简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Cube Forex

摘要:Cube Forex, operated by Cube Global Impex Limited and headquartered in Hong Kong, offers trading in a limited selection of assets, primarily focusing on USD/EUR pairs. The platform provides several account types—Silver, Gold, Platinum, and Ultimate—each tailored to different trading preferences. With a low minimum deposit requirement of $200 and high maximum leverage of 1:1000, Cube Forex fit for both cautious and aggressive traders. Notably, the absence of regulatory oversight may pose risks related to investor protection. While offering popular MT4/MT5 trading platforms and no commissions on trades, Cube Forex lacks formal payment methods and educational resources, relying instead on social media for customer support. Additionally, the platform does not provide bonus offerings, making it suitable for straightforward trading without additional incentives.

| Cube Forex | Basic Information |

| Company Name | Cube Global Impex Limited |

| Founded in | 5-10 years |

| Headquarters | Hong Kong |

| Regulations | Not Regulated |

| Tradable Assets | USD / EUR |

| Account Types | Silver, Gold, Platinum, Ultimate |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:1000 |

| Minimum Spread | From 1.3 |

| Trading Platforms | MT4/5 |

| Customer Support | Social media: Twitter, Facebook |

Overview of Cube Forex

Cube Forex, operated by Cube Global Impex Limited and headquartered in Hong Kong, offers trading in a limited selection of assets, primarily focusing on USD/EUR pairs. The platform provides several account types—Silver, Gold, Platinum, and Ultimate—each tailored to different trading preferences. With a low minimum deposit requirement of $200 and high maximum leverage of 1:1000, Cube Forex fit for both cautious and aggressive traders. Notably, the absence of regulatory oversight may pose risks related to investor protection. While offering popular MT4/MT5 trading platforms and no commissions on trades, Cube Forex lacks formal payment methods and educational resources, relying instead on social media for customer support. Additionally, the platform does not provide bonus offerings, making it suitable for straightforward trading without additional incentives.

Regulation

Cube Forex operates without regulation, as indicated by the provided information. This means that the company is not subject to supervision or guidelines enforced by any financial regulatory authority. Trading with an unregulated broker like Cube Forex carries inherent risks for investors, including potential issues related to transparency, security of funds, and dispute resolution mechanisms.

Pros & Cons

Cube Forex presents several notable advantages and drawbacks for traders considering its platform. On the positive side, Cube Forex offers high leverage up to 1:1000, providing traders with the potential to maximize their trading positions with a smaller initial investment. Additionally, a low minimum deposit requirement of $200 makes it accessible to a broader range of traders. However, potential clients should be mindful of certain limitations. Cube Forex operates without regulation, which can impact investor protection and accountability. The platform also offers a limited selection of tradable assets, primarily focusing on the USD/EUR pair, which may restrict diversification opportunities for traders. While it supports Expert Advisors (EAs) for automated trading strategies, the absence of formal payment methods could present challenges for clients seeking secure and convenient fund transfer options.

| Pros | Cons |

|

|

|

|

|

|

Market Instruments

Cube Forex focuses its trading offerings primarily on the USD/EUR currency pair. This limited selection of tradable assets underscores its specialization in forex trading, particularly between the US Dollar (USD) and Euro (EUR). By concentrating on this currency pair, Cube Forex aims to cater to traders interested in major currency exchanges, providing focused opportunities for speculation and investment within the forex market. However, potential clients should consider the platform's narrower scope compared to brokers offering a broader range of assets, which may impact diversification strategies depending on individual trading preferences and goals.

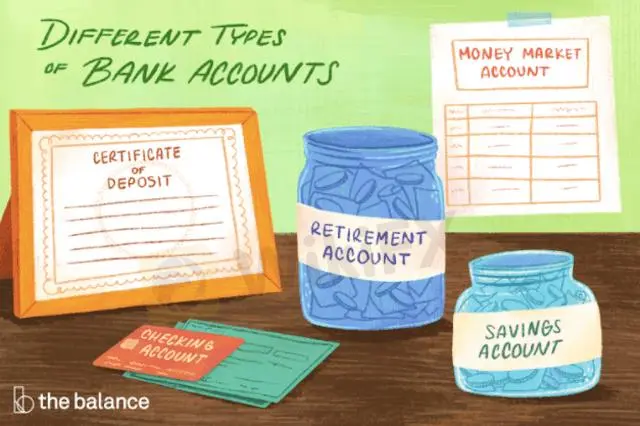

Account Types

Cube Forex offers a tiered system of account types tailored to accommodate various trading preferences and experience levels. The range includes Silver, Gold, Platinum, and Ultimate accounts, each offering distinct features and benefits. These account tiers likely differ in terms of trading conditions such as leverage options, minimum deposit requirements, and possibly additional perks such as personalized support or access to educational resources. This tiered structure allows traders to choose an account type that aligns with their specific trading goals and risk tolerance.

| Account types | Silver Account | Gold Account | Platinum Account | Ultimate Account |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| Minimum Deposit | $200 | $200 | $200 | $200 |

| Minimum Spread | From 1.3 | From 1.3 | From 1.3 | From 1.3 |

| Products | USD / EUR | USD / EUR | USD / EUR | USD / EUR |

Leverage

Cube Forex offers a maximum leverage of 1:1000, providing traders with the opportunity to significantly amplify their trading positions relative to their initial margin deposit. This high leverage ratio allows traders to potentially enhance their trading profits with a smaller capital outlay.

Spreads & Commissions

Cube Forex offers a competitive trading environment with a minimum spread starting from 1.3 pips, reflecting the difference between buy and sell prices.

Trading Platform

Cube Forex utilizes the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, renowned for their robust features and user-friendly interfaces. These platforms are widely recognized in the industry for their advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs).

Deposit & Withdrawal

Cube Forex maintains a straightforward approach to deposit and withdrawal processes, setting a minimum deposit requirement of $200.

Customer Support

Cube Forex provides customer support primarily through social media platforms such as Twitter and Facebook.

Twitter: https://twitter.com/cube_forex

Facebook: https://www.facebook.com/CubeFxGlobal/

Conclusion

In conclusion, Cube Forex offers a focused trading experience primarily centered on the USD/EUR currency pair with competitive trading conditions such as high leverage up to 1:1000 and minimal spreads starting from 1.3 pips. The platform offers with a low minimum deposit requirement of $200 and supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, known for their robust features and versatility. However, potential clients should consider the lack of regulatory oversight, limited tradable assets beyond USD/EUR, and the absence of formal payment methods as factors impacting their decision. Cube Forex provides accessible customer support through social media channels, Twitter and Facebook.

FAQs

- Is Cube Forex regulated by any financial authority?

No, Cube Forex operates without regulatory oversight.

- What is the minimum deposit required to open an account with Cube Forex?

The minimum deposit required to start trading with Cube Forex is $200.

- What trading platforms does Cube Forex support?

Cube Forex supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

继大选后,市场预期正在被颠覆和改写,美元或将拒绝下跌

美联储官员古尔斯比讲话前,美元/印度卢比持稳

比特币、以太坊、瑞波币预测:比特币价格创出历史新高后盘整

欧元/美元关注反弹,但涨势可能受限

曝光私照威胁持续入金!当人妻遇上黑平台人渣业务员

英国经济增长再次有所放缓 - 德国商业银行

美元/日元:将跌破 153.85 - 大华银行集团

美元/瑞郎:看涨,但超买 - 华侨银行

澳大利亚央行会议纪要公布前,澳元/美元在 0.6450 附近谨慎交投

澳元在0.65以下似乎超卖 -星展银行

汇率计算