No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between WELTRADE and Charterprime ?

In the table below, you can compare the features of WELTRADE , Charterprime side by side to determine the best fit for your needs.

EURUSD: 0.1

XAUUSD: 1.1

Long: -16

Short: -7.5

Long: -44.57

Short: -30

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of weltrade, charter lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| WELTRADE Review Summary in 10 Points | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSCA (exceeded) |

| Market Instruments | forex, Index CFDs, commodities, stock CFDs, metals and digital currencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | Floating from 0.5 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $1 |

| Customer Support | 24/7 live chat, phone, email |

Established in 2006, WELTRADE is an online CFDs broker incorporated in Saint Vincent and the Grenadines and regulated in Belarus that provides its clients with the worlds most widely-used MetaTrader4 and MetaTrader5 trading platforms, flexible leverage up to 1:1000, floating spreads on various tradable assets, a choice of four different live account types, as well as auto-trading service and 24/7 customer support service.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

WELTRADE has several advantages, such as a variety of trading instruments, flexible leverage options, and a range of account types suitable for traders at different levels. The broker also provides a range of trading platforms and tools, as well as 24/7 customer support.

However, the negative reviews from some customers regarding withdrawal issues and scams are concerning. Additionally, the lack of valid regulatory license may be a cause for caution. Traders should always exercise caution when selecting a broker and conduct thorough research before investing.

| Pros | Cons |

| • Negative balance protection | • Exceeded FSCA license |

| • Multiple account types to choose from | • Negative reviews and reports of scams |

| • Flexible leverage options | • Clients from the USA, Canada, EU, Belarus and Russia are not accepted |

| • Low spreads with no commissions | |

| • MT4 and MT5 supported | |

| • Low minimum deposit ($1) | |

| • Multiple deposit and withdrawal methods | |

| • 24/7 customer support |

There are many alternative brokers to WELTRADE depending on the specific needs and preferences of the trader. Some popular options include:

CMC Markets - A reliable broker with a long history and competitive pricing.

FOREX TB - A broker with a wide range of trading instruments and a user-friendly platform.

GMO - A well-known Japanese broker with with a strong focus on technology and innovation.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Currently, WELTRADE is regulated in Belarus, holding a Retail Forex License authorized by the National Bank of the Republic of Belarus (NBRB) under license no. 192727233.

WELTRADE offers a diverse range of market instruments to trade including Forex, metals, commodities, index CFDs, and CFDs for digital instruments such as Bitcoin, Litecoin, and Ethereum. The Forex instruments include a variety of major, minor, and exotic currency pairs, with competitive spreads and high leverage options available. The commodity markets available to trade include precious metals like gold and silver, as well as energy products such as oil and gas.

Furthermore, traders can also access a variety of CFDs on popular stock indices from around the world. WELTRADE's offering of digital instrument CFDs allows traders to participate in the growing cryptocurrency market with competitive conditions.

Weltrade provides access to unique SyntX trading instruments that simulate the price movements of real-world assets while offering enhanced features. Unlike traditional stock or forex trading, SyntX allow traders to leverage their positions up to 1:10000 and benefit from spreads that are 5-10 times tighter compared to standard instruments. These synthetic instruments are designed to exhibit volatility up to 8 times higher than even highly volatile assets like gold, creating opportunities for increased portfolio returns. Additionally, SyntX markets operate around the clock, enabling traders to act on market insights at any time without being constrained by traditional trading sessions.

WELTRADE offers four account types tailored for various traders: Micro, Pro, Premium and Syntx. The Micro account, tailored for beginners, requires just a $1 minimum deposit and provides access to forex, metals, commodities, and indices with floating leverage up to 1:1000 on the MetaTrader 4/5 platforms. The Pro account, considered the best choice, requires a $100 deposit and adds stocks, exotics, and tighter spreads from 0.5 pips. The Premium account, for advanced traders, has a $25 minimum deposit, similar instrument offering, but executes slightly slower at 0.8 seconds. Additionally, the SyntX account provides access to unique SyntXes products with leverage up to 1:10000 on the MetaTrader 5 platform with a $1 minimum deposit, suitable for any trader type.

