简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IB Platform

摘要:The IB Platform is based in the United Kingdom and operates without regulatory oversight. It offers a variety of trading platforms including cTrader, MT4, and MT5, catering to different trading preferences. Traders can access a range of tradable assets such as commodities, currency indices, ETFs, and Share CFDs. The platform provides a demo account for users to practice trading strategies before committing real funds. Customer support is available via email and phone, and funding options include Visa, Mastercard, and PayPal. Spreads and fees vary depending on the instrument being traded.

| Aspect | Information |

| Registered Country | United Kingdom |

| Company Name | IB Platform |

| Regulation | Not regulated |

| Spreads/Fees | Vary based on instrument; see provided details |

| Trading Platforms | cTrader, MT4, MT5 |

| Tradable Assets | Commodities, Currency Indices, ETFs, Share CFDs |

| Demo Account | Available |

| Customer Support | Email at support@ibplatform.co, Phone: +442030973955 |

| Payment Methods | Visa, Mastercard, PayPal |

Overview

The IB Platform is based in the United Kingdom and operates without regulatory oversight. It offers a variety of trading platforms including cTrader, MT4, and MT5, catering to different trading preferences. Traders can access a range of tradable assets such as commodities, currency indices, ETFs, and Share CFDs. The platform provides a demo account for users to practice trading strategies before committing real funds. Customer support is available via email and phone, and funding options include Visa, Mastercard, and PayPal. Spreads and fees vary depending on the instrument being traded.

Regulation

The IB Platform operates without regulatory oversight as a broker. This means that there isn't an external authority ensuring compliance with financial regulations or safeguarding investor interests. As a result, users should exercise caution and thoroughly research the platform's credibility and security measures before engaging in any transactions.

Pros and Cons

The IB Platform offers a range of advantages and disadvantages for traders to consider. While it provides access to diverse trading instruments and flexible funding options, its lack of regulatory oversight may raise concerns for some users. Additionally, competitive spreads and commissions enhance the trading experience, although traders should remain vigilant and conduct thorough research to mitigate potential risks.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

In summary, the IB Platform offers a comprehensive suite of trading services with advantages such as diverse trading instruments, flexible funding options, competitive spreads, and advanced trading platforms. However, the lack of regulatory oversight and potential security concerns may be drawbacks for some traders.

Market Instruments

IB Platform offers:

Commodities Trading:

The IB Platform facilitates the buying and selling of various commodities such as energy, grains, metals, and softs. Traders can take advantage of price movements in these markets to make informed decisions. For instance, they may choose to go long on a commodity when they anticipate its price will increase in the future.

Currency Indices Trading:

Clients can trade currency pairs as CFDs or stocks within the IB Platform. All upcoming currency pairings are available for trading, offering flexibility to investors. With the possibility of trading on margin, currency indices provide added benefits such as limited liability, dividends, and potential for price appreciation.

ETF CFDs Trading:

Exchange-traded funds (ETFs) are accessible through the IB Platform, allowing investors to express views on specific equity market themes, sectors, and global markets. Whether focusing on individual countries or broader market trends, ETF CFDs offer a versatile investment vehicle.

Share CFDs Trading:

Investors can gain exposure to a wide range of shares from AU, US, UK, and German markets through Share CFDs on the IB Platform. With leverage, competitive pricing, low commissions, and deep liquidity, traders can efficiently execute their strategies and capitalize on market opportunities.

Spreads and Commissions

Commissions:

Commissions are applicable solely on Razor accounts when engaging in CFD trading on Forex and Shares. These commissions are calculated based on the trading volume, with rates varying depending on the currency of the trading account. For instance, in USD accounts, the commission per 0.01 lots (or 1000 base currency) is USD 0.04 (round turn USD 0.08), and for 1 lot (or 100,000 base currency), it's USD 3.50 (round turn USD 7). Similarly, in EUR accounts, the commission per 0.01 lots is EUR 0.03 (round turn EUR 0.06), and for 1 lot, it's EUR 2.60 (round turn EUR 5.20). GBP accounts incur a commission of GBP 0.02 per 0.01 lots (round turn GBP 0.05) and GBP 2.25 per 1 lot (round turn GBP 4.50), while KES accounts are charged KES 0.03 per 0.01 lots (round turn CHF 0.06) and KES 3.30 per 1 lot (round turn CHF 6.60).

Commodities Spreads:

Commodities trading on the IB Platform features varying spreads depending on the instrument. The minimum spreads indicate the lowest possible spread for each commodity, while the average spread gives traders an idea of the typical spread range they can expect. For example, commodities like Cocoa come with a minimum spread of 5 and an average spread of 5.00, Coffee has a minimum spread of 0.3 and an average spread of 4.20, and Wheat offers a minimum spread of 0.8, with the same average spread.

