Score

NYFX

United States|1-2 years|

United States|1-2 years| https://nyprofx.com/en/index

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed NYFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

nyprofx.com

Server Location

Lithuania

Website Domain Name

nyprofx.com

Server IP

194.31.55.25

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | NYFX |

| Regulation | Unregulated |

| Maximum Leverage | Up to 1:500 |

| Spreads | Limited information available |

| Trading Platforms | Limited transparency |

| Tradable Assets | Forex pairs, Cryptocurrency CFDs |

| Account Types | Demo Account, Trading Account |

| Demo Account | Available |

| Customer Support | Support email: support@nyprofx.com (Potential delays) |

| Payment Methods | Information not provided |

| Educational Tools | “Study” section with trading term explanations (Limited in-depth resources) |

Overview

NYFX, operating from the United States, presents a disconcerting profile with several notable shortcomings. The broker operates without regulatory oversight, raising concerns about security and transparency. Transparency is further compromised by limited information available on spreads and trading platforms. NYFX faces serious allegations of using a fake license, casting a shadow over its legitimacy and trustworthiness. Educational resources are meager, confined to explanations of trading terms with little depth. Additionally, customer support, accessible through email, may lead to potential delays in responses. The absence of information regarding payment methods adds to the inconvenience for traders. Given these concerning aspects, traders are strongly advised to exercise caution and conduct comprehensive research before engaging with NYFX to ensure a secure and transparent trading experience.

Regulation

Unregulated.

NYFX is facing serious allegations of using a fake license as a broker. This has raised concerns about the trustworthiness and legality of their operations. It's a stark reminder of the importance of verifying licenses and regulatory approvals when dealing with financial institutions. Investors should exercise caution and refrain from engaging with NYFX until the authenticity of their license is confirmed by authorities. This incident underscores the need for regulatory oversight and enforcement to maintain trust and stability in the financial sector.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated |

| High Leverage | Lack of Transparency |

| Secure Deposit and Withdrawal | Allegations of Fake License |

| Educational Resources | Potentially Delayed Customer Support Responses |

In summary, NYFX offers a variety of market instruments and high leverage, making it attractive to traders. However, its lack of regulation, limited transparency, allegations of a fake license, and potential delays in customer support may raise concerns for traders seeking a more secure and transparent trading environment.

