简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Efixxen

บทคัดย่อ:Efixxen, an unregulated broker headquartered in the United States, offers a trading platform with a minimum deposit requirement of $250 and high leverage of up to 1:400. Traders can benefit from flexible spreads starting at 0 pips while accessing various asset classes, including currencies, stocks, spot metals, commodities, digital currencies, and indices. Efixxen provides multiple account types, ranging from Beginner to VIP, with Islamic account options available for certain types. They offer customer support services 24/5 via phone and email; however, information about accepted payment methods and educational resources is not provided. Traders considering Efixxen should be mindful of the absence of regulation and perform thorough research before engaging with the platform.

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | Efixxen |

| Regulation | Unregulated |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Flexible, starting at 0 pips |

| Trading Platforms | Mobile Trader, Linux Trader, MacOS Trader |

| Tradable Assets | Currencies, Stocks, Spot Metals, Commodities, Digital Currencies, Indices |

| Account Types | Beginner, Standard, Intermediate, Advanced, Integral, VIP |

| Islamic Account | Available for certain account types |

| Customer Support | 24/5 support via phone and email |

| Payment Methods | Information not provided |

| Educational Tools | Not offered by Efixxen |

Overview

Efixxen, an unregulated broker headquartered in the United States, offers a trading platform with a minimum deposit requirement of $250 and high leverage of up to 1:400. Traders can benefit from flexible spreads starting at 0 pips while accessing various asset classes, including currencies, stocks, spot metals, commodities, digital currencies, and indices. Efixxen provides multiple account types, ranging from Beginner to VIP, with Islamic account options available for certain types. They offer customer support services 24/5 via phone and email; however, information about accepted payment methods and educational resources is not provided. Traders considering Efixxen should be mindful of the absence of regulation and perform thorough research before engaging with the platform.

Regulation

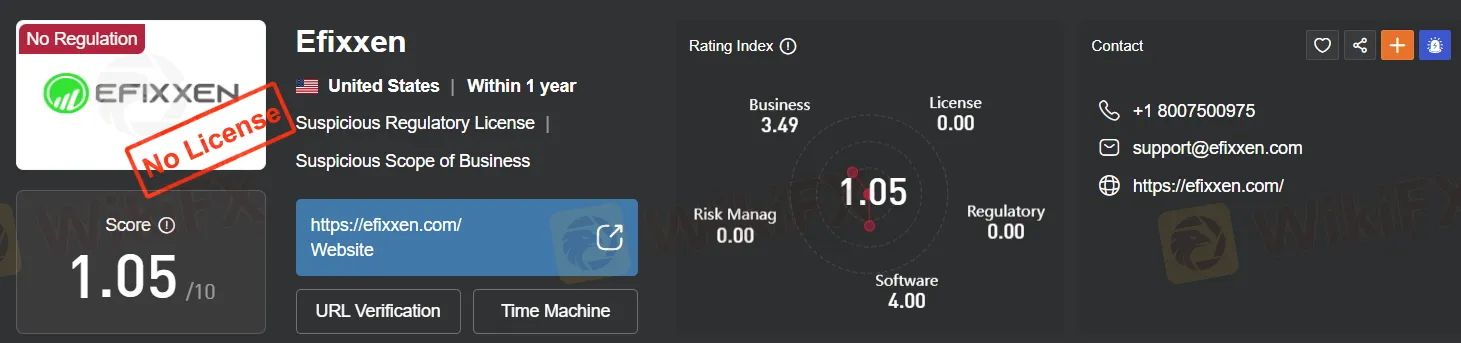

Efixxen operates as an unregulated broker in the financial industry, offering trading and investment services. Unregulated brokers like Efixxen are not subject to the oversight and regulations imposed by financial authorities, which raises concerns regarding investor protection.

The primary issue with unregulated brokers is the absence of safeguards such as capital requirements, segregation of client funds, and regulatory audits. This lack of oversight can expose clients to higher risks and reduce transparency and accountability.