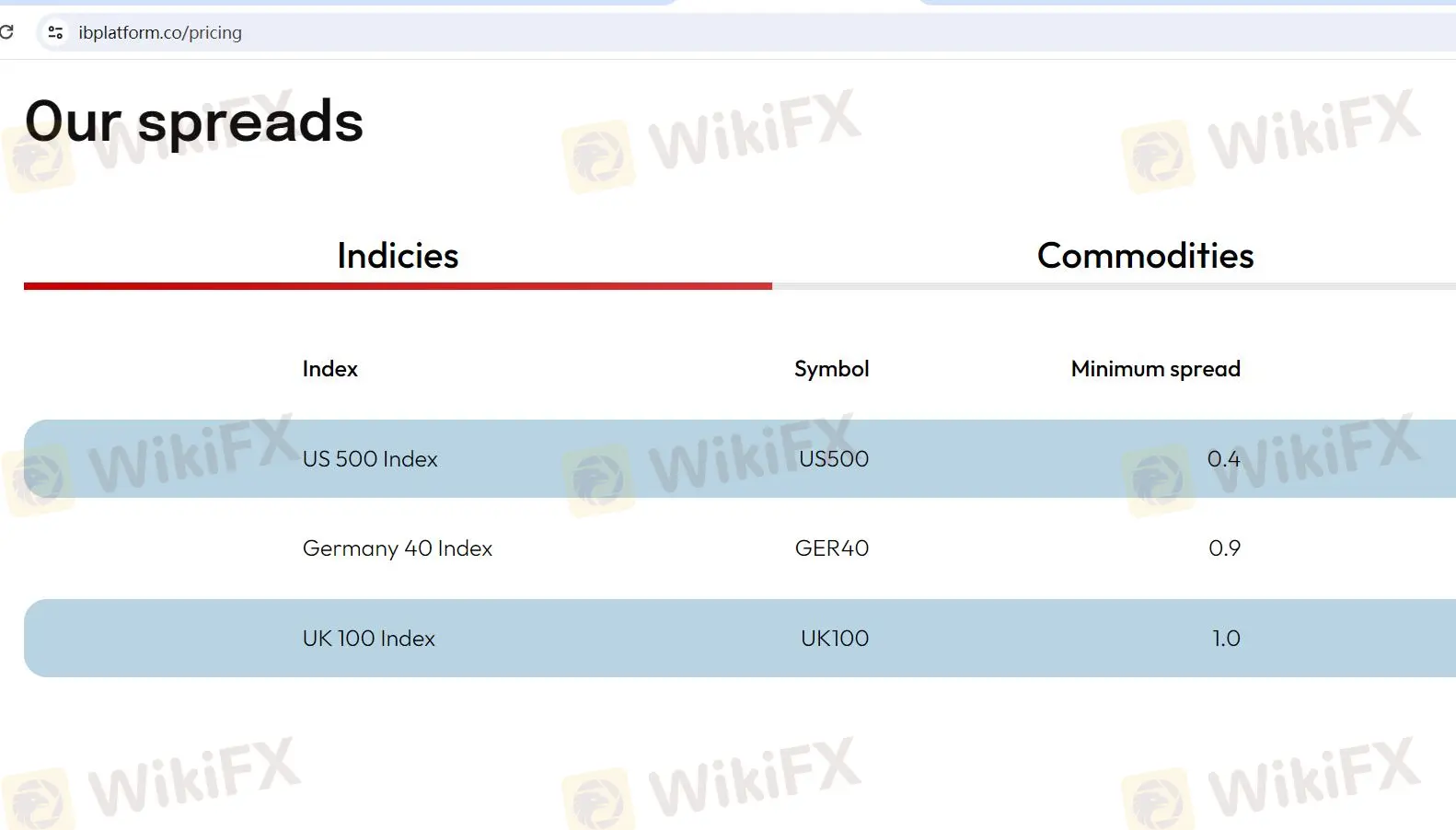

Indices Spreads:

Indices trading on the IB Platform involves spreads that differ according to the specific index being traded. The minimum spread represents the lowest spread possible for each index, allowing traders to gauge the cost of trading these instruments. For instance, the US 500 Index (US500) comes with a minimum spread of 0.4, the Germany 40 Index (GER40) has a minimum spread of 0.9, and the UK 100 Index (UK100) features a minimum spread of 1.0. These spreads provide valuable insight for traders assessing their trading costs and strategies within the indices market.

Deposit & Withdrawal

The IB Platform offers funding and withdrawal options through Visa, Mastercard, and PayPal for seamless management of finances and transactions.

Visa and Mastercard:

Funding: The IB Platform allows users to fund their trading accounts using Visa or Mastercard debit or credit cards. This method offers convenience and speed, with funds typically credited instantly or within a short period after the transaction is confirmed.

Withdrawal: Withdrawals to Visa or Mastercard are also supported, although the process may take longer compared to deposits. Users can initiate withdrawals through the platform, with funds usually received within a few business days, depending on the broker's processing times and the card issuer's policies.

