No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between au Kabucom Securities and ZFX ?

In the table below, you can compare the features of au Kabucom Securities , ZFX side by side to determine the best fit for your needs.

--

--

EURUSD:-0.3

EURUSD:-2.3

EURUSD:16.78

XAUUSD:31.2

EURUSD: -6.51 ~ 2.8

XAUUSD: -32.54 ~ 15.5

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of kabu, zfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered Country/Area | Japan |

| Founded Year | 1999 |

| Company Name | au Kabucom Securities |

| Regulation | FSA |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | From 0.2 pips |

| Trading Platforms | au Kabucom FX Navi (for forex trading), au Kabucom FX for iPhone/Android (mobile app) |

| Tradable Assets | Cash stock, Margin trading, petit stock, US stocks, Mutual fund, NISA, FX, CFDs, and futures |

| Account Types | Not mentioned |

| Customer Support | Email and Phone |

| Payment Methods | Net transfer, Account transfer, Direct debit (automatic debit), Direct debit (real-time fund transfer), Direct debit (automatic debit from other financial institutions) |

| Educational Tools | Informative movies, events, face-to-face seminars, Investment Information Office, investment guides and courses, reports, and social networking services (SNS) |

au Kabucom Securities is an online brokerage company and is the core company of Mitsubishi UFJ Financial Group (MUFG Group)s online financial services. It is a Japan-based company mainly engaged in financial product trading business through the net, as well as related business. The Company is engaged in the provision of brokerage, trading, offering and sale of securities. It also provides bank agency business, foreign exchange margin trading business and other financial services.

Founded in 1999, it operates under the regulation of the Financial Services Agency (FSA). The company offers a diverse range of tradable assets, including stocks, margin transactions, IPO/PO, ETF/ETN/REIT, free ETF, petit shares, tender offer, investment trust, FX (Forex Margin Trading), futures/options trading, bonds (foreign bonds), foreign currency-denominated MMF, and CFD (Share 365). The trading platforms provided by au Kabucom Securities are au Kabucom FX Navi for forex trading and au Kabucom FX for iPhone/Android as a mobile app. The company supports customer inquiries through email and phone. Various payment methods, such as net transfer, account transfer, direct debit (automatic debit), direct debit (real-time fund transfer), and direct debit (automatic debit from other financial institutions) are available. For educational purposes, au Kabucom Securities offers informative movies, events, face-to-face seminars, an Investment Information Office, investment guides and courses, reports, and social networking services (SNS).

au Kabucom Securities is a financial institution that operates as a securities broker in Japan. It is authorized and regulated by the Financial Services Agency (FSA), which is the regulatory body responsible for overseeing the financial industry in Japan. The regulatory license number assigned to au Kabucom Securities is 関東財務局長(金商)第61号, which signifies its registration and compliance with the FSA's regulations.Being authorized and regulated by the FSA indicates that au Kabucom Securities has met the necessary requirements and standards set by the regulatory authority.

The FSA's oversight ensures that the company operates in a fair, transparent, and compliant manner, protecting the interests of investors and maintaining the integrity of the financial markets.As a regulated entity, au Kabucom Securities is expected to adhere to various regulatory guidelines, such as conducting thorough customer due diligence, implementing robust risk management systems, maintaining adequate financial resources, and providing transparent disclosure of information to its clients. Regular audits and inspections may be conducted by the FSA to ensure compliance with these regulations and to safeguard the interests of investors.

au Kabucom Securities offers a wide range of tradable assets and is backed by the reputable Mitsubishi UFJ Financial Group. It is regulated by the Financial Services Agency, providing a sense of security for investors. The company provides informative educational resources to enhance investors' understanding of the market.

