简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HEDGECENT

Extracto: HEDGECENT, established in 2021 and based in Bulgaria, is an unregulated trading exchange offering a wide array of financial instruments, including Forex, commodities, metals, stocks, indices, and cryptocurrencies. Meeting a diverse trading community, HEDGECENT provides four distinct account types: Cent, ECN, Elite, and Standard, with leverage reaching up to an impressive 1:2000. The platform stands out for its competitive trading conditions, boasting spreads from as low as 0 to 0.8 pips and a zero-commission structure across all account types. HEDGECENT utilizes advanced trading platforms such as MetaTrader 5 and cTrader, ensuring a robust trading experience. Traders can start with a minimum deposit of just 10 USD and have access to a demo account for practice. The platform also offers comprehensive support and resources, including 24/7 market news, an economic calendar, weekly outlooks, technical analysis, and a financial glossary, all backed by customer support available via p

| Aspect | Information |

| Company Name | HEDGECENT |

| Registered Country/Area | Bulgaria |

| Founded Year | 2021 |

| Regulation | Unregulated |

| Products & Services | Forex,Commodities,Metals,Stocks,Indices,Crypto |

| Account Types | Cent Account,ECN Account,Elite Account,Standard Account |

| Leverage | Up to 1:2000 |

| Spreads&Commissions | Spreads:from 0 to 0.8pips;Commissions:all 0 commissions |

| Trading Platforms | Meta Trader 5,c Trader |

| Demo Account | Available |

| Customer Support | Phone:+359 (2) 4928450;Email:info@hedgecent.com |

| Deposit & Withdrawal | Minimum deposit:10 USDPyament methods:STICPAY,USDT,PAYPAL,MASTERCARD,VISA,Skrill,NETELLER,Online banking |

