No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ADSS and Hirose-fx ?

In the table below, you can compare the features of ADSS , Hirose-fx side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of adss, hirose-fx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered Country/Region | United Arab Emirates |

| Regulation | FCA |

| Minimum Deposit | $100 |

| Maximum Leverage | 1: 500 |

| Minimum Spreads | 1.9 pips on the EUR/USD pair |

| Trading Platform | MT4 trading platform |

| Demo Account | Available |

| Trading Assets | Forex (major currency pairs and minor currency pairs), 16 Indices, Commodities, and CFDs |

| Payment Methods | Bank Wire Transfer, BipiPay, GSD Pay, Neteller, Skrill |

| Customer Support | 5/24, email, phone |

ADS Securities LLC (“ADSS”) is a limited liability company incorporated under United Arab Emirates law. The company is registered with the Department of Economic Development of Abu Dhabi (No. 1190047) and has its principal place of business at 8th Floor, CI Tower, Corniche Road, P.O. Box 93894, Abu Dhabi, United Arab Emirates. ADSS is authorised and regulated by the Central Bank of the United Arab Emirates. ADSS began operations from Abu Dhabi, United Arab Emirates (UAE) since 2011. Today, the broker has offices in Hong Kong, Singapore and London, UK. It boasts of over 150,000 individual clients and about 400 institutional clients from all over the world.

With tradable assets such as indices, forex, equities, cryptocurrencies, and commodities, traders can diversify their portfolios and take advantage of market opportunities. The company provides multiple account types, including Classic, Elite, and Elite+, to cater to traders with different preferences and capital sizes. Traders can choose between the ADSS Platform and the MT4 platform for their trading activities.

ADSS is regulated by the Financial Conduct Authority (FCA), providing traders with a level of trust and security. However, it's important to note that the regulatory status of the Securities and Futures Commission of Hong Kong (SFC) is listed as “Revoked,” which may raise concerns for some traders.

ADSS has its strengths and weaknesses. It offers a range of features and services that may appeal to traders, while also having certain limitations that need to be taken into account. It's important for traders to assess the overall picture and consider these factors before deciding to trade with ADSS.

| Pros | Cons |

| Wide range of tradable assets | Regulatory status of the SFC in Hong Kong listed as “Revoked” |

| Leverage of up to 500:1 | Withdrawal fee of $15 |

| Multilingual customer support | Potential payment provider fees for deposits |

| Educational resources and access to webinars/seminars | Limited trading options (no options trading or ETFs) |

| Significant Research Tools |

ADSS is regulated by the Financial Conduct Authority (Regulation No. 577453) and the Securities and Futures Commission of Hong Kong (Regulation No. AXC847). However, the regulatory status of the Securities and Futures Commission of Hong Kong (license number: AXC847) is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

ADSS offers a wide range of trading instruments to cater to different market preferences. Traders can access global markets and choose from various options to diversify their portfolios.

Indices: Traders can trade indices CFDs on ADSS's platform, providing exposure to major indices like Nasdaq, S&P, FTSE, and Dax. With competitive spreads and leverage of up to 333:1, traders can take advantage of market moves and trade on both long and short positions.

Forex: ADSS allows traders to trade forex pairs with their user-friendly trading platform. With no hidden fees and competitive spreads, traders can access major, minor, and exotic currency pairs, such as EUR/USD and NZD/CHF. The market-leading leverage of 500:1 on FX majors offers increased trading power.

Equities: Traders can take positions on equities listed on global stock exchanges, including major players from the GCC region. By trading CFDs on equities like Netflix, Tesla, and Apple, traders can capitalize on volatility and benefit from favorable spreads.

Cryptos: ADSS enables traders to participate in the cryptocurrency market by offering CFDs on leading cryptocurrencies like Bitcoin. Traders can take advantage of 24/5 trading, competitive spreads, and the opportunity to go long or short on the price movements of cryptocurrencies.

Commodities: Traders can benefit from market volatility by trading CFDs on spot commodities, futures, and commodity-linked ETFs. With 0% commission on trades, traders can access popular commodities such as gold, oil, and coffee. Trading commodities on ADSS provides a simplified approach compared to commodity futures.

Here is a comparison table of trading instruments offered by different brokers::

| ADSS | RoboForex | Pocket Option | Tickmill | EXNESS Group | AMarkets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metals | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

ADSS provides a range of account types to suit the diverse needs of traders, including Classic Account, Elite Account, and Elite+ Account.

Classic Account:

The Classic account is designed for traders who want to start with a minimum deposit of $100. This account offers market spreads, allowing traders to participate in the financial markets at favorable rates. With a maximum leverage of 500:1, traders can potentially amplify their trading positions. The Classic account also includes 24/5 support and access to training courses, providing traders with the necessary resources to enhance their trading skills.

Elite Account:

For traders with larger capital and seeking additional benefits, the Elite account requires a deposit of $100,000. With this account, traders enjoy spreads that are 25% lower compared to the Classic account, resulting in potentially reduced trading costs. Similar to the Classic account, the Elite account offers a maximum leverage of 500:1, enabling traders to take advantage of larger trading positions. Elite account holders receive dedicated support from a Senior Manager, ensuring personalized assistance and guidance. They also gain access to exclusive Elite events and have the flexibility of multi-base currency options.

Elite+ Account:

For elite traders with significant capital, the Elite+ account requires a deposit of $250,000. Elite+ account holders benefit from ultra-low spreads, which can further minimize their trading costs. With a maximum leverage of 500:1, traders have the potential to engage in larger trading positions. In addition to personalized support from a Manager and Sales Trader, Elite+ account holders enjoy exclusive Elite events and the convenience of multi-base currency options.

ADSS offers these different account types to accommodate traders with varying capital sizes and provide them with tailored features and benefits that suit their trading objectives and preferences.

Visit the ADSS website. Look for the “Open Account” button on the homepage and click on it.

2. Open your account by providing the required information. For UAE residents, ADSS offers the option to register with UAE Pass, making the account setup process convenient and efficient.

3. After filling out the application and uploading documents, the system will open a personal account for the client.

4. Deposit funds into your account using options such as UAEPGS, Apple Pay, or Samsung Pay. These payment methods offer flexibility and security, allowing you to easily and securely fund your trading account.

5. Download the platform and start trading

ADSS offers leverage for trading in different instruments:

Indices: Trade major indices such as FTSE, S&P500, Dow Jones, German Dax, Nasdaq, and CAC 40 with leverage of up to 333:1.

Forex: Access major currency pairs like EUR/USD, GBP/USD, USD/JPY, as well as minor and exotic pairs with leverage of up to 500:1.

