简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FOREX.com

摘要:Forex.com is one of the most respected and trusted forex brokers in the foreign exchange trading industry. Founded in 2001, Forex.com is a global company licensed and regulated by several reputable regulatory authorities, including ASIC in Australia, FCA in the United Kingdom, FSA in Japan, NFA in the United States, IIROC in Canada, CIMA in the Cayman Islands and MAS in Singapore. These regulators are known for their strict compliance and oversight requirements, which means that Forex.com is required to meet high ethical and operational standards to protect its clients and ensure the safety of their funds.

Let's start here:

Forex.com is a major player in forex trading, providing various options including forex, indices, stocks, cryptocurrency, commodities, gold & silver. Their platforms, like the popular MetaTrader 4 and MetaTrader 5, are available worldwide to meet different trader preferences. Backed by robust regulation and a strong focus on security, Forex.com is a favored choice for professionals looking for an all-encompassing trading experience. Now, let's delve deeper to verify if Forex.com lives up to its reputation.

| Quick Forex.com Review | |

| Founded | 2001 |

| Registered | USA |

| Regulation | ASIC (Australia), FCA (UK), FSA (Japan), NFA (USA), CIRO (Canada), MAS (Singapore) |

| Market Instruments | Forex, indices, stocks, cryptocurrency, commodities, gold & silver |

| Demo Account | ✅(90 days risk-free trading with $50,000 in virtual funds) |

| Max. Leverage | 1:200 |

| EUR/USD Spread | Floating around 1.0 pips |

| Trading Platforms | Web Trader, Mobile App, TradingView, MT4, MT5 |

| Minimum Deposit | $100 |

| Customer Service | Live chat, contact form, phone, email |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Forex.com Information

Forex.com is one of the most respected and trusted forex brokers in the foreign exchange trading industry. Founded in 2001, Forex.com is a global company licensed and regulated by several reputable regulatory authorities, including ASIC in Australia, FCA in the UK, FSA in Japan, NFA in the USA, CIRO in Canada, and MAS in Singapore.

Pros & Cons

| Pros | Cons |

| Well-regulated | Less user-friendly for novice traders |

| Wide variety of investment products | High stock trading fees |

| Advanced trading tools | |

| Low forex fees, no fx commissions | |

| Multiple trading platforms available | |

| Decent customer service | |

| Negtive balance protection |

Is Forex.com Legit?

Yes, Forex.com operates legally. Forex.com, a globally recognized broker, is part of an international holding company regulated by reputable authorities worldwide, including ASIC (Australia), FCA (UK), FSA (Japan), NFA(USA), CIRO (Canada), and MAS (Singapore).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | STONEX FINANCIAL PTY LTD | Market Making(MM) | 345646 |