However, there are areas for improvement. Information about account types is lacking, making it difficult for potential clients to choose the most suitable option. The selection of trading platforms is limited, which may not meet the preferences of all traders. Customer support options are somewhat limited, with email and phone support available, but lacking additional channels like live chat or dedicated account managers.

| Pros | Cons |

| Wide range of tradable assets | Lack of information on account types |

| Established company with a reputable parent company | Limited trading platforms |

| Regulated by FSA | Limited customer support options |

| Informative educational resources |

au Kabucom Securities offers a wide range of products to cater to different investment needs and preferences. Here are the various products available:

1. Stocks: au Kabucom Securities provides opportunities to invest in stocks, including in-kind stocks where you can directly own shares of companies.

2. Margin Transaction (System/General): Margin trading allows investors to trade stocks with borrowed funds, potentially amplifying their investment returns. au Kabucom Securities offers margin trading services through both system-based and general methods.

3. Initial Public Offering (IPO)/Public Offering Sale (PO): au Kabucom Securities enables participation in initial public offerings and public offering sales, giving investors a chance to invest in newly listed companies.

4. ETF/ETN/REIT: au Kabucom Securities offers exchange-traded funds (ETFs), exchange-traded notes (ETNs), and real estate investment trusts (REITs) for diversifying investment portfolios across different asset classes.

5. Free ETF (Commission-Free Exchange Traded Fund): au Kabucom Securities provides commission-free trading for certain listed ETFs, allowing investors to save on transaction costs.

6. Petit Shares (Shares Less Than One Unit): au Kabucom Securities facilitates trading of fractional shares, enabling investors to own a portion of a share rather than purchasing a full unit.

7. Tender Offer (TOB): au Kabucom Securities allows investors to participate in tender offers, which are offers made by a company to purchase shares from existing shareholders.

8. Investment Trust: au Kabucom Securities offers investment trust products, which are professionally managed funds that pool money from multiple investors to invest in a diversified portfolio of assets.

9. FX (Forex Margin Trading): Investors can engage in forex margin trading through au Kabucom Securities, speculating on the price movements of different currency pairs.

10. Futures/Options Trading: au Kabucom Securities provides access to futures and options trading, allowing investors to trade contracts based on underlying assets such as commodities, indices, or currencies.

11. Bonds (Foreign Bonds): au Kabucom Securities offers the opportunity to invest in foreign bonds, providing diversification and potential fixed-income returns.

12. Foreign Currency Denominated MMF: au Kabucom Securities facilitates investments in foreign currency-denominated money market funds, which provide short-term liquidity and potential currency exposure.

13. CFD (Share 365): au Kabucom Securities offers contracts for difference (CFDs) specifically for shares, allowing investors to speculate on the price movements of shares without owning the underlying asset.

au Kabucom Securities did not say what kind of accounts were offered. Other traders, such as AMarkets, are much better, which offer a total of 4 account types, including crypto, fixed, standard, and ECN, with an Islamic account option for traders who adhere to Islamic rules on trading, catering to diverse needs of various traders.

To open an account with au Kabucom Securities, you can follow these general steps:

1. Visit the au Kabucom Securities website: Go to https://kabu.com/.

2. Navigate to the account opening section: Look for the “Account Opening” option on the website. It is typically located in the main menu or prominently displayed on the homepage.

3. Choose the type of account: Select the appropriate account type for your requirements.

4. Start the application process: You may be directed to an online application form or prompted to download and fill out a physical application form. Provide the necessary details accurately and completely. This typically includes personal information, contact details, employment information, and financial information. Follow the instructions provided and ensure all required fields are filled in.

5. Agree to terms and conditions: Read and understand the terms and conditions of opening an account with au Kabucom Securities. If you agree to the terms, confirm your acceptance by checking the appropriate box or signing the physical application form.

6. Review and submit: Before submitting your application, review all the provided information to ensure its accuracy. Make any necessary corrections or adjustments. Once you are satisfied, submit the application form through the online submission process or by mailing it to the designated address.