Market Instruments

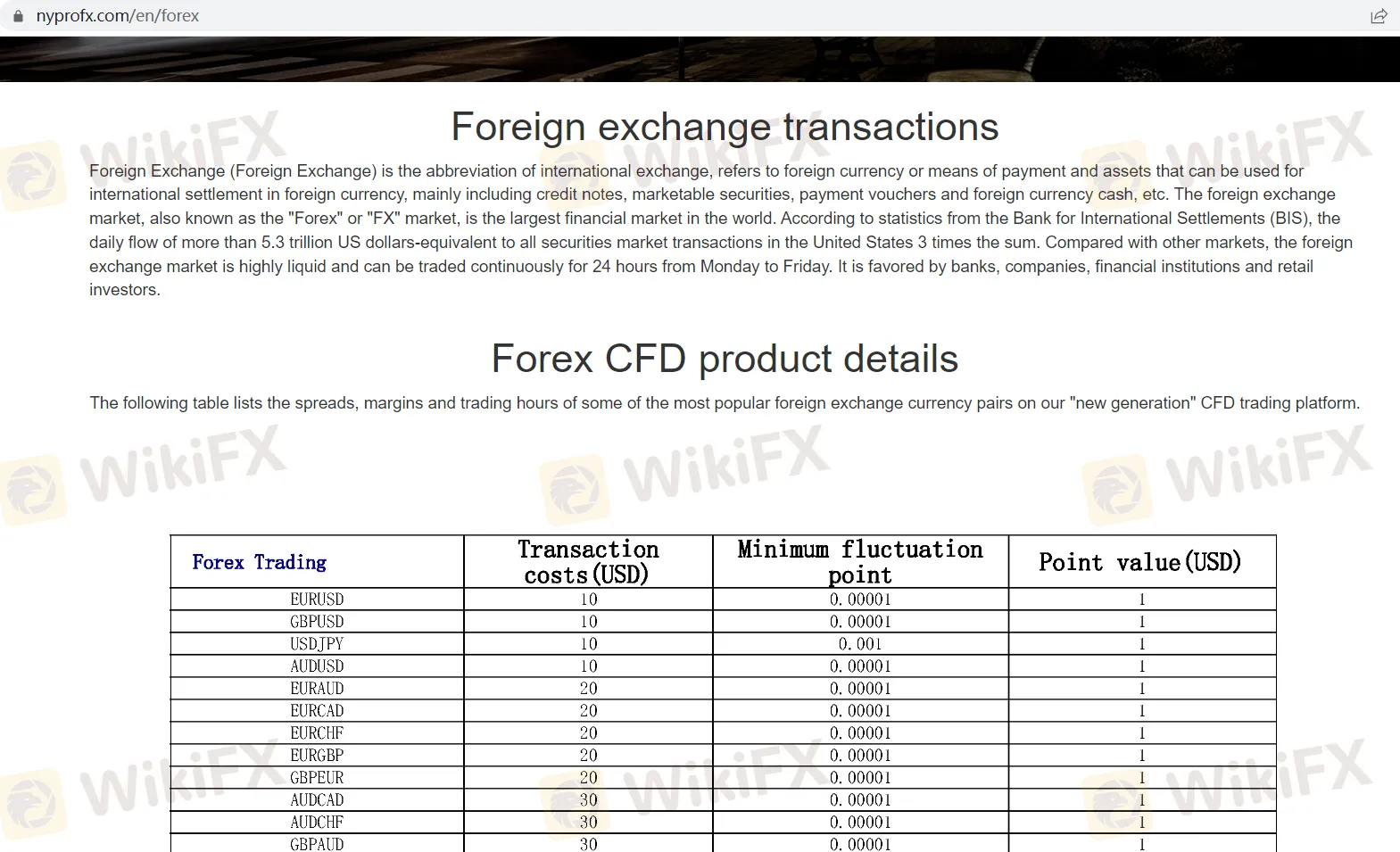

The broker offers a wide range of trading instruments to cater to the diverse needs of traders and investors. These instruments include foreign exchange currency pairs, commonly referred to as Forex, as well as Contracts for Difference (CFDs) in cryptocurrencies. Let's delve into these market instruments in more detail:

Foreign Exchange (Forex) Pairs:

The Forex market is the largest and most liquid financial market globally, with a daily trading volume exceeding $5.3 trillion. It encompasses the trading of various currency pairs, where one currency is exchanged for another at an agreed-upon exchange rate. This market is highly favored by banks, companies, financial institutions, and retail investors due to its liquidity and 24/5 trading availability.

