No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between CMCMarkets and LegacyFX ?

In the table below, you can compare the features of CMCMarkets , LegacyFX side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of cmc-markets, legacyfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Australia |

| Regulated by | FCA, FMA, MAS, IIROC |

| Year(s) of establishment | Above 20 years |

| Trading instruments | forex, indices, commodities, cryptos and stocks, treasuries, ETFs |

| Minimum Initial Deposit | $0 |

| Demo account | Yes |

| Maximum Leverage | Information not available |

| Minimum spread | 0.7 pips onwards for EURUSD |

| Trading platform | MT4 and its own platform CMC Markets Invest. |

| Deposit and withdrawal method | POLi, PayPal, credit and debit card, plus bank transfers. No cash or cheque. |

| Customer Service | 24/5, phone number, address, live chat, social medias |

| Fraud Complaints Exposure | No for now |

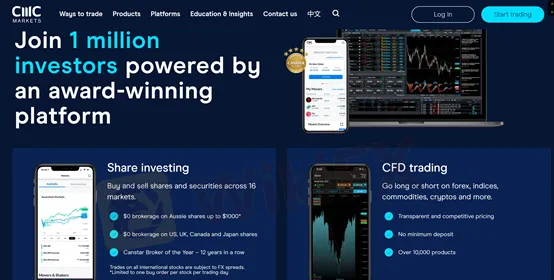

CMCMarkets is an established brokerage firm registered in Australia and regulated by FCA, FMA, MAS, and IIROC. With over 20 years of experience, they offer a wide range of trading instruments including forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs. Traders can access their services through the popular MT4 platform as well as CMC Markets Invest. CMCMarkets provides a flexible account structure with no minimum initial deposit requirement and offers a free demo account for practice trading. They have a strong customer support system, available 24/5, and provide various educational resources to assist traders in their financial journey.

CMC Markets is a globally recognized trading platform, rigorously regulated by several top-tier financial authorities including the Financial Conduct Authority (FCA) in the United Kingdom, the Financial Markets Authority (FMA) in New Zealand, the Canadian Investor Protection Fund (CIRO) in Canada, and the Monetary Authority of Singapore (MAS).

These regulations ensure that CMC Markets adheres to strict standards of market making and retail forex trading, offering a secure and transparent trading environment across multiple jurisdictions. This regulatory framework supports CMC Markets' commitment to providing safe and reliable trading services to its clients worldwide.

Pros of CMCMarkets:

Regulatory Compliance: Being registered in Australia and regulated by reputable authorities like FCA, FMA, MAS, and IIROC, CMCMarkets provides a sense of trust and security for traders.

Wide Range of Trading Instruments: With access to forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs, CMCMarkets offers a diverse portfolio for traders to choose from.

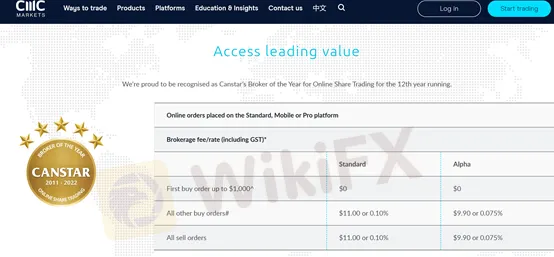

Flexible Account Options: CMCMarkets provides a variety of account types, including standard and alpha accounts, catering to different trading preferences and experience levels.

Free Demo Account: The availability of a free demo account allows traders to practice and familiarize themselves with the platform before risking real money.

Multiple Trading Platforms: CMCMarkets supports the widely used MT4 platform, known for its advanced features, as well as their proprietary platform CMC Markets Invest, offering versatility for traders.

Educational Resources: The company offers a comprehensive range of educational resources such as video tutorials, glossary, webinars, eBooks, podcasts, and news analysis to help traders enhance their knowledge and skills.

Customer Support: CMCMarkets provides 24/5 customer support through various channels, including phone, live chat, and social media platforms, ensuring prompt assistance and resolving queries effectively.

