简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Some Detailed Information about PI Financial Corp

摘要:Founded in 1982 and headquartered in Vancouver, Canada, PI Financial has expanded to a total of 11 branches across the country. The firm offers a broad spectrum of financial products and services such as Investment Advisory, Wealth Management, Futures, Insurance, Research, Investment banking, Advisory, Sales, and trading catering to both individual and corporate clients. It currently holds a Market Making (MM) license regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

| PI Financial Review Summary in 5 Points | |

| Founded | 1982 |

| Registered Country/Region | Canada |

| Regulation | IIROC regulated |

| Financial Products & Services | Investment Advisory, Wealth Management, Futures, Insurance, Research, Investment-banking, Advisory, Sales and trading |

| Customer Support | Phone, Address, Social media, Contact us form, Advisory Directory |

What is PI Financial?

Founded in 1982 and headquartered in Vancouver, Canada, PI Financial has expanded to a total of 11 branches across the country. The firm offers a broad spectrum of financial products and services such as Investment Advisory, Wealth Management, Futures, Insurance, Research, Investment banking, Advisory, Sales, and trading catering to both individual and corporate clients. It currently holds a Market Making (MM) license regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

In the forthcoming article, we will dissect the attributes of this broker from varied angles, equipping you with concise and structured information. If this piques your interest, we urge you to continue reading. We will wrap up the article with a succinct conclusion, enabling a quick snapshot understanding of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| • IIROC regulated | • Limited info on deposits/accounts/fee structure |

| • Wide range of financial products and services | |

| • Abundant and accessible customer supports |

Is PI Financial Safe or Scam?

When considering the safety of a financial company like PI Financial or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial company:

Regulatory sight: Currently, operating under the Investment Industry Regulatory Organization of Canada (IIROC) regulation, PI Financial holds a Market Making (MM) license. While this regulatory status may instill a sense of dependability, it's essential to bear in mind that possessing experience in the field doesn't inherently guarantee the legitimacy or safety of a financial company.

User feedback: Peruse through reviews and feedback from other clients to gain insights into their encounters with the brokerage. You can find these reviews on trustworthy websites and online forums

Security measures: PI Financial bolsters its safety protocols by implementing a stringent privacy policy. This policy outlines their meticulous methods of managing and protecting users' personal data.

Ultimately, the decision to trade with PI Financial is an individual one. It is crucial that traders carefully weigh the potential risks and rewards before making a final choice.

Financial Products & Services

PI Financial offers a broad array of financial products and services to all client segments through its international network.

For Individual Clients:

Investment Advisory: Their services include a comprehensive analysis of the client's current financial situation, asset allocation guidance, portfolio design, ongoing management and monitoring, extensive reporting, and financial, retirement, and estate planning services.

Commodities Futures and Futures Options: PI Financial offers expertise in various segments including Stock Indexes, Soft Commodities, Agriculture, Interest Rates, Currencies, and Base & Precious Metals.

Insurance: Their suite of personal insurance services extends to life, accident & sickness, critical illness, disability, and long-term insurance needs. They also provide segregated funds, annuities and business insurance.

For Corporate Clients:

Investment Banking: PI Financial offers services including Initial Public Offerings (IPOs), underwritten financings and private placements, advisory services for mergers and acquisition, divesture and spin-out mandates, transaction sponsorship, fairness opinions, and transaction financing.

Institutional Sales & Trading: Coverage spans a range of sectors like mining, metals, technology, special situations and emerging industries. They offer the sales and trading of diverse financial products for institutional investors.

Equity and Economic Research Services: The company provides profound market research services, giving corporate clients beneficial insights to make informed decisions about their investments.