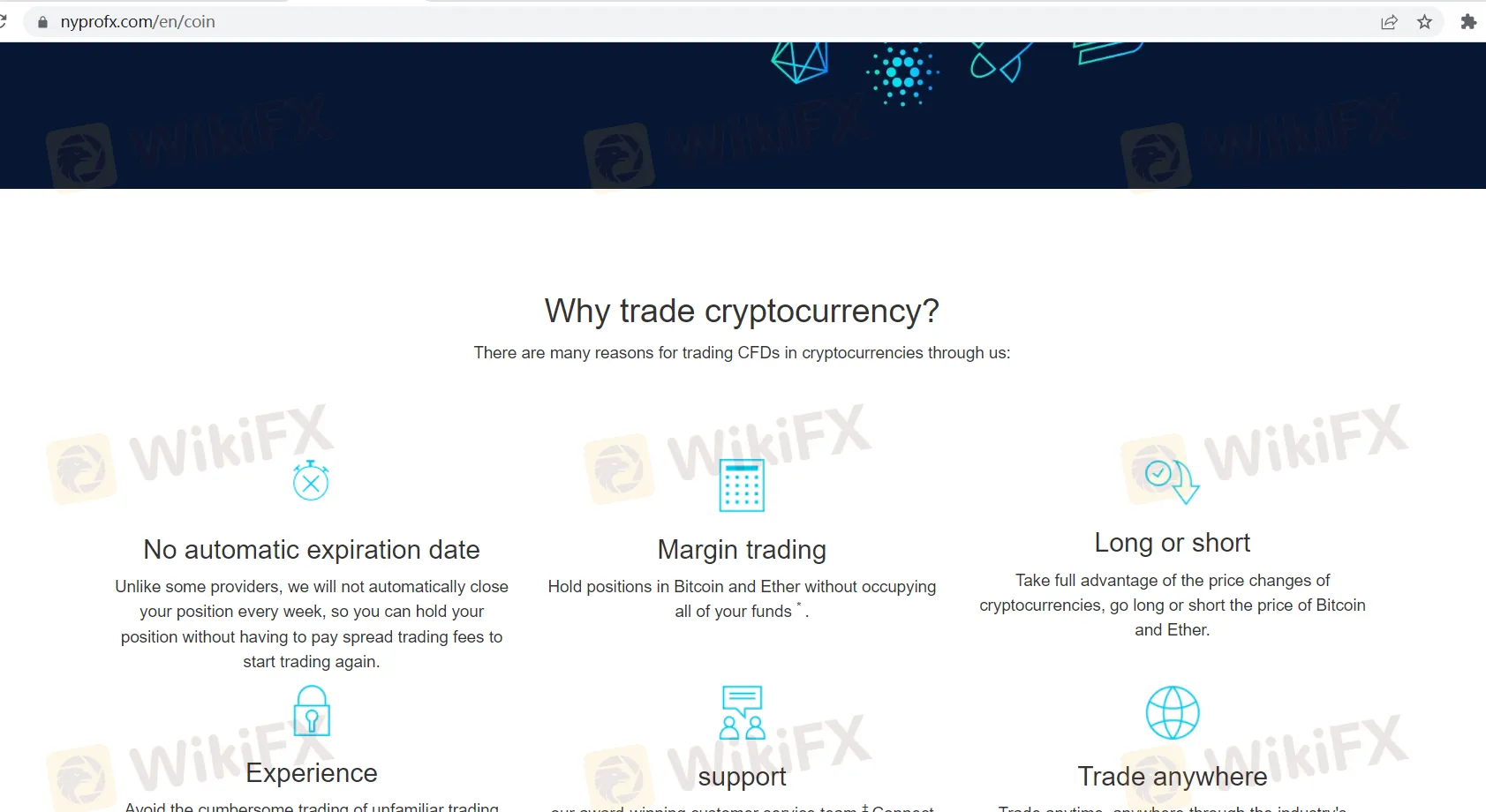

Cryptocurrency CFDs:

In addition to Forex pairs, the broker also offers Contracts for Difference (CFDs) in cryptocurrencies. CFDs allow traders to speculate on the price movements of cryptocurrencies without owning the underlying assets. This provides an opportunity to profit from both rising and falling cryptocurrency prices.

Some of the popular cryptocurrencies available as CFDs include:

Bitcoin (BTC)

Ethereum (ETH)

Ripple (XRP)

Litecoin (LTC)

Bitcoin Cash (BCH)

While specific details may vary, the broker typically offers competitive spreads and margin requirements for cryptocurrency CFDs. The trading hours for cryptocurrency CFDs are usually 24/7, allowing traders to access the market at any time.

Please note that the actual spread, margin requirements, and trading hours may vary depending on the broker and market conditions. Traders should always refer to the broker's platform for the most up-to-date information on these instruments.