| FCA | Gain Capital UK Limited | Market Making(MM) | 113942 |

| FSA | GAIN Capital Japan Co., Ltd | Retail Forex License | 関東財務局長(金商)第291号 |

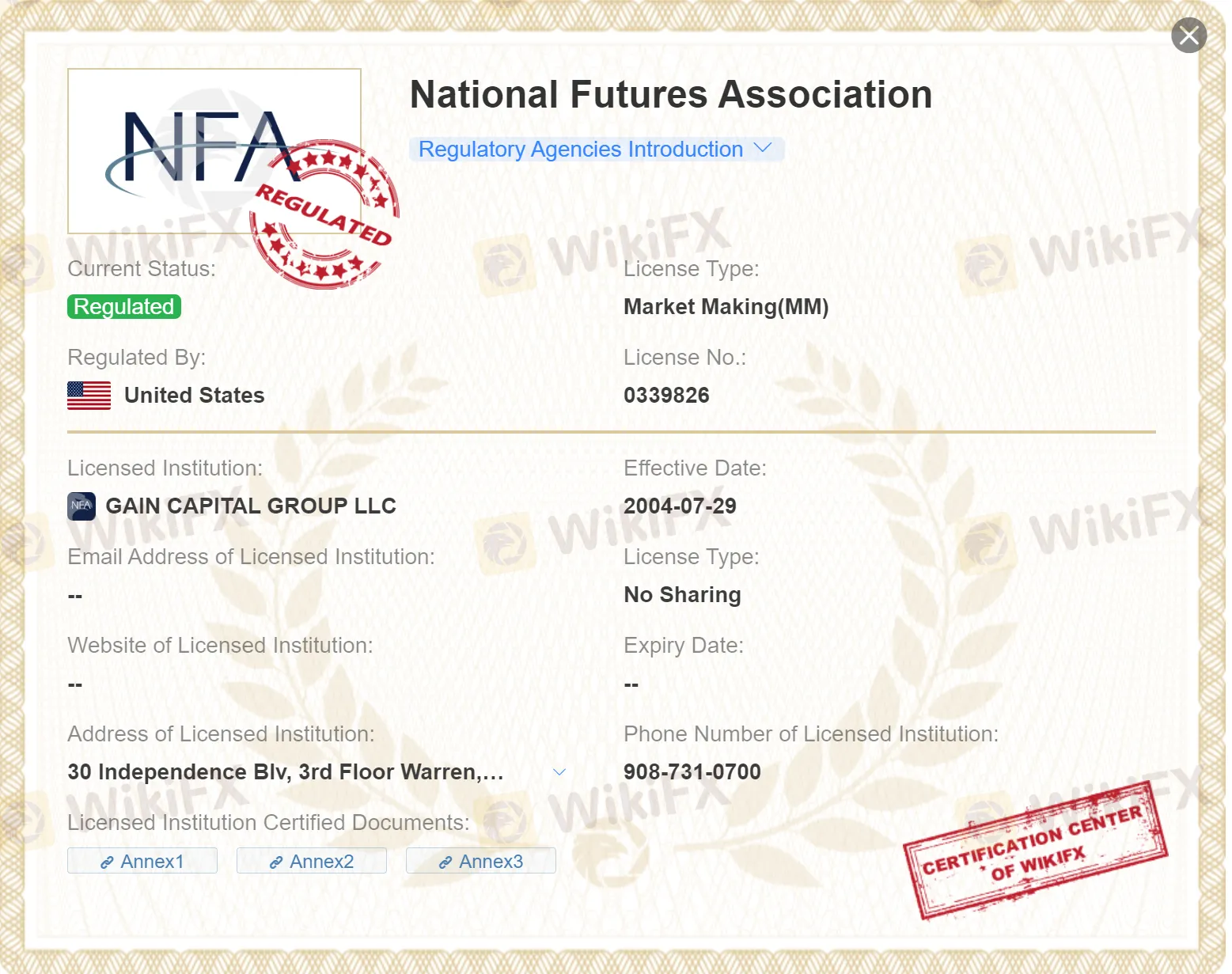

| NFA | GAIN CAPITAL GROUP LLC | Market Making(MM) | 0339826 |

| CIRO | GAIN Capital - FOREX.com Canada Ltd. | Market Making(MM) | Unreleased |

| MAS | STONEX FINANCIAL PTE. LTD. | Retail Forex License | Unreleased |

Forex.com's Australian entity, STONEX FINANCIAL PTY LTD, regulated by the ASIC in Asutralia under regulatory number 345646, holding a license for Market Making(MM).

Forex.com's UK entity, Gain Capital UK Limited, regulated by tier-one regulatory FCA under regulatory number 113942, holding a license for Market Making(MM).

The entity based in Japan, GAIN Capital Japan Co., Ltd, regulated by FSA under regulatory number 関東財務局長(金商)第291号, holding a license for Retail Forex License.

GAIN CAPITAL GROUP LLC, the US entity, regulated by the NFA under regulatory number0339826, holding a license for Market Making(MM).

Candian entity, GAIN Capital - FOREX.com Canada Ltd., is regulated by the IIROC, holding a license for Market Making (MM), with license unreleased.