Equities: Take positions on UK shares, US shares, German shares, Saudi shares, and other euro shares with leverage ratios varying from 4:1 to 20:1.

Cryptos: Trade popular cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin with leverage ratios ranging from 2:1 to 4:1.

Commodities: Engage in trading commodities such as US Crude, Gold, Silver, Coffee, Natural Gas, and Copper with leverage ratios ranging from 20:1 to 200:1.

Note: Leveraged trading involves risks and should be carefully considered.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | ADSS | RoboForex | Pocket Option | Tickmill | Exness | AMarkets |

| Maximum Leverage | 1:500 | 1:2000 | 1:500 | 1:500 | 1:3000 | 1:3000 |

ADSS, like most brokers, makes a profit from spreads instead of charging commissions. Prices are competitive and traders can view current prices at any time. For CFDs and forex pairs, you can view the value, the change, the percent change, the open, the high, the low, and the previous. You can also view the required margin in percentage.

The broker does offer variable or fixed spreads. The target spreads for EUR/USD range from 1.6 to 2.4 pips depending on account type.

The Classic Account with a minimum deposit of $100 makes it more affordable for the most conservative traders, yet it carries higher spreads than the Elite account type. In the Classic account, target spreads drop to 1.6 pips on the EUR/USD. In contrast, ADSSs most competitive offering is the Elite account which requires a $200 000 deposit or a trading volume of more than $500 million per month. It comes with perks beyond discounted spreads.

Other spreads that traders can expect when trading with ADS Securities are:

GBP/USD Average: 1.1 pips

USD/JPY Average: 1.1 pips

AUD/USD Average: 0.8 pips

USD/CHF Average: 2.3 pips

There is a $15 processing fee per withdrawal, plus additional fees may be applied on the bank's side. The broker does not charge commissions for depositing funds, and there are no fees for inactivity on the account.

ADSS provides two trading platforms for its clients: ADSS Platform and MT4 (MetaTrader 4)

ADSS Platform: The ADSS platform offers essential functionalities such as a product page, order ticket, charting tools, blotters, account summary, and funding options. It provides traders with an overview of relevant information, including price evolution charts, daily statistics, instrument overviews, and product access details. By expanding the view, traders can access additional trading information such as order sizes, margin requirements, commissions (if applicable), and overnight holding costs. The platform also displays any active working orders for efficient position management.

2. MT4 (MetaTrader 4): ADSS offers access to the widely recognized MT4 platform, known for its advanced charting capabilities, fast trade execution, and extensive range of technical analysis tools. Traders can benefit from the features and flexibility of MT4, including its user-friendly interface and robust functionalities. ADSS has customized the MT4 platform to ensure a secure and efficient trading experience for its clients.

Both platforms provide traders with the necessary tools and features to meet their trading needs. They offer charting options, order placement capabilities, and execution efficiency to enhance the overall trading experience.

ADSS offers multiple deposit and withdrawal methods for its clients. Deposits can be made using methods such as bank wire transfer, credit card, online bank transfer, Skrill, Neteller, and Cash U. Notably, ADSS stands out as the only broker in the UAE that provides funding through UAEPGS, a local payment gateway. Clients can also withdraw funds using the same options available for deposits.

While ADSS offers a diverse selection of deposit and withdrawal methods, it's important to consider that the broker applies a withdrawal fee of $15 for all withdrawal transactions. This withdrawal fee has had a negative impact on the broker's overall rating. On the other hand, ADSS does not impose any charges on deposits, although clients should be aware that their payment providers may apply fees.

There are many ways to deposit funds into ADSS accounts, so clients will have enough options to choose from. As a MENA-focused broker, ADSS provides the opportunity to use the local UAEPGS (UAE Payment Gateway Services) solution. Traders should note that there is no deposit fee at ADSS.

| Deposit Method | Base Currencies | Fees |

| Wire Transfer | USD | No |

| Credit Card | USD | No |

| Online Bank Transfer | USD | No |

| Skrill | USD | No |

| Neteller | USD | No |

| Cash U | USD | No |

| UAEPGS | AED | No |

The same options that are available for deposits can be used for withdrawals. Traders should note that ADSS charges a $15 withdrawal fee for all withdrawal methods.

| Withdrawal Method | Base Currencies | Fees |

| Wire Transfer | USD | $15 |

| Credit Card | USD | $15 |

| Online Bank Transfer | USD | $15 |

| Skrill | USD | $15 |

| Neteller | USD | $15 |

| Cash U | USD | $15 |

| UAEPGS | AED | $15 |

The ADSS customer support team is multilingual and can be reached 24/5. The quickest way to get support is to use the instant web chat facility on the website. There is also an 'Enquiry form' on the 'Contact us' page of the website. A support representative will respond by email or by calling the enquirer. There are several phone lines provided by the support team. They can also be reached through email and fax. On social media, ADSS is on Facebook, Twitter, LinkedIn, and Instagram.

Client Enquiries:

Email: ts@adss.com

Phone: +971 2 657 2414

Address:

8th floor, CI Tower

Corniche Road, PO Box 93894

Abu Dhabi, United Arab Emirates

ADSS provides a range of educational resources and community support to help traders enhance their skills and knowledge:

1. Learning Materials: ADSS offers a variety of learning materials, including trading guides, video tutorials, and a comprehensive financial glossary. These resources empower traders by providing them with the necessary information and understanding of trading terms and concepts.

2. Seminars and Webinars: ADSS organizes seminars and webinars conducted by industry experts. These events serve as valuable learning opportunities for both beginner and experienced traders. Participants can gain insights, learn new strategies, and stay updated on market trends.

3. FAQ Section: ADSS has a dedicated page that addresses common questions and provides answers related to ADSS, trading account information, and trading basics. This section aims to assist prospective clients and beginner traders by addressing their queries and providing helpful information.

4. MT4 Platform Tutorials: ADSS offers tutorials specifically designed for traders who are new to the MT4 platform. These tutorials provide step-by-step guidance on using the platform effectively, helping traders navigate its features and functions.

5. Educational Webinars: ADSS conducts educational webinars that cover various topics, including the risks and rewards of trading. These webinars provide valuable insights and guidance to traders, enabling them to make informed trading decisions.

6. Training Workshops: ADSS organizes training workshops in the UAE and UK, offering traders the opportunity to enhance their trading skills through practical training sessions.

These expert educational resources, seminars, webinars, tutorials, and workshops collectively support the ADSS trading community, fostering continuous learning and improvement among traders.

ADSS offers a range of user experience enhancements and additional features to support traders in their trading activities. Traders can access exclusive market analysis provided by the research team, which includes daily and weekly market emails. These emails provide insights into market trends, fundamental analysis, and market sentiment on widely traded instruments. This information can assist traders in staying informed about the market conditions.