7. Account verification and approval: After submitting your application, au Kabucom Securities will review your information and documents. Once your application is approved, you will receive confirmation and instructions on how to fund your account.

au Kabucom Securities offers commission-free forex trading, where the trading cost is incorporated into the spreads. Here are the approximate spreads for some currency pairs:

- USD/JPY: As low as 0.2 pips

- EUR/JPY: From 0.5 pips

- GBP/JPY: From 1 pip

- AUD/JPY: From 0.6 pips

- CAD/JPY: From 2.8 pips

It's important to note that spreads may vary depending on market conditions, liquidity, and other factors. The figures provided are approximate and subject to change. It's always a good idea to check the current spreads on the au Kabucom Securities website or contact their customer support for the most accurate and up-to-date information.

au Kabucom Securities provides a range of useful tools for different types of trading activities. For cash stock and margin trading, the following tools are available:

1. Futures/Options Board: A tool that displays information and data related to futures and options trading, allowing users to analyze market trends and make informed trading decisions.

2. Flash: This tool provides real-time market data, including stock prices, charts, and news updates, enabling traders to stay up to date with the latest market movements.

3. Margin Simulator: A simulator that allows users to calculate and simulate margin requirements for margin trading, helping traders plan their positions and manage risk.

4. Destination OP Navigation: A navigation tool specifically designed for options trading, providing users with access to various options strategies and information to support their trading decisions.

5. Bond Simulator: This simulator enables users to simulate bond trading scenarios, helping them understand bond market dynamics and test different investment strategies.

6. 365CFD Simple Chart: A simplified charting tool specifically for CFD (Contract for Difference) trading, providing basic charting features to analyze CFD instruments and monitor price movements.

For futures, options trading, and other activities, au Kabucom Securities offers additional tools such as:

1. au Kabucom FX Navi: A comprehensive tool for forex trading, providing access to real-time forex market data, charting tools, and trading functions.

2. au Kabucom FX for iPhone/Android: A mobile application specifically designed for forex trading, offering convenience and flexibility to trade on the go using smartphones.

3. App-Recommended-Smartphone Light (simplified version): A simplified version of the au Kabucom Securities trading application, designed for users who prefer a streamlined and user-friendly trading experience.

Au Kabucom Securities provides customers with five convenient methods for depositing funds into their accounts. These methods include Net transfer, Account transfer, Direct debit (automatic debit), Direct debit (real-time fund transfer), and Direct debit (automatic debit from other financial institutions). These options offer flexibility and ease of use for customers to deposit funds according to their preferences and convenience.

When it comes to withdrawals, customers can withdraw amounts starting from 1,000 yen or more in 1 yen increments, with a maximum withdrawal limit of up to 10 billion yen. However, if customers have set up an account transfer contract with au Jibun Bank, they can withdraw amounts starting from 1 yen or more in 1 yen increments, with a maximum withdrawal limit of up to 100 million yen.

These deposit and withdrawal options provide customers with flexibility and accessibility to manage their funds effectively within the specified limits. Whether it's depositing funds for trading or withdrawing profits, Au Kabucom Securities strives to offer convenient and efficient services to meet the financial needs of their customers.

Inquire by email:

au Kabucom Securities offers several customer support options. For customers who do not have an account, they can make inquiries by email. The company aims to respond as quickly as possible and requests customers to send their inquiries to the following email address: cs@kabu.com.

Customers who have an account:

For customers who have already opened an account with au Kabucom Securities, they can use the “E-mail inquiry” form located on the “Support” page, accessible from the top right of the My Page section after logging in. By filling out the form and submitting it, they can send their inquiries to the company.

Inquire by phone:

Customers who do not have an account can make inquiries by phone. They need to follow the voice guidance and press the appropriate number. The phone numbers to dial are:

- Mobile/IP phone starting with 0120-390-390

- Mobile/IP phone starting with 05003-6688-8888

The operator reception is available from 8:00 to 16:00 on weekdays, excluding year-end and New Year holidays.

Au Kabucom Securities offers a range of educational resources to support and empower their customers in making informed investment decisions. These resources are designed to enhance customers' understanding of the market, investment strategies, and industry trends.

One of the educational resources provided is a collection of informative movies, events, and face-to-face seminars. Au Kabucom Securities also provides investment information and news through their Investment Information Office. By keeping customers informed about market trends, they can make more informed decisions about their investment portfolios.