First-time Bonus

Weltrade incentivizes new clients by providing a deposit bonus on their first funded account. To qualify, traders simply need to register on the trading platform, open an account type suited to their needs, and make an initial deposit of at least $25. The broker will then double the deposited amount, providing traders with a bonus equal to 100% of their first deposit. This allows them to instantly trade with a larger capital base. To withdraw bonus profits, clients must meet specified trading volume requirements, though the initial deposit can be withdrawn at any time. By offering this generous bonus, Weltrade aims to boost its new clients' potential for returns while giving them the flexibility to trade a wider range of assets and strategies from the start.

100% Credit Bonus

For clients opening an MT5 trading account, Weltrade provides an enticing 100% credit bonus incentive. After signing up and depositing a minimum of $200 or €200, traders receive a bonus credit of an equal amount, effectively doubling their initial margin and enabling them to open higher volume positions from the start. This bonus is designed to amplify a trader's leverage and profit potential.

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Micro or Premium account can enjoy flexible leverage ranging from 1:33 to 1:1000, while the Pro account with the leverage of 1:1-1:1000. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads are influenced by what type of accounts traders are holding. WELTRADE reveals that the spread on the Micro and Premium accounts is floating from 1.5 pips, while the clients on the Pro account can experience floating spreads from 0.5 pips. All charging no commissions. It is important for traders to understand the different spread and commission structures before opening an account with WELTRADE.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| WELTRADE | From 0.5 pips | None |

| CMC Markets | From 0.7 pips | None |

| FOREX TB | From 0.5 pips | None |

| GMO | From 0.8 pips | None |

Note: Spreads can vary depending on market conditions and volatility.

MetaTrader 4 & MetaTrader 5

Weltrade offers the industry-leading MetaTrader 4 platform, providing traders with cutting-edge trading and analytical technologies. MT4 comes packed with features like 9 timeframes, over 1,700 trading robots, 2,100+ technical indicators, and timely notifications. It supports 3 execution modes and is available on iOS, Android, Windows, Mac OS, and Web Terminal, ensuring traders can access the markets from virtually anywhere.

The broker also provides the latest MetaTrader 5 multi-asset platform, which adds support for hedging positions in the same instrument. MT5 boasts 5 execution modes, a multi-currency tester, over 2,500 ready-made algorithmic applications, and 6 types of pending orders. Like MT4, it is available across iOS, Android, Huawei, Windows, Mac OS, and Web Terminal, catering to traders' needs for flexibility and accessibility.

Weltrade App

In addition to the MetaTrader platforms, Weltrade provides its own proprietary trading application called the Weltrade App. This app allows clients to conveniently access their accounts, monitor positions, place trades, and stay updated on market movements directly from their mobile devices. The Weltrade App offers a user-friendly interface optimized for on-the-go trading, providing an alternative solution for those who prefer a native trading experience outside of the MetaTrader suite. By offering this app alongside MT4 and MT5, Weltrade ensures its clients have access to multiple robust trading platforms catered to their preferences.

Weltrade provides its clients with access to popular copy trading solutions. To start copy trading, clients simply need to open a trading account, fund their CopyWallet, and access the Copy Trading environment. From there, they can browse through a range of available trading strategies and select the trader they wish to copy based on factors such as historical performance, risk levels, and investment approach.

| Broker | Trading Platforms |

| WELTRADE | MT4, MT5 |

| CMC Markets | CMC Next Generation, MT4, MT5, Stockbroking platform |

| FOREX TB | MT4, MT5, WebTrader, MobileTrader |

| GMO | Z.com Trader, MT4, FXBook Mobile, Z.com Trader Mobile, FXBook Web |

Note: This table is subject to change as brokers may add or remove trading platforms over time.

In addition to its trading platforms, WELTRADE provides traders with some trading tools to assist with their trading decisions. One of these tools is the Trading Calculator, which enables traders to estimate their potential profits or losses on a trade before executing it.

The Economic Calendar is also available to traders, which shows upcoming economic events and releases and their expected impact on the markets. These tools can be useful for traders who want to keep up with the latest market news and make informed trading decisions.

WELTRADE accepts deposits and withdrawals with credit/debit cards, like Visa and MasterCard Skrill, Neteller, digital currencies, Perfect Money, Indonesia Local Bank, and Fasapay,making it convenient for traders from different countries. The minimum deposit amount depends on the terms of the payment system.

| WELTRADE | Most other | |

| Minimum Deposit | $1 | $100 |

Deposits via Indonesia Local Bank can be processed in 24 hours, while other deposits are instant. All withdrawal requests are said to be processed within 30 minutes and the broker supports 24/7 withdrawals. More details can be found in the below screenshots.