Furthermore, ADSS offers daily analysis and trading ideas delivered directly to traders' inboxes. This feature keeps traders updated on the latest market developments and provides potential trading opportunities. Additionally, ADSS provides technical data, including forex analysis via Autochartist trade set-ups, which can help traders analyze market trends and make informed trading decisions.

These user-friendly features and additional resources aim to enhance the trading experience for ADSS clients. By providing market analysis, trading ideas, and technical insights, ADSS supports traders in their decision-making process and helps them stay informed about market conditions.

ADSS is a regulated brokerage company that provides traders with access to various financial markets and a range of account types to suit their needs. While it offers advantages such as competitive spreads, leverage, and multilingual support, there are also disadvantages to consider, including the abnormal regulatory status of the SFC and the withdrawal fee. Traders should carefully evaluate these factors before deciding to trade with ADSS.

| Pros | Cons |

| FCA-Regulated | MT5 trading platform is not availabl |

| MT4 trading platform | Lack of a comprehensive trading academy |

| Demo & Islamic accounts available | Clients from some countries are not allowed to register |

| Professional customer support | No 7/24 customer support available |

| Acceptable minimum deposit of $100 | |

| Competitive spreads and fees |

Q: Is ADSS regulated?

A: ADSS is regulated by the Financial Conduct Authority (FCA) and the Securities and Futures Commission of Hong Kong (SFC). However, it's important to note that the regulatory status of the Securities and Futures Commission of Hong Kong (SFC) is listed as “Revoked.”

Q: What are the tradable assets offered by ADSS?

A: ADSS offers indices, forex, equities, cryptocurrencies, and commodities as tradable assets.

Q: What are the different account types offered by ADSS?

A: ADSS provides Classic, Elite, and Elite+ account types to cater to traders with different capital sizes.

Q: What is the minimum deposit required to open an account with ADSS?

A: The minimum deposit required to open an account with ADSS is $100.

Q: What is the maximum leverage offered by ADSS?

A: ADSS offers leverage of up to 500:1.

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded Year | 15-20 years ago |

| Company Name | Hirose Tusyo Co., Ltd. |

| Regulation | Regulated in Japan |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Fixed spreads on certain currency pairs |

| Trading Platforms | NET4 (installed version), LION FX C2 (installed version), LION FX Mobile App, HTML5 version, Flash version, Mobile app/portable version |

| Tradable Assets | 51 currency pairs, including major currencies and large currency pairs |

| Account Types | FX accounts, LION CFD accounts |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone, email, fax, website |

| Payment Methods | Quick deposit, quick deposit at ATM, transfer deposit |

| Educational Tools | LION FX easy operation video seminar, FX MARKET INFORMATION SEMINAR, seminars on campaign product cooking, resources on website |

Established in 2004, Hirose Tusyo Inc. is a Japan-based company mainly engaged in foreign exchange margin trading business, and was listed on the JASDAQ market of the Tokyo Stock Exchange on March 18, 2016.The Company is mainly engaged in foreign exchange margin trading business, which provides investors with foreign exchange margin trading and binary options trading through the Internet; provision of trading systems for group companies; provision of white label services for financial instruments traders, as well as covering transaction business as a counterparty of financial instruments traders, among others. Hirose Tusyo Inc. is authorized and regulated by Financial Services Agency, with regulatory license number 9120001106932.

The broker provides fixed spreads on several currency pairs, although these spreads may vary based on market conditions. Hirose-fx does not charge any commissions on trades, reducing the overall cost of trading. They offer deposit and withdrawal options and provide customer support through various channels, including phone, fax, and an online inquiry form.

Overall, Hirose-fx is a regulated broker with a range of trading instruments, account types, and trading platforms. Traders can benefit from their fixed spreads, commission-free trading, and accessible customer support.

Hirose-fx is a regulated Forex broker that offers a range of trading instruments, including 51 currency pairs. The company holds a Retail Forex License and is regulated by the Financial Services Agency (FSA) of Japan. Hirose-fx provides two types of accounts, FX accounts, and LION CFD accounts. They offer various order types to meet different trading needs and have both fixed and variable spreads, depending on market conditions. Hirose-fx does not charge any commissions on trades, which can be advantageous for traders. They offer multiple deposit and withdrawal options, as well as a variety of trading platforms to cater to different preferences and devices. The broker also provides trading tools, educational resources, and customer support through various channels. Overall, Hirose-fx has its strengths and weaknesses, and traders should carefully consider their options before choosing this broker.

| Pros | Cons |

| Regulated by the Financial Services Agency (FSA) of Japan | Medium potential risk |

| Offers a variety of trading instruments, including 51 currency pairs | Limited account types (FX accounts and LION CFD accounts) |

| Provides a range of trading platforms for different preferences and devices | Spreads may widen or contract based on market conditions |

| Offers a selection of order types to meet different trading needs | Variable spreads based on market conditions |

| Does not charge commissions on trades | Withdrawal requests have specific request and reflection times |

| Deposit options with various payment methods available | Limited customer support channels |

| Provides trading tools for market analysis and economic news updates | Maintenance periods during trading hours |

| Offers educational resources to improve trading knowledge and skills | Limited availability during rollover time |

Based on the information provided, Hirose-fx, also known as Hirose Financial UK Ltd, is regulated by the Financial Services Agency (FSA) of Japan. It holds a Retail Forex License and is regulated under the supervision of the Kinki Local Finance Bureau (近畿財務局長(金商)第41号). The licensing institution is Hirose Tsusho Kaisya Limited (ヒロセ通商株式会社).

The effective date of the license is September 30, 2007. The company's address is located at MG Building, 1-3-19 Shimmachi, Nishi-ku, Osaka, Japan. The phone number provided for the licensed institution is 06-6534-0708.

Hirose-fx offers a variety of trading instruments, including 51 currency pairs. These currency pairs encompass major currencies from around the world and provide opportunities for traders to engage in foreign exchange (Forex) trading. Some of the currency pairs offered include AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, CNH/JPY, EUR/AUD, EUR/CAD, and others.

