简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ATG

Extrait:ATG, a global electronic financial transaction group, operates from its headquarters in Seychelles. ATG offers a variety of tradable assets, including forex, indices, cryptocurrencies, commodities, precious metals, stock CFDs, and energies. Traders can choose from a range of account types, including demo, standard, VIP, ECN, Islamic, PAMM, and MAM accounts. The trading platform offered by ATG World is MetaTrader 5, known for its reliability and advanced features. However, it's important to note that there are suspicions regarding its legitimacy as a potential fake clone.

| ATG | Basic Information |

| Company Name | ATG |

| Headquarters | Seychelles |

| Regulations | Suspected Fake Clone |

| Tradable Assets | Forex, indices, crypto, commodities, precious metal, stock CFD, energies |

| Account Types | Demo, standard, VIP, ECN, Islamic, PAMM, MAM account |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:500 |

| Spreads | Variable |

| Commission | Variable |

| Trading Platforms | MetaTrader 5 |

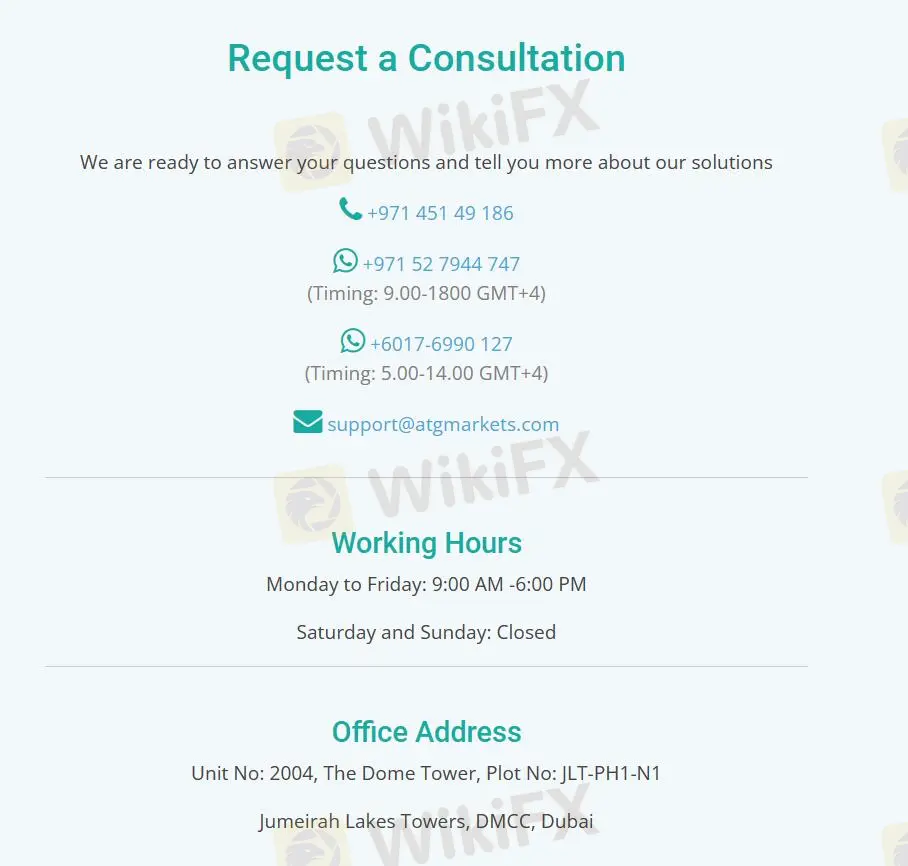

| Customer Support | Phone (+971-451-49-186, +971-52-7944-747 or +6017-6990-127)Email (support@atgmarkets.com) |

Overview of ATG

Based in Seychelles, ATG is a global electronic financial transaction group providing traders with access to a diverse array of tradable assets, including forex, indices, cryptocurrencies, commodities, precious metals, stock CFDs, and energies. Traders have the flexibility to choose from various account types such as demo, standard, VIP, ECN, Islamic, PAMM, and MAM accounts. The platform offers MetaTrader 5 as its trading interface, renowned for its reliability and advanced functionalities. However, it's crucial to be aware of concerns surrounding its authenticity, as suspicions of being a potential fake clone have arisen.