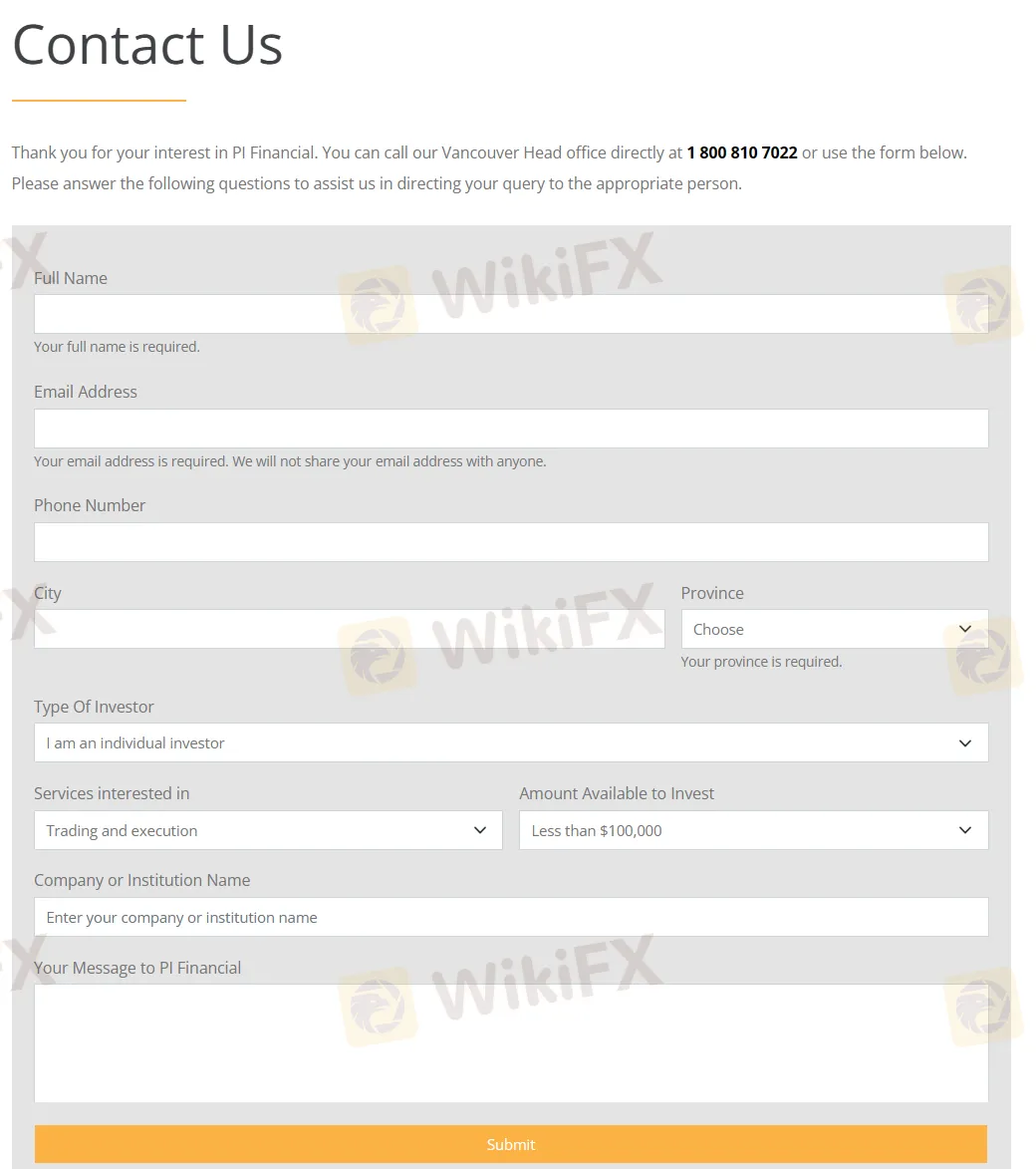

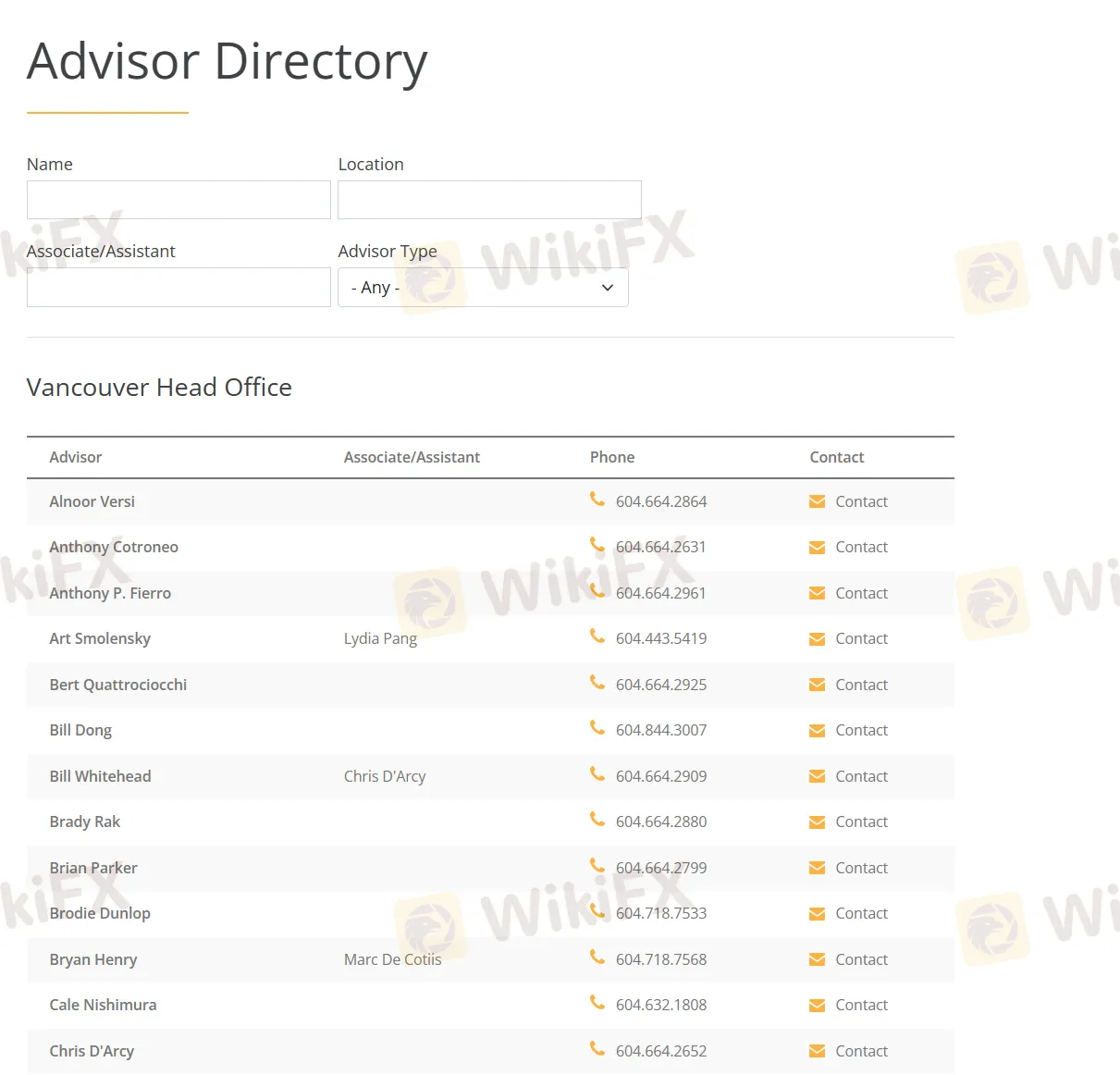

Customer Service

PI Financial provides a variety of support options for their clients. They can be reached via phone and through a “Contact Us” form for general inquiries and concerns. Clients can also engage with them on social media such as Facebook and Linkedin for updates and information.

Phone:+1 800 810 7022.

In addition, PI Financial has made it easy for traders to seek advice and guidance by providing distinct contact details for each branch, including office locations and associated advisors. This can be accessed via specific links as below.

https://www.pifinancialcorp.com/contact-us/advisor-directory

https://www.pifinancialcorp.com/contact-us/office-locations

Education

PI Financial offers various educational resources to support their clients.

They host “Analyst Talks,” where their knowledgeable analysts share industry insights, trends, and investment strategies.

Additionally, they conduct webinars and conferences covering a wide range of financial topics.

These sessions provide an excellent learning platform, allowing clients to gain valuable knowledge from industry experts while also having opportunities to ask questions and interact directly with industry professionals. This commitment to education by PI Financial empowers their clients by enhancing their understanding of the dynamic world of finance.

Conclusion