Additionally, Hirose-fx offers a selection of large currency pairs, which are often traded frequently and have high liquidity. These large currency pairs include Large USD/JPY, Large EUR/USD, Large EUR/JPY, Large GBP/USD, Large GBP/JPY, and Large AUD/JPY.

| Pros | Cons |

| Offers a variety of trading instruments, including 51 currency pairs | Medium potential risk |

| Provides opportunities for Forex trading with major currencies worldwide | Limited account types (FX accounts and LION CFD accounts) |

| Includes large currency pairs with high liquidity for frequent trading | Spreads may widen or contract based on market conditions |

| Access to popular currency pairs like AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, CNH/JPY, EUR/AUD, EUR/CAD, and others | Variable spreads based on market conditions |

| Allows trading of Large USD/JPY, Large EUR/USD, Large EUR/JPY, Large GBP/USD, Large GBP/JPY, and Large AUD/JPY | Withdrawal requests have specific request and reflection times |

Hirose-fx offers two types of accounts: FX accounts and LION CFD accounts. Customers residing overseas are unable to open a LION CFD account. If a customer already has a LION FX account and wishes to open a LION CFD account, they can do so from the trading screen after the next business day following the completion of the FX account opening procedure. For more information on how to apply for a LION CFD account, customers can refer to the provided guidelines.

| Pros | Cons |

| Provides options for different trading preferences and strategies | Limited availability of LION CFD accounts for customers residing overseas |

| Allows customers to choose the account type that suits their needs | Additional procedures required to open a LION CFD account if already holding a LION FX account |

| Supports different trading platforms for each account type | Customers need to refer to guidelines for information on applying for a LION CFD account |

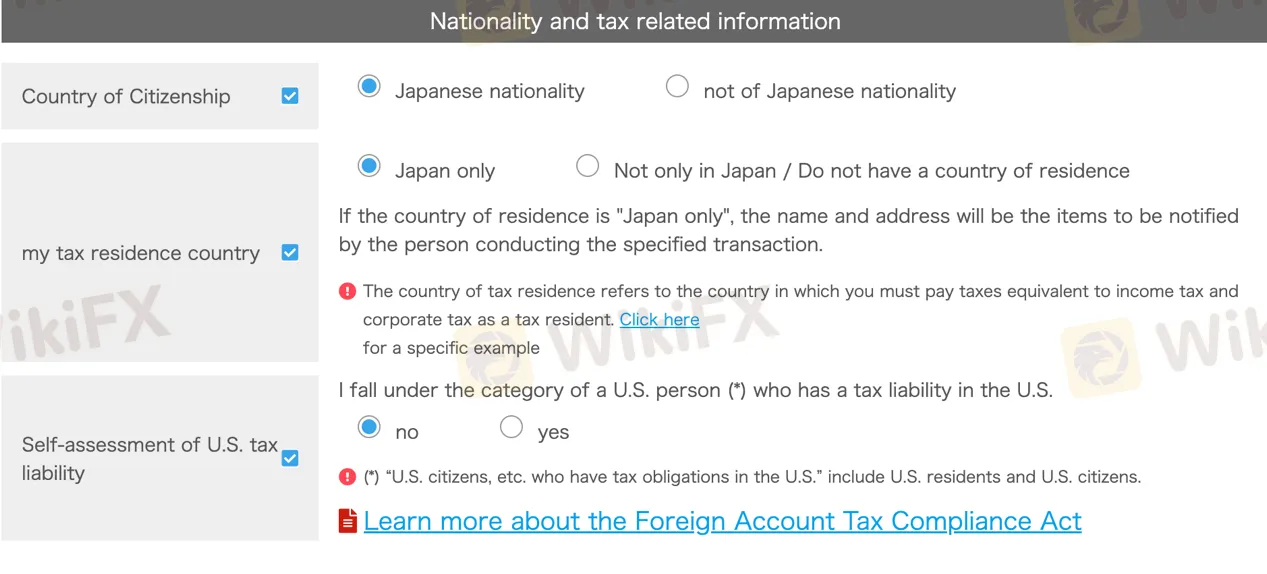

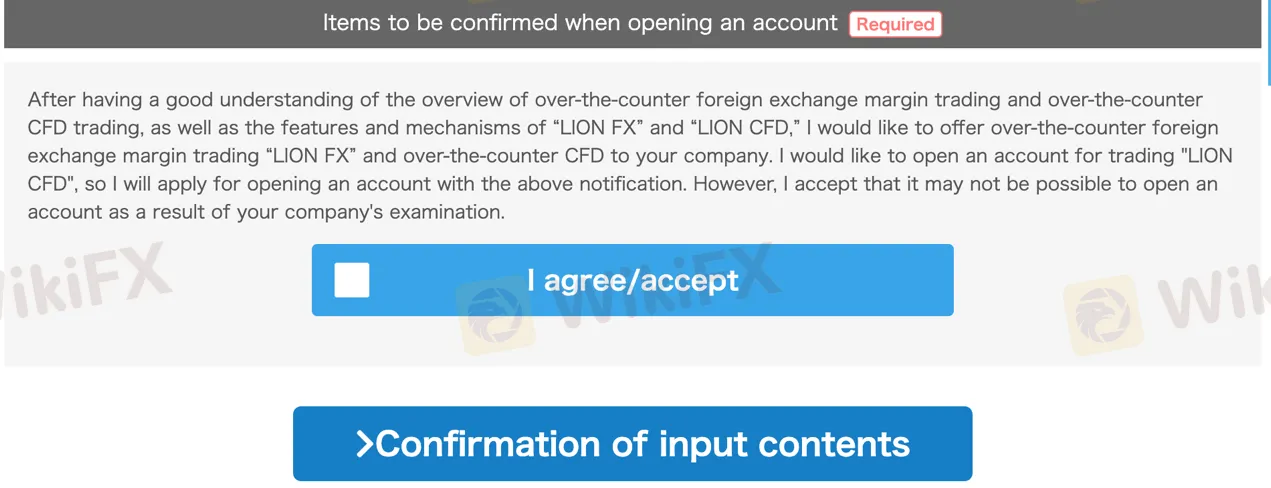

To open an account with Hirose-fx, follow these steps:

Access the main website of Hirose-fx and click on “新規口座開設” (Open a new account) or a similar option.

The account opening process may vary depending on the required identity verification documents and delivery method. Choose the appropriate option and proceed.

Fill in the necessary information and review the required documents. Note that using Internet Explorer (IE) is. not recommended; it's advisable to use another browser.

Submit your identity verification documents and My Number verification documents. You can choose from various sending methods, including simple identity verification with a smartphone, easy identity verification with Internet banking, upload, email, fax, or mail.

5. Once all the necessary documents are received, Hirose-fx will begin the screening and account opening process. Normally, it takes 1-2 business days after the arrival of the verification documents.

6. You will receive your user ID and password via email. The method of sending the user ID and password depends on the method used to send the identification documents.