Is ATG Legit?

ATG is not regulated. It's crucial to emphasize that this broker is suspected to be a clone, underscoring the need for vigilance and awareness of potential risks. Traders should exercise caution and remain mindful of the associated risks when contemplating trading with an unregulated broker like ATG. These risks may include limited avenues for dispute resolution, potential concerns regarding the safety and security of funds, and a lack of transparency in the broker's business practices.

Pros and Cons

ATG presents traders with a diverse range of trading instruments, offering ample opportunities to explore various markets. However, it's essential to note that the platform operates without regulatory oversight, potentially exposing traders to risks associated with unregulated trading environments. Despite this drawback, ATG caters to different trading preferences by offering multiple account types, providing flexibility for traders to choose according to their needs. Nonetheless, a notable limitation is the lack of educational resources and transparency regarding company policies and procedures, which may hinder traders' ability to make informed decisions. On a positive note, ATG utilizes the popular MetaTrader 5 platform, known for its reliability and advanced features, enhancing the trading experience for users. However, there is unclear information regarding payment methods, which could pose challenges for traders.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

ATG offers a diverse array of trading instruments, encompassing foreign exchange, precious metals, energy, stocks, options, futures, contracts for difference (CFDs), and other financial products.

Specifically, traders can access a wide range of assets, including forex pairs like GBPUSD, EURUSD, and USDJPY, with leverage of up to 1:500, tight spreads, and zero commission fees.

In addition to forex, ATG provides opportunities to trade indices, cryptocurrencies such as bitcoin, ether, and litecoin, as well as the Crypto 10 Index, offering broad exposure in a single trade.

Moreover, traders can engage in commodities trading, covering metals, energies, and agricultural markets, and speculate on the price of precious metals like gold and silver through CFDs.

Additionally, ATG facilitates stock CFD trading, allowing investors to own a portion of a company, participate in management decisions, and receive profits based on corporate performance.

Lastly, traders can leverage CFDs to capitalize on fast movements in energy prices, making it an ideal instrument for day traders seeking swift market opportunities.