To further support customers, Au Kabucom Securities offers guides and investment courses. These resources are designed to provide step-by-step instructions, explanations of investment concepts, and practical guidance for customers who are new to investing or looking to expand their investment knowledge.

Additionally, customers can access reports and utilize social networking services (SNS) provided by Au Kabucom Securities.

Overall, Au Kabucom Securities' educational resources encompass a wide range of tools and platforms, including movies, events, seminars, an Investment Information Office, investment guides and courses, reports, and SNS. These resources aim to equip customers with the knowledge and information needed to make informed investment decisions and navigate the financial markets effectively.

In conclusion, au Kabucom Securities is a legitimate online brokerage company operating under the regulation of the Financial Services Agency (FSA) in Japan. As part of the Mitsubishi UFJ Financial Group (MUFG Group), it offers a wide range of tradable assets and financial services. The company provides various trading products, including stocks, margin trading, IPO/PO participation, ETFs/ETNs/REITs, investment trusts, forex margin trading, futures/options trading, bonds, foreign currency-denominated MMFs, and CFDs. The trading platforms, au Kabucom FX Navi and au Kabucom FX for iPhone/Android, cater to different trading needs. The company supports customer inquiries through email and phone, and multiple payment methods are available. Educational resources such as informative movies, events, seminars, investment guides and courses, reports, and SNS are offered to enhance customers' investment knowledge. While the company's advantages include its regulation by the FSA, diverse product offerings, and educational resources, a notable disadvantage is the lack of information regarding specific account types. Overall, au Kabucom Securities provides a legitimate and comprehensive platform for individuals interested in online financial trading and investment.

Q: Is au Kabucom Securities a legitimate company?

A: au Kabucom Securities is a genuine online brokerage company operating under the regulation of the Financial Services Agency (FSA) in Japan.

Q: What trading platforms does au Kabucom Securities offer?

A: au Kabucom Securities provides the au Kabucom FX Navi platform for forex trading and the au Kabucom FX for iPhone/Android as a mobile app for trading convenience.

Q: What types of assets can be traded on au Kabucom Securities?

A: au Kabucom Securities offers a diverse range of tradable assets, including cash stock, margin trading, petit stock, US stocks, mutual funds, NISA, forex (FX), CFDs, and futures.

Q: What are the customer support options provided by au Kabucom Securities?

A: au Kabucom Securities offers customer support via email and phone. Customers can send inquiries by email to cs@kabu.com or make inquiries by phone using the provided phone numbers.

Q: What are the available payment methods for au Kabucom Securities?

A: au Kabucom Securities offers payment methods including net transfer, account transfer, direct debit (automatic debit), direct debit (real-time fund transfer), and direct debit (automatic debit from other financial institutions).

Q: Are there different account types offered by au Kabucom Securities?

A: The specific account types offered by au Kabucom Securities are not mentioned.

| Company Name | ZFX |

| Registered Country/Region | London, UK |

| Founded in | 2010 |

| Regulation | FCA, FSA (Offshore) |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Max. Leverage | 1:2000 |

| Spread | From 1.3 pips (Standard account) |

| Trading Platforms | ZFX mobile app, MT4 Web Trader, MT4 for Windows, Mac and Android & ios |