7. Deposit funds into your trading account. Once the funds are deposited, you can log in and start trading.

FIXED SPREADS: Hirose-fx provides fixed spreads on several currency pairs. For example, USD/JPY has a fixed spread of 0.2 pips, AUD/JPY has a fixed spread of 0.6 pips, GBP/JPY has a fixed spread of 1.0 pip, AUD/USD has a fixed spread of 0.4 pips, EUR/USD has a fixed spread of 0.3 pips, NZD/JPY has a fixed spread of 0.8 pips, and MXN/JPY has a fixed spread of 0.2 pips. These fixed spreads indicate that the difference between the buying and selling prices of these currency pairs remains constant under normal market conditions.

VARIABLE SPREADS: It should be noted that while Hirose-fx provides fixed spreads, these spreads are not completely fixed. The spreads may widen or contract based on market conditions and exceptional events such as low liquidity times. This means that during times of increased volatility or reduced market liquidity, the spreads may change from their fixed values. As a result, the actual spreads experienced by traders may differ from the ones mentioned above.

COMMISSIONS: Hirose-fx does not charge any commissions on its trades. This means that traders can execute their trades without incurring any additional fees in the form of commissions. The absence of commissions can be advantageous for traders.

There are 27 order types, including Market Order, Limit Order, Stop Order, OCO order, IF-DONE order, IF-OCO order, Trail Order, Streaming order, Timed Market order, Timed Limit ( stop) order, one-click order, Quick Order, One-click payment order, Bulk Settlement Order, Bulk Purchase Settlement order, Bulk Sale Settlement order, All Settlement Order by currency, All settlements Orders, Pip difference Settlement order, Doten Order, Bulk Order, Amount specified all settlement, trigger order, Timed All Settlement order, BID Judgment Buy (ASK Judgment Sell) Stop Order, Trigger orders in other currencies, Repeat time specified market order.

When US standard time is applied, Japan time Monday 7:00 am to Saturday 6:30 am Japan time. When summertime is applied, Japan time Monday 6:30 am to Saturday 5:30 am. Rollover time (6:59 am Japan time) Minutes, 5:59 am when US summer time is applied), communication will be disconnected, and day closing work and maintenance will be performed. (It takes about 15 minutes for the day closing work and maintenance, but it may take up to 30 minutes.)

Hirose-fx offers a range of trading platforms designed to cater to the diverse needs of traders. These platforms provide access to the financial markets and offer various tools and features to facilitate trading activities.

NET4 (installed version): This trading platform is available for Windows and Mac operating systems. It offers customizability, easy-to-see screens, and the ability to view charts and execute orders. It supports various order types and provides access to account information and news.

LION FX C2 (installed version): This platform is recommended for beginners and offers versatile functionality. It allows for simultaneous ordering and payment, displays order and position execution history, and supports collective payment. It provides a simple and comfortable user experience.

LION FX Mobile App (iPad, iPhone, Android): Hirose-fx offers mobile apps for iPad, iPhone, and Android devices. These apps provide access to essential functions and information. Traders can check rates, view charts, place orders, monitor positions, and manage their accounts using these mobile apps.

HTML5 version, Flash version: Hirose-fx also offers web-based trading platforms compatible with various web browsers. The HTML5 version provides access to charting tools, order placement, and account information. The Flash version may have similar functionality but requires Flash support.

Mobile app/portable version: Hirose-fx provides a mobile version of its trading platform that is compatible with mobile phones from different carriers such as docomo, au, and SoftBank. This version allows traders to conduct transactions and access various features on their mobile devices.

The trading platforms offered by Hirose-fx provide traders with the ability to view real-time rates, analyze charts, place different types of orders, manage positions, and access account information. Each platform has its own set of features and compatibility options to cater to traders' preferences and device capabilities.

| Pros | Cons |

| Multiple platform options (NET4, LION FX C2, LION FX Mobile App, HTML5 version, Flash version, Mobile app/portable version) | May require separate platform downloads for different devices |

| Customizability and easy-to-use interfaces | Flash version requires Flash support |

| Real-time rate viewing and chart analysis | Limited platform availability for certain carriers or operating systems |

| Support for various order types | Mobile app/portable version may have limited features compared to other platforms |

| Access to account information and news updates | Web-based platforms may have performance limitations compared to installed versions |