Cons of CMCMarkets:

Maximum Leverage Unknown: The lack of information regarding the maximum leverage offered by CMCMarkets can be a limitation for traders who rely on leverage as a trading strategy.

Limited Information on Spreads and Commissions: The absence of detailed information about spreads and commissions may make it challenging for traders to accurately assess the cost of trading on the platform.

Dormancy Fee: CMCMarkets charges a dormancy fee if there is no trading activity for 12 months, which may pose an additional cost for inactive accounts.

Merchant Fees for Deposits: Deposits made via credit or debit cards attract merchant fees, which can add to the overall transaction costs for traders.

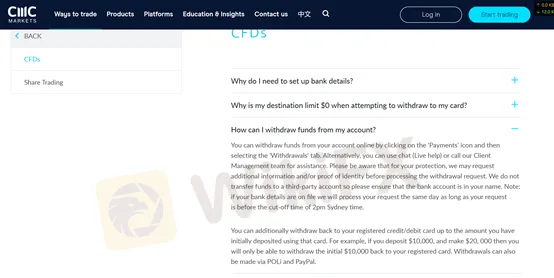

Withdrawal Restrictions: The limitation on withdrawing funds only up to the initial deposit amount on the registered card may restrict traders' flexibility in managing their funds.

Limited Availability of Information on Leverage, Deposits, and Withdrawals: The provided information lacks specific details regarding leverage options, minimum deposit requirements, and withdrawal processing times, which may require traders to seek additional clarification.

| Pros | Cons |

| Regulatory Compliance with FCA, FMA, MAS, IIROC | Maximum Leverage Unknown |

| Diverse Trading Instruments across multiple asset classes | Limited Information on Spreads and Commissions |

| Multiple Account Options for different trader needs | Dormancy Fee for inactivity over 12 months |

| Demo Account for risk-free practice | Merchant Fees for card deposits |

| Variety of Platforms including MT4 and proprietary platforms | Withdrawal Restrictions to initial card deposit amounts |

| Comprehensive Educational Resources | |

| Robust Customer Support available 24/5 |

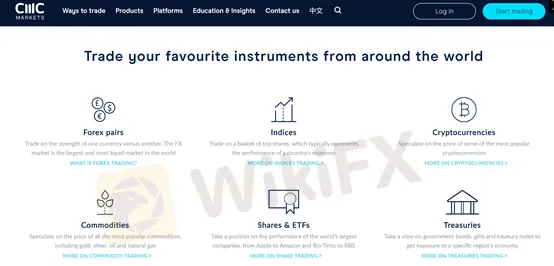

CMC Markets provides a diverse range of trading instruments to cater to the needs of different traders. With CFD trading, users have the flexibility to go long or short on a variety of assets including forex, indices, commodities, and cryptocurrencies. This allows traders to profit from both rising and falling markets, maximizing their trading opportunities. In addition, CMC Markets offers share investing, enabling users to buy and sell shares and securities across 16 markets. This allows for a comprehensive portfolio diversification and investment in different sectors and industries. Furthermore, CMC Markets provides access to treasuries and ETFs, allowing traders to trade and invest in these financial instruments.

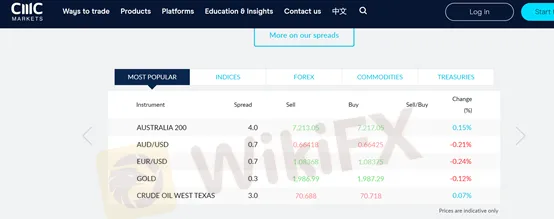

CMC Markets offers competitive spreads for major currency pairs, with a live spread form indicating indicative prices. However, it's important to note that spreads may vary, especially during volatile market conditions. The company adopts a transparent commission structure, with commissions varying depending on the specific instruments traded. Traders can refer to the provided information to determine the commission charges applicable to their trades. It is worth mentioning that commissions are subject to minimum charge requirements, such as the minimum commission charge of US$10 for US shares. Additionally, CMC Markets implements a dormancy fee for accounts with no trading activity for 12 consecutive months, based on the account currency. While this fee promotes account activity, traders who remain inactive may incur additional costs. Traders should carefully consider these factors and evaluate their trading strategies to effectively manage spreads, commissions, and other associated costs.