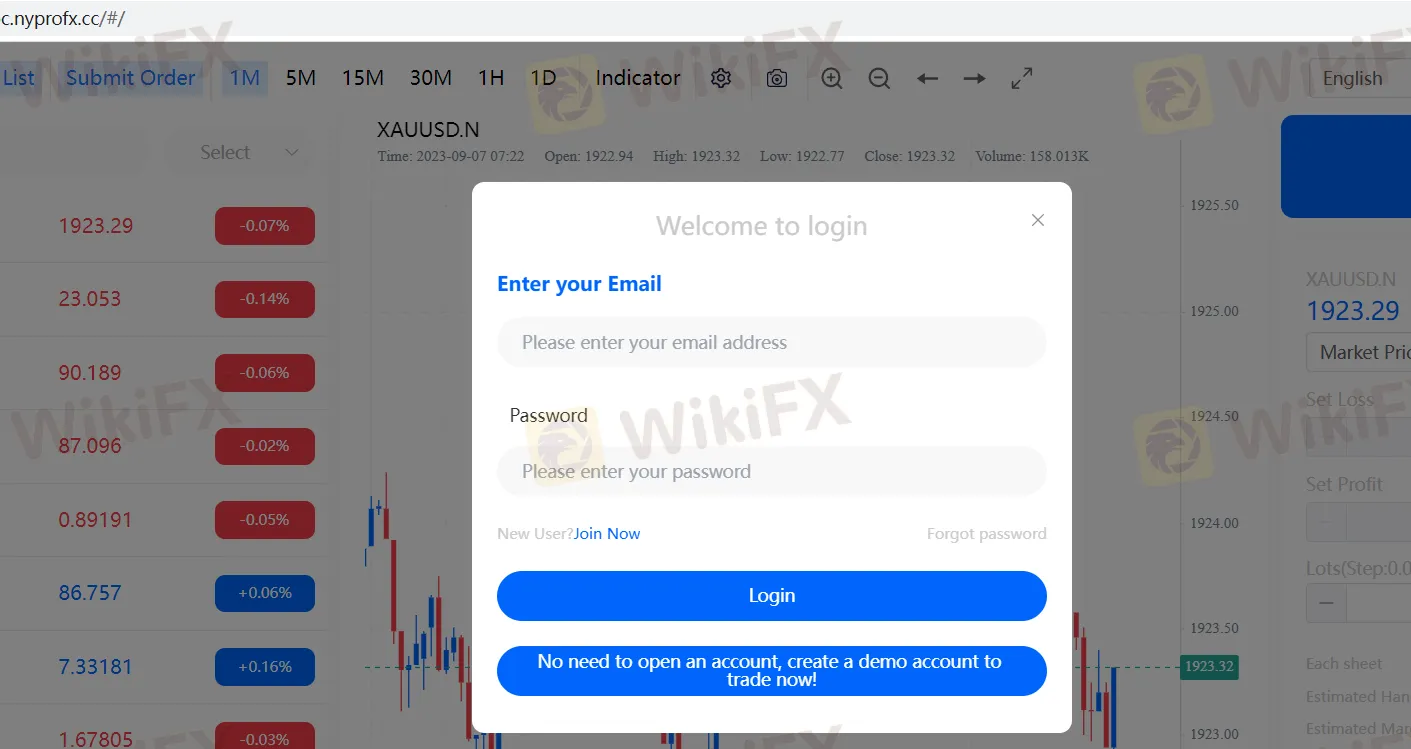

Account Types

NYFX offers two main types of accounts:

Demo Account: This account is for practice and learning. It provides a risk-free environment with virtual funds, allowing traders to test strategies and get familiar with the trading platform.

Trading Account: Also known as a Live Account, this is for real trading with actual money. Traders use this account to execute live trades in the financial markets, with potential for profit and risk of loss. It offers access to all available assets and reflects real market conditions.