| Mobile apps for iPad, iPhone, and Android devices available |

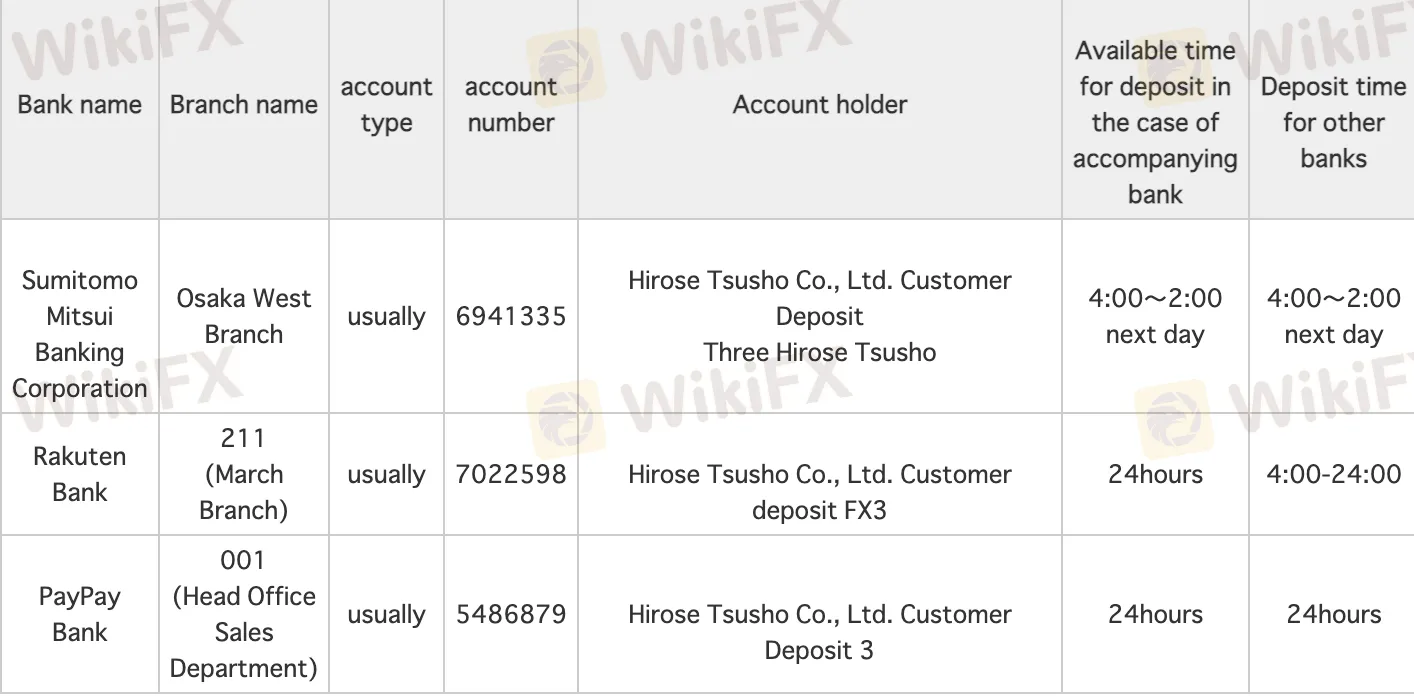

There are three types of deposit options available with Hirose-fx: quick deposit, quick deposit at ATM, and transfer deposit. Payments can be made 24 hours a day, 365 days a year. Quick deposits support approximately 380 lines and are free of charge, except for PayPay, Mizuho, and Sumitomo Mitsui Banking Corporation, which may charge a fee. Quick deposit at ATMs allows fee-free deposits and supports various banks, including Japan Post Bank, Mizuho, Mitsubishi UFJ, Mitsui Sumitomo, Resona, Saitama Resona, Aomori, Shonai, Gunma, Chiba, Yokohama, Kansai Mirai, Nanto, Hyakujushi, Fukuoka, Juhachi Shinwa, Towa, Keiyo, and Kumamoto. Some agricultural cooperatives and Shinren also support this option. There is also a general transfer deposit available for users.

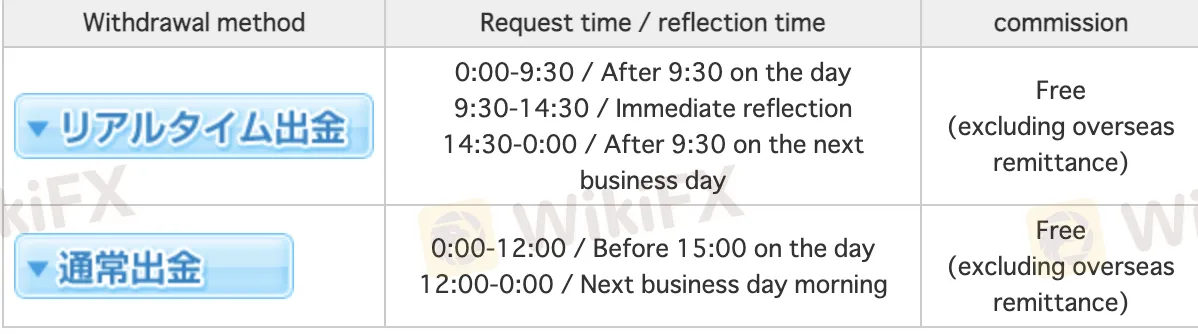

Hirose-fx offers two types of withdrawals: real-time withdrawals and regular withdrawals. Real-time withdrawals allow for immediate reflection of funds and can be requested within specific timeframes. There are no commissions for real-time withdrawals, except for overseas remittances. Normal withdrawals have specific request and reflection times and are also commission-free, excluding overseas remittances. Withdrawals can be requested once a day, either for real-time withdrawals or regular withdrawals. However, on Saturdays, Sundays, and Mondays, withdrawals can only be made once every three days. It's important to note that real-time withdrawals cannot be canceled once the procedure is completed. Withdrawal requests require authentication with a PIN code set by the customer in advance.

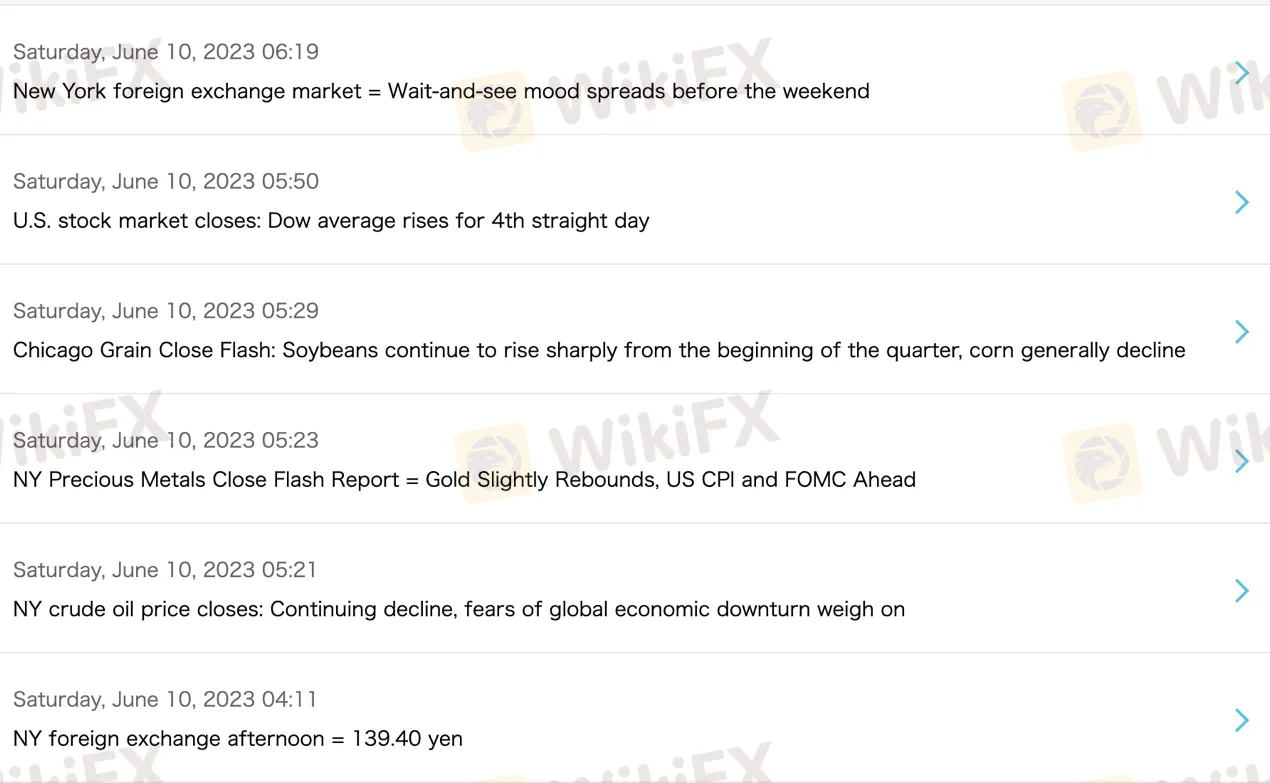

Hirose-fx offers several trading tools to assist users in their investment activities. These tools include:

1. Economic News: The platform provides real-time updates on economic bulletins. Users can stay informed about the latest economic developments that may impact their trading decisions.