STONEX FINANCIAL PTE. LTD., the entity in Singapore, regulated by the MAS in Singapore, holding a license for retail forex.

Additionally, Forex.com offers negative balance protection on all of its trading accounts. This means that clients cannot lose more money than they have in their account, providing an additional layer of security and peace of mind in trading. In the event that an extreme market situation occurs and a position moves against the client, Forex.com will automatically close the position before the account balance falls below zero. This protection helps limit risk for clients and is an important feature to consider when choosing a forex broker.

Market Instruments

Forex.com offers a wide variety of trading instruments, includingforex, indices, stocks, cryptocurrency, commodities, gold & silver. Traders have a wide range of options to choose from and can find opportunities in a variety of markets.

Minimum Deposit

The minimum deposit amount required to register a Forex.com Standard live trading account is $100, which is quite friendly to most investors.

Here is the table showing the comparison of Forex.com minimum deposit with other brokers:

| Broker | Minimum Deposit |

| $100 |

| $0 |

| $5 |

| $200 |

Accounts

Forex.com offers its clients two types of trading accounts: the Standard account and the Raw Spread account.

The Standard account is ideal for traders looking for a wide range of advanced charting tools with more than 80 technical indicators and a wide selection of markets to trade with variable spreads as low as 1.0 pips on the EUR/USD currency pair. In addition, this account does not charge commissions on over 300 markets. The commission is only for equities.

On the other hand, the Raw Spread account is ideal for traders looking for raw spreads. Both accounts offer access to Forex.com's award-winning, technologically advanced and easy-to-use trading platform. In addition, clients can switch between the two accounts at any time to suit their trading needs.

| Account Type | Spread | Commission |

| Standard | Variable, EUR/USD as low as 1.0 pips | Only for quities |

| Raw Spread | Tightest, majors as low as 0.0 pips | Fixed 5 per 100k USD traded on FX |

Forex.com also provides beginners with demo accounts, allowing them to practice in a real trading setting without any financial risks. Demo accounts come with $50,000 in virtual funds and are active for 30 days from the time of registration. Please be aware that once this period ends, you won't be able to access the demo account with the same login details. Notably, each email address can only be used to open one demo account for each type, whether it's on FOREX.com platforms or MetaTrader.

With Forex.com demo accounts, you can enjoy the following features:

- $50,000 virtual funds

- Demo accounts active for 90 days

- Access to 80+ tradable FX pairs, plus gold and silver

- Using customizable charts

Here is the simple demo account sign-up process for you to follow:

Step 1: Click the “Free Demo Account” button on the “Account” Navigation section.

Step 2: Fill in your full name, email and phone number in the form, and then click I'm not a robot for verification.

Step 3: After a simple registration, you can use the demo account and start trading.

Spreads & Commissions

Forex.com offers competitive spreads and low commissions on a wide range of trading instruments. Spreads for the EUR/USD currency pair is floating around 1.0 pips, which is very low compared to other brokers. You can find spreads on other pairs in the screenshot below:

Commissions vary by market: for most US stocks it is 1.8 cents per share, and 0.08% of the consideration for most UK, EU, and Asian stocks. The minimum commission rates are 10 of the stock's base currency.

Trading Platforms

FOREX.com offers a variety of trading platforms designed to cater to the diverse needs of its traders, from beginners to experienced market participants.

MetaTrader 4 (MT4): Widely recognized as the industry standard for forex trading, MT4 is favored for its advanced charting capabilities, automated trading features through Expert Advisors (EAs), and extensive back-testing environment. FOREX.com enhances MT4 with additional tools and research to optimize trading.

MetaTrader 5 (MT5): As the successor to MT4, MT5 offers all the admired features of MT4 but with additional capabilities such as more timeframes, more technical indicators, advanced charting tools, and supports trading in stocks, commodities, and futures markets along with forex.