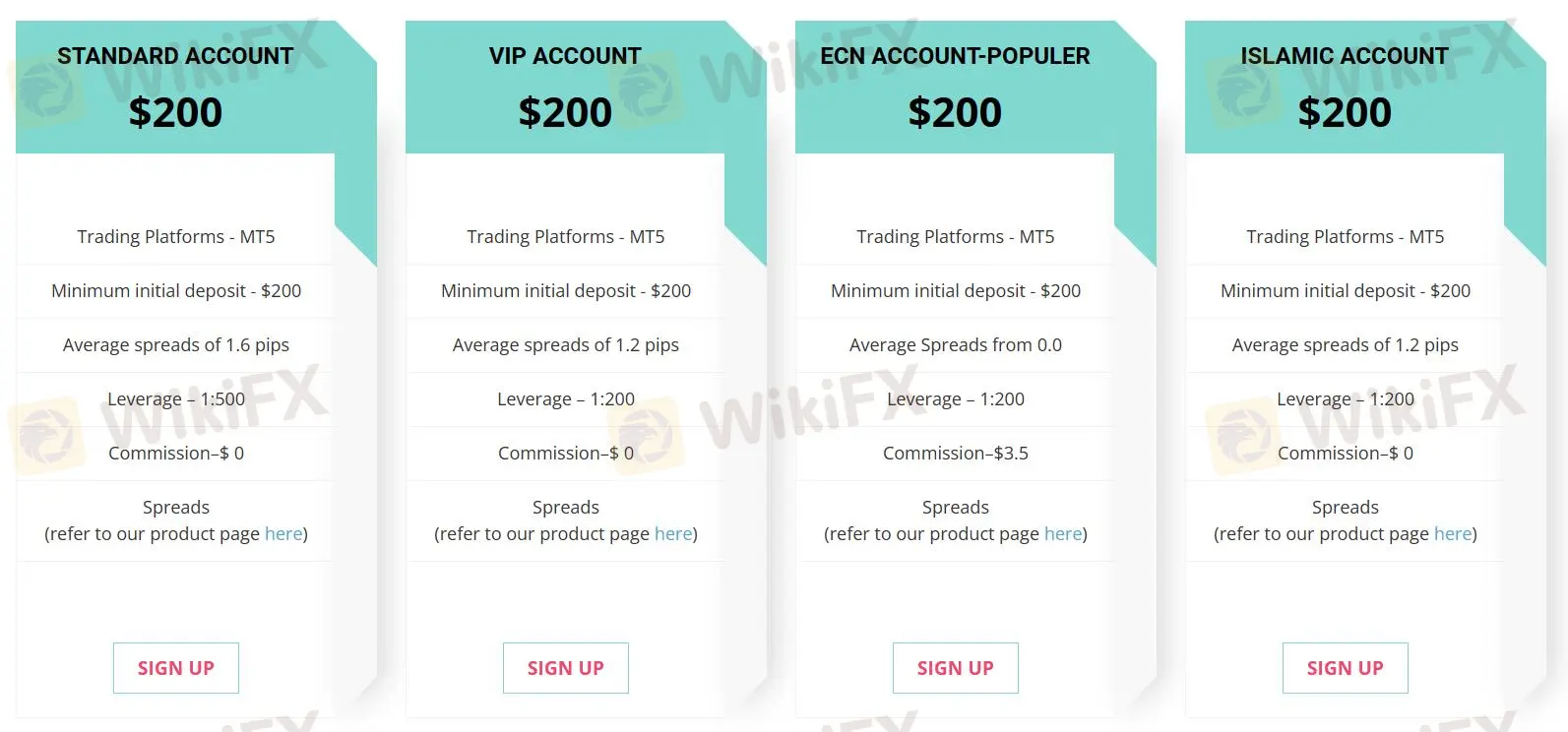

Account Types

ATG offers a variety of account types tailored to meet different trading preferences and strategies.

The Standard Account provides a basic trading experience, requiring a minimum deposit of $200.

Similarly, the VIP Account maintains the same minimum deposit requirement of $200.

Traders seeking tighter spreads and direct market access may opt for the ECN Account, ideal for advanced traders.

Additionally, ATG offers Islamic Accounts to ensure compliance with Sharia law for traders adhering to Islamic principles.

For investors interested in automated or professional account management, ATG provides PAMM (Percentage Allocation Money Management) and MAM (Multi-Account Management) accounts. PAMM accounts allow professional account managers to trade on behalf of clients, with the manager acting as the Investment Manager and clients as Investors. MAM accounts enable authorised fund managers to trade for their clients, earning commissions, performance fees, and management fees based on client trading results and activities.

In addition to live trading accounts, ATG also provides a demo account option for traders. A demo account allows traders to practice trading strategies, familiarize themselves with the platform's features, and test the markets without risking real capital.

| Account Type | Trading Platforms | Minimum Deposit | Maximum Leverage | Commission | Average Spreads from |

| Standard Account | MT5 | $200 | 1:500 | $0 | 1.6 pips |

| VIP Account | MT5 | $200 | 1:200 | $0 | 1.2 pips |

| ECN Account | MT5 | $200 | 1:200 | $3.5 | 0.0 pips |

| Islamic Account | MT5 | $200 | 1:200 | $0 | 1.2 pips |

Leverage

ATG offers varying maximum leverage options across its account types:

Standard Account: Maximum leverage of 1:500

VIP Account: Maximum leverage of 1:200

ECN Account: Maximum leverage of 1:200

Islamic Account: Maximum leverage of 1:200

Spreads and Commissions

ATG offers different spreads and commission structures tailored to each account type:

Standard Account: No commission is charged, and traders can expect average spreads starting from 1.6 pips.