2. FX Wave: This feature delivers 24-hour real-time investment information focused on foreign exchange. Users can access over 150 articles per day, providing insights and analysis to help them make informed trading choices.

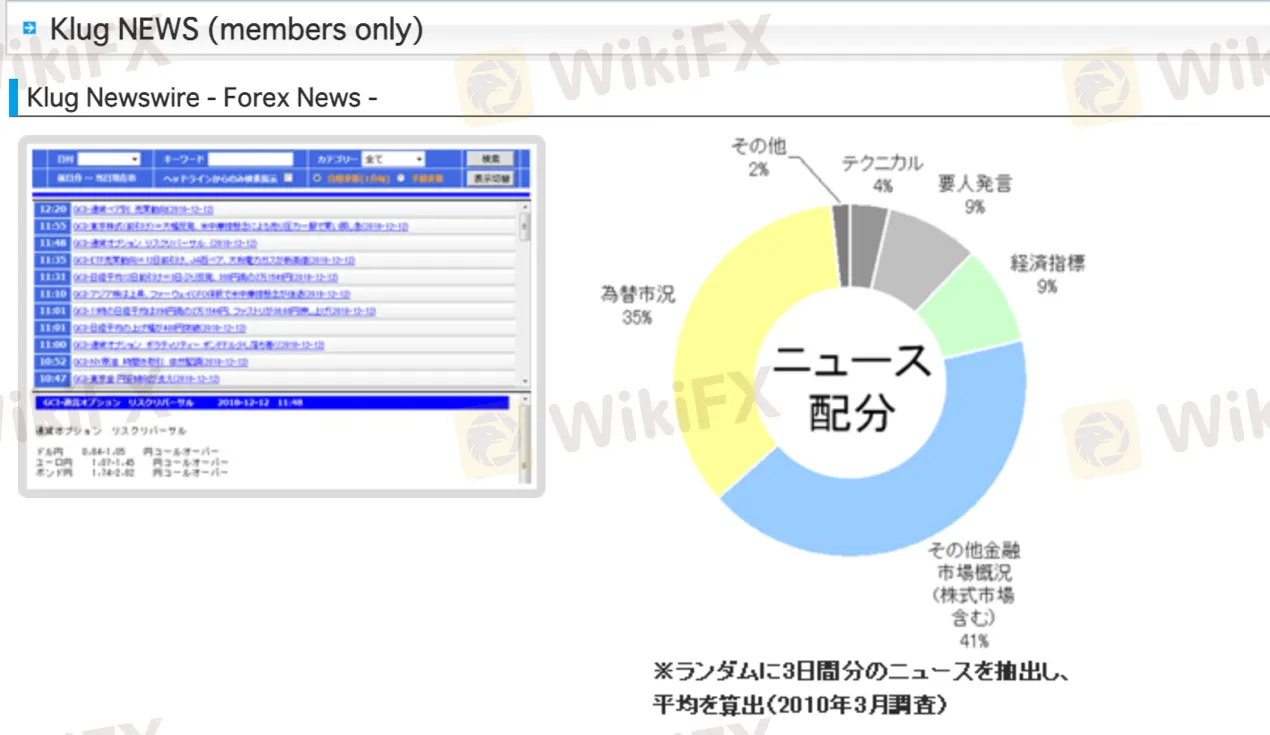

3. Klug NEWS: Klug NEWS offers a continuous feed of Forex news, available 24 hours a day. Users can access more than 180 news deliveries daily, ensuring they stay updated on the latest developments in the Forex market.

4. Dow Jones: Hirose-fx translates and delivers news on various asset classes, providing users with information necessary for making investment decisions. Users can expect around 150 news articles per day, covering a range of relevant topics.

These trading tools aim to keep users informed about market trends, economic news, and relevant investment information, enabling them to make well-informed trading decisions.

| Pros | Cons |

| Real-time updates on economic bulletins | Some tools may require additional fees or subscriptions |

| Access to over 150 articles per day for foreign exchange insights | Language translation may not be perfect for all news sources |

| Continuous feed of Forex news available 24/7 | Information overload may be overwhelming for some users |

| Delivery of news on various asset classes for comprehensive investment information | Limited customization options for news delivery |

| Helps users stay informed about market trends and economic news | Dependency on external news sources for analysis and decision-making |

| Provides insights and analysis to support informed trading choices | Potential delays or lag in news delivery |

Hirose-fx offers a variety of educational resources to assist users in improving their trading knowledge and skills. One of their resources is the LION FX easy operation video seminar, which provides step-by-step guidance on using their trading platform. The seminar covers topics such as installing the app, navigating the transaction screen, understanding different order types, making payments, and managing orders.

Additionally, they offer the FX MARKET INFORMATION SEMINAR, which provides valuable insights into the market and strategies to enhance trading performance. The seminar includes various equations and formulas aimed at helping traders achieve success in their trades. They also offer a special equation designed specifically for winning trades.

Moreover, Hirose-fx provides resources on topics like quick deposit methods, changing currency pairs and order display, order preferences setup, chart analysis techniques, saving chart settings, using technical indicators and trend lines, and accessing execution history. They also cover features such as signal functions, measurement tools, and customizing the transaction screen.

Furthermore, Hirose-fx offers seminars on campaign product cooking, which may provide additional information or strategies related to specific trading promotions or offerings.

| Pros | Cons |

| Provides step-by-step guidance on using the trading platform | Limited variety of educational resources |

| Offers insights into the market and strategies to enhance trading performance | Limited coverage of advanced trading topics |

| Includes equations and formulas for successful trades | May not cater to all trading styles or preferences |

| Covers a wide range of topics, including deposit methods, chart analysis, and execution history | Availability of seminars may vary |

| Offers information on campaign product offerings | Limited interactivity or hands-on learning opportunities |

- When US standard time applies, Hirose-fx operates from Monday 7:00 am to Saturday 6:30 am Japan time.

- When daylight saving time applies in Japan, the trading hours shift to Monday 6:30 am to Saturday 5:30 am Japan time.

During Rollover time, which is at 6:59 am Japan time (or 5:59 am when US daylight saving time is applied), certain activities occur. Communication will be temporarily cut off, and date closing work as well as maintenance will be performed. This process usually takes around 15 minutes, but it could extend up to 30 minutes. Additionally, a maintenance pop-up may appear, potentially affecting the ability to trade during this period.

Hirose-fx provides various channels for customer support. You can reach their customer support team via telephone using the toll-free number 0120-63-0727 or the representative number 06-6534-0708. Additionally, you can contact them through fax using the toll-free number 0120-34-0709 or the number 06-6534-0709. Visiting their head office or branches is also an option.