However, it is important for traders to carefully review the terms and conditions of each payment method, as well as any potential fees or limitations that may apply. More details can be found in the below screenshots.

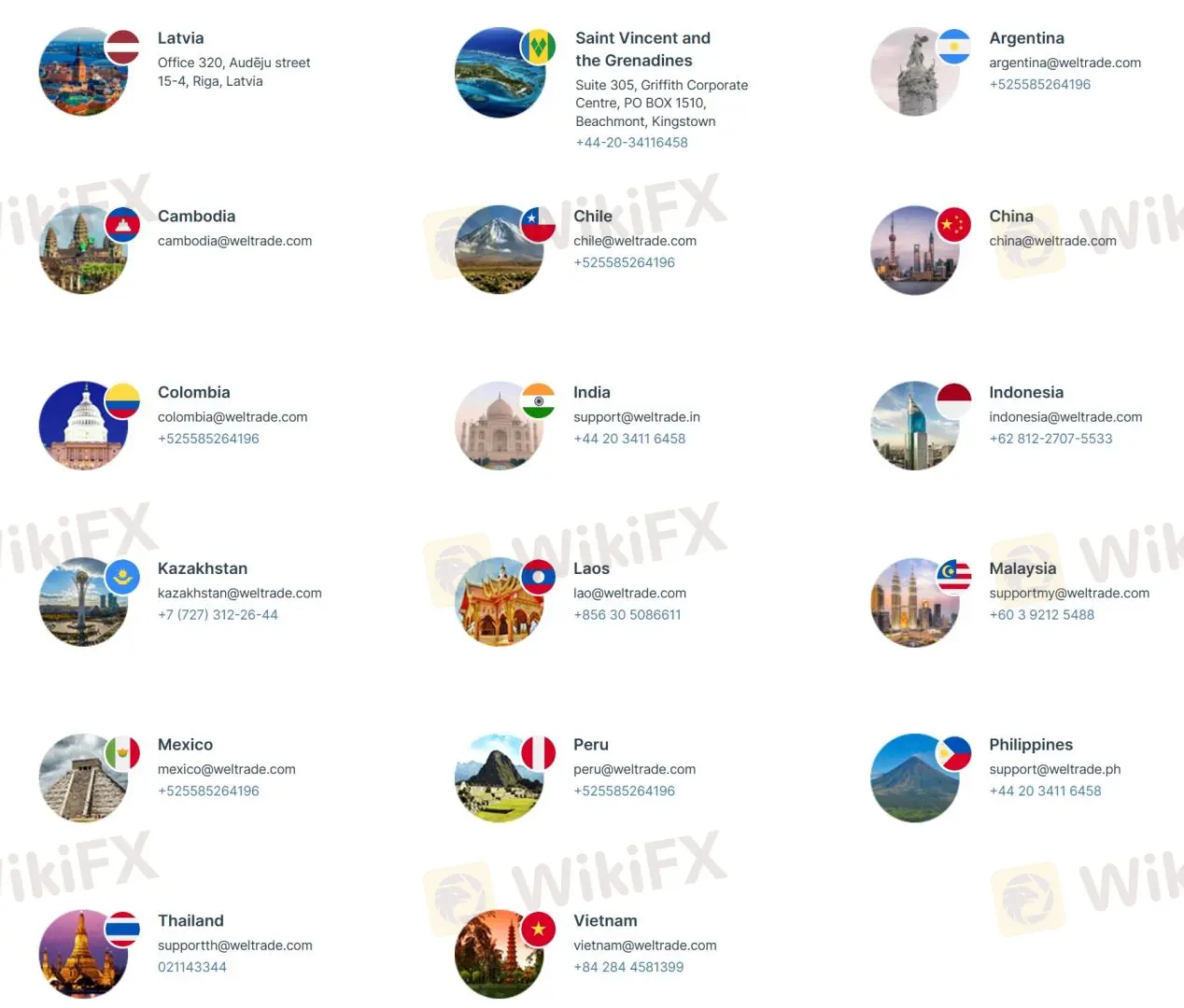

It is a good sign that WELTRADE offers multiple ways to get in touch with their customer support team, including 24/7 Live chat, phone, email, online messaging, or request a callback. The broker also has a presence on popular social media platforms, including Twitter, Facebook, Instagram and Line, which may be convenient for some traders. It should be noted that the broker is registered in Saint Vincent and the Grenadines, which is not a heavily regulated jurisdiction, so traders should exercise caution and do their due diligence before investing.