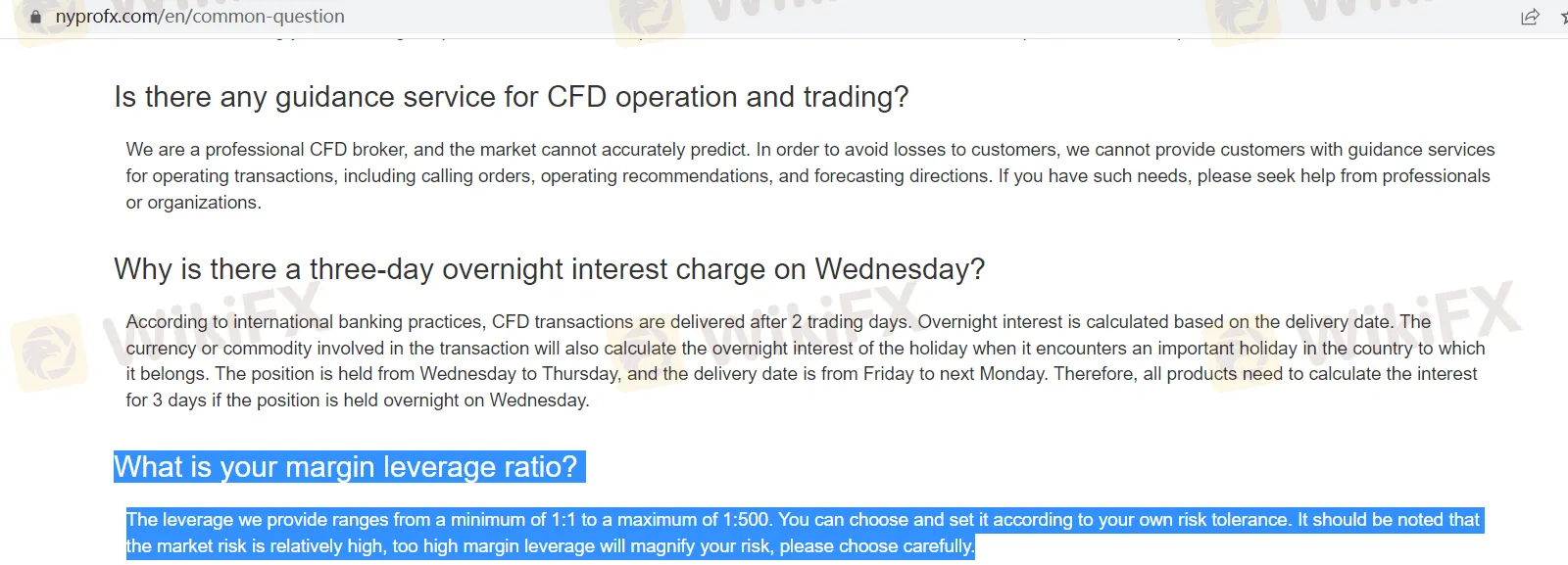

Leverage

This broker provides traders with the option to access a maximum trading leverage of up to 1:500. This level of leverage can be chosen by traders based on their risk appetite and trading preferences. However, it's crucial to be aware that trading with high leverage can significantly magnify both potential profits and losses, so it should be used with careful consideration and risk management strategies in place.

Spreads & Commissions

NYFX provides limited information regarding spreads and commissions on their platform, leaving traders with uncertainty about the specific costs involved. While they claim to offer “ultra-low spreads and ultra-low interest rates,” they do not provide transparent details on these charges. This lack of transparency can be frustrating for traders who seek clarity on the costs associated with their trades. To obtain accurate information about spreads and commissions, traders are required to contact the platform's customer service, which may not be convenient or efficient. This opacity in fee structures can raise concerns about the broker's commitment to transparency and customer satisfaction, leaving traders potentially at a disadvantage when making trading decisions.

