No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Windsor Brokers and MSC GROUP ?

In the table below, you can compare the features of Windsor Brokers , MSC GROUP side by side to determine the best fit for your needs.

EURUSD:-1

EURUSD:-0.1

EURUSD:11.31

XAUUSD:24.67

EURUSD: -7.54 ~ 2

XAUUSD: -36.45 ~ 21.86

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of windsor-brokers, msc-group lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC, FSC (Offshore) , FSA ( Offshore) |

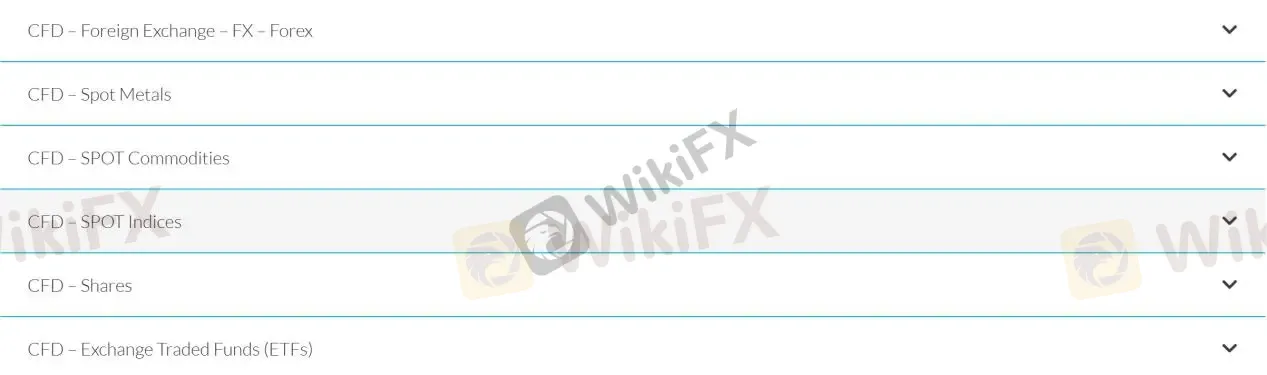

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Account Types | Prime account, Zero account |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| $30 no deposit bonus | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers offers two types of real trading accounts: the Prime Account and the Zero Account. The Prime Account, geared towards support-oriented traders, has a lower $50 minimum deposit and spreads starting from 1.0 pips on major pairs. It provides zero commission on forex CFDs, an $8 commission per lot for crypto CFDs, and includes training resources.The Zero Account targets heavy traders with a $1,000 minimum deposit, zero spreads on major currency pairs, and a maximum leverage of 1:1000. It charges an $8 commission per lot for forex, metals, and crypto CFDs, with no commission on other CFDs. Both accounts offer negative balance protection, personal account managers, a 0.01 minimum trade volume, a 50 lot restriction per ticket, hedging allowance, and a 20% stop-out level with a 100% margin call. Notably, the Zero Account does not support Islamic/swap-free accounts.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Broker offers a $30 no deposit bonus for new clients, credited after completing a straightforward account opening process - apply, register by meeting requirements, and receive $30 in trading credit upon approval, allowing risk-free platform exploration.

Windsor Brokers offers some educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On the WikiFX website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Aspect | Information |

| Company Name | MSC Group Inc |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years |

| Regulation | Currently lacks valid regulation |

| Minimum Deposit | N/A |

| Maximum Leverage | Up to 1:500 |

| Spreads | N/A |

| Trading Platforms | MetaTrader4 (MT4) |

| Tradable Assets | Currencies, indices, metals, commodities, stocks |

| Account Types | N/A |

| Demo Account | N/A |

| Customer Support | Email: support@mscgroupglobal.com Online chat available |

| Deposit & Withdrawal | Range of payment methods available, specific details not provided |

| Educational Resources | N/A |

Based in Delaware, USA, MSC Group Inc is an online broker offering a diversified range of trading products, including currencies, indices, metals, and commodities. They provide up to 1:500 leverage and utilize the popular MetaTrader4 (MT4) trading platform. However, it is important to note that MSC Group currently lacks valid regulation, which should be considered when evaluating the potential risks involved in trading with an unregulated broker. While they offer multilingual customer support and a variety of payment methods, educational resources are not currently provided. Traders are advised to seek alternative sources for educational materials and prioritize regulated brokers for enhanced protection of their funds and trading activities.