| Minimum Deposit | $50 |

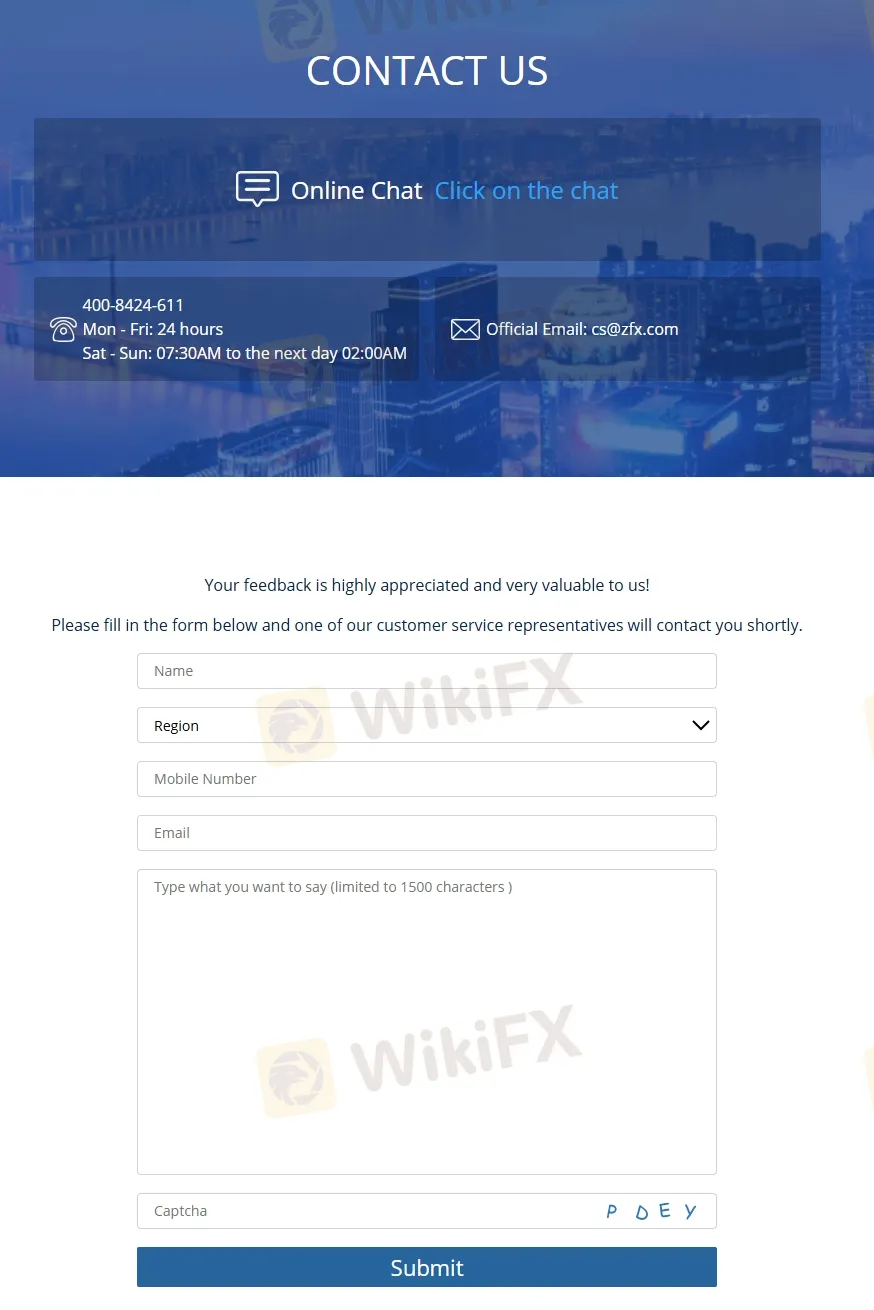

| Customer Support | Mon - Fri: 24 hours, Sat - Sun: 07:30 AM to the next day 02:00 A |

| Online chat, contact form | |

| Phone: 400-8424-611 | |

| Email: cs@zfx.com | |

| Social media: Facebook, Instagram, LinkedIn, Twitter | |

| Regional Restrictions | Residents of the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries are not allowed. |

Zeal Group of Companies, often referred to collectively as the Zeal Group, is a conglomerate of fintech corporations and regulated financial institutions that trade under the name ZFX. The group specializes in providing liquidity solutions for various types of assets in regulated markets and is backed by exclusive technology. Furthermore, the Zeal Group operates globally, combining with their multi-asset specializations and regulatory frameworks, solidifies their position as a competitive player in the financial industry.