Deposit & Withdrawal

Depositing Funds:

To fund your trading account with NYFX:

Bank Support: NYFX supports deposits from all banks, with daily limits set by your bank. You can adjust these limits by contacting your bank directly for details.

Online Deposit: Log in to NYFX's official website and visit the “Deposit” menu. Follow the instructions, select the deposit option, specify the amount, and provide your bank account details. Click “Submit” to complete the process.

Security: NYFX employs top-level encryption technology for secure online deposits, ensuring the safety of your funds and account information.

Withdrawal Process:

Withdrawing funds from your NYFX trading account:

Access Withdrawals: Log in and select “Withdraw” from the top menu.

Fill in Details: Choose withdrawal, specify the amount, and provide your bank account information for the transfer.

Submission: Click “Submit” to initiate the withdrawal process.

Processing Times:

Online deposits are instant.

Bank wire transfers take 1-3 working days depending on your bank.

Withdrawals are processed within minutes to a maximum of 24 hours, depending on your bank's procedures.

Currency Conversion:

Currency conversion during funding is based on your country's Central Settlement Bank's real-time exchange rate.

In summary, NYFX offers a straightforward and secure deposit and withdrawal process, with support for all banks and transparent procedures. This ensures efficient account management for traders.

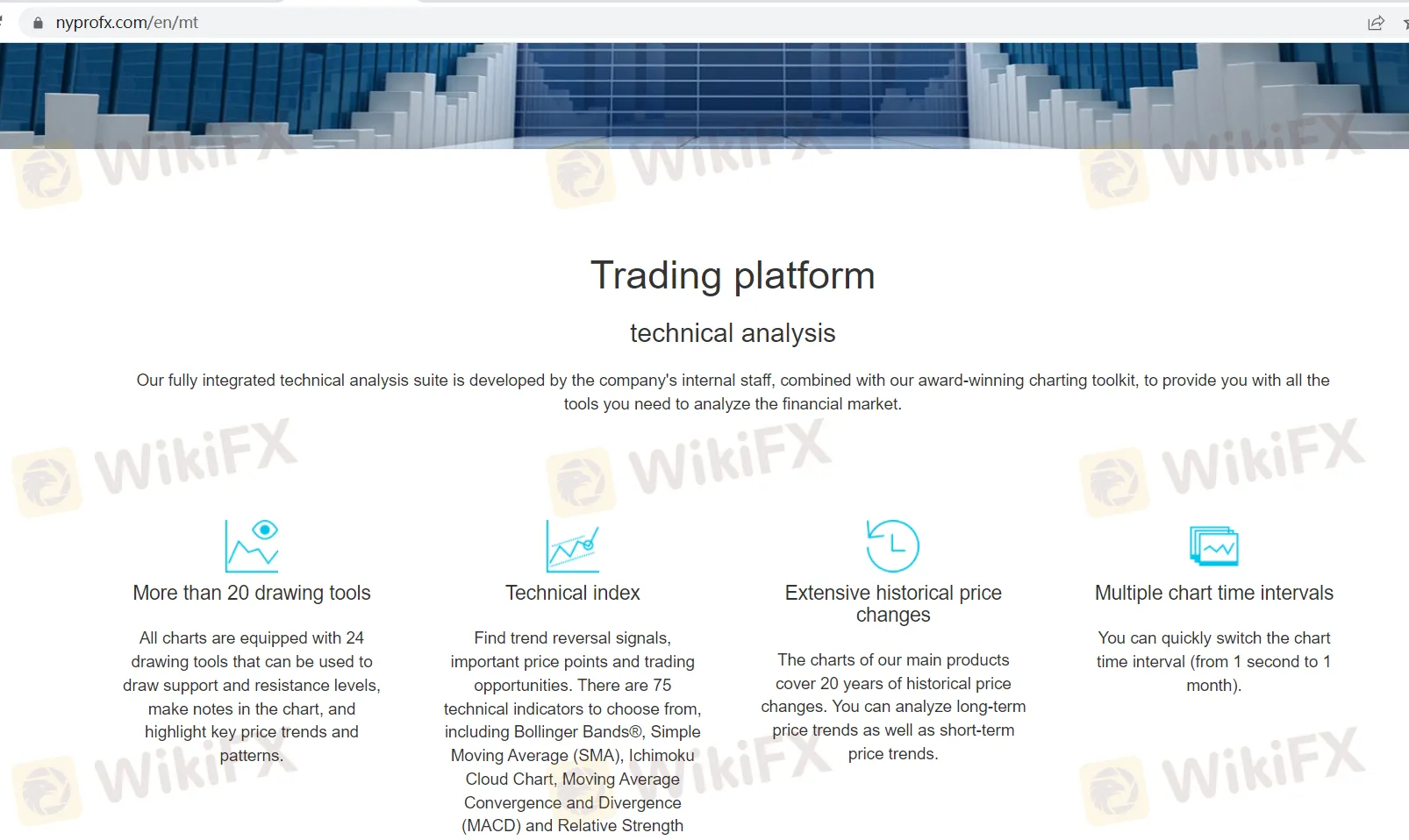

Trading Platforms

NYFX's trading platform offers technical analysis tools but lacks transparency and user-friendliness. While it boasts over 20 drawing tools and 75 technical indicators, the platform's limited historical data and cumbersome customization process can frustrate traders. Moreover, the lack of clear information on spreads, commissions, and other crucial details raises concerns about transparency. The mobile app does provide advanced order options but falls short in delivering a seamless user experience. Traders may find better alternatives with more intuitive platforms and transparent fee structures.

Customer Support

NYFX's customer support, available through support@nyprofx.com, may leave traders frustrated due to potential delays in responses. While they express their intention to reply promptly, time differences could lead to extended wait times for assistance. This could be inconvenient, especially during urgent situations. Traders might seek more responsive and accessible customer support from other brokers.