| Account currency | Monthly inactivity fee |

| AUD | 15 |

| USD | 15 |

| HKD | 100 |

| Country/market | Commission charge | Minimum commission charge |

| Australia | 0.09% | AUD 7.00 |

| UK | 0.08% | GBP 9.00 |

| US | 2 cents per unit | USD 10.00 |

| Austria | 0.08% | EUR 9.00 |

| Belgium | 0.10% | EUR 9.00 |

| Denmark | 0.08% | DKK 90.00 |

| Finland | 0.08% | EUR 9.00 |

| France | 0.06% | EUR 5.00 |

CMC Markets offers two live account types, Standard and Alpha, providing traders with options that suit their individual needs. The Standard account offers a unique advantage by providing zero brokerage fee for the first buy order up to $1,000. This feature allows traders to make their initial investment without incurring any brokerage costs. On the other hand, the Alpha account offers lower brokerage fees for most buy and sell orders, providing cost-saving opportunities for active traders. It is important to note that different account types may have specific eligibility criteria or minimum balance requirements, and traders should consider these factors when choosing an account type. Additionally, CMC Markets provides a free demo account, enabling traders to practice and familiarize themselves with the platform before opening a live account. Traders have the flexibility to select the account type that aligns with their trading preferences, taking advantage of the benefits offered by each option.

CMC Markets provides traders with two platform options: MT4 and CMC Markets Invest. MT4 is a widely recognized and popular trading platform known for its extensive range of technical indicators and automated trading tools. It offers a user-friendly interface and provides access to a diverse set of features. On the other hand, CMC Markets Invest is a proprietary platform specifically designed for CMC Markets clients. It offers seamless integration with other CMC Markets services and features, providing a cohesive trading experience. While MT4 has a larger community and third-party plugins, CMC Markets Invest may have a learning curve for new users and a smaller community. Traders can choose the platform that suits their preferences, whether they prefer the familiarity and customization options of MT4 or the integrated features of CMC Markets Invest.

The maximum leverage offered by CMCMarkets is currently unknown. While leverage can provide traders with several advantages, such as greater trading flexibility, potential for higher profits, increased market access, and enhanced trading opportunities, it also comes with certain disadvantages. One of the primary disadvantages is the increased risk exposure, as leverage magnifies both gains and losses. Traders need to exercise caution and implement proper risk management strategies to avoid significant losses. Additionally, the use of leverage requires a good understanding of the market and trading principles to make informed decisions.

The dimension of deposits and withdrawals with CMCMarkets offers several advantages and a few considerations to keep in mind. One of the advantages is the variety of funding options available, including credit/debit cards and bank transfers. The online withdrawal process is convenient, and funds can be withdrawn to registered credit/debit cards. Withdrawal requests are typically processed quickly, ensuring prompt access to funds. Additionally, the overall process is secure to safeguard user transactions.

The educational resources dimension at CMCMarkets offers a range of advantages to traders and investors. They provide a wide variety of educational materials, including videos, webinars, eBooks, podcasts, news, analysis, guides, and more. The availability of different formats ensures that users can choose the learning style that suits them best. Additionally, CMCMarkets has an official YouTube channel where users can find additional video content. The comprehensive resources, such as the glossary and FAQ section, help users understand key concepts and terms. The inclusion of news and analysis keeps users informed about market developments.

You may also visit their official YouTube channel to watch more videos. Here is a video about some basic knowledge that every trader should know.