It has been verified that MSC Group currently lacks valid regulation. It is essential to be cautious and aware of the associated risks. The broker's regulatory status is abnormal, with an official designation of “Unauthorized.” Please exercise caution and consider the potential risks involved in trading with an unregulated broker.

MSC Group offers a diversified range of tradable instruments and competitive leverage of up to 1:500, along with the availability of the MetaTrader4 (MT4) platform. The broker also provides multilingual customer support and convenient deposit and withdrawal options. However, it is important to note that MSC Group currently lacks valid regulation, and specific details about spreads and commissions, educational resources, and payment methods are not provided.

| Pros | Cons |

| Diversified range of tradable instruments | Lack of valid regulation |

| Competitive leverage of up to 1:500 | No specific details about spreads and commissions |

| Availability of MetaTrader4 (MT4) platform | Limited educational resources provided |

| Multilingual customer support | Specific details about payment methods not provided |

| Convenient deposit and withdrawal options |

On the MSC Group platform, you can trade the following financial instruments:

1. Currencies: MSC Group provides access to a wide range of currency pairs, including major, minor, and exotic pairs. These currency pairs allow traders to participate in the forex market and take advantage of fluctuations in exchange rates.

2. Indices: MSC Group offers trading opportunities in various global stock market indices. Popular indices such as the S&P 500, Dow Jones Industrial Average, FTSE 100, and Nikkei 225 are among the options available. Trading indices allows traders to speculate on the overall performance of specific markets or sectors.

3. Metals: Precious metals like gold, silver, platinum, and palladium are available for trading on the MSC Group platform. These metals are known for their value and are often considered as safe-haven assets during times of economic uncertainty.

4. Commodities: Traders can also access a range of commodities on the MSC Group platform, including energy commodities like crude oil and natural gas, agricultural commodities like corn and wheat, and soft commodities like coffee and sugar. Trading commodities allows traders to speculate on the price movements of these essential resources.

5. Stocks: MSC Group provides access to a selection of stocks from global markets. These stocks represent shares of publicly traded companies across various sectors, including technology, finance, healthcare, and more. Trading stocks allows investors to participate in the performance of specific companies and benefit from their price fluctuations.

MSC Group offers a diversified range of tradable instruments with varying trading leverage. For Forex instruments, the leverage can go up to 1:500, while for indices and commodities, it can reach up to 1:100. Trading leverage can be advantageous as it allows traders to amplify their potential profits with a smaller initial investment. However, it is important to understand that higher leverage also increases the risk of potential losses, as losses are magnified in proportion to the leverage used. Traders should exercise caution and employ risk management strategies when utilizing high leverage to mitigate potential risks.

Cedar FX offers a low minimum deposit requirement of $10 to open a trading account, which is in line with what legitimate brokers typically require for a micro account. While this may seem attractive, it is important to note that Cedar FX is currently an unregulated broker. Due to the lack of regulatory oversight, traders are advised to exercise caution and consider the potential risks associated with trading with an unregulated broker. It is recommended to choose regulated brokers that provide additional safeguards and protections for clients' funds and trading activities.

MSC Group offers the widely acclaimed MetaTrader4 (MT4) trading platform, known for its powerful features and extensive capabilities. With MT4, traders can enjoy convenient access to the platform through various channels, ensuring flexibility and ease of use. The user-friendly interface of MT4 makes it accessible to traders of all experience levels, including novice traders. One of the standout features of MT4 is its advanced charting capabilities, allowing traders to analyze market trends and make informed trading decisions. Furthermore, MT4 is designed to support multiple markets, enabling traders to access a wide range of financial instruments. The platform also includes an embedded expert advisor system, allowing traders to automate certain aspects of their trading strategies. By choosing to trade with MSC Group, traders can leverage the benefits of MT4 for their trading needs, providing them with every possible advantage for achieving financial success.

