简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Hotfxoption

摘要:Gedik YATIRIM provides various financial products and services, such as portfolio management and investment consultancy. Conversely, it lacks regulatory oversight. The complexity of its services could also intimidate newcomers, and the opaque details regarding account types and fees could complicate users' financial decisions.

| Aspect | Details |

| Company Name | Gedik YATIRIM |

| Registered Country | Turkey |

| Founded Year | 1991 |

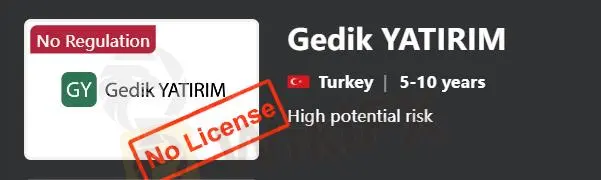

| Regulation | No Regulation |

| Tradable Assets | Stock Certificates, F&O Market (Futures and Options), Forex, Commodities, Precious Metals, Energy, Fixed Income Securities |

| Services | Portfolio Management, Investment Consultancy, Corporate Finance, Public Offering Brokerage, Corporate Treasury Transactions, International Corporate Sales, Brokerage Services |

| Trading Platforms | Gedik Trader (Web and Mobile) |

| Customer Support | Email bilgi@gedik.com, live chat, phone 0216-453-00-53, contact form |

| Educational Resources | Research and analysis, Newsletters |

Overview of Gedik YATIRIM

Gedik YATIRIM, established in 1991 in Turkey, operates without formal regulatory oversight. It provides several financial products including stock certificates, futures, options, forex, commodities, and precious metals. Geared towards both individual and corporate clients, Gedik YATIRIM offers investment solutions services, such as portfolio management, investment consultancy, and corporate finance services. It primarily operates through its proprietary trading platform, Gedik Trader, available on both web and mobile interfaces.

Pros and Cons

Gedik YATIRIM, a broker with a substantial offering of market instruments such as stocks, futures, and options, operates across international markets, providing various financial products. However, Gedik YATIRIM lacks regulatory oversight. Furthermore, the broker's services could be too complex for novice investors, and there is a lack of transparency in terms of account types, leverage options, spreads, and associated fees.

| Pros | Cons |

| Multiple market instruments including stocks, futures, and options | Not regulated |

| Operates in international markets offering access to multiple financial products | Relatively narrow focus on specific types of investments and regions |

| Provides financial instruments for sophisticated trading strategies | Services could be complex for new investors without prior market knowledge |

| Services covering individual and corporate financial needs | Lack of transparency of account types |

| Investment strategies and personalized consultancy | Obscurity regarding leverage, spreads and fees |

Is Gedik YATIRIM legit or a scam?

Gedik YATIRIM operates without formal regulatory oversight. The absence of a regulatory body means that traders are at greater risk of encountering fraudulent activities and unethical practices.

Market Instruments

Stock Certificates and Equity Markets:

Futures and Options Market (F&O):

International Markets:

Investment Funds:

Treasury Transactions:

Gedik YATIRIM allows trading in stock certificates, which are vital components of capital markets, under regulations defined in the Capital Markets Law and the Turkish Commercial Code.

The broker provides access to the Futures and Options Market within the Istanbul Stock Exchange. This market includes futures and options contracts on capital market instruments such as stock certificates, indices, currencies, precious metals, commodities, and energy.

It operates across 15 countries and 32 stock exchanges, facilitating trading in stock certificates, futures, options, and Eurobonds, with specific provisions for hedging and leveraging.

Gedik YATIRIM manages investment funds which are unincorporated assets managed on behalf of savers, focusing on fiduciary ownership and claiming to provide maximum benefit to investors.

The broker claims to protect against price movements or to capitalize on them in foreign exchange, commodity, interest, and share markets.

Services

Individual Services

Portfolio Management:

Investment Consultancy:

Corporate Services

Corporate Finance:

Public Offering Brokerage:

Corporate Treasury Transactions:

International Corporate Sales:

This service involves the expert management of investors' savings according to different risk and return preferences. It claims to adapt to changing market conditions, having alignment with the financial goals and risk profiles of individual and institutional investors.

The Investment Consultancy team provides investment consultancy based on detailed risk profile analyses. This service includes daily, weekly, and monthly communications, with one-on-one support for newcomers to the capital markets, enhanced by digital platforms like YouTube for instant support and detailed investment reports.

Offers a broad range of consultancy services at international standards, including brokerage for public offerings, mergers and acquisitions consultancy, and other specialized financial transactions. This service leverages an experienced team and a wide network to execute complex financial operations and enhance corporate financial strategies.

