WikiFX作为一家独立的第三方信息服务平台,致力于为用户提供全面、客观的交易商监管信息查询服务。WikiFX不直接参与任何外汇交易行为,也不提供任何形式的交易渠道推荐或投资建议。WikiFX对交易商的评分评级依据公开渠道的客观信息,并充分兼顾不同国家和地区的监管政策差异。交易商评分评级是WikiFX的核心产品,我们坚决反对任何可能损害其客观性和公正性的商业行为,欢迎全球用户的监督和建议。举报热线:report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

交易商搜索

简体中文

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Benny44

0123456789

0123456789

0123456789

0123456789

投资者

ID: 3765117124

香港

6-10年

关注

Benny44

Understanding the Concept of Forex Trading

What is Forex Trading?*

Forex trading involves buying and selling currencies on the foreign exchange market.

Why Trade Forex?*

- Liquidity: Forex market is highly liquid

- Accessibility: Trade from anywhere with an internet connection

- Market hours: Forex market is open 24/5

- Leverage: Use borrowed capital to increase potential gains

Basic Forex Concepts*

- Currency pairs: EUR/USD, USD/JPY, etc.

- Exchange rates: Price of one currency in terms of another

- Bid/Ask prices: Buy/Sell prices

- Pips: Smallest price change (0.0001)

- Leverage: Borrowed capital to increase trade size

1周内

Benny44

Forex Trading: Currency Exchange

1. Currency pairs: Forex trading involves trading currency pairs, such as EUR/USD (Euro vs. US Dollar) or USD/JPY (US Dollar vs. Japanese Yen).

2. Major currencies: The most widely traded currencies are the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD), Australian Dollar (AUD), and New Zealand Dollar (NZD).

3. Currency symbols: Each currency has a unique symbol, such as $ for the US Dollar, € for the Euro, and £ for the British Pound.

4. Exchange rates: Exchange rates determine how much of one currency can be exchanged for another.

5. Currency strength: Currencies can strengthen (appreciate) or weaken (depreciate) relative to other currencies.

6. Currency correlation: Certain currency pairs tend to move together, such as the EUR/USD and GBP/USD.

7. Currency intervention: Central banks can intervene in the Forex market to influence exchange rates.

8. Currency risks: Forex traders face risks such as exchange rate fluctuations, political instability, and economic changes.

9. Currency converter: A currency converter tool helps traders convert between currencies.

10. Currency quotes: Forex brokers provide currency quotes, which include the bid (buy) and ask (sell) prices.

Remember, understanding currencies and their interactions is crucial for successful Forex trading!

1周内

Benny44

Concepts on Forex trading: Brokers

Forex brokers are intermediary firms that facilitate Forex trading between individuals and institutions. They provide traders with access to the Forex market, enabling them to buy and sell currencies

Choosing a Forex Broker:

1. Reputation: Research the broker's history and reviews.

2. Regulation: Ensure the broker is properly licensed and regulated.

3. Trading Conditions: Compare spreads, leverage, and execution quality.

4. Customer Support: Evaluate the broker's support and education resources.

5. Security: Verify the broker's security measures and fund segregation.

1周内

Benny44

Forex Trading Brokers

Forex brokers are intermediary firms that facilitate Forex trading between individuals and institutions. They provide traders with access to the Forex market, enabling them to buy and sell currencies.

Types of Forex Brokers:

1. Market Makers: Set bid/ask prices, provide liquidity, and profit from spreads.

2. Electronic Communication Network (ECN) Brokers: Connect traders directly to the market, charging commissions.

3. Straight-Through Processing (STP) Brokers: Route trades directly to liquidity providers, earning commissions

Regulation and Security:

1. Licensing: Brokers must obtain licenses from regulatory bodies, such as the Commodity Futures Trading Commission (CFTC).

2. Segregation of Funds: Brokers must separate client funds from their own.

3. Negative Balance Protection: Ensures traders cannot lose more than their account balance.

Forex brokers play a crucial role in the Forex market, providing traders with access to the market and essential services. When choosing a Forex broker, it is essential to consider reputation, regulation, trading conditions, customer support, and security. By selecting a reliable and suitable broker, traders can ensure a successful and secure Forex trading experience.