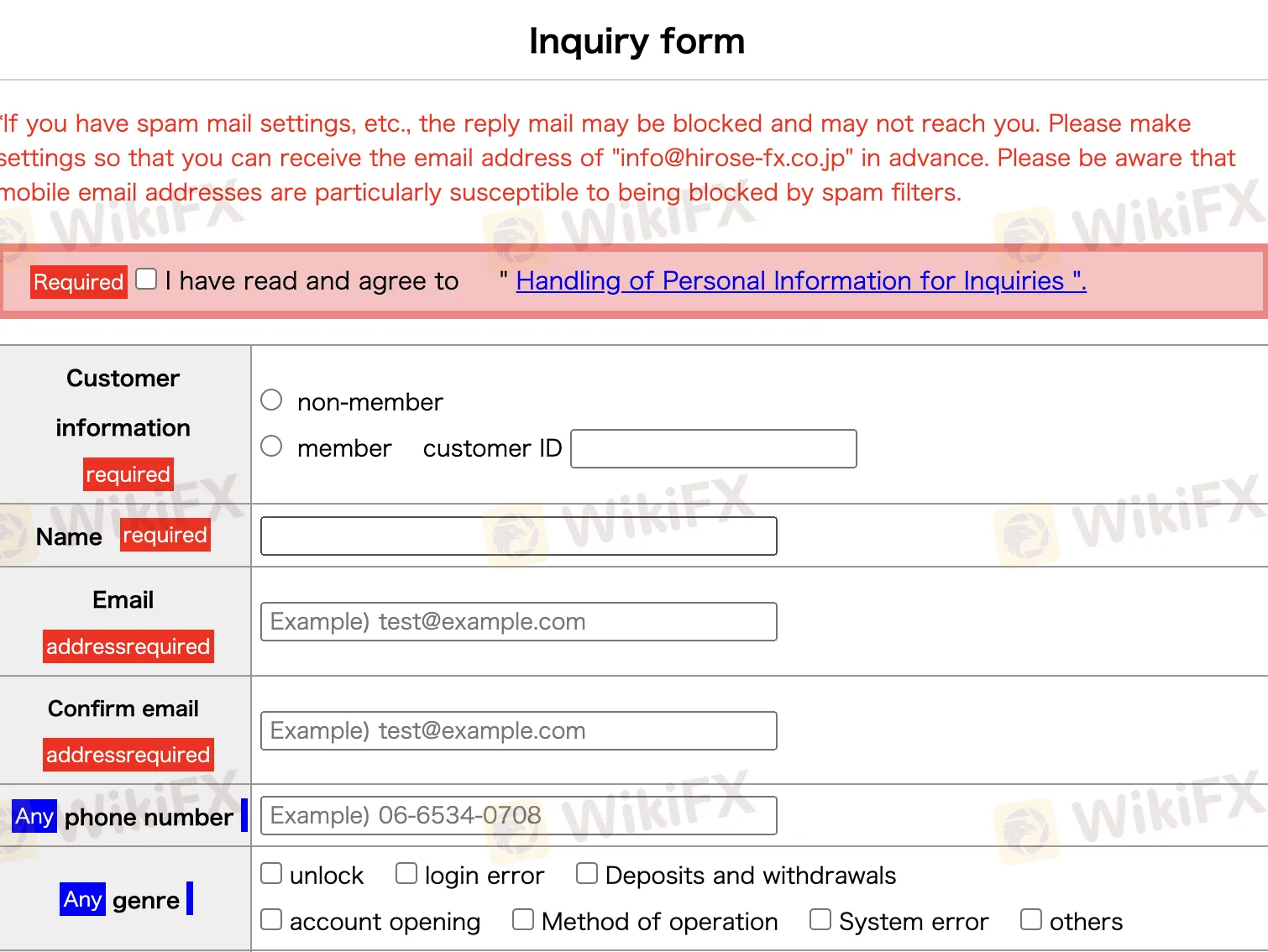

They offer an inquiry form on their website where you can submit your opinions, questions, or requests directly. They also provide a FAQ section where you can find answers to frequently asked questions.

For specific information on deposits, withdrawals, and changing registration information, they provide detailed information on their website. They have a complaint consultation desk for addressing any complaints, and you can contact them for information about the final tax return.

There is an opinion box where you can share your feedback and impressions about their website, trading system, and various services. They offer an operation manual for LION FX, and you can access information to better understand Forex, including country information and technical analysis.

You can contact their customer support team via phone using the toll-free number 0120-63-0727 or the direct dial number 06-6534-0708. They also provide an email address, info@hirose-fx.co.jp, for inquiries if you are unable to use the inquiry form on their website.

Hirose-FX is a forex trading platform that offers several advantages to traders. It provides a user-friendly interface with various tools and features to facilitate trading activities. Hirose-FX also offers a range of trading instruments, allowing users to diversify their portfolios. However, there are some disadvantages worth considering. The platform may lack in-depth educational resources and research materials, which could limit the learning opportunities for traders. Additionally, customer support may not always be readily available or responsive, potentially leading to delays in issue resolution. Traders should carefully assess these factors before deciding to engage with Hirose-FX.

Q: Is Hirose-fx a regulated broker?

A: Yes, Hirose-fx is regulated by the Financial Services Agency (FSA) of Japan and holds a Retail Forex License.

Q: What is the address of Hirose-fx?

A: Hirose-fx is located at MG Building, 1-3-19 Shimmachi, Nishi-ku, Osaka, Japan.

Q: What trading instruments does Hirose-fx offer?

A: Hirose-fx offers 51 currency pairs for trading, including major currency pairs like AUD/USD, EUR/USD, GBP/JPY, and more.

Q: What types of accounts does Hirose-fx offer?

A: Hirose-fx offers two types of accounts: FX accounts and LION CFD accounts. Overseas customers can only open FX accounts.

Q: How can I open an account with Hirose-fx?

A: To open an account with Hirose-fx, you need to visit their website and follow the account opening process, which involves providing necessary information and submitting verification documents.

Q: What order types are available on Hirose-fx?

A: Hirose-fx offers various order types, including Market Order, Limit Order, Stop Order, OCO order, Trail Order, and more, to meet different trading needs.

Q: Does Hirose-fx charge commissions on trades?

A: No, Hirose-fx does not charge any commissions on trades.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive adss and hirose-fx are, we first considered common fees for standard accounts. On adss, the average spread for the EUR/USD currency pair is -- pips, while on hirose-fx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

adss is regulated by SFC,SCA. hirose-fx is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

adss provides trading platform including PRO,ELITE,Classic and trading variety including --. hirose-fx provides trading platform including -- and trading variety including --.