VIP Account: Traders with a VIP Account enjoy competitive spreads, starting from 1.2 pips, with no commission fees.

ECN Account: For traders opting for the ECN Account, there is a $3.5 commission fee, and average spreads start from 0.0 pips, providing excellent trading conditions.

Islamic Account: With the Islamic Account, traders benefit from commission-free trading and competitive spreads starting from 1.2 pips.

Trading Platforms

ATG offers traders a robust and user-friendly MetaTrader 5 trading platform, equipped with a comprehensive set of tools to enhance trading efficiency. This platform offers a flexible trading system, allowing traders to execute trades with ease and flexibility. Furthermore, traders have access to advanced technical and fundamental analysis tools, empowering them to make informed trading decisions. The platform also features a professional MQL5 development environment, enabling traders to create custom indicators and automated trading strategies. Additionally, traders can utilize the multi-currency tester to backtest their strategies and receive alerts for important market events. To accommodate traders from diverse linguistic backgrounds, the platform interface has been translated into 31 of the most widely spoken languages worldwide. ATG's trading platform is available for Windows, Android, Apple devices, and web browsers, ensuring seamless access to the markets anytime, anywhere.

Customer Support

ATG promises to provide customized support 24/7. For inquiries related to trading or account management, traders can contact the dedicated phone numbers: +971 451 49 186 or +971 52 7944 747 during the operational hours of 9:00 AM to 6:00 PM GMT+4, Monday to Friday. Additionally, traders can also reach out via email at support@atgmarkets.com for assistance or clarification on any trading-related matters. The support team is available to address queries regarding ATG's solutions and trading services. Please note that customer support is not available on Saturdays and Sundays.

Conclusion

In conclusion, ATG offers a diverse range of trading instruments but lacks regulatory oversight, posing risks. However, it provides flexibility with multiple account types. Limited educational resources and unclear company policies may hinder informed decisions. Despite this, the use of MetaTrader 5 enhances the trading experience, but unclear payment methods may pose challenges. Traders should exercise caution and conduct thorough research.

FAQs

Q: Is ATG regulated?

A: No, ATG operates without regulation, meaning it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on ATG?

A: ATG offers a variety of trading instruments, including forex, indices, cryptocurrencies, commodities, precious metals, stock CFDs, and energies.

Q: What account types does ATG offer?

A: ATG provides various account types, including demo, standard, VIP, ECN, Islamic, PAMM, and MAM accounts, catering to different trading preferences and experience levels.

Q: How can I contact ATG's customer support?

A: For inquiries related to trading or account management, traders can contact the dedicated phone numbers: +971 451 49 186 or +971 52 7944 747 during the operational hours of 9:00 AM to 6:00 PM GMT+4, Monday to Friday. Additionally, traders can also reach out via email at support@atgmarkets.com for assistance or clarification on any trading-related matters.

Risk Warning

Trading online carries significant risks, including the potential loss of all invested capital. It's crucial to understand these risks before engaging in trading activities. Please note that the information provided in this review may change over time due to updates in the company's services and policies. The date of this review's generation is also important to consider, as information may have evolved since then. Readers are encouraged to verify updated information directly with the company before making any decisions or taking action. The responsibility for using the information in this review lies solely with the reader.

Avertissement:

Les opinions exprimées dans cet article représentent le point de vue personnel de l'auteur et ne constituent pas des conseils d'investissement de la plateforme. La plateforme ne garantit pas l'exactitude, l'exhaustivité ou l'actualité des informations contenues dans cet article et n'est pas responsable de toute perte résultant de l'utilisation ou de la confiance dans les informations contenues dans cet article.

Courtiers WikiFX

Tickmill

OANDA

FxPro

IC Markets Global

ATFX

TMGM

Tickmill

OANDA

FxPro

IC Markets Global

ATFX

TMGM

Courtiers WikiFX

Tickmill

OANDA

FxPro

IC Markets Global

ATFX

TMGM

Tickmill

OANDA

FxPro

IC Markets Global

ATFX

TMGM

Calcul du taux de change