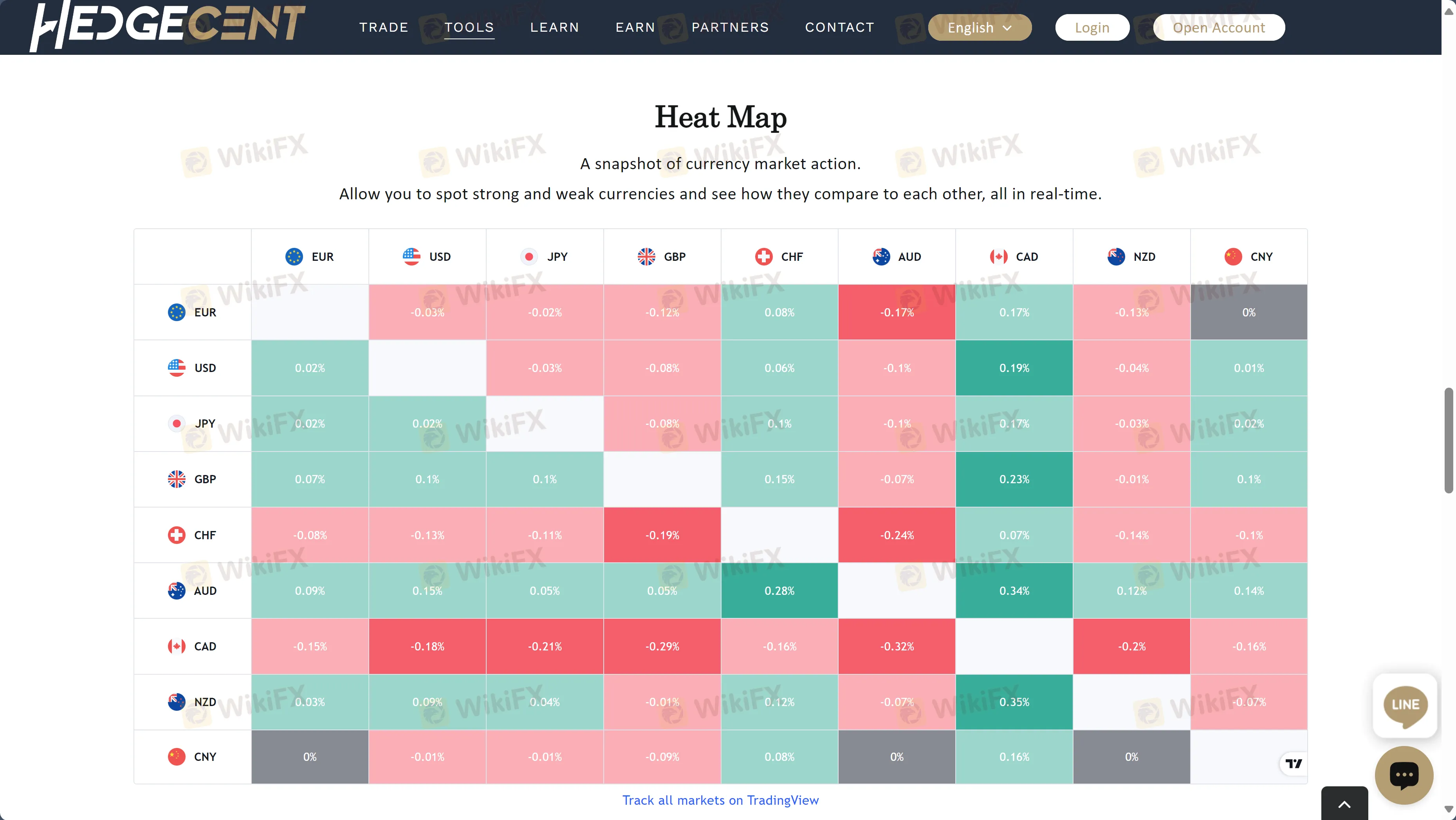

| Tools | 7*24 Market news,Economic calendar,Forex quotes,Heat map,Market screener |

| Educational Resources | Weekly outlook,Technical analysis,Financial glossary |

Overview of HEDGECENT

HEDGECENT, established in 2021 and based in Bulgaria, is an unregulated trading exchange offering a wide array of financial instruments, including Forex, commodities, metals, stocks, indices, and cryptocurrencies.

Meeting a diverse trading community, HEDGECENT provides four distinct account types: Cent, ECN, Elite, and Standard, with leverage reaching up to an impressive 1:2000. The platform stands out for its competitive trading conditions, boasting spreads from as low as 0 to 0.8 pips and a zero-commission structure across all account types.

HEDGECENT utilizes advanced trading platforms such as MetaTrader 5 and cTrader, ensuring a robust trading experience. Traders can start with a minimum deposit of just 10 USD and have access to a demo account for practice.

The platform also offers comprehensive support and resources, including 24/7 market news, an economic calendar, weekly outlooks, technical analysis, and a financial glossary, all backed by customer support available via phone and email.

Is HEDGECENT Limited Legit or a Scam?

HEDGECENT is currently unregulated, meaning that it does not fall under the supervision of any specific financial regulatory body.

Operating without such oversight can offer more flexibility in the services and trading conditions it provides, but it also means that clients may not have the same level of protections or recourse that come with regulated entities.

Pros and Cons

| Pros | Cons |

| Diverse Product Offering | Unregulated |

| Advanced Trading Platforms | Limited Platform Choices |

| Demo Account Availability | Potential Risk in Product Complexity |

| Demo Account Availability | Email-Only Customer Support |

| Supportive Trading Tools | Geographical Limitations |

Pros of HEDGECENT:

Low Entry Barrier: With a minimum deposit requirement of just 10 USD, HEDGECENT makes trading accessible to a wide range of traders, including beginners with limited capital.

High Leverage Options: Offering leverage up to 1:2000, HEDGECENT provides traders the opportunity to maximize their trading potential, appealing to those who wish to amplify their positions.

Competitive Trading Conditions: Attractive spreads starting from 0 to 0.8 pips, combined with a zero-commission policy, make HEDGECENT an appealing option for cost-efficient trading.

Advanced Trading Platforms: The availability of MetaTrader 5 and cTrader platforms ensures traders have access to top-tier trading tools, charts, and automated trading capabilities.

Rich Educational and Analytical Resources: A wealth of educational materials and trading tools, including market news and an economic calendar, supports traders in making informed decisions.

Cons of HEDGECENT:

Unregulated Status: The lack of regulatory oversight might raise concerns about the security of funds and the overall reliability of the trading environment.

Limited Customer Support Options: While support is available via phone and email, the absence of live chat support might not meet the needs of traders seeking instant assistance.

Risk Associated with High Leverage: The very high leverage of up to 1:2000 can significantly increase the risk of substantial losses, particularly for inexperienced traders.

