is unregulated, which may raise concerns about client protection and oversight.

Q5: Does Sun Capital provide educational resources for traders?

A5: No, Sun Capital lacks educational resources such as webinars or tutorials, which can limit opportunities for traders to enhance their knowledge and skills.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now