MSC Group offers a range of payment methods for depositing and withdrawing funds, ensuring convenient and secure transactions for its clients. While specific details about the payment methods are not provided, clients can expect to have access to popular options such as bank transfers, credit/debit cards, and electronic payment systems. The availability of payment methods may vary depending on the client's country of residence. It is recommended to visit the MSC Group website or contact their customer support to obtain detailed information about the payment methods supported and any associated fees or processing times.

The MSC Group prioritizes effective communication and provides multilingual customer support to cater to the diverse needs of its clients. You can reach their customer support team through email at support@mscgroupglobal.com. Additionally, an online chat feature is available for real-time assistance and prompt resolution of queries or concerns. Whether you have questions about their services, need technical support, or require general assistance, the MSC Group's customer support is dedicated to providing helpful and timely responses to ensure a positive trading experience for their clients.Educational Resources

The MSC Group recognizes the importance of educational resources for traders, especially for those who are new to the market. However, it is important to note that the availability of educational materials or resources may vary among different brokers. While the MSC Group may not currently provide specific educational resources such as webinars or daily Forex news, traders can explore alternative sources to enhance their knowledge and understanding of the market. There are numerous reputable websites, online forums, and educational platforms that offer comprehensive educational content, tutorials, market analysis, and news updates. Traders are encouraged to leverage these external resources to supplement their trading education and stay informed about market trends and developments.

In conclusion, MSC Group Inc is an online broker based in Delaware, USA, offering a diverse range of trading products through the MetaTrader4 (MT4) platform. The broker provides access to various financial instruments, offers competitive leverage ratios, and supports micro trade sizes, making it beginner-friendly. However, it is important to note that MSC Group lacks valid regulation, and its regulatory status is designated as “Unauthorized.” This lack of regulation poses risks to traders, and caution is advised when considering trading with an unregulated broker. While MSC Group offers multilingual customer support and convenient deposit and withdrawal options, it does not currently provide specific educational resources. Traders are encouraged to seek alternative sources for educational materials to enhance their trading knowledge. It is recommended to prioritize regulated brokers that offer additional safeguards and protections for clients' funds and trading activities.

Q: Is MSC Group regulated?

A: Currently, MSC Group lacks valid regulation, and its regulatory status is classified as “Unauthorized.”

Q: What financial instruments can I trade with MSC Group?

A: MSC Group offers a variety of tradable instruments, including currencies, indices, metals, commodities, and stocks.

Q: What leverage does MSC Group offer?

A: The leverage offered by MSC Group varies depending on the specific instrument. For Forex instruments, leverage can go up to 1:500, while for indices and commodities, it can reach up to 1:100.

Q: What is the minimum trade size with MSC Group?

A: MSC Group allows a micro trade size of 0.01 lots.

Q: Does MSC Group charge spreads or commissions?

A: Specific details about spreads and commissions are not provided.

Q: What trading platform is available with MSC Group?

A: MSC Group offers the MetaTrader4 (MT4) trading platform, known for its powerful features, user-friendly interface, advanced charting capabilities, and support for multiple markets.

Q: What are the deposit and withdrawal methods supported by MSC Group?

A: MSC Group offers a range of payment methods for depositing and withdrawing funds, including bank transfers, credit/debit cards, and electronic payment systems.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive windsor-brokers and msc-group are, we first considered common fees for standard accounts. On windsor-brokers, the average spread for the EUR/USD currency pair is 0.1 pips, while on msc-group the spread is 0 pip onwards.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

windsor-brokers is regulated by CYSEC,FSC,FSA. msc-group is regulated by ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs. msc-group provides trading platform including ECN,SWAP FREE,STANDARD and trading variety including Forex, CFD’s, Commodities.