Geographical Limitations: Being based in Bulgaria and unregulated, HEDGECENT might not be suitable for traders in jurisdictions with stringent regulatory requirements.

Potential Platform Overwhelm: The advanced nature of MetaTrader 5 and cTrader, while beneficial, may present a steep learning curve for novice traders unfamiliar with such comprehensive trading platforms.

Products & Services

HEDGECENT offers an extensive array of trading products tailored to meet the diverse needs of its clientele:

Forex: HEDGECENT provides traders with access to the global foreign exchange market, offering a wide range of currency pairs from major, minor to exotic. This allows traders to speculate on the price movements of different currencies against each other, leveraging the liquidity and 24/5 nature of the Forex market. Forex trading at HEDGECENT is designed to cater to traders of all levels, from beginners looking to explore currency trading to experienced traders seeking to implement complex strategies.

Commodities: The platform's commodities trading services include a variety of hard and soft commodities such as oil, natural gas, gold, silver, and agricultural products like wheat and corn. Trading commodities with HEDGECENT enables clients to diversify their portfolios beyond traditional asset classes, taking advantage of price fluctuations driven by economic, geopolitical, and environmental factors.

Metals: HEDGECENT offers trading in precious and industrial metals, including gold, silver, platinum, and copper. Metal trading is often used as a hedge against inflation and currency devaluation, making it an attractive option for traders looking to protect their capital in volatile markets. The platform provides competitive spreads and leverage options for metal trading, appealing to investors interested in tapping into the intrinsic value and stability of these assets.

Stocks: Traders at HEDGECENT have the opportunity to trade shares of leading global companies, allowing them to speculate on the performance of individual businesses without the need to own the physical shares. Stock trading on HEDGECENT covers various sectors and industries, offering traders the chance to capitalize on market trends, earnings reports, and economic indicators that influence stock prices.

Indices: HEDGECENT provides access to some of the world's major stock indices, such as the S&P 500, FTSE 100, and Nikkei 225. Index trading allows clients to speculate on the overall movement of the stock markets they represent, offering a broader market exposure compared to individual stock trading. This product is suitable for traders looking to gain insights into the economic health of a particular region or sector.

Cryptocurrencies: Embracing the digital asset revolution, HEDGECENT offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others. Cryptocurrency trading is known for its high volatility, providing significant profit potential but also higher risk. HEDGECENT's cryptocurrency trading services cater to traders keen on exploring the dynamic and rapidly evolving digital currency market.

Account Types

HEDGECENT offers 4 types of accounts for its users.

CENT ACCOUNT at HEDGECENT:

The Cent Account offers an accessible entry point for novice traders or those testing new strategies, with a minimal initial deposit requirement of only $10. It features leverage up to 1:2000, enabling significant market exposure for small-scale traders. With spreads starting from 0.8 pips, it provides a balanced trading environment for those looking to minimize costs while gaining experience in real market conditions.

The stop-out level is set at 20%, offering a safety net against volatile market movements. This account operates without commission charges and does not provide a dedicated account manager, making it streamlined for straightforward trading activities. The Cent Account also includes a swap-free option under specific terms and conditions, catering to traders who require or prefer such arrangements.

ELITE ACCOUNT at HEDGECENT:

Geared towards experienced traders and high-net-worth individuals, the Elite Account requires a significant minimum deposit of $10,000. It boasts ultra-competitive trading conditions with spreads from 0.0 pips and a high maximum leverage of 1:2000.

The stop-out level is strategically set at 20% to balance the high leverage offered. This account distinguishes itself by having no commission fees, enhancing profitability potential for large volume traders. However, it does not offer an account manager or a swap-free option, focusing instead on providing optimal trading conditions for serious investors.

ECN ACCOUNT at HEDGECENT:

Designed for traders who prefer the Electronic Communication Network model, the ECN Account demands a $1,000 minimum deposit. It offers spreads from 0.4 pips and the same high leverage of 1:2000. A fixed commission of $10 per lot is applied, reflecting the direct access to market prices and liquidity.

This account type includes the service of an account manager, adding a personalized touch to the trading experience, although it lacks a swap-free option, which might be a consideration for certain traders.