1周内

Benny44

Forex Trading:Specialization

1. Currency pair specialization: Focus on specific pairs, such as EUR/USD or USD/JPY.

2. Trading strategy specialization: Expertise in specific strategies, like day trading or swing trading.

3. Market analysis specialization: Focus on technical analysis, fundamental analysis, or sentiment analysis.

4. Time frame specialization: Focus on specific time frames, such as scalping or long-term trading.

Benefits of specialization:

1. Improved expertise: In-depth knowledge of a specific area.

2. Increased efficiency: Focus on a specific area allows for more effective use of time and resources.

3. Better risk management: Specialization helps traders understand and manage risks more effectively.

4. Enhanced performance: Specialization leads to more accurate predictions and profitable trades.

1周内

Benny44

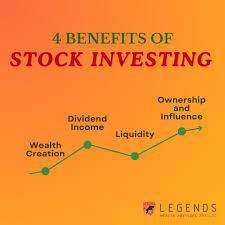

Stock Market Rewards

Benefits of Stock Market:

- Wealth Creation: Share price appreciation and dividends generate wealth for investors.

- Economic Growth: Companies use raised capital for growth, driving economic expansion.

- Ownership: Shareholders have a stake in companies, promoting accountability and transparency.

1周内

Benny44

Stock Market Limitations

Key Players:

- Investors: Individuals, institutions, and organizations that buy and sell shares.

- Listed Companies: Companies whose shares are traded on the stock exchange.

- Stock Exchanges: Platforms where buying and selling occur, such as the NYSE and NASDAQ.

- Brokers: Intermediaries who facilitate transactions between investors and the exchange.

Challenges and Risks:

- Volatility: Share prices fluctuate rapidly, posing risks for investors.

- Risk of Loss: Investors may lose some or all of their investment.

- Market Manipulation: Unethical practices, such as insider trading, can distort the market.

- Regulatory Challenges: Evolving regulatory frameworks can impact market dynamics

1周内

Benny44

Global stock market

The stock market, also known as the equity market, is a platform where companies raise capital by issuing shares of stock to the public, and investors buy and sell those shares in hopes of earning a profit. It plays a vital role in the global economy by enabling companies to raise capital, facilitating wealth creation, and providing a platform for investment.

History of Stock Market:

The modern stock market originated in Amsterdam in the 17th century, with the establishment of the Dutch East India Company. The London Stock Exchange was founded in 1698, followed by the New York Stock Exchange (NYSE) in 1792.

- Raising Capital: Companies issue shares to raise funds for expansion, research, and development.

- Investment Avenue: Investors buy shares to earn dividends and capital appreciation.

- Liquidity: Investors can easily buy and sell shares.

- Price Discovery: Market forces determine share prices, reflecting a company's performance and prospects.

- Risk Management: Investors can diversify portfolios to minimize risk.

l

1周内

Benny44

Forex trading Analysis

- Decentralized: Forex is a global network of banks, brokers, and individual traders, with no central exchange.

- Global: Forex is traded worldwide, with markets open 24/5 (Sunday evening to Friday evening).

- $6 trillion daily volume: The Forex market is the largest financial market, with a massive daily trading volume.

- Currency pairs: Currencies are traded in pairs (e.g., EUR/USD, USD/JPY).

- Exchange rates: Rates fluctuate based on supply and demand.

- Traders buy and sell: Traders profit from exchange rate fluctuations.

- Liquidity: Easy entry and exit, with markets open 24/5.

- Accessibility: Trade online from anywhere.

- Leverage: Control large positions with a small amount of capital.

- Volatility: Profit from changes in currency values.

1周内

Benny44

Risk management: Forex trading

- Risks:

- Market risk: Rapid changes in currency values.

- Leverage risk: Amplifies losses and gains.

- Liquidity risk: Difficulty entering or exiting trades.

-

- Risk management:

- Position sizing (manage trade size).

- Stop-loss orders (limit losses).

- Take-profit orders (secure profits).

- Diversification (spread risk).

1周内

点击加载更多

可能感兴趣的人

换一换

黄金ea策略172852722

关注

Exness平台 高效率~找Golddabai

关注

AXI顶级投资平台-代理招商顾问

关注

黄金交易系统 搜172852722

关注

指数技术,业内霸主地位,来玩啊-2

关注