To summarize, PI Financial is a reputable Canadian financial firm regulated by the IIROC. It offers a diverse range of financial products and services to cater to both individual and corporate clients. These include Investment Advisory, Wealth Management, Futures, Insurance, Research, and Investment-Banking, alongside Advisory, Sales and Trading services.

Despite its commendable credentials and comprehensive service offering, potential clients should exercise due diligence. It is particularly important to carry out in-depth research and reach out directly to PI Financial for the most current, factual information prior to making any firm investment decisions. This is crucial to fully understand the potential risks and rewards associated with their financial services.

Frequently Asked Questions (FAQs)

| Q 1: | Is PI Financial regulated? |

| A 1: | Yes, it currently under IIROC (Investment Industry Regulatory Organization of Canada) regulation. |

| Q 2: | Is PI Financial a good broker for beginners? |

| A 2: | Yes, it‘s a good broker for beginners because it’s well regulated by IIROC and offers educational resources to traders. |

| Q 3: | Whats the products and services of PI Financial? |

| A 3: | PI Financial offers services including Investment Advisory, Wealth Management, Futures, Insurance, Research, Investment-banking, Advisory, Sales and trading to all client sectors, both individual and corporate. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

曝光私照威胁持续入金!当人妻遇上黑平台人渣业务员

澳大利亚央行会议纪要公布前,澳元/美元在 0.6450 附近谨慎交投

英国经济增长再次有所放缓 - 德国商业银行

美元指数:当日盘整 - 华侨银行

澳元/日元依然低于100.00,澳洲联储鹰派前景使得汇价仍有上涨潜力

欧元/美元:将交投于1.0505-1.0585之间 - 大华银行

美元/瑞郎:看涨,但超买 - 华侨银行

澳元在0.65以下似乎超卖 -星展银行

澳大利亚央行行长助理肯特:澳大利亚的前瞻性指导可能不如美国有用

美元/日元:将跌破 153.85 - 大华银行集团

汇率计算