STANDARD ACCOUNT at HEDGECENT:

Suitable for a broad spectrum of traders, the Standard Account features a low minimum deposit of $100, making it accessible to beginners and those with limited capital. It provides leverage up to 1:2000 and competitive spreads starting from 0.8 pips.

The stop-out level is set at 20%, offering protection against adverse market movements. This account is commission-free and does not include an account manager or swap-free trading, aiming to offer straightforward and cost-effective trading conditions.

How to Open an Account?

Opening an account with HEDGECENT involves a straightforward process that can be completed in four steps:

Download the HEDGECENT App: Start by downloading the HEDGECENT App, available for both iOS and Android devices, from the respective app store on your smartphone or tablet.

Register for an Account: Open the app and navigate to the registration section. Fill in the required information, such as your name, email address, and any other personal details necessary to create your account.

Verify Your Identity: To comply with financial regulations and ensure the security of your account, you may be asked to verify your identity. This typically involves submitting a form of identification, such as a passport or driver's license, and possibly a recent utility bill or bank statement to confirm your address.

Fund Your Account: Once your account is set up and verified, you'll need to deposit funds to start trading. Check the minimum deposit requirement and choose your preferred funding method among the options provided by HEDGECENT. After completing the deposit, you're ready to begin trading on the HEDGECENT platform.

Leverage

HEDGECENT offers a remarkably high leverage option across all its account types, reaching up to 1:2000. This level of leverage allows traders to amplify their trading positions significantly, providing the potential to increase profits from small price movements in the markets.

Whether opting for the Cent, Standard, ECN, or Elite Account, traders have the flexibility to utilize this extensive leverage, meeting a wide range of trading strategies and risk appetites.

Spreads & Commissions

Spreads:

HEDGECENT offers competitive spreads across its account types, starting as low as 0.0 pips for the Elite Account, indicating an extremely tight spread ideal for high-volume traders seeking minimal trading costs. The ECN Account features spreads from 0.4 pips, attracting those who prefer electronic communication network trading with low spreads and fixed commissions.

The Standard and Cent Accounts provide spreads starting from 0.8 pips, offering a balanced option for both novice and experienced traders who prefer no commission charges.

Commissions:

Commissions at HEDGECENT are account-specific; the ECN Account incurs a fixed commission of $10 per lot, a structure that complements its low spread offering, making it suitable for traders who prioritize direct market access and cost efficiency.

The Elite, Standard, and Cent Accounts, on the other hand, boast a zero-commission policy, aligning with traders' preferences for straightforward cost structures without additional per-trade charges.

Deposit & Withdrawal

HEDGECENT offers a user-friendly deposit and withdrawal system designed to accommodate a wide range of client preferences. The minimum deposit required to start trading is set at a low threshold of just 10 USD, making it accessible for both novice and experienced traders.

For deposits and withdrawals, HEDGECENT supports a variety of payment methods to ensure flexibility and convenience for its clients. These methods include STICPAY, USDT (Tether), PayPal, major credit cards like MasterCard and Visa, as well as popular e-wallets such as Skrill and NETELLER.

Additionally, online banking options are available, catering to those who prefer direct bank transactions. This range of payment options reflects HEDGECENT's commitment to providing a seamless trading experience for its users.

Trading Platform

HEDGECENT provides its traders with access to two of the industry's leading trading platforms: MetaTrader 5 (MT5) and cTrader. These platforms are renowned for their advanced trading features, user-friendly interfaces, and comprehensive analytical tools.

MetaTrader 5 (MT5): MT5 is a highly versatile platform that caters to traders of all experience levels, offering advanced financial trading functions along with superior tools for technical and fundamental analysis. MT5 supports the use of automated trading systems, known as trading robots or Expert Advisors, and allows for extensive back-testing of trading strategies on historical data.

cTrader: Known for its intuitive interface and sophisticated trading capabilities, cTrader is especially favored by ECN traders. It offers fast entry and execution, level II pricing, and a range of advanced order types. cTrader is well-regarded for its transparency and advanced charting tools, making it an excellent choice for traders who rely heavily on technical analysis.

Customer Support

HEDGECENT places a strong emphasis on customer support, offering multiple channels to ensure that traders can easily get assistance whenever needed.

Traders can reach out to the HEDGECENT support team via phone at +359 (2) 4928450 for direct and immediate assistance with any queries or issues they might encounter.