ZFX is a broker that offers several advantages and disadvantages to traders.

| Pros | Cons |

| • Regulated by the FCA | • No MT5 platform available |

| • Multiple account types available | • No Islamic account option for Muslim traders |

| • Demo accounts available | • Lack of info on deposits and withdrawals |

| • Low minimum deposit requirement for the Mini Trading Account | • Regional restrictions |

| • Wide range of funding options | |

| • MT4 and proprietary trading platform supported | |

| • Copy trading available | |

| • Multi-channel support |

On the positive side, ZFX is a regulated broker, providing traders with demo accounts option, which is beneficial for beginner traders who want to practice their trading strategies before trading with real money. In addition, ZFX offers competitive trading conditions and low minimum deposit requirement through the popular MetaTrader4 trading platform.

On the negative side, no MT5 platform and no Islamic account option for Muslim traders. And ZFX doesn't reveal any info on deposits and withdrawals. Additionally, the broker does not provide services for residents of certain countries such as the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries.

ZFX is a regulated broker. Its company name is Zeal Capital Market (UK) Limited, and it is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration No. 768451. The FCA is one of the most reputable regulatory bodies in the world, and its strict regulations ensure that ZFX adheres to high standards of transparency and fairness.

ZFX's other entity, Zeal Capital Market (Seychelles) Limited, is authorized and offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number: SD027.

Additionally, ZFX ensures the safety of its clients' funds by keeping them fully segregated in a designated client bank account. This means that the clients' funds are kept separate from ZFX's operating funds. In the event that the company faces financial difficulties or becomes insolvent, the funds in these client accounts cannot be used to meet the liabilities of the company. This measure provides an added layer of security for ZFX clients, ensuring their capital cannot be used for any other purposes aside from their trading activities.

ZFX provides a comprehensive range of market instruments, catering to diverse trading preferences and strategies. This includes major asset classes such as forex, where traders can engage in currency trading across major, minor, and exotic pairs. For those interested in the stock market, ZFX offers the ability to trade stocks from leading global companies, allowing traders to tap into corporate performance and stock market trends.

Additionally, ZFX includes indices trading, which aggregates the performance of a number of stocks representing a segment of the stock market, providing a broader market exposure. Commodities are also available, offering opportunities to trade in essential goods such as oil and gold, which are often used as hedge investments against inflation or currency devaluation.

Furthermore, ZFX has embraced the growing interest in digital currencies by including cryptocurrencies in their offerings, thus allowing traders to speculate on the highly volatile crypto markets. Overall, ZFX's diverse selection of trading instruments ensures that traders have ample opportunities to diversify their portfolios and explore various market dynamics.

Apart from demo accounts, ZFX offers three types of trading accounts, namely Mini Trading, Standard Trading, and ECN Trading accounts. Each account has its own unique features and advantages, catering to different levels of traders with varying trading styles and preferences.

| Account Type | Minimum Deposit |

| Mini | $50 |

| Standard STP | $200 |

| ECN | $1000 |

| Pros | Cons |

| • Variety of account types to choose from | • Limited features in the Mini account |

| • Low minimum deposit requirement for the Mini account | • High minimum deposit requirement for the ECN account |

| • Access to high leverage for all account types | • No Islamic account option available |

Opening an account with ZFX is a simple and straightforward process that can be completed in just a few steps.

The maximum leverage offered by ZFX is up to 1:2000 and the leverage amount may vary depending on the account type and trading instrument. Additionally, ZFX operates on a tiered margin system, where the leverage is determined based on account equity. For accounts with equity between $0 and $3,000, the maximum leverage is 1:2000. For equity between $3,001 and $10,000, the maximum leverage is 1:1000. More detailed info on leverage can be found in the screenshot below:

ZFX says it offers competitive spreads and commissions on its trading instruments.

| Account Type | Spreads | Commissions |

| Mini Trading | From 1.5 pips | N/A |

| Standard Trading | From 1.3 pips | |

| ECN Trading | From 0.2 pips |

For the Mini Trading account, the minimum spread for forex pairs is 1.5 pips. The Standard Trading account has a minimum spread of 1.3 pips for forex pairs. The ECN Trading account has a minimum spread of 0.2 pips for forex pairs. However, no specific info on commissions is revealed openly.