Facilitates the public offering process from pre-offering preparation to post-offering support. This includes managing compliance, marketing, and the distribution processes critical for successful public listings.

Provides products for protecting or capitalizing on price movements in various markets, targeting importers, exporters, and individual clients.

Delivers personalized long-term and daily investment strategies and advanced market analysis for a wide range of clients, from high-frequency institutional investors to conventional ones relying on fundamental analysis.

Brokerage Services

Gedik YATIRIM offers extensive brokerage services across a variety of markets including equity, debt, and derivatives. The brokerage services are supported by an experienced team that assists clients in selecting and managing the best investment products to meet their risk and return expectations.

How to Open an Account with Gedik YATIRIM

To open an account with Gedik YATIRIM, start by navigating to their website and clicking the 'open account' button. The initial steps involve:

Create Your Account: Begin by filling in the required personal details to set up your account.

Confirm Your Contracts: Review and agree to the necessary contracts and terms of service.

Verify Your Identity: Provide the required documentation to verify your identity, which often includes ID, proof of address, and other relevant information.

Trading Platform

Gedik YATIRIM presents its bespoke trading platform, Gedik Trader, which is engineered to accommodate a broad spectrum of trading activities in the BIST Equity and Futures & Options (F&O) markets. Drawing on over a quarter-century of market expertise, Gedik Trader is accessible both via web and mobile applications, enabling investors to engage with the market effectively. It offers real-time or 15-minute delayed market data and supports extensive trading functionalities, including equity and derivatives trading.

Customer Support

Email: bilgi@gedik.com

Headquarters: Altayçeşme Mahallesi, Çamlı Sokak, No: 21, Kat: 10-11-12, 34843 Maltepe/İstanbul

Investor Contact Center: 0216-453-00-53

Online live chat and a contact form are available on their website.

Educational Resources

Gedik YATIRIM's Research and Analysis capability, foundational to Gedik Investment, delivers comprehensive market insights through various publications such as Daily, Weekly, and Monthly Newsletters, Strategy Reports, and Company Reports.

The Newsletter Subscription service complements this by allowing investors to receive customized reports and analyses. Investors can select to receive information on specific investment products, streamlining the influx of data to suit their unique investment goals and strategies.

Conclusion

Founded in 1991, Gedik YATIRIM is a Turkish-based financial brokerage that offers multiple financial products, including equities, derivatives, forex, and commodities. The firm also provides services such as portfolio management and investment consultancy. While Gedik YATIRIM boasts a broad market presence and varied service offerings, the absence of regulatory oversight indicates potential challenges. The brokerage operates via its proprietary trading platform, Gedik Trader, which supports both web and mobile interfaces.

FAQs

Q: What types of financial instruments can I trade at Gedik YATIRIM?

A: Gedik YATIRIM offers trading in equities, derivatives, foreign exchange, commodities, and precious metals.

Q: Does Gedik YATIRIM have regulatory accreditation?

A: No, Gedik YATIRIM is not regulated.

Q: What trading platforms are available at Gedik YATIRIM?

A: The brokerage uses its proprietary platform, Gedik Trader, accessible via web and mobile apps for trading.

Q: What are the main services provided by Gedik YATIRIM?

A: The firm provides portfolio management, investment consultancy, corporate finance, and various brokerage services.

Q: How do I start trading with Gedik YATIRIM?

A: You can start by visiting their website, registering for an account, accepting the terms, and verifying your identity.

Q: Are there educational materials available at Gedik YATIRIM?

A: Yes, Gedik YATIRIM offers analyses and newsletters on a regular basis.

Q: How can I contact Gedik YATIRIM customer service?

A: Customer support is available via email, live chat, phone calls, and an online contact form.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. We strongly advise readers to verify updated details directly with the company before making any decisions, as the readers must be aware of and willing to accept the inherent risks involved in utilizing this information.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

曝光私照威胁持续入金!当人妻遇上黑平台人渣业务员

澳大利亚央行会议纪要公布前,澳元/美元在 0.6450 附近谨慎交投

英国经济增长再次有所放缓 - 德国商业银行

美元指数:当日盘整 - 华侨银行

澳元/日元依然低于100.00,澳洲联储鹰派前景使得汇价仍有上涨潜力

欧元/美元:将交投于1.0505-1.0585之间 - 大华银行

美元/瑞郎:看涨,但超买 - 华侨银行

澳元在0.65以下似乎超卖 -星展银行

澳大利亚央行行长助理肯特:澳大利亚的前瞻性指导可能不如美国有用

美元/日元:将跌破 153.85 - 大华银行集团

汇率计算