PayPal:

Funding: PayPal provides a secure and convenient funding option for trading accounts on the IB Platform. Users can link their PayPal accounts and transfer funds directly from their PayPal balance or linked bank account. Deposits made via PayPal are typically credited instantly or within a short timeframe.

Withdrawal: Withdrawals to PayPal accounts are supported by many brokers on the IB Platform. Users can initiate withdrawals through the platform, with funds usually processed within a few business days and credited to their PayPal accounts.

Overall, Visa, Mastercard, and PayPal offer flexible funding and withdrawal options for traders on the IB Platform, allowing for seamless management of finances and transactions.

Trading Platforms

The IB Platform offers a variety of trading platforms, including cTrader, MT4 (MetaTrader 4), and MT5 (MetaTrader 5), each catering to different trading preferences and strategies.

cTrader:

cTrader is a user-friendly and intuitive trading platform known for its advanced charting capabilities and customizable interface. It offers features such as one-click trading, advanced order types, and access to a wide range of markets including Forex, indices, commodities, and cryptocurrencies. cTrader also provides comprehensive trading tools and indicators, making it ideal for both novice and experienced traders who prefer a modern and efficient trading experience.

MT4 (MetaTrader 4):

MT4 is a popular and widely used trading platform known for its extensive charting capabilities, automated trading features, and large community of expert advisors (EAs). It offers a wide range of technical analysis tools, customizable indicators, and automated trading strategies through the use of EAs. MT4 also provides access to multiple asset classes including Forex, stocks, indices, and commodities, making it suitable for traders of all levels who prefer algorithmic trading and advanced charting functionality.

MT5 (MetaTrader 5):

MT5 is the successor to MT4 and offers similar features with additional enhancements. It provides advanced charting tools, an expanded range of technical indicators, and improved execution speed. MT5 also supports more asset classes than MT4, including options, futures, and shares. Additionally, MT5 offers a built-in economic calendar, depth of market (DOM) feature, and enhanced back-testing capabilities, making it suitable for traders who require advanced trading tools and access to a broader range of markets.

Overall, the IB Platform's trading platforms, including cTrade, MT4, and MT5, offer a comprehensive suite of features and tools to meet the diverse needs of traders, whether they prefer a modern interface, advanced charting functionality, or automated trading capabilities.

Customer Support

The IB Platform offers customer support through email at support@ibplatform.co and phone at +442030973955. With dedicated channels for communication, traders can reach out for assistance with account-related inquiries, technical issues, or general queries. The support team is equipped to provide timely and helpful responses, ensuring a smooth trading experience for users. Whether traders require assistance with platform navigation, account funding, or troubleshooting, the IB Platform's customer support is readily available to address their needs and concerns effectively.

Conclusion

In conclusion, the IB Platform provides a comprehensive range of trading products and services, catering to the diverse needs of traders. With offerings such as commodities, currency indices, ETFs, and share CFDs, alongside flexible funding options through Visa, Mastercard, and PayPal, traders have access to a robust and versatile trading environment. Supported by advanced trading platforms like cTrader, MT4, and MT5, as well as dedicated customer support channels, the IB Platform prioritizes user experience and aims to facilitate seamless trading operations. However, it's essential to note that the platform operates without regulatory oversight, underscoring the importance of thorough research and caution when engaging in transactions.

FAQs

Q1: How can I fund my trading account on the IB Platform?

A1: You can fund your trading account using Visa, Mastercard, or PayPal for seamless transactions.

Q2: What trading platforms are available on the IB Platform?

A2: The IB Platform offers cTrader, MT4, and MT5, each catering to different trading preferences and strategies.

Q3: What are the minimum spreads for commodities trading?

A3: The minimum spreads vary for different commodities, providing traders with insight into trading costs and strategies.

Q4: Can I withdraw funds to my PayPal account?

A4: Yes, withdrawals to PayPal accounts are supported by many brokers on the IB Platform for added convenience.

Q5: Is there customer support available for assistance?

A5: Yes, the IB Platform offers customer support via email and phone to address account-related inquiries and technical issues promptly.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

继大选后,市场预期正在被颠覆和改写,美元或将拒绝下跌

美联储官员古尔斯比讲话前,美元/印度卢比持稳

比特币、以太坊、瑞波币预测:比特币价格创出历史新高后盘整

欧元/美元关注反弹,但涨势可能受限

曝光私照威胁持续入金!当人妻遇上黑平台人渣业务员

英国经济增长再次有所放缓 - 德国商业银行

美元/日元:将跌破 153.85 - 大华银行集团

美元/瑞郎:看涨,但超买 - 华侨银行

澳大利亚央行会议纪要公布前,澳元/美元在 0.6450 附近谨慎交投

澳元在0.65以下似乎超卖 -星展银行

汇率计算