Additionally, the platform provides email support through info@hedgecent.com, allowing for detailed inquiries and the submission of documents when necessary.

This multi-faceted approach to customers enhances their overall trading experience with HEDGECENT.

Tools

HEDGECENT offers a suite of advanced tools designed to provide traders with comprehensive market insights and analytics, facilitating informed trading decisions:

7×24 Market News: This feature ensures traders have around-the-clock access to the latest market news, covering global markets, stocks, currencies, and more. It includes breaking news, expert analysis, and real-time data, keeping traders well-informed about current market dynamics.

Economic Calendar: A crucial tool for staying abreast of significant financial events, key economic indicators, and market-moving announcements. The Economic Calendar helps traders anticipate market fluctuations and plan their trades around major economic releases.

Forex Quotes: Offers real-time price updates for various currency pairs, essential for traders involved in international trade and investment. This tool allows traders to monitor live forex market prices, aiding in timely decision-making.

Heat Map: Provides a visual representation of currency market activity, highlighting strong and weak currencies in real-time. The Heat Map enables traders to quickly assess market conditions and identify potential trading opportunities based on currency strength.

Market Screener: A versatile tool that allows traders to filter and sort trading symbols based on both fundamental and technical indicators. This feature is valuable for identifying potential trading instruments that meet specific criteria, enhancing trading strategy effectiveness.

Educational Resources

HEDGECENT provides a range of educational resources designed to enhance the knowledge and trading skills of its clients:

Weekly Outlook: This resource offers a comprehensive analysis of what to expect in the financial markets for the upcoming week. It covers various asset classes and provides insights into potential market movers, economic events, and technical setups, helping traders to prepare their strategies accordingly.

Technical Analysis: HEDGECENT offers in-depth technical analysis resources, including articles, tutorials, and video content that cover key technical indicators, chart patterns, and analytical tools. This resource is invaluable for traders looking to base their trading decisions on technical market analysis.

Financial Glossary: To help traders familiarize themselves with trading and financial terminology, HEDGECENT provides an extensive financial glossary. This glossary covers a wide range of terms, from basic trading concepts to more advanced financial instruments, making it a useful reference for both novice and experienced traders.

Conclusion

HEDGECENT stands out as a comprehensive trading platform offering a wide array of financial instruments including Forex, commodities, metals, stocks, indices, and cryptocurrencies, accessible via leading platforms like MetaTrader 5 and cTrader.

Despite its unregulated status, it attracts traders with competitive spreads, high leverage up to 1:2000, and a minimum deposit requirement of just $10, making it accessible to a broad spectrum of traders.

With a commitment to enhancing trader knowledge and skills, HEDGECENT provides valuable educational resources and a suite of analytical tools to support informed trading decisions.

FAQs

Q: What trading platforms does HEDGECENT offer?

A: HEDGECENT offers MetaTrader 5 (MT5) and cTrader for trading.

Q: What is the minimum deposit required to open an account with HEDGECENT?

A: The minimum deposit required at HEDGECENT is $10.

Q: What types of accounts does HEDGECENT provide?

A: HEDGECENT provides various account types including Cent, ECN, Elite, and Standard Accounts.

Q: Does HEDGECENT offer educational resources?

A: Yes, HEDGECENT offers educational resources such as weekly outlooks, technical analysis, and a financial glossary.

Q: What is the maximum leverage available at HEDGECENT?

A: The maximum leverage offered by HEDGECENT is up to 1:2000.

Q: How can I contact HEDGECENT customer support?

A: You can contact HEDGECENT customer support via phone at +359 (2) 4928450 or email at info@hedgecent.com.

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Relacionada broker

Brokers de WikiFX

últimas noticias

¿Pepperstone manipula los mercados? Cliente afirma no poder retirar.

Impacto de las elecciones estadounidenses de 2024 en el precio del oro y de las divisas.

Análisis del USD/EUR: ¿Qué está pasando con el par de divisas más importante del mundo?

Lo que NO se debe hacer durante las elecciones de EE. UU. de 2024

¿Cuáles son las mejores estrategias para el trading? ¡Guía para novatos!

¿Más estafas de EZINVEST? Cliente pierde toda su inversión.

FOREX.com se asocia con Kalshi en el trading electoral de EE. UU.

Exness selecciona Centroid Bridge para mejorar la oferta de liquidez.

Cálculo de tasa de cambio