简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Understand the three major types of chart patterns.

Extracto:Reversal patterns are chart formations that indicate that a current trend is poised to shift direction.

That's a lot of chart patterns we just went through with you. We're both exhausted, so it's time for us to depart and leave the rest to you.

I'm just having fun! We're not going anywhere till you're ready!

We'll go through how to leverage these chart patterns to your advantage a little more in this part.

We must learn how to use the tools in addition to understanding how they work. We'd best get those profits revved up with all these new weaponry in your armory!

Let's take a look at the chart patterns we just studied and classify them based on the indications they provide.

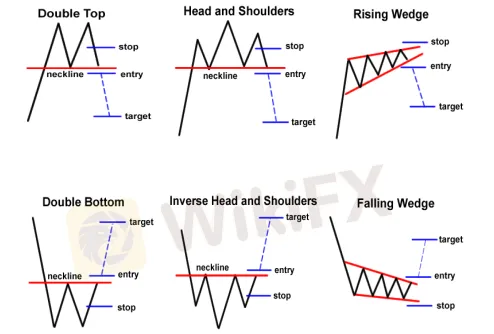

Patterns of Reversal in Charts

Reversal patterns are chart formations that indicate that a current trend is poised to shift direction.

When a reversal chart pattern appears during an uptrend, it indicates that the trend will soon reverse and the price will fall.

If a reversal chart pattern appears during a downturn, it indicates that the price will rise later.

We went over six chart patterns that provide reversal signs in this class. Are you able to name all six?

Double-Sided

Bottom with two layers

Shoulders and Head

Head and Shoulders in the Opposite Direction

Wedge that is rising

Wedge that is falling

You get brownie points if you get all six correct.

Simply place an order beyond the neckline and in the direction of the new trend to trade these chart patterns. Then aim at a target that's almost the same height as the formation's height.

If you detect a double bottom, for example, place a long order at the top of the formation's neckline and aim for a target that is the same height as the gap between the bottoms and the neckline.

Don't forget to position your pauses in the interest of adequate risk management! Around the middle of the chart formation, a decent stop loss can be established.

You can, for example, take the distance between the double bottoms and the neckline, split it by two, and use that as the size of your bottoms.

Patterns of Continuation Charts

Continuation chart patterns are ones that indicate that the current trend will continue.

These are commonly referred to as consolidation patterns because they depict how buyers or sellers take a brief pause before continuing in the same direction as the previous trend.

Trends rarely go in a straight line upwards or downwards. They take a breather and move laterally, “correcting” down or upward before regaining momentum and continuing the main trend.

We've gone through wedges, rectangles, and pennants as examples of continuation chart patterns. Wedge patterns can be classified as reversal or continuation patterns, based on the trend they originate on.

Simply place an order above or below the formation to trade these patterns (following the direction of the ongoing trend, of course).

Then aim for a target that's at least the size of the wedges and rectangles chart design.

When it comes to pennants, you might aim higher and target the mast's height.

Stops are frequently placed above or below the actual chart formation for continuation patterns.

When trading a bearish rectangle, for example, set your stop a few pips above the rectangle's top or resistance.

Patterns in Bilateral Charts

Bilateral chart patterns are more difficult to interpret since they indicate that the price can move in either direction.

Huh? What type of message does that send?!

A two-way signal.

Triangle formations belong under this category. Remember how we said that triangles might break either to the upside or to the downside?

To trade these chart patterns, think about both options (upside or downside breakout) and put one order on top of the formation and another on the bottom.

You can cancel the other order if one is triggered. You'd be a part of the action in any case.

Double the fun, double the possibilities!

The only issue is that if you place your entry orders too close to the top or bottom of the pattern, you can get a fake break.

So, be cautious, and don't forget to set your stops!

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Brokers de WikiFX

Cálculo de tasa de cambio