Overall, WELTRADE's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 multi-channel support available | • Registered address is shady |

| • Active presence on social media platforms for easy communication | |

| • Support for multiple languages |

Note: These pros and cons are subjective and may vary depending on the individual's experience with WELTRADE's customer service.

WELTRADE offers a range of educational resources to help traders improve their knowledge and skills. The broker provides market news and analytics to keep clients updated on the latest market trends and developments. In addition, WELTRADE offers training and seminars to help traders learn the basics of trading, as well as more advanced strategies. The MetaTrader guide is also available for traders to learn how to use the trading platform effectively. These educational resources can help traders make better-informed trading decisions and improve their overall trading performance.

It is important to exercise caution when investing with any broker, and this includes WELTRADE. It is concerning to see reports of scams and issues with withdrawals from some users. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Based on the information available, WELTRADE is a Forex and CFD broker offering a range of trading instruments, account types, and platforms. It has some attractive features such as competitive spreads, a wide range of payment methods, and negative balance protection.

However, there are also some concerns raised by clients regarding withdrawal issues and scams. Additionally, the broker is registered in Saint Vincent and the Grenadines, which is a less regulated jurisdiction compared to major financial centers. Traders should exercise caution and conduct their own research before investing with WELTRADE or any other broker.

Is WELTRADE regulated?

No. WELTRADE holds an exceeded Financial Sector Conduct Authority (FSCA) license.

At WELTRADE, are there any regional restrictions for traders?

Yes. Not for residents of the USA, Canada, EU, Belarus and Russia and other not-supported (restricted) countries.

Does WELTRADE offer demo accounts?

Yes. Demo accounts are offered on the WELTRADE platform.

Does WELTRADE offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are supportable.

Is WELTRADE a good broker for beginners?

No. WELTRADE is a good choice for beginners, as it provides the micro account, demo account, user-friendly MT4 trading platform and rich educational resources.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | ASIC |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Minimum Spreads | From 0.0 pips |

| Trading Platform | MT4 trading platform |

| Demo Account | Yes |

| Trading Assets | Forex, Precious Metals, Indices CFDs, and Spot C ommodities. |

| Payment Methods | Bitcoin, USDT, Wire Transfer, Skrill, Neteller, Local Gateway |

| Customer Support | Phone & Email Support |

General Information & Regulation

Charterprime is a global financial and foreign exchange brokerage group established in 2012, headquartered in Sydney, Australia. The company adopts the STP processing system as its business model and is authorized and regulated by the ASIC in Australia, with regulatory license number 421210.

Markets Instruments

Financial instruments can be traded online with Charterprime include forex, precious metals, indices CFDs, and spot commodities.

Charterprime Account Types

Three account types are offered by Charterprime: the Variable account, the ECN account and the Swap-free account. The minimum initial deposit for three account is $100, the reasonable amount for most regular traders to get started.

Charterprime Leverage

CharterPrime as an Australia and New Zealand broker together with its obligations to local regulation still allows high leverage. The maximum trading leverage available by this broker is up to 1:500 for forex instruments and major currency pairs available for retail traders.

Spreads & Commissions

The average spread of the EURUSD for the Floating Spread Account is 2.0, the average spread of the EURGBP 1.9, and the average spread of the AUDUSD is 2.2. The average spread of ECN accounts for the EURUSD is 0.5, the average spread for the EURGBP 0.8, and the average spread for the AUDUSD is 0.7. The average spread of Gold Price in US dollar for Floating Spread Accounts is 3.8, and the average spread for Silver Price in US dollar is 3.4. The average spread of Gold Price in US dollar for ECN accounts is 1.5, and the spread for Silver Price in US dollar is 3.6. See the following swap chart:

| Swap | ||

| Product | Long | Short |

| AUDCAD | -0.99 | -1.47 |

| AUDCHF | 0.83 | -3.01 |

| AUDJPY | -0.73 | -1.93 |

| AUDNZD | -2.93 | -0.21 |

| AUDUSD | -1.34 | -1.11 |

| EURUSD | -4.56 | 0.43 |

Trading Platform

The MT4 trading platform used by Charter has powerful trading functions and analytical capabilities. Apart from Multiple order execution, it enables traders to conduct complete and flexible tradings. At the same time, it also integrates market charts, technical analysis, and order transactions. Three functions are integrated, allowing users to quickly determine trends and determine the best entry and exit time. Besides, the company also provides a multi-account management model, which refers to a practical and convenient way to manage accounts on behalf of clients and manage multiple accounts simultaneously from a single interface. It can quickly execute a large number of customer orders as long as the management account clicks a button, and a large number of transactions can be automatically allocated to their respective customer accounts.

Virtual Private Server (VPS)

VPS, also known as Virtual Private Server, is a stand-alone server that runs 24 hours per day. Traders can log into a VPS with a computer or mobile device, without any pullback issues caused by network failure or any other factor that can affect their trading progress. A VPS is suitable for and mainly used by traders who employ automated strategies which require uninterrupted access to the market 24 hours a day.

Deposit & Withdrawal

Deposit and withdrawal methods support Bitcoin (deposit time taking 1 day, and the withdrawal time taking 3 days, and the minimum withdrawal amount is 100 US dollars), USDT (the stable value currency U.S. dollar (USD) token Tether USD launched by the Ether company, USDTfor short, 1USDT equals 1 U.S. dollar, deposit taking 1 day, withdrawal taking 3 days, deposit and withdrawal fees are both 5%), UnionPay (no charge for deposit and withdrawal, deposit time taking 1 day, withdrawal taking 3 days , the minimum amount of gold withdrawal is US$100), wire transfer (the deposit and withdrawal taking 3-5 days, the withdrawal fee is 40 US dollars, and the minimum amount of withdrawal is 100 US dollars), Skrill (deposit taking 1 day, the withdrawal taking 3 Day, no deposit fee, withdrawal fee is 1%, the minimum amount for withdrawal is 100 USD), Neteller (Deposit time taking 1 day, withdrawal taking 3 days, no deposit fee, withdrawal fee is 2%, the maximum is 30 USD , The minimum withdrawal amount is US$100), and Local Gateway (currently supported currencies are Thailand, Indonesia, the Philippines and Vietnam, deposit taking 1 day, withdrawal time taking 3 days, no deposit and withdrawal fees, and the minimum withdrawal amount is 100 US dollars).

Educational & Research Tools

There are no other educational resources provided by the broker apart from a baic glossary, FAQ, user and installation guiders fro the MT4 trading platform.

Additional research tools offered by CharterPrime consist of market news, updates and an economic calendar of featured events and data releases.

Customer Support

CharterPrime Customer Support team can be contacted within working hours through Live Chat, email or contact form.

Here are some contact details:

Telephone: +852 8175 6090

Email: enquiry@charterprime.com

Or you can also follow this broker on some social media platforms, such as Facebook, Twitter, Instagram and Linkedin.

Pros & Cons

| Pros | Cons |

| ASIC-regulated | Product portfolios are not that rich |

| Low minimum deposit requirement | No 7/24 customer support |

| MT4 trading platform | |

| VPS provided | |

| High leverage up to 1:500 |

Frequently Asked Questions

Is Charterprime regulated?

Charterprime is authorized and regulated by the ASIC in Asutralia under regulatory license number 421210.

Does Charterprime offer a demo account?

Yes, demo accounts are available with Charterprime.

What trading platform does CharterPrime provide?

CharterPrime makes the popular trading platform MT4 available.

What are CharterPrime's customer service hours?

The CharterPrime customer service team is available 24/5 from Monday to Friday.

Can I change my leverage with Charterprime?

Yes, leverage can be changed by contacting the Charterprime customer support team.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive weltrade and charter are, we first considered common fees for standard accounts. On weltrade, the average spread for the EUR/USD currency pair is from 0.5 pips, while on charter the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

weltrade is regulated by NBRB,FSC,FSCA. charter is regulated by FSPR,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

weltrade provides trading platform including Pro,Premium,Micro and trading variety including --. charter provides trading platform including Swap interest fee-free account,ECN account,Floating spread account and trading variety including --.