When considering Efixxen or any unregulated broker, it's essential to exercise caution, conduct thorough research, and be aware of the potential risks. It's generally advisable to prioritize regulated brokers with reputable oversight to ensure a higher level of confidence and protection for your investments. Always understand the risks associated with unregulated brokers and seek professional advice if necessary.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulation |

| Multiple Account Types | Inactivity Fee |

| Competitive Spreads | Limited Educational Resources |

| No Commission Fees | No Demo Account Information |

| Low Minimum Deposit | Unclear Payment Methods |

| High Leverage |

Efixxen offers a diverse range of market instruments, multiple account types, competitive spreads, no commission fees, a low minimum deposit requirement, and high leverage. However, it operates as an unregulated broker, potentially raising concerns about investor protection. The broker also imposes an inactivity fee, lacks educational resources, and does not provide clear information about the availability and features of a demo account or accepted payment methods. Traders should carefully weigh these pros and cons when considering Efixxen as their trading platform.

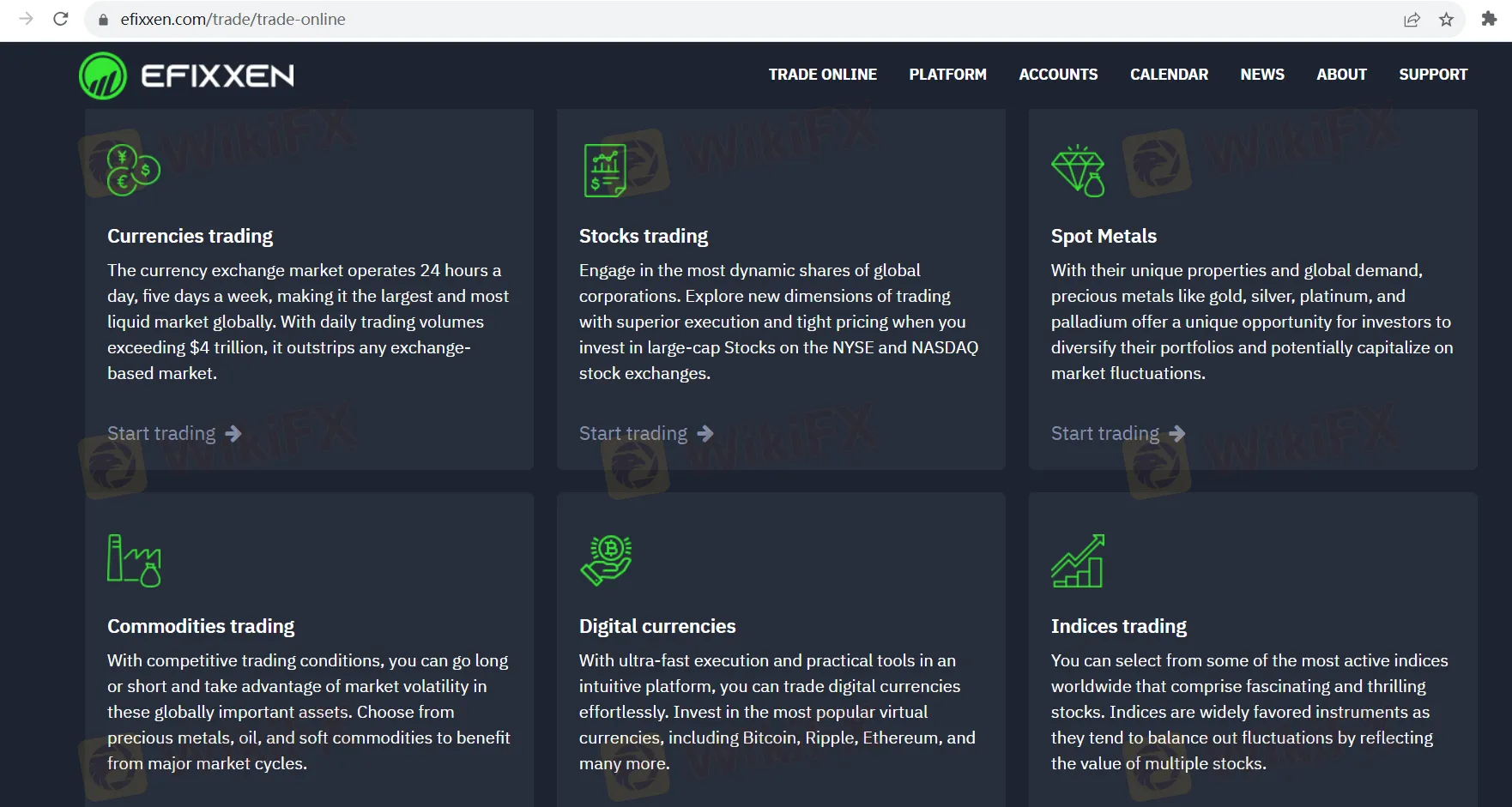

Market Instruments

The broker offers a diverse range of market instruments to cater to the needs of various traders and investors. These instruments encompass different asset classes, each with its unique characteristics and opportunities. Here's a breakdown of the market instruments the broker provides:

Currencies Trading: The broker facilitates trading in the currency exchange market, commonly known as Forex. This market operates 24 hours a day, five days a week, and is the largest and most liquid globally, with daily trading volumes exceeding $4 trillion. Traders can engage in Forex trading, where they buy and sell currency pairs, aiming to profit from exchange rate fluctuations.

Stocks Trading: Investors can participate in the stock market by trading shares of global corporations. The broker offers access to large-cap stocks listed on major exchanges like the NYSE and NASDAQ. This allows traders to invest in companies and potentially benefit from their stock price movements.

Spot Metals: Precious metals such as gold, silver, platinum, and palladium are available for trading. These metals have unique properties and global demand, making them attractive assets for portfolio diversification. Traders can capitalize on market fluctuations in the prices of these metals.

Commodities Trading: The broker provides access to a variety of commodities, including precious metals, oil, and soft commodities. Traders can take advantage of market volatility by going long (buying) or short (selling) these globally important assets, potentially profiting from market cycles.

Digital Currencies: The broker offers trading in digital currencies, including popular cryptocurrencies like Bitcoin, Ripple, and Ethereum. The platform provides ultra-fast execution and practical tools, making it convenient for traders to participate in the growing digital currency market.

Indices Trading: Traders can select from a range of active indices from around the world. Indices represent a collection of stocks, and trading them allows investors to gain exposure to a basket of assets. This diversification can help mitigate risks associated with individual stock fluctuations.

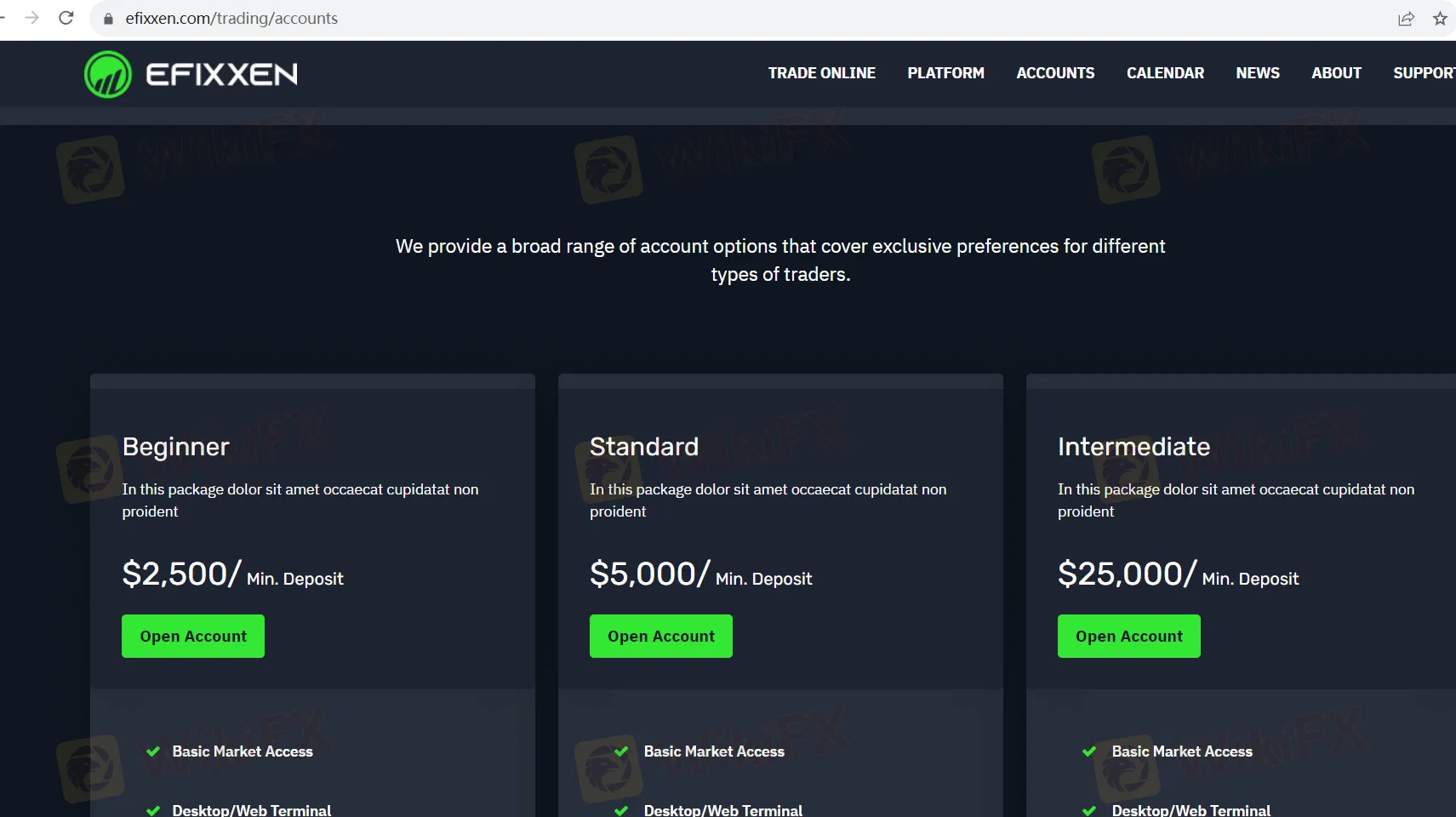

Account Types

This broker provides a tiered system of trading accounts, each tailored to cater to the varying needs and preferences of traders. These accounts offer different levels of features and services, allowing traders to choose the one that best aligns with their trading goals and financial capabilities.

Beginner Account:

Minimum Deposit: $2,500

Key Features: The Beginner Account is designed for those who are just starting in the world of trading. It offers basic market access, providing traders with the essentials such as access to desktop and web terminals, mobile trading, analytical materials, and one-click trading. Additionally, it offers a Swap Free/Islamic option and daily analysis. However, it does not include features like special market coverage, trading strategies, special event invitations, private instant support, or a VIP personal manager.

Standard Account:

Minimum Deposit: $5,000

Key Features: The Standard Account builds upon the features of the Beginner Account, providing all the essentials along with special market coverage. However, it still does not include trading strategies, special event invitations, private instant support, or a VIP personal manager.

Intermediate Account:

Minimum Deposit: $25,000

Key Features: The Intermediate Account caters to more experienced traders who require a broader range of services. It offers full market access, advanced analytical tools, and the flexibility to employ various trading strategies. However, it does not include features like special event invitations, private instant support, or a VIP personal manager.

Advanced Account:

Minimum Deposit: $50,000

Key Features: The Advanced Account is designed for seasoned traders who demand a comprehensive set of tools and resources. It includes features such as special event invitations, but it lacks private instant support or a VIP personal manager.

Integral Account:

Minimum Deposit: $100,000

Key Features: The Integral Account offers an extensive suite of services, including special event invitations and private instant support. However, it does not include a VIP personal manager.

VIP Account:

Minimum Deposit: $250,000

Key Features: The VIP Account is the highest-tiered account, providing full market access, advanced tools, and personalized assistance. Traders at this level benefit from special event invitations, private instant support, and the guidance of a dedicated VIP personal manager.

| Account Type | Minimum Deposit | Key Features |

| Beginner | $2,500 | Basic market access, analytical materials |

| Standard | $5,000 | Special market coverage |

| Intermediate | $25,000 | Full market access, trading strategies |

| Advanced | $50,000 | Special event invitations |

| Integral | $100,000 | Private instant support |

| VIP | $250,000 | VIP personal manager |

Leverage

This broker offers a maximum trading leverage of up to 1:400. Leverage is a financial tool that allows traders to control a larger position size with a relatively smaller amount of capital. In the case of 1:400 leverage, for every $1 in the trader's account, they can control a position worth up to $400 in the market.

While leverage can magnify potential profits, it also significantly increases the level of risk associated with trading. Traders should use leverage cautiously, as it can lead to substantial losses if the market moves against their positions. It's essential for traders to have a thorough understanding of leverage and risk management strategies before utilizing higher leverage levels like 1:400 to ensure responsible and informed trading decisions.

Spreads and Commissions

Certainly, here's the information about Spreads & Commissions from Efixxen in a more organized format:

Commissions:

Efixxen does not charge any commission fees for trading.

This fee structure benefits traders by allowing them to retain their profits without additional commission expenses.

Spreads:

Efixxen offers flexible spreads starting at 0 pips.

Spread values can change based on market conditions and the assets being traded.

Competitive spreads provide traders with favorable pricing for entering and exiting positions.

Fees:

Deposit Fee: None

Withdrawal Fee: None

Inactivity Fee: Yes (Traders may incur an inactivity fee for dormant accounts.)

Fee Ranking: Low/Average

Additional Considerations:

While Efixxen doesn't charge commission fees, traders should be aware that there may be other fees associated with trading or account-related activities.

It's advisable to review Efixxen's terms and conditions or contact customer service to understand any potential fees related to deposits, withdrawals, account inactivity, or other charges.

Deposit & Withdrawal

Minimum Deposit: Efixxen requires a minimum deposit of $250 to start trading on their platform. This low minimum deposit allows traders of various experience levels to enter the market with ease, even if they have limited capital.

Deposit Fees: Efixxen does not charge any deposit fees. Traders can fund their accounts without incurring additional costs.

Withdrawal Fees: Efixxen also does not impose any withdrawal fees, ensuring that traders can access their funds without deductions.

Inactivity Fee: Efixxen does have an inactivity fee. Traders should be aware that if their accounts remain inactive for a certain period, they may be subject to this fee. However, specific details about the inactivity fee duration and amount are not provided in the provided information.

Trading Platforms

Efixxen offers a versatile range of trading platforms, catering to traders' diverse preferences and needs. These platforms are meticulously designed to provide an efficient and seamless trading experience, equipping traders with essential tools for informed decision-making and swift trade execution. Efixxen's primary trading platforms include:

Mobile Trader:

Designed for easy trading on smartphones and computers.

User-friendly interface optimized for mobile devices.

Real-time market information and interactive charts.

Quick trade execution with a few screen taps.

Portfolio management and on-the-go trading capabilities.

Linux Trader:

Tailored for Linux operating systems.

Reliable trading experience on Linux computers.

Real-time market data and advanced charting tools.

User-friendly interface for easy navigation.

Stable and rapid trading platform.

MacOS Trader:

Exclusively for iOS devices (iPhones and iPads).

User-friendly interface designed for Apple devices.

Real-time market information and interactive charts.

Effortless trade execution with a few clicks.

Synchronized functionality for seamless trading across devices.

Customer Support

Efixxen prioritizes accessible customer support to assist traders effectively:

Availability: Efixxen's support desk is open 24/5, ensuring assistance during trading hours.

Contact Options: Reach out to their knowledgeable agents for account support, product inquiries, or platform guidance.

Phone Support: Contact Efixxen directly at 18007500975 for immediate assistance.

Email Support: Alternatively, you can email them at support@efixxen.com for detailed inquiries and prompt responses.

Efixxen's responsive customer support team is dedicated to ensuring a seamless trading experience, offering multiple ways to connect for assistance.

Educational Resources

Efixxen does not offer educational resources as part of its services, focusing primarily on providing trading opportunities and support. Traders looking for educational materials or resources to enhance their trading knowledge may need to explore external educational sources or platforms to supplement their learning.

Summary

Efixxen is an unregulated broker offering a diverse range of market instruments, multiple account types, competitive spreads, and high leverage. However, the absence of regulatory oversight raises concerns about investor protection, and the broker imposes an inactivity fee. Educational resources are limited, and information about demo accounts and accepted payment methods is unclear. Efixxen provides a range of trading platforms and responsive customer support, but traders should exercise caution and conduct thorough research when considering this broker.

FAQs

Q: Is Efixxen a regulated broker?

A: No, Efixxen operates as an unregulated broker in the financial industry.

Q: What is the minimum deposit requirement to start trading with Efixxen?

A: The minimum deposit to begin trading with Efixxen is $250.

Q: Does Efixxen charge commission fees for trading?

A: No, Efixxen does not charge any commission fees for trading.

Q: What is the maximum leverage offered by Efixxen?

A: Efixxen offers a maximum trading leverage of up to 1:400.

Q: Does Efixxen provide educational resources for traders?

A: No, Efixxen does not offer educational resources as part of its services.

ข้อจำกัดความรับผิดชอบ:

มุมมองในบทความนี้แสดงถึงมุมมองส่วนตัวของผู้เขียนเท่านั้นและไม่ถือเป็นคำแนะนำในการลงทุน สำหรับแพลตฟอร์มนี้ไม่รับประกันความถูกต้องครบถ้วนและทันเวลาของข้อมูลบทความ และไม่รับผิดชอบต่อการสูญเสียใด ๆ ที่เกิดจากการใช้ข้อมูลในบทความ

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

WikiFX โบรกเกอร์

FP Markets

STARTRADER

XM

HFM

EC Markets

GO MARKETS

FP Markets

STARTRADER

XM

HFM

EC Markets

GO MARKETS

WikiFX โบรกเกอร์

FP Markets

STARTRADER

XM

HFM

EC Markets

GO MARKETS

FP Markets

STARTRADER

XM

HFM

EC Markets

GO MARKETS

ข่าวล่าสุด

“พาวเวล” ส่งสัญญาณเฟดไม่รีบลดดอกเบี้ย เหตุเศรษฐกิจ-ตลาดแรงงานยังแกร่ง

รวมวิธีการเป็น “Day trader ” ประสบความสำเร็จ

ข้อคิดดีๆ จากหนังสือ "วิธีบริหารเวลาให้คุ้มค่าที่สุดในแต่ละวัน"

บิตคอยน์ทุบ All Time High ทะลุ $93,000 กูรูฟันธง $100,000 ก็แค่ปากซอย!

เพราะอะไร? นักเทรดที่มีประสบการณ์จึงใส่ใจสเปรด

กฎสำคัญของการเทรดแบบ Scalping

กว่าจะมาเป็นผู้ร่วมก่อตั้ง Ethereum เรื่องราวของ Vitalik Buterin เป็นมาอย่างไร?

ดอลลาร์แข็งค่า คาดนโยบายทรัมป์หนุนเฟดชะลอหั่นดอกเบี้ย

ฝึกเทรดบัญชี Demo ลงตลาดจริงโดยไม่เสี่ยงเสียเงิน!

มาเช็คกันหน่อย...เรากำลังเสพติดการเทรดอยู่หรือเปล่า?

คำนวณอัตราแลกเปลี่ยน