ZFX offers the popular trading platform MetaTrader 4 (MT4), which is widely recognized in the forex industry for its user-friendly interface and advanced trading tools. MT4 provides access to various order types, technical analysis tools, and customization options, making it suitable for both novice and experienced traders. In addition, ZFX offers mobile versions of the MT4 platform for both iOS and Android devices, enabling traders to access the markets from anywhere, at any time.

ZFX also provides a mobile application for its clients, ensuring they can trade on the go. This ZFX Mobile App offers access to all the major features of the trading platform and enables clients to manage their portfolio, place trades, and monitor the markets from their mobile device.

The mobile app can be a valuable tool for traders who need the flexibility to trade anywhere and anytime, while still having access to key functionalities of the platform. Before using the app, make sure it is downloaded from an official source like the App Store or Google Play to ensure security and authenticity.

ZFX offers a Copy Trade feature, which is great news for both beginner and busy traders. Copy trading, also known as social trading, allows traders to automatically copy the trades of experienced and successful traders. This can help beginners to learn trading strategies from experienced traders, and help busy traders to automate their trading. By using the Copy Trade feature, you can potentially increase your chances of making profitable trades.

ZFX is committed to providing an extensive educational framework to support both novice and experienced traders through their A-to-Z Academy, which offers comprehensive learning resources designed to master trading from the basics to advanced strategies. This initiative underscores ZFX's dedication to empowering its clients with the knowledge needed to navigate the financial markets confidently.

Additionally, ZFX enhances trader support with a 24/7 Help Center, serving as a constant trading support hub where traders can obtain assistance at any time.

The platform also features a detailed Glossary, which acts as a valuable dictionary for demystifying complex trading terminology, making the trading language more accessible to everyone.

Moreover, their FAQ section addresses common queries related to trading mechanics, account management, funding procedures, withdrawals, and specific product details.

Collectively, these educational resources equip ZFX traders with a solid foundation of knowledge and continuous support, facilitating a well-rounded and informed trading experience.

ZFX provides robust customer support with extensive availability and multiple communication channels to ensure that traders can receive assistance whenever needed. Operating hours extend throughout the week, with round-the-clock support from Monday to Friday and extended hours over the weekend from 07:30 AM to 02:00 AM the next day, accommodating traders across different time zones.

Traders can reach out via online chat for immediate responses, use the contact form for less urgent inquiries, or call directly through the phone number 400-8424-611 for personalized assistance. Additionally, ZFX can be contacted through email at cs@zfx.com for comprehensive support.

The broker also maintains a strong presence on several social media platforms including Facebook, Instagram, LinkedIn, and Twitter. This multi-faceted approach ensures that ZFX's clients receive timely and effective support, enhancing their trading experience.

Overall, ZFX is a reputable option for traders looking to access the financial markets. The broker's maximum trading leverage of 1:2000, based on account equity, is one of the highest in the industry and can provide traders with significant opportunities for profit. Additionally, competitive spreads and a choice of popular MT4 trading platforms further strengthen ZFX's position as a reliable broker.

| Is ZFX regulated? |

| Yes. It is regulated by FCA and FSA (Offshore). |

| At ZFX, are there any regional restrictions for traders? |

| Yes. It does not provide services for residents of certain countries such as the United States of America, Canada, Egypt, Iran and North Korea (Democratic People's Republic of Korea). |

| Does ZFX demo accounts? |

| Yes. |

| Does ZFX offer industry leading MT4 & MT5? |

| Yes. It supports MT4 and ZFX Mobile App. |

| What is the minimum deposit for ZFX? |

| $50 for the Mini Trading account, while higher for other account types. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive kabu and zfx are, we first considered common fees for standard accounts. On kabu, the average spread for the EUR/USD currency pair is -- pips, while on zfx the spread is From 0.2.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

kabu is regulated by FSA. zfx is regulated by FCA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

kabu provides trading platform including -- and trading variety including --. zfx provides trading platform including ECN,Standard STP,Mini and trading variety including --.