The customer care dimension at CMCMarkets offers several advantages to users. Firstly, they provide 24/5 contact availability, ensuring that customers can reach out for support during weekdays. The dedicated phone lines for CFD and Share Trading inquiries allow for specialized assistance in each area. Multiple communication channels, including phone, social media platforms like Facebook, Twitter, LinkedIn, and YouTube, offer users flexibility in choosing their preferred method of contact. The convenient customer service hours for Share Trading align with market opening hours, enabling timely assistance. Additionally, the physical office address in Sydney provides customers with a sense of trust and security. CMCMarkets' active presence on popular social media platforms allows users to stay updated and engaged.

In conclusion, CMCMarkets is an Australia-registered company that has established itself as a reputable and regulated broker in the financial industry. With over 20 years of experience, they offer a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs. Traders have the flexibility to choose from different account types and access their platform through MT4 or their proprietary platform, CMC Markets Invest. The availability of a free demo account and extensive educational resources further enhance the trading experience for both novice and experienced traders. Customer support is readily available through various channels, ensuring prompt assistance and resolving queries effectively. However, the lack of information on maximum leverage, detailed spreads and commissions, as well as certain fees like the dormancy fee and merchant fees for deposits, could be considered as limitations.

How can I fund my CMCMarkets account?

You can fund your CMCMarkets account by using a credit or debit card or by transferring funds from your bank account. Please note that third-party payments are not accepted, and additional charges may apply for bank transfers from outside of Australia.

What are the trading platforms offered by CMCMarkets?

CMCMarkets provides two trading platforms: MT4 and their own platform called CMC Markets Invest. These platforms offer a range of features and tools to support your trading activities.

Is there a minimum initial deposit required to open an account with CMCMarkets?

No, CMCMarkets does not require a minimum initial deposit. You can start trading with any amount you are comfortable with.

Does CMCMarkets offer a demo account?

Yes.

Does CMCMarkets charge any fees for deposits or withdrawals?

CMCMarkets does not charge any fees for deposit or withdrawal operations. However, please note that payment systems may have their own fees, and internal currency conversion rates may apply.

| LegacyFX | Basic Information |

| Company Name | LegacyFX |

| Headquarters | Belarus |

| Regulations | Regulated |

| Tradable Assets | Currencies, stocks, indices, commodities, and cryptocurrencies |

| Payment Methods | International banks |

| Trading Platforms | MT5 trading platform |

| Customer Support | Email (info@legacyfx.by)Phone (+375 291788410) |

The Brand LegacyFX is an established broker providing a wide range of products and services for traders worldwide since 2017. It grants traders access to a broad spectrum of tradable assets, encompassing currencies, stocks, indices, commodities, and cryptocurrencies. Through its MT5 trading platform, LegacyFX provides users with a seamless and intuitive interface, known for its robust functionality and ease of use.

The company “AN All New Investments BY LLC” (operating under the LegacyFX brand) was registered on 12/14/2018 (UNP 193180778) with Company Registration number 193180778 (Certificate of the National Bank of the Republic of Belarus No. 17). The activities of AN All New Investments BY LLC are regulated by Decree of the President of the Republic of Belarus No. 231 dated June 4, 2015 “On the implementation of activities in the OTC Forex market”.

LegacyFX is regulated, operating under the supervision of the National Bank of the Republic of Belarus and licensed under number 193180778. It ensures that brokers operate legally, minimizing the risk of fraudulent activities and fostering a secure trading environment. Regulated brokers adhere to stringent financial reporting standards, offering investors transparent and dependable information to make informed decisions. However, while regulation enhances oversight and accountability, it does not entirely eliminate risks. Therefore, traders should maintain vigilance and exercise caution when participating in online trading activities.

LegacyFX offers a diverse range of trading instruments, providing traders with ample opportunities to diversify their portfolios and explore various markets. The platform utilizes the popular MetaTrader 5 platform, known for its advanced trading tools and user-friendly interface, enhancing the trading experience for users. Additionally, LegacyFX operates with regulatory oversight, providing clients with an added layer of security and peace of mind. However, the platform's website is currently inaccessible, which could pose challenges for users trying to access essential information or execute trades. Furthermore, high account minimums can be a burden to most traders, especially beginners.

| Pros | Cons |

|

|

|

|

|

Besides a good selection of currency pairs, traders can diversify their portfolio with indices, commodity CFDs, metals, cryptocurrency pairs, and stocks on LegacyFX platform.