Educational Resources

NYFX offers a “Study” section for educational purposes, focusing on explaining various trading terms and concepts. However, it's important to note that this section primarily provides definitions and explanations, and it may not offer in-depth articles, videos, or tutorials on trading strategies or advanced topics. Traders seeking more comprehensive education may need to explore additional resources elsewhere.

Summary

NYFX, an unregulated broker, faces allegations of using a fake license, raising serious concerns about its legitimacy. This casts doubt on the trustworthiness of their operations and highlights the importance of verifying licenses when dealing with financial institutions. Investors should exercise caution and refrain from engaging with NYFX until authorities confirm the authenticity of their license. The lack of transparency regarding spreads and commissions, coupled with potential delays in customer support, further adds to the uncertainties associated with this broker. Traders seeking a more transparent and reliable trading experience may explore alternative options in the market.

FAQs

Q1: What is the maximum leverage NYFX offers?

A1: NYFX provides traders with a maximum trading leverage of up to 1:500, allowing flexibility in risk management. However, traders should use high leverage cautiously due to its potential for magnifying both profits and losses.

Q2: How can I fund my NYFX trading account?

A2: Funding your NYFX account is easy. After logging in to the official website, go to the “Deposit” menu, follow the instructions, specify the amount, provide your bank account details, and click “Submit.”

Q3: Does NYFX offer educational resources?

A3: Yes, NYFX has a “Study” section where traders can find explanations of trading terms and concepts. However, it primarily provides definitions and may not offer in-depth articles or videos on trading strategies.

Q4: Is NYFX regulated?

A4: No, NYFX operates as an unregulated broker, which may raise concerns about the security and transparency of its services. Traders should exercise caution when considering unregulated brokers.

Q5: How long does it take to process withdrawals with NYFX?

A5: Withdrawals from NYFX trading accounts are typically processed within minutes to a maximum of 24 hours, depending on your bank's procedures. Bank wire transfers may take 1-3 working days, depending on your bank.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now