TradingView: TradingView is a premium business utility that offers a free demo of its trade charting platform. The app is simple for beginners and effective for technical analysis experts.

Web Trading Platform: Accessible directly from a web browser without the need to download or install any software, this platform is built on HTML5 and offers a rich set of features including powerful charts, a suite of trading tools, and integrated trading strategies.

Mobile Trading Apps: FOREX.com provides mobile applications compatible with Android and iOS devices, allowing traders to manage their accounts on the go. These apps offer full trading capabilities, complex order types, and interactive charts.

Deposit & Withdrawal

Forex.com offers several payment methods for depositing and withdrawing funds, such as credit card (Visa, Mastercard, Maestro), wire transfer, Skrill and Neteller. Deposits are processed within 24 hours, which means traders can start trading quickly. Withdrawals are also fast, usually taking 1-2 business days to process. It is important to note that Forex.com does not charge any additional fees for deposits or withdrawals, but payment service providers may impose their own fees.

Education

Forex.com offers different educational resources for different traders. If you are just a beginner, you can choose “new to trading”, and then you can find beginner-friendly educational resources. If you are professional, you can choose “an experienced trader”, then you can go to more advanced educational resources. Academy, tutorials, webinars, and free demo accounts are all available to practice and improve trading skills.

Conclusion

In summary, Forex.com is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid reputation in the industry and its focus on security and protection of client funds, Forex.com is an attractive option for traders looking for a reliable and secure broker.

Frequently Asked Questions (FAQs)

Does Forex.com offer a demo account for practice?

Yes.

What is the minimum deposit to open an account at Forex.com?

100 dollars.

Does Forex.com charge commissions for trades?

Forex.com charges commissions for some trades, such as stock trading. However, it does not charge commissions in most markets. Instead, Forex.com earns profits through the spread between the bid and ask prices of assets.

Does Forex.com have any kind of training or education program for traders?

Yes, Forex.com offers a wide variety of educational resources for traders of all levels, including live webinars, seminars, trading guides, articles and educational videos.

What payment methods does Forex.com accept?

Forex.com accepts various payment methods, including credit and debit cards, bank transfers, as well as electronic payment systems such as Skrill and Neteller.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

相关阅读

【RockGlobal】全世界都在用的交易软件——MT4

从2000年发布的 FX图表起, MetaQuotes软件公司的创始人怎么也没料到,自己开发出来的一款软件竟然能在短短13年内风靡全球,甚至连后来的软件都受到了极大的限制。 这款传说中的机器就是迈达在2005年7月1日发布的MetaTrader4。

关于iOS端MT4与MT5使用重要公告

移动版 MT4 和 MT5

玩转交易场赢IPhone13

新客户首入金达指定金额即可获取红包,再达指定层级手数即可获取礼品

【小海龟】顺势、盈利、再加仓。让雪球变大,唯一办法是盈利并加仓!

如果按照是否加仓来划分策略类型的话,那么有两种情况:1.加仓策略2.不加仓策略如果再把加仓策略氛围两种类型的话,分为:1.亏损加仓2.盈利加仓亏损加仓、盈利加仓。虽然都是加仓策略,但是结局就是天堂与地狱的区别。亏损加仓:

天眼交易商

热点资讯

曝光私照威胁持续入金!当人妻遇上黑平台人渣业务员

澳大利亚央行会议纪要公布前,澳元/美元在 0.6450 附近谨慎交投

英国经济增长再次有所放缓 - 德国商业银行

美元指数:当日盘整 - 华侨银行

澳元/日元依然低于100.00,澳洲联储鹰派前景使得汇价仍有上涨潜力

欧元/美元:将交投于1.0505-1.0585之间 - 大华银行

美元/瑞郎:看涨,但超买 - 华侨银行

澳元在0.65以下似乎超卖 -星展银行

澳大利亚央行行长助理肯特:澳大利亚的前瞻性指导可能不如美国有用

美元/日元:将跌破 153.85 - 大华银行集团

汇率计算