There are four account options on offer: Silver, Gold, Platinum, and VIP. The Silver account is available from a minimum deposit of $500, the Gold account for a deposit of $5,000, $25,000 for the Platinum account, and the VIP account is yielded for deposits exceeding $50,000. Swap-free Accounts are available, but swap-free accounts are granted to all traders.

Leverage varies from 1:5 to 1:200 depending on the asset traded: Stocks – 1:5, Forex – 1:200, Metals – 1:100

Indices – 1:100, Commodities – 1:100, Cryptocurrencies – 1:5.

Traders can choose between fixed or variable spread accounts. Variable spreads for major forex pairs such as EUR/USD start at 1.6 pips with the Silver account. Spreads get tighter with the Gold and Platinum accounts, going down to 0.6 pips. Fixed spreads are around 3 pips for EUR/USD with the Silver account. All assets are commission-free, except for stocks where charges range from 0.15% to 0.45% depending on the account.

LegacyFX offers traders access to the MetaTrader 5 (MT5) trading platform, renowned for its advanced features and versatility. With the MT5 platform, traders can execute trades across various financial markets, including forex, stocks, indices, commodities, and cryptocurrencies.

The minimum deposit for a LegacyFX account is $500, while there is a maximum deposit of $10,000 with credit/debit cards. LegacyFX‘s website clearly states that withdrawals to credit cards can only be in the amount of the deposit from that particular card; the remainder will be wired to the client’s bank account. Clicking on Bank Wire Transfers returns the bank wire information, while all other buttons lead to a log-in screen. Legacy FX covers all deposit and withdrawal fees for transactions via major credit/debit cards, Skrill, Neteller, and bank wires above $200.

LegacyFX offers customer support through email at info@legacyfx.by and phone at +375 291788410.

In summary, LegacyFX offers traders a wide array of trading instruments and account types, coupled with the renowned MetaTrader 5 platform, fostering flexible and accessible trading opportunities. The platform operates under regulatory oversight, ensuring adherence to industry standards and bolstering investor confidence. However, the inability to access the website and the lack of clarity regarding account types may hinder the trading experience for some users. Traders are advised to proceed with caution, conduct thorough research, and verify information directly with LegacyFX to mitigate potential risks and ensure a safer trading journey.

Q: Is LegacyFX regulated?

A: Yes, LegacyFX is regulated by the National Bank of the Republic of Belarus and holds license number 193180778.

Q: What trading instruments are available on LegacyFX?

A: LegacyFX offers a diverse range of trading instruments, including currencies, stocks, indices, commodities, and cryptocurrencies.

Q: How can I contact LegacyFX's customer support?

A: You can contact LegacyFX's customer support via email at info@legacyfx.by or by phone at +375 291788410.

Trading online carries inherent risks, and there's a possibility of losing your entire investment capital. It's crucial to acknowledge these risks and understand that the information presented in this review may not always be up-to-date due to changes in the company's services and policies. Therefore, readers are encouraged to verify the information directly with the company before making any decisions. Ultimately, it's the responsibility of the reader to use the information provided in this review wisely and make informed decisions.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive cmc-markets and legacyfx are, we first considered common fees for standard accounts. On cmc-markets, the average spread for the EUR/USD currency pair is Currency pairs 0.7 pips, gold0.3 US dollars, crude oil 0.03 US dollars pips, while on legacyfx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

cmc-markets is regulated by FCA,FCA,FMA,BaFin,AMF,CIRO,MAS,ASIC,BaFin. legacyfx is regulated by NBRB.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

cmc-markets provides trading platform including Next Generation and trading variety including Forex, stocks, stock indexes, commodities, bonds, CFDs. legacyfx provides trading platform including VIP,PREMIUM,PLATINUM,GOLD,SILVER,BRONZE